Dead Generals out, Grandpa's defensives in?

The Blind Squirrel's Monday Morning Notes, 22nd April 2024.

So, the mob finally came in earnest for the ‘market generals’ of large cap tech last week. Is the FANG / FANGMAT / MAG7 narrative that has dominated investor consciousness (for what seems like a painful eternity to this rodent!) finally showing some chinks in its armor?

If we are at a narrative pivot point, which sectors had the best week? It was our grandparents’ favorite defensive plays: consumer staples, healthcare and utilities! But just how defensive are these sectors?

In Section 2 this week (for paid subs), the 🐿️ tries to temper his excited expectation about the potential for an encore of the great ‘long energy, short tech’ trade of 2022. It’s different this time.

Welcome! I'm Rupert Mitchell aka The Blind Squirrel and this is my weekly newsletter on markets and investment ideas. If you've received it, then you either subscribed or someone forwarded it to you (add yourself to the list via the button below). Please also consider becoming a paid subscriber or gifting to a friend!

Dead Generals out, Grandpa's defensives in?

So, the mob finally came in earnest for the market generals of large cap tech last week. Is the FANG / FANGMAT / MAG7 narrative that has dominated investor consciousness (for what seems like a painful eternity to this rodent!) finally showing some chinks in its armor?

Friday saw nearly half a trillion dollars erased from the market capitalization of the US technology leaders. Almost 40% of that figure came from the ‘Highlander’, Nvidia, alone. Amazingly not enough to qualify as its largest 1-day value reduction for the year! That was back on March 8th.

NVDA 0.00%↑ closed on Friday less than $2 above its volume weighted average price for the year ($760.55). Essentially, the ‘average' investor that joined Jensen Huang’s ‘AI’ party during 2024 is barely holding on to a positive return. The poor folk that bought the top tick on March 8th are now nursing a 22% loss! Incidentally, a buyer of GOOGL 0.00%↑ on that date is up 15% (😉).

This ‘signal’ emerges at an awkward time for the market. Trend-following (CTAs) and other systematic positioning (i.e., risk parity and volatility control funds) are as long US equities as they have been in 2 years (per Goldman Sachs data below). The risk is that this sudden reversal in sentiment (and price) now gets amplified by indiscriminate ‘selling by the machines’.

Let’s cross-check this by looking at the equity holdings within the DBMF 0.00%↑ ETF, Andrew Beer’s managed futures trend-following replication strategy.

It would appear that the process of selling down US equities by CTAs actually started towards the end of March (or indeed even earlier given that there is a lag to DBMF’s position changes as the strategy rebalances based on the observed recent performance of the CTAs). Inconclusive.

The market bears have been vocal over the past 72 hours. Regular readers will know that the 🐿️ has never really been a fully paid-up member of the ‘Mag7’ fan club and was ‘renting’ the Q1 2024 rally in tech equities via options. Your rodent does not yet have a sense for whether or not these latest moves are merely a ‘to be expected’ (and therefore buyable) 5-10% pull back or in fact the beginning of something more sinister. We will find out soon enough.

I instead wanted to spend some time thinking about the week’s relative winners. Some long-standing market conventions - such as the inverse correlation of stock and bond prices - have been thrown out during the latest market cycle. However, one of the topics that I have been giving some thought to of late is just what constitutes a truly ‘defensive’ equity allocation in the 2020s.

Last week, the sector performance of the S&P 500 tore a page straight out of our grandpas’ defensive positioning playbook. Investors appeared to be fleeing from crowded positions in technology and into utilities, healthcare and consumer staples names.

Now, a 1-week move hardly constitutes a major trend shift. Furthermore, in modern markets the noise from the de-grossing of long/short positions needs to be filtered out before you can make the argument that fresh money is being actively reallocated to new sectors and themes.

Judging by the changes in shares outstanding for these 3 ETFs, investors have been retreating from these defensive sectors for almost 12 months. Instead - and much to their cost (as we have discussed many times before) - they have been seeking out protection in long duration Treasuries via the TLT 0.00%↑ ETF. 🤦♂️

But it is worth asking the question. Just how defensive are these (so called) ‘defensive’ sectors that your grandfather used to hide out in when markets felt a bit tough in years past?

Let’s start with the consumer staples. If you strip the tobacco stocks out of the largest cap staples constituents of the S&P 500 index you are looking at a universe of stocks that is trading on an earnings yield of 5.2% (versus a 3-month Treasury yield of 5.4%). Capital allocation is also pretty unexciting, with forward dividend yields of around 3% and ‘gesture level’ share repurchase activity.

We had some fun earlier this year and last summer thinking about the risks to ‘Big Food’ from YouTube influencer-led challengers. This 🐿️ suspects that the ‘brand moats’ for the likes of Hershey and PepsiCo are not as wide as many may think in a world of Mr. Beasts and Prime energy drinks.

The FMCG players were very quick to pass on costs during the (‘20-’23) Covid inflation. However, “Shrinkflation” is now a political football (even before those higher cocoa prices have been absorbed) and good luck with upselling new ‘premium’ washing liquid lines during a cost-of-living crisis!

Then let’s look at healthcare. On the positive side, the large cap health services segment trades at a discount to the broader equity market and offers the potential for some inflation-busting double-digit earnings growth. But again, capital allocation policies (dividends and buybacks) are underwhelming.

The 🐿️ has never personally had to wrangle with the US healthcare system. It does not look like much fun to this rodent! However, in an era of populist politics, I get the sense that Big Healthcare’s lobbyists in Washington are going to need to be working overtime to keep their paymasters out of the firing line. This sector does not feel cheap enough to be defensive.

If the healthcare services sector feels like an unlikely safe hiding place, spare a thought for the utilities! Of course, I understand the traditional appeal. Largely monopolistic market positions, twinned with stable, regulated returns. However, their attractiveness as ‘the bond proxy in equity land’ assumes that you were interested in owning bonds in the first place!

You already know that the 🐿️ is no bond bull. Utility equities offer the upside of regulated returns and come with a heap of baggage. I am beginning to hear whispers of a bullish thesis for electricity producers around AI data center related power demand. Would love to be contradicted, but I am not sure that I get how (mainstream) utilities can effectively capitalize on this trend.

Sure, our West Coast based tech overlords have finally woken up to the fact that their new AI toys are going to require more electrical power than the grid has to offer them. This is only going to place additional strain on an industry that is already facing numerous challenges:

Demand - potentially tripling by 2050. Electric vehicle penetration forecasts may now be looking less like hockey sticks, but AI data center power demand is a whole new ball game!

Ageing power production assets and a grid in desperate need of overhaul and hardening - just as the cost of debt and equity is rising;

Utilities are consumer-facing businesses. They too have ‘political football’ risk in a populist world (remember that they came after the ‘price gouging’ petrol/gas station owners who make most of their money from selling you coffee and candy!);

Political / ESG decarbonization targets that have diverted investment away from core infrastructure towards less reliable wind and solar renewable capacity;

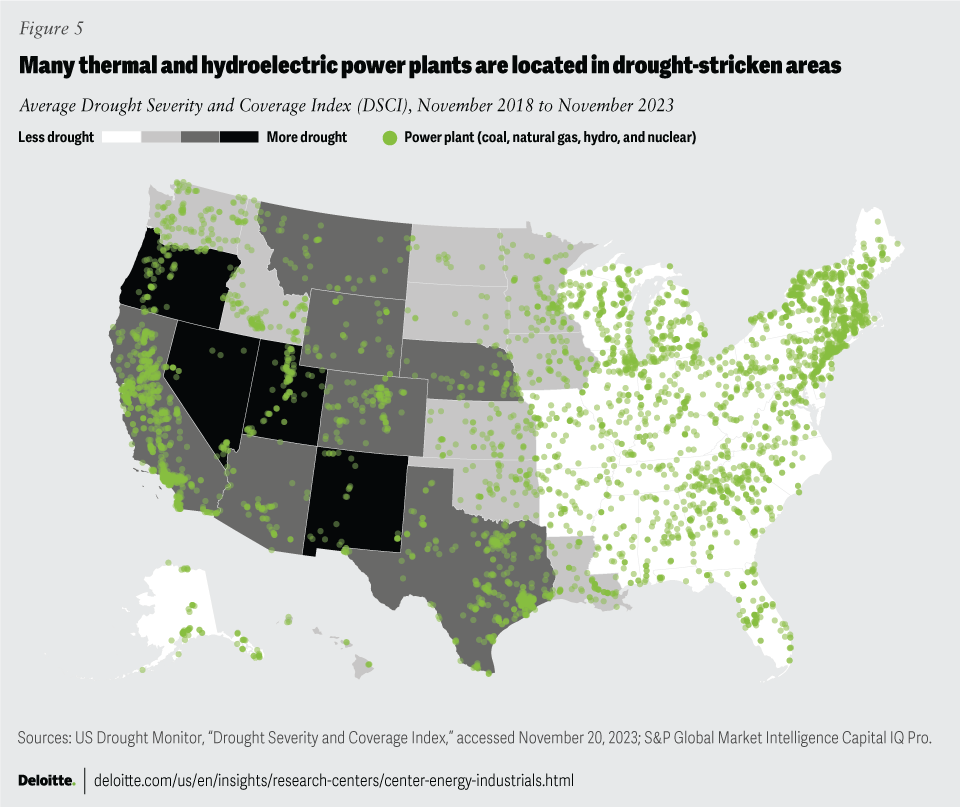

Increased heat and drought conditions. Climate is already creating litigation liabilities for utilities (wildfires in California and Hawaii), now power companies (particularly in the Western US) must deal with disruption from water stress and summer cooling (AC) demand.

There may be individual examples of independent players that can manage the regulatory red tape and capitalize on the opportunity to meet the demand from AI’s hungry power users, but at the end of the day don’t the tech overlords just end up building these capabilities themselves (probably with SMR nuclear technology)?

I shudder as I say this, but what if the new defensive plays are in fact a subset of our existing market generals! These players are not concerned with capital constraints; they have been allowed to become too powerful for the politicians to effectively curb their market positions; and on a price / earnings growth basis, they are priced with an impressive margin of safety.

That’s all for the front section this week. In Section 2 this week (for paid subs) the 🐿️ tries to temper his excited expectation about the potential for an encore of the great ‘long energy, short tech’ trade of 2022. It’s different this time.