Taking on Omar: Part 1

Time to bet on further downside in Blackstone, the big beast of 'Big PE'.

Summary

The 🐿️ has been on the case about private asset markets since late 2022. Fortunately, we chose to express our view via ‘short’ position in the intermediaries that benefit from transaction flow in ‘Big PE’.

Now, it is time for a more direct approach. Blackstone is undoubtedly ‘the King’ of the ‘Big PE’ jungle. We go through the rationale.

Reminder: Blind Squirrel Macro has just launched its subscription service. Details here. The Acorn (trade ideas) and archives will be going behind a paywall next week.

Taking on Omar

We are now close to the time where the 🐿️ is comfortable that a more direct approach on private asset markets, as outlined in the ‘front section’ of our October 23rd letter, is appropriate.

Omar Little, the fictional hitman and antihero of Baltimore gangland in HBO’s TV show, The Wire (the 🐿️’s 2nd favorite TV show after Succession), was the character that launched a thousand memes. Most of the memes were inspired by this particularly eerie scene:

Blackstone is undoubtedly ‘the King’ of the ‘Big PE’ jungle. The 🐿️ is now planning to ‘come at the King’, and we shall try not to miss. This requires a degree of justification as well as thoughtful structuring. Let’s dig in!

Why now?

As mentioned in my earlier notes on this private asset market theme, the 🐿️ has steered clear of shorting the asset gatherers, focusing instead on a second derivative - deal activity by ‘Big PE’. This is what led us to the Goldman Sachs short trade that we closed out in late October.

The turns out to have been the right choice. Until late September, the industry giants were showing no signs of weakness and were destroying their service providers in the investment banking world (in share price terms).

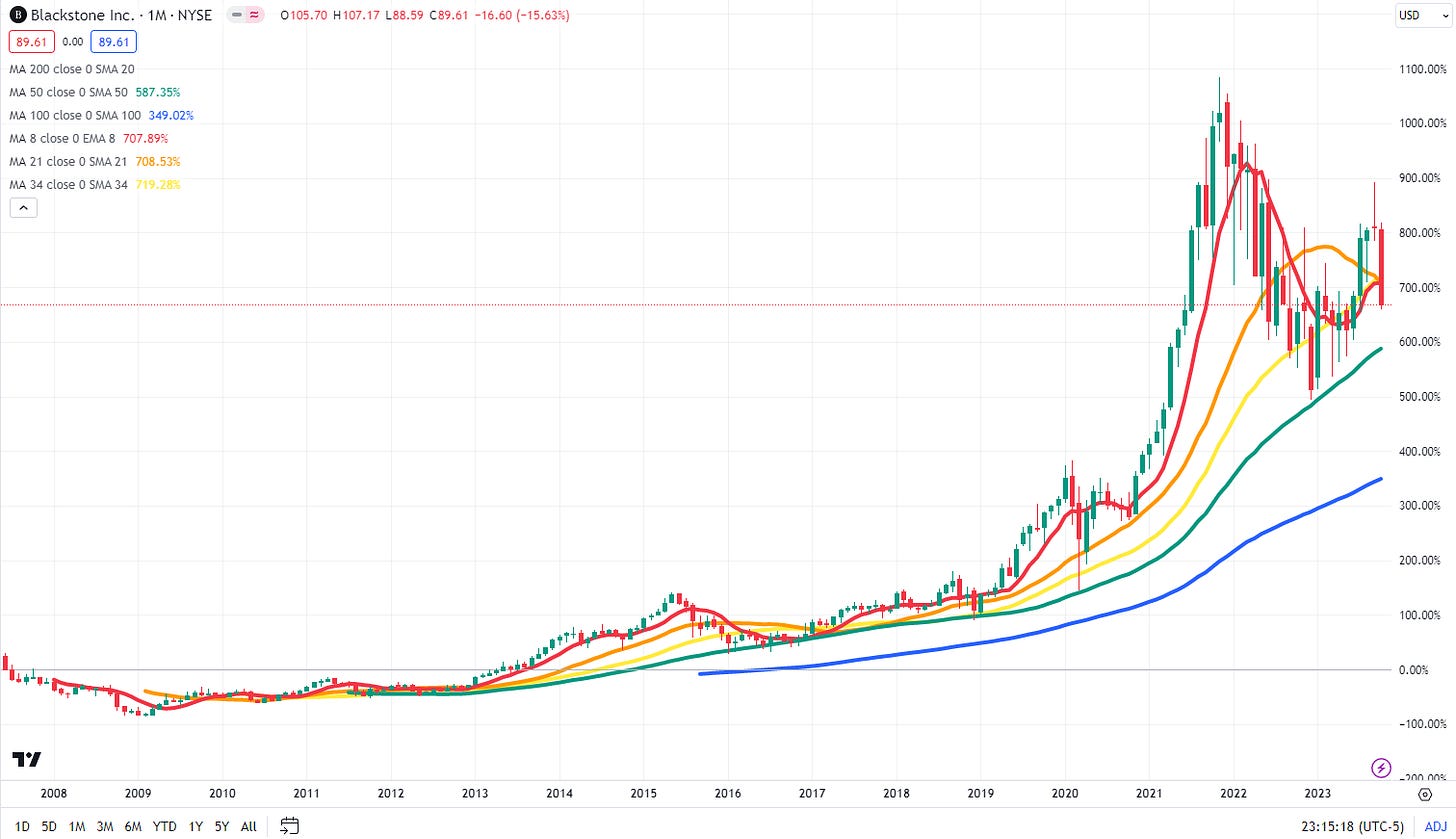

A possible broken uptrend. The famous short seller, Bill Fleckenstein, has a saying that has always stuck in my mind. He advises short sellers to only shoot a stock ‘in the back’ (i.e., when it has already started to go down). Betting against a stock on the basis of valuation or narrative when it is still in an uptrend is often a fool’s errand.

Rising interest rates finally start to bite. ‘Big PE’ is a long duration animal and therefore highly sensitive to interest rates, both absolute level and, more importantly, the rate of change of those rates.

A shift in the politics. ‘Big PE’ enjoys an incredibly favorable tax regime just as fiscal deficits are reaching eye-popping levels. The industry has invested wisely in political influence, but economic populism is fast becoming a bipartisan cause and the industry could fast become a larger ‘fiscal contributor’. The ‘Carried Interest Loophole’ is an obvious target. Washington can drop its donor friends fast. Just ask Sam Bankman-Fried!

On this point I have been bouncing ideas off Russell Clark. He has published a couple of excellent podcasts on shorting PE (and Blackstone) outside of his paywall (here and here). He agrees that Carried Interest reform would be an Achilles Heel for ‘Big PE’ but believes that a Democratic political ‘lock’ is required for that to happen. I am not so sure (and Russell too acknowledges that political priorities can change fast):

“I suspect you need to see the Democrats control both houses for such a change. My views on a pro-labor shift means I think this is likely. But short selling is often a timing game. I am not sure this is the right time, but then again, a week is a long time in politics!”

Next, there is an increasing drumbeat of displeasure emerging with respect to some of the anti-competitive practices being employed by the PE complex. Lincoln Project Reed Galen’s conversation with Brendan Ballou and Bloomberg’s Barry Ritholz’s chat with Gretchen Morgenson give a good idea of a narrative that could create a major political stink if it becomes ‘mainstream’ in an election year. FTC enforcement has started, even if the front pages are reserved for ‘Big Tech’ cases.

Finally, I am not going to repeat my rants about ‘volatility laundering’ and the way in which the industry has been marking its own homework when it comes to returns. You know where to find that.

Volatility laundering aside, private asset exposures are pitched to fiduciaries as portfolio diversifiers. The reality, as DBi’s Andrew Beer (CIO of the CTA replicator ETF DBMF 0.00%↑ that we monitor) has worked out that they deliver completely the opposite (basically a levered version of what you already own)!

There are unlikely to be a lot of tears shed when Ivy League endowments start to recognize losses from their private market forays. 🐿️Note: Yale’s David Swenson’s success in alternative investments was due to the fact that he was ‘zigging’ when other funds were ‘zagging’. He was the only one doing alternatives when he was compounding the Yale endowment at 25%. Endowments and pension funds are now overallocated to a crowded, correlated, levered and underperforming space.

When already underfunded public (think teachers, police, firefighters etc.) pension funds start to have to contend with the implications of poor private asset investment performance (in terms of beneficiary payouts), expect some extreme political outrage. The 🐿️ suspects that this is closer than people think.

Why Blackstone?

The 🐿️ first came across Blackstone as a young investment banker in the early 1990s. Somewhat strangely for a New York boutique advisory shop, they were trying to clip an intermediary fee from of …wait for it … an equity offering that I was working on…in Egypt! I still to this day have no idea what they were doing there! However, Blackstone’s origin story got a lot more impressive from there.

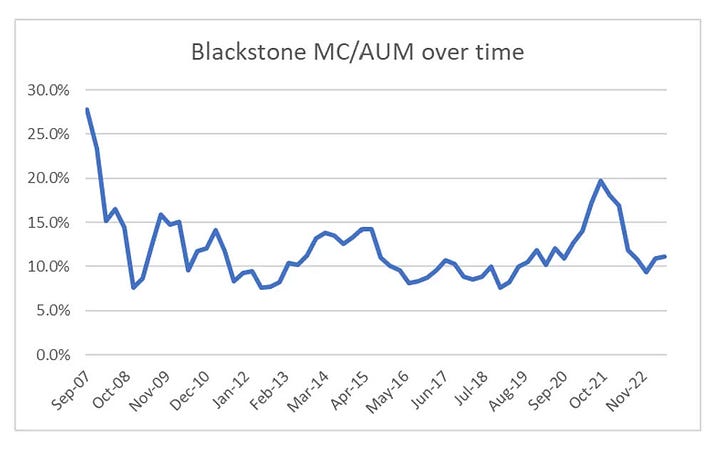

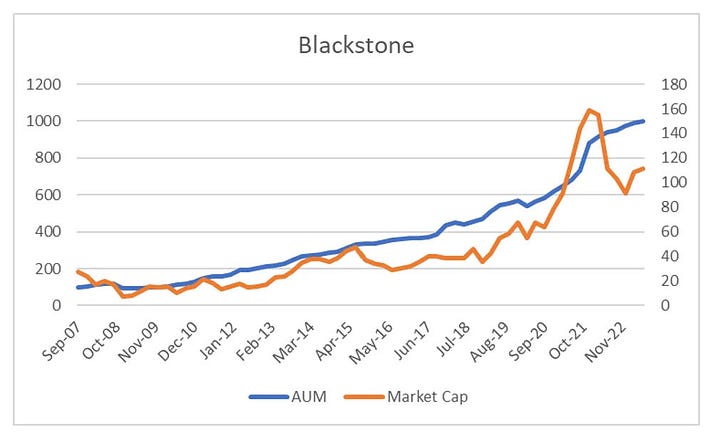

The firm sneaked out its IPO in June of 2007, on the very eve of the Great Financial Crisis. The initial IPO investors were sitting on an 86% drawdown by the time the stock bottomed in March of 2009. Since then, Blackstone has barely looked back (unlike my former employer from the time, they did not have to take $25bn of Mr. Paulson’s TARP money). It looks as though CVC has just decided against trying to pull off a similar feat.

So 🐿️, why don’t you pick on someone your own size? Not that it is my size, but Invesco has a global listed PE ETF, PSP 0.00%↑. It tracks an equal weighted index of listed PE firms. If you would prefer to take a ‘catch all’ approach to the ‘short PE’ theme, look no further than this vehicle (especially for a plain vanilla short position).

But the 🐿️ is going to channel his inner Omar here:

The Brick-and-Mortar Achilles Heel

The answer: the real estate kicker. Blackstone may have a diversified asset management business on ‘PowerPoint’, but it is very levered to the real estate cycle. As regular readers will know, the 🐿️ is a huge MASSIVE fan of the work of Armada ETF’s Phil Bak. He has been doing ‘God’s work’ (no Blankfein blasphemy intended!) on this topic:

BREIT, Blackstone’s unlisted REIT, makes great outrage headlines. Call the 🐿️ old-fashioned, but the idea that gating (for redemptions) a $70+bn fund owned largely in retirement funds is not a national scandal in the US and elsewhere is nothing short of staggering.

However, BREIT is the tip of the iceberg when it comes to Blackstone’s exposure to real estate that is potentially marked at the wrong price. Russell’s first Blackstone podcast digs into this with some great analysis. Interest rates at current levels will expose the lack of ‘imprecision’ in these valuations over time.

How to do it and what are the risks?

Frankly, the ‘Financial Justice Warrior’ (TMChase Taylor) in me makes me inclined to be short the entire complex! After all, as Omar said, “A man gotta have a code.” However, we need to be smart. We think that Blackstone’s real estate exposure creates an extra edge, but other aspects of the trade need careful risk management.

The big one? Interest rates. An emergency easing cycle has rescued ‘Big PE’ in the past. It could do so again.

This week has somewhat changed the dynamic. Mrs. Yellen’s long bond friendly QRA and a pretty dovish FOMC meeting this week have lit a fire under long duration assets.

I am currently considering a number of implementation structures. The hedge structures that I had in mind before this week were very much in the “when something really breaks category”.

After this week, any near-term execution of a BX short now probably needs to be packaged with either a more significant duration hedge component or fully paired with another long equity exposure (probably broad-based financials).

The 🐿️ has a number of ideas and structures that would suit this purpose. Near term, we need to clear the final hurdle of ‘macro-Halloween’ week, Friday’s payroll numbers. A ‘hot’ jobs number could see renewed (upward) pressure on long yields, which would actually make structuring the trade much more straightforward.

Any neutral or week number, will need much more defensive structuring. We will have a final view (and Acorn!) early next week.

Final Thought

One of the 🐿️’s favorite lines of Omar pop-philosophy was this one:

“Man, money ain’t got no owners, only spenders.”

I fear that making a call on structuring ahead of Friday’s Non-Farm Payrolls number heightens the risk of the 🐿️ becoming a spender rather than an owner of money…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

!["How you expect..." - Omar Little [506 x 316] : r/QuotesPorn "How you expect..." - Omar Little [506 x 316] : r/QuotesPorn](https://substackcdn.com/image/fetch/$s_!R_nP!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc65160cf-317d-4f3b-ab21-7166af2e0b66_506x316.jpeg)

I will give you a present for your trade: Take a look at Riverstone when it got into trouble. Google "Riverstone, clawback", they had to sell part of the GP to Goldman Sach's Petershill fund. Here's the present. You are looking for PE funds that take American style carry. When the markdowns in assets start, the funds with American style carry will be left with in the real financing death spiral.

An added bonus, but don't have a specific fund to point to; if a non-SEC compliant investment manager is running a Ponzi scheme, the beneficiaries of the fraud, even if they didn't know there was a fraud have to pay back the proceeds of the fraud. Madoff investors who had redeemed 10-20 years BEFORE the ponzi scheme was discovered had to give the money back to the liquidators so it could be distributed back to investors.

https://en.wikipedia.org/wiki/Recovery_of_funds_from_the_Madoff_investment_scandal

One thought, do not expect that only the Democrats will be favorable to labor, both sides of the aisle have become far more populist lately, especially with Trump, and it would not be hard to believe that carried interest, which does not help the ordinary citizen, is an easy target for the fiscal conservatives