Crop Gear! (Oh, Deere!)

The Blind Squirrel's Monday Morning Notes, 20th May 2024.

Further thoughts on agriculture markets triggered by a binge-streaming of Season 3 of Clarkson’s Farm on Amazon.

Beyond the banter, the show does some public service in terms of providing insights into the challenges facing the world of agriculture which would have been completely lost on 99% of the show’s viewers before watching.

In Section 2 this week (for paid subs), we take a look at how the utility sector is the latest to be graced with an AI ‘halo’. The situation looks ‘over-cooked’ to the 🐿️! The Acorn Overview and Portfolio Update this week covers everything from the metals to Formula One and motoring UK midcap investment trusts!

Welcome! I'm Rupert Mitchell aka The Blind Squirrel and this is my weekly newsletter on markets and investment ideas. While much of this letter is free (and I promise not to cut off any punchlines), please consider becoming a paid subscriber to receive the other 60% of my content!

Last week paid subscribers got the 🐿️’s detailed plans for his strategic portfolio allocation to a basket of trend-following ETFs:

Crop Gear! (Oh, Deere!)

I spent last Thursday evening stream-binging Season 3 of Clarkson’s Farm on Amazon Prime. The things that I do for my readers. The show represents an interesting pivot from Jeremy Clarkson’s days of worshiping at the altar of the muscle car and destroying caravans.

The trials and tribulations of the owner and staff of Diddly Squat Farm provide the expected dose of laughs and wonderment at the endless stoicism of Lisa (looking at you Kevin Muir 😉!). Banter aside, the show does some public service in terms of providing insights into the challenges facing the world of agriculture which would have been completely lost on 99% of the show’s viewers before watching.

The food on the supermarket shelves is taken for granted in modern society. This is reasonably understandable. Developments in agricultural technology and productivity since the turn of the 20th Century have seen the share of modern populations actually involved in food production shrink to a fraction of where it was 100 years ago.

Agriculture’s share of developed economies has shrunk dramatically over that period.

As we set out in Wheat Kings and Should the🐿️ be bullish (Synthetic) birdsh*t? this rodent remains convinced that the price weakness seen in the grain complex over the past 2 years sits uneasily with the reality of a new world order of weather and geopolitical volatility.

The topic of the calculation of CPI components is a topic for a rant on another day, but if you want to laugh rather than cry about it may I strongly recommend my pal Le Shrub’s superb ‘gold digger’ analogy.

In the official CPI data ‘at home’ food inflation has been remarkably contained as compared with other categories. Goods and energy have retreated extensively since the 2022 spike. Food inflation’s more muted move higher has also been given back almost entirely. However, this data point sits at odds with the lived experience of any regular visitor to a grocery store.

Desperate politicians are always on the hunt for ‘blame deflectors’ when it comes to inflation. The Australian Senate has already launched is ‘price gouging’ inquiry on the Coles and Woolies supermarket duopoly ‘down under’. In the US, Lina Khan’s FTC also has its antitrust sights trained on the food retailers.

Let’s be clear, the grocery business loves a period of inflation and elevated interest rates. Any CFO will tell you that rising prices and lengthy payment terms with suppliers are very good for the interest income line! In our note on ‘Grandpa’s Defensives’, the 🐿️ also pointed out that the FMCG players were very quick to pass on costs during the Covid inflation and that ‘Shrinkflation’ was fast becoming a hot political issue.

One group firmly not in the firing line for the blame for food inflation is the farming community. ‘Big Farm’ would be the wrong target. In fact, only about 15 cents of every dollar spent on food at the grocery is attributable to farm production. Last week, to borrow the tired soccer commentator’s cliche, was a week ‘of two halves’ for the world of food:

Walmart appears to be benefitting from a ‘trading down’ effect by wealthier consumers. Deere cut its full year net income guidance by $500m blaming falling farm incomes as a result of weaker grain markets. Oh, Deere indeed!

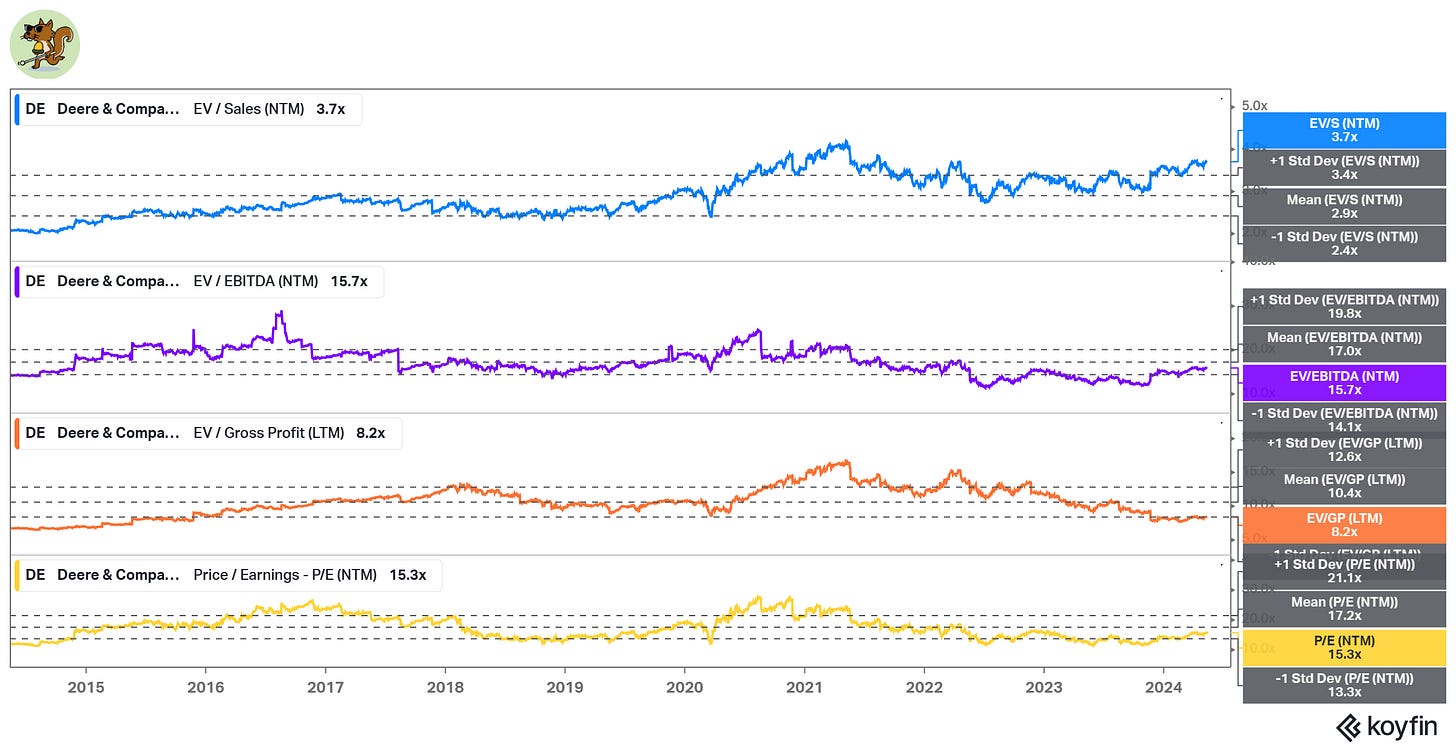

The USDA is forecasting net farm income in the US of about $116bn for 2024, down c.25% from 2023. That drop may sound dramatic. However, this number is still 10% above the average for the past 10 years. Regular readers will know that DE 0.00%↑ is a component of our new agribusiness equities basket.

Softness in the market for agricultural equipment is not new news for the sector.

In response to the last acorn report, I had a couple of follow up questions from readers around margins (have they peaked?) and secondhand equipment markets (apparently the OEMs have been propping up resale values). I thought it would be worth addressing these points with a couple of charts. I have a theory that the points could be inter-related.

The increase in Deere’s tractor-as-a-service like revenue streams probably makes current margins less comparable to history. I suspect that one of the reasons that Deere is taking secondhand equipment off the market is that they want more of their newer 'cloud connected' versions out in the field (with the associated recurring revenue streams).

I continue to think that there is better news ahead for farm balance sheets. Current sentiment feels like extrapolation of the painful 2-year downtrend that we have been enduring in grain markets. This 🐿️ thinks that the recent buoyancy in corn and wheat futures in particular promises to be the start of a bigger move.

Estimates of both of the final output for last year’s production yields for the current year in both North and South America feel way too high. Are weather risks in Russia / Ukraine, Brazil and North America later this summer starting to be priced more appropriately?

Higher grain markets will likely take the agribusiness equities with them on expectation of better incomes on the farm. We are positioned accordingly.

Finally, and filed under the topic of fun farming-related facts that I learned from watching Clarkson’s Farm, was learning that 1990s UK house music legend, Andy Cato, sold the rights to his Groove Armada catalogue to finance his significant investments in organic farming. This means that I mercifully do not have to play you out this week with any combine harvester-themed tunes from The Wurzels (please do not click that link if you have any musical taste whatsoever!).

Groove Armada’s classic 1997 anthem “At the River” only made it past the UK’s BBC Radio 1 playlist committee (who thought it was too slow) as a result of the forceful intervention of DJ Zoe Ball (aka Mrs. Fat Boy Slim herself!).

I think Zoe nailed it. Judge for yourself by clicking on the image below:

That’s all for front section this week. In Section 2 (for paid subscribers), we take a look at how the utility sector is the latest to be graced with an AI ‘halo’. This looks ‘over-cooked’ to the 🐿️! The Acorn Overview and Portfolio Update this week covers everything from the metals to Formula One and motoring UK midcap investment trusts!