Wheat Kings

The Blind Squirrel's Monday Morning Notes, 29th April 2024.

It’s time to finally get off the fence in terms of our positioning in agriculture-related equities. The 🐿️ is drawn to the Merchants of Grain.

Can these traders overcome ‘the Goldman dilemma’ when it comes to valuation?

In Section 2 this week (for paid subs), we outline where they fit in in the context of our broader Ag basket. We also discuss some new positions in ‘trend-following’ and in the Japanese Yen.

Welcome! I'm Rupert Mitchell aka The Blind Squirrel and this is my weekly newsletter on markets and investment ideas. If you've received it, then you either subscribed or someone forwarded it to you (add yourself to the list via the button below). Please also consider becoming a paid subscriber or gifting to a friend!

Wheat Kings

The introduction of the Javier Blas and Jack Farchy book on the commodity trading empires, The World for Sale, is aptly titled ‘The Last Swashbucklers’. This rodent has always been completely fascinated by and is somewhat in awe of the power exerted by these secretive groups in the world of the resources that drive the global economy.

The upending of the global traffic of oil and refined energy products created by geopolitics and the imposition of various sanctions regimes is fascinating but will be a topic for another day. For now, I want to focus on food. While on holiday earlier this month, I enjoyed re-reading Dan Morgan’s 1979 classic history of the agricultural trading houses, Merchants of Grain.

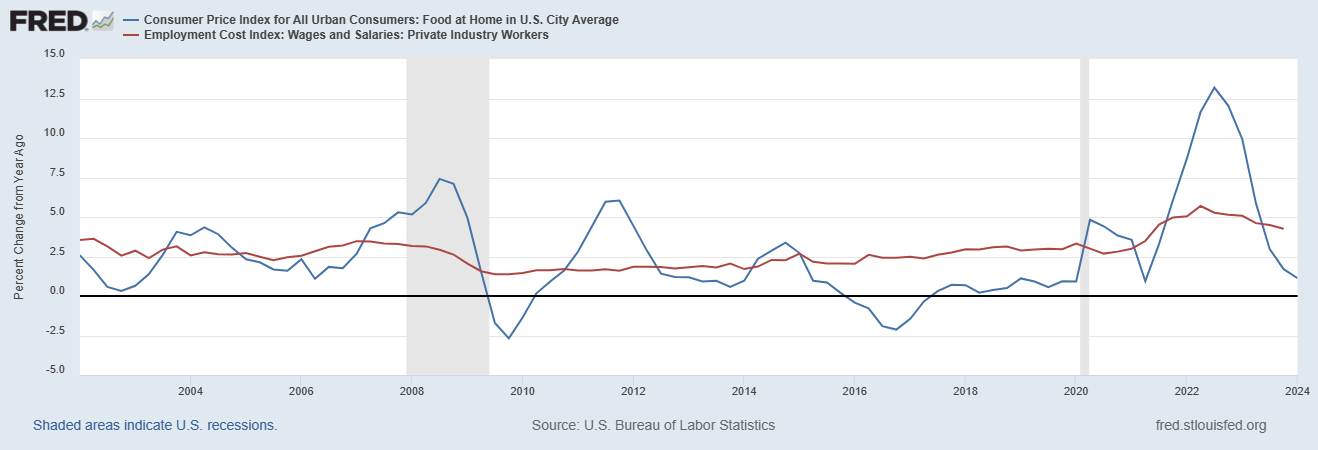

I chose to pull this one back off the bookshelf as part of my ongoing due diligence into understanding how the recent surge in global inflation has managed to largely bypass food prices (apart from a temporary spike at the time of Russia’s invasion of Ukraine).

I know that this 🐿️ is not alone in being surprised that climate / weather and geopolitical volatility has been shrugged off by the global grain markets that have now been in a downtrend for almost 2 years.

I completely understand how the rules-based systematic models of the CTAs have latched on to these powerful downtrends. Regular readers of this note will know that the 🐿️ has incorrectly called for a trend shift twice in the past 15 months based on weather and crowded positioning theses (most recent piece here).

The latest 6-day surge in the price of wheat (+9% last week) has certainly caught this rodent’s interest. A deterioration in Middle East geopolitics twinned with increasing risk of drought in the southern Russian wheat belt appears to be behind the move.

Will it be enough to get the rest of the grains complex moving at a time when questions continue to be asked about corn and soybean yields in Brazil and Argentina? Hot and dry conditions in Latin America for 2023/24 was central to the 🐿️’s earlier calls on grain prices.

I have fielded plenty of emails and questions in The Drey (our members’ Discord channel) about whether or not I am ready to ‘double down’ on my earlier (and incorrect) bullish grains calls. All I have said is that I certainly see what they see but that previous ‘swings and misses’ probably disqualify me from calling the turn this time. I shall however be the first to pile on any move that looks like a definitive shift in trend. It’s time to ‘buy the dip’ in food prices?

Agriculture related equities have performed in sympathy. This is VanEck’s Agribusiness with its brilliant ticker MOO 0.00%↑. It is down almost 35% since the May 2022 highs.

This feels unsustainable. However, the title of this piece is ‘Wheat Kings’, a homage to the commodity traders that no doubt have a much clearer sense for what comes next for the grain complex (as well as homage to the classic track of the same name from Canadian rockers The Tragically Hip - h/t to Kevin Muir for the intro!).

The world of food commodities is the ultimate insider market. A market that has been dominated since the 19th Century by the ‘ABCD’ oligopoly of Archer Daniel Midland ADM 0.00%↑, Bunge BG 0.00%↑ and (privately held) Cargill and Louis Dreyfus. In the modern era, this group is now bolstered by the Japanese sogo shosha (trading houses), COFCO (the Chinese state-owned food giant) and Viterra (a division of Glencore that is expected to be merged into Bunge in the coming months).

These trading houses are active across the supply chain, from seed supply to wholesale distribution, milling / refining, storage, transportation and merchandising of food commodities. They are not necessarily reliant on rising prices. This is because they are the ultimate arbitrageurs of price, based on geography, season or form factor (raw or refined for food, animal feed or fuel).

The scale and complexity of food transactions will expand enormously in the next 10 years even before taking into account the potential for trade frictions (and pricing anomalies) created by geopolitics. ABCD will sit at the epicenter of this web of transactions.

The 3 tables below, taken from the OECD and UN FAO’s Agricultural Outlook 2023-2032, should give readers an idea of the scale and complexity of these trade and processing flows.

I do not plan to give up in my attempts to profit from what I expect to be rising grain prices in the coming months and years. However, I do want to make a core allocation to investing alongside the agricultural commodity insiders, the so-called Merchants of Grain!

Outside of a couple of niche regional plays in Asia, Wilmar (F34:SGX) (in which ADM has a minority stake) and Olam (VC2: SGX), the only way to gain direct exposure to these Ag traders is via ADM 0.00%↑ and BG 0.00%↑.

Let’s start with the larger of the 2 (currently!), Archer Daniels Midland. The following photo montage of images taken from ADM’s most recent annual review goes to prove that even hard-nosed commodity traders are not averse to a bit of ‘greenwashing’!

Bunge was founded in 1818 in Amsterdam but is perhaps better known for its expansion into Latin America in the late 19th Century (first Argentina, then Brazil). Like ADM, the modern-day Bunge now a (very) global operation.

The smaller of the 2 listed global ag players has been seen as a potential acquisition target for either ADM (2018) or Glencore (2017). However, in June 2023, Glencore announced a plan to merge Viterra, its agriculture division, into Bunge in a $8.2bn cash and stock deal that will see Bunge leapfrog ADM to become the largest global listed ag trader when/if the deal closes this summer.

I have often viewed Glencore as the ‘apex predator’ at the top of the global commodities pyramid. Clearly, the group had seen value in the combination of their Ag assets with Bunge in the past. The relatively modest valuation premium embedded withing the merger terms and the high stock percentage in the consideration suggest to me that the Masters of Zug view the deal as a deeper expansion into, rather than a retreat from, the agricultural commodities sector.

Financial profile, valuation and ‘the Goldman dilemma’

At first glance, the fundamentals of agricultural commodity trading might seem pretty unattractive. Their revenue line suffers from the vagaries of both the weather and of geopolitics, and the economics of processing of grains and oilseeds appear to feature some truly razor thin margins. Not much to get excited about, right?

Here the rodent disagrees! The players in the ‘Big Grain’ oligopoly have assembled global networks of infrastructure, processing and logistical assets, relationship and know-how that it would be almost impossible to replicate if one started today. I suspect that the earnings power of this network is just about to be switched on.

In an increasingly multi-polar world, we are already seeing signs of national governments prepared to manage food security with export bans and seeking to build strategic grain reserves. This a game that can only be played by those nations with the greatest resources and will no doubt increase price volatility for marginal food demand (and edge for the agile traders).

I am sure that many of my readers believe that man-made carbon emissions are solely to blame for the recent changes to our climate. This 🐿️ believes that the impact of solar cycles and volcanic activity should also be taken very seriously indeed (we wrote about this last year).

Irrespective of your point of view, I think we can all agree that this increased geopolitical uncertainty comes at a time when we also expect to see greatly increased climate volatility and extreme weather events that will give rise to harvest failures and ag market uncertainty.

These are the circumstances in which the commodity traders should be expected to thrive. But what should we as outside investors pay for that opportunity?

The market has a problem with accurately forecasting revenues and earnings for the traders and consequently assigns a MASSIVE discount to those earnings in terms of a multiple (a 67% discount to the S&P500 on a PE basis). The commodity traders suffer from the ‘Goldman dilemma’ when it comes to their public market valuations.

This 🐿️ worked on the IPO of Glencore as well as those of some of the larger private equity businesses. Assigning a multiple to the trading business of the commodity traders is as challenging as assigning a multiple to the hard-to-forecast performance fee / carried interest income stream of the PE shops.

Glencore has partially addressed this challenge by acquiring physical mining assets with (more predictable) cash flows but a ‘full’ multiple for their trading profits still eludes them.

The private equity giants have basically all but given up on trying to obtain a multiple for their 'carried interest’ - they do not even seem to care about performance metrics these days. They are frankly just in the business of asset gathering. On this topic, the 🐿️ has written much 👇.

So, the big boys have given up and decided to ‘play the game’. In no way am I trying to justify or defend the recent accounting shenanigans at ADM, but the focus on ‘bulking out’ the nutrition business was clearly driven by a view that the market would attribute a better multiple to that type of business. In the meantime, Bunge and ADM’s EBITDA is valued at ‘25 cents in the dollar’ versus the broader S&P 500.

So, is this a value trap? I see a couple of things happening here. The transcript from Bunge’s Q1 earnings call from last week was insightful. The gross margins at BG 0.00%↑ once again appeared to be uninspiring. Management paints the picture of a reasonably challenging revenue environment. However, you get the strong sense that they have been absorbing some inflationary pressure on behalf of consumers over the past few quarters.

Then came the Q&A and the inevitable enquiry about the most recent Canadian anti-trust challenge to the Viterra merger. Greg Heckman’s response was really interesting:

“…we got to file in a little 40 jurisdictions and 28 of those have issued unconditional clearances at this point. Of the remaining 13, of course, we've got some of the big ones, U.S., Canada, Brazil, China and the EU. If you remember, Argentina is post-closing review.” Bunge CEO, Greg Heckman.

They are sooo far from approved. They are still missing approvals from the 5 largest players in global agriculture! This is precisely the time to be portraying yourself as a low margin, humble grain miller and oil seed refiner. There is no chance that Bunge is going to allow the outside world to see its “earnings power” right now. I suspect that this is something that we can look forward to.

In the meantime, it appears that these companies have got religion on capital allocation. A strategic takeover thesis had always existed around Bunge (and the other commodity traders). The more likely outcome is that they just do it themselves by reducing their share counts. We are starting to see clear evidence of this plan in action.

That’s all for front section this week. In Section 2 (for paid subscribers), we will do a deep dive on how the 🐿️ plans to play the traders and the broader opportunity in agricultural commodities (including a really interesting mid-cap special situation in fertilizers).