Should the🐿️ be bullish (Synthetic) birdsh*t?

The Blind Squirrel's Monday Morning Notes, 19th February 2024.

Summary

After last week’s inflation news, the 🐿️ steps back from the noise and looks more deeply into food inflation.

After the pandemic-related supply chain shocks, global food prices have been remarkably suppressed given geopolitical pressure and, more recently, the significant negative impacts from drought and flood in certain parts of the world.

Is the data on global stocks flawed? Is Agtech already delivering farming productivity gains that are not being factored into the numbers?

It looks like we are nearing some important long term support prices in agricultural commodity prices and agribusiness equities.

In the second section, we look at how we might be able to improve on VanEck’s MOO ETF for out Ag exposure and review the latest on our acorn positions in a number of energy verticals, coherent optics, tires, Brazil and UK midcaps. It may also be time to come ‘off the fence’ (we have in the ‘T-Bill and Chill’ camp) in the US Treasury market.

Welcome! I'm Rupert Mitchell aka The Blind Squirrel and this is my weekly newsletter on markets and investment ideas. If you've received it, then you either subscribed or someone forwarded it to you (add yourself to the list via the button below). Please also consider becoming a paid subscriber!

The audio companion to this week’s note will be uploaded to Substack on Tuesday to allow me to incorporate comments and feedback from this note. It will also be available as a podcast on Apple, Spotify and the other usual podcast apps.

Should the🐿️ be bullish (Synthetic) birdsh*t?

“There began to fall a greyness on the face of the sea; little dabs of pink and red, like coals of slow fire, came in the east; and at the same time the geese awakened, and began crying about the top of the Bass. It is just the one crag of rock, as everybody knows, but great enough to carve a city from. With the growing of the dawn, I could see it clearer and clearer; the straight crags painted with seabirds’ droppings like a morning frost, the sloping top of it green with grass, the clan of white geese that cried about the sides, and the black, broken buildings of the prison sitting close on the sea’s edge.” The Bass, Chapter XIV, Robert Louis Stevenson’s Catriona.

The magnificent Bass Rock and the coastline of East Lothian in Scotland were a backdrop to the 🐿️’s childhood. I always used to marvel at how the magnificence of this barren rock, made famous in the fiction of Stevenson, jarred with the gag reflex inducing stench of excrement from its population of 150,000 gannets when you got close to the island by boat.

Seabird droppings, or Guano, is still used as fertilizer in some parts of the world, for its nitrogen, phosphate, and potassium content. However, for the most part, there is no longer ‘brass’ in that muck business. Since the early 20th Century, synthetic fertilizers have done the heavy lifting of the “green revolution” (without which our planet could only support a population about 50% of its current size).

The success of mechanized agriculture and the ‘Green Revolution’ has happily put the Malthusians firmly back in their box. The lifesaving role of agricultural technology dwarfs the roles of blood transfusion, vaccines, antibiotics and other medical break throughs.

Agricultural technology has also ensured that the portion of economic activity devoted to feeding people does not dominate national GDP in all except some of the poorest populations on the planet.

I am not alone in being surprised at the extent to which food prices have collapsed since peaking at the time of Russia’s invasion of Ukraine in February 2022. After the pandemic-related supply chain shocks, global food prices have been remarkably suppressed given geopolitical pressure and, more recently, the significant negative impacts from drought and flood in certain parts of the world.

Forecasts of the risk of ‘the next Arab Spring’ resulting from a lack of Ukrainian / Black Sea food supply appear to have been overstated. For now, grains have managed to find a way to their end markets and grain prices have remained under significant pressure.

At face value, Russia and China, the latter having endured significant well documented weather stress, have managed to increase grain ‘production’ to offset reduced supplies from war torn Ukraine and ‘failed Monsoon’-hit India. Either that, or global stocks / balances were woefully understated before the crises. A deglobalizing world has to make that type of data far more unreliable.

Then there is technology. In the same way that man-made fertilizers have ensured that the world’s growing population has continued to receive the calories it needs, is advancing seed science (GM crops and CRISPR) keeping the impact of increasing weather volatility at bay?

It is not clear to the 🐿️ that this amazing technology is yet operational at ‘mission accomplished’ scale. I suspect that it is in fact the official data on stocks and balances that is flawed. We saw only last week that the USDA feels qualified to disagree with CONAB, its equivalent government body in Brazil about [*checks notes] the BRAZILIAN corn and soybean crop forecasts for 2024!

I am not planning to kick off a theoretical debate about the disinflationary impact of ‘Agtech’ on food prices. That’s not the point. In a world where a growing global population is faced with increased weather volatility and climate stress, mankind needs all the help we can get to keep up with food production requirements!

Am going to bring up the ‘T’ word. Last week’s surprise increases in US CPI and PPI inflation made tough reading for the camp of economists determined to write off the global inflationary pressures evidenced since the pandemic as ‘transitory’. Last week’s scorching hot numbers, even though flattered by still depressed energy prices, have been analyzed extensively elsewhere.

Let’s stick with food inflation. Surely there can be no more important a topic in a year when so many of the world’s democracies go to the polls (although I will add ‘pump’ gasoline prices to food in the case of the US!). In most parts of the world, food inflation has decelerated dramatically.

As ever, human beings love to extrapolate the current trend. Look no further than the current positioning in grain futures markets. Feels like a tinderbox to this rodent! I simply do not understand the inner ‘expect value’ calculations of those traders that are pressing their short positions at this stage of the cycle. Flat can be a position too!

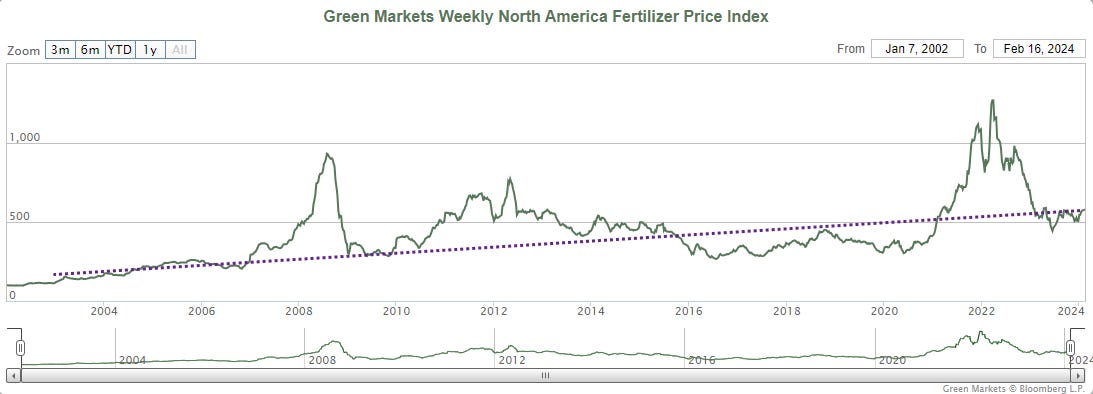

Let’s drill down a little further and come back to where we started, with fertilizers. Fertilizer prices clearly got ahead of themselves in 2021/22 but have now ‘caught down’ and appear to be holding the long-term upward trendline.

It feels like food prices may be about to do exactly the same thing. Back in October in ‘Refocusing the 🐿️’s Ag Positioning’, I did some work on trying to understand correlations between the various agricultural commodities over time.

I still need to do this correlation analysis properly, but I do still have my eyeballs and if you isolate the major grains from the multi-colored spaghetti (all the ‘Ags’ from the 1970s) in the chart above, it does look as though we are at - or at least approaching - a multi-decade line of uptrend.

Then let’s take a look at the equities. VanEck’s Agribusiness ETF MOO 0.00%↑ holds a diversified portfolio of global agriculture linked stocks.

I have spent the last few weeks immersed in earnings call transcripts for fertilizer companies, commodity trading shops and ‘ag equipment’ companies. I have even been listening to podcasts about the secondhand market for tractors and combine harvesters!

The Ag complex feels as though it is about to turn. I am however waiting for that technical confirmation (of trend reversal) before publishing a new acorn report. For exposure to the sector, VanEck’s MOO is a decent vehicle and certainly superior to Blackrock’s VEGI (which is less liquid and has an outsized 22% allocation to Deere & Co). However, I believe that you need to be a bit more surgical about the choice of sub-sectors within Ag. More to come on this.

Last week marked the 1st anniversary of Blind Squirrel Macro going live on Substack. Thank you for your loyal readership so far. I have put together a brief reader survey. It will only take 30 seconds of your time to complete, and I would love your feedback as I strive to make the content better. Important: Please add your email to the comments box if you would like a reply (otherwise it’s 100% anonymous)!

This week is a big one for AI with Nvidia’s earnings coming on Wednesday (post-market). Last Thursday, we published an acorn report on coherent optics, an alternative ‘picks and shovels’ play on AI if ~40x revenues for NVDA 0.00%↑ is too racy a valuation for you! Please check it out (link below). The (free) front section covers the full background to the theme.

That’s it for the front section this week. In Section Two (for paid subscribers), we look at how we might be able to improve on VanEck’s MOO ETF for out Ag exposure and review the latest on our acorn positions in a number of energy verticals, coherent optics, tires, Brazil and UK midcaps. It may also be time to come ‘off the fence’ (we have in the ‘T-Bill and Chill’ camp) in the US Treasury market.