Who dares to fade 'The Highlander Effect'?

The Blind Squirrel's Monday Morning Notes, 11th March 2024.

Summary

After a day in which we finally saw a big ‘red day’ for Nvidia, this week’s (still reasonably bullish) note could end up aging spectacularly poorly.

I am almost certainly not alone in finding it frustrating that the fortune of the entire global equity complex is seemingly inextricably tied to the success of Jensen Huang’s latest earnings report or graphics processor launch.

Let’s take a step back to assess where the true effects of AI have been over or under priced in other corners of the market.

The 🐿️ also has some thoughts on one of the ‘fallen’ Magnificent 7 names.

In Section Two (for paid subscribers), we focus on our tactical equity positional as we go in to a critical 6-week period. There is also plenty to discuss in fixed income, energy and precious metals markets.

Welcome! I'm Rupert Mitchell aka The Blind Squirrel and this is my weekly newsletter on markets and investment ideas. If you've received it, then you either subscribed or someone forwarded it to you (add yourself to the list via the button below). Please also consider becoming a paid subscriber!

The audio companion to this week’s note will be uploaded to Substack on Tuesday to allow me to incorporate comments and feedback from this note. It will also be available as a podcast on Apple, Spotify and the other usual podcast apps.

Who dares to fade 'The Highlander Effect'?

After a day in which we finally saw a big ‘red day’ for Nvidia, this week’s note could end up aging spectacularly poorly. You have been warned.

I certainly do not place myself in the same league as Twitter meme legend “Arun S Chopra”, but I did at least manage to make myself laugh with my ‘Highlander’ take on the recent extreme narrowing of equity market breadth. If it ever starts trending, just remember that you heard it first from the 🐿️ back in January!

The original 1986 Highlander movie charts the progress of a cohort of broadsword-toting immortals over the ages as they seek to be the last man standing. Similarly, the original ranks of the ‘Magnificent 7’ have seen their number dwindle since the start of the year to the delight of the commentariat.

I am almost certainly not alone in finding it frustrating that the fortune of the entire global equity complex is seemingly inextricably tied to the success of Jensen Huang’s latest earnings report or GPU launch. It is sometimes easy to forget that Nvidia has a spectacular track record of surfing the latest ‘new things’, be it gaming, crypto-mining or now the large language models of AI.

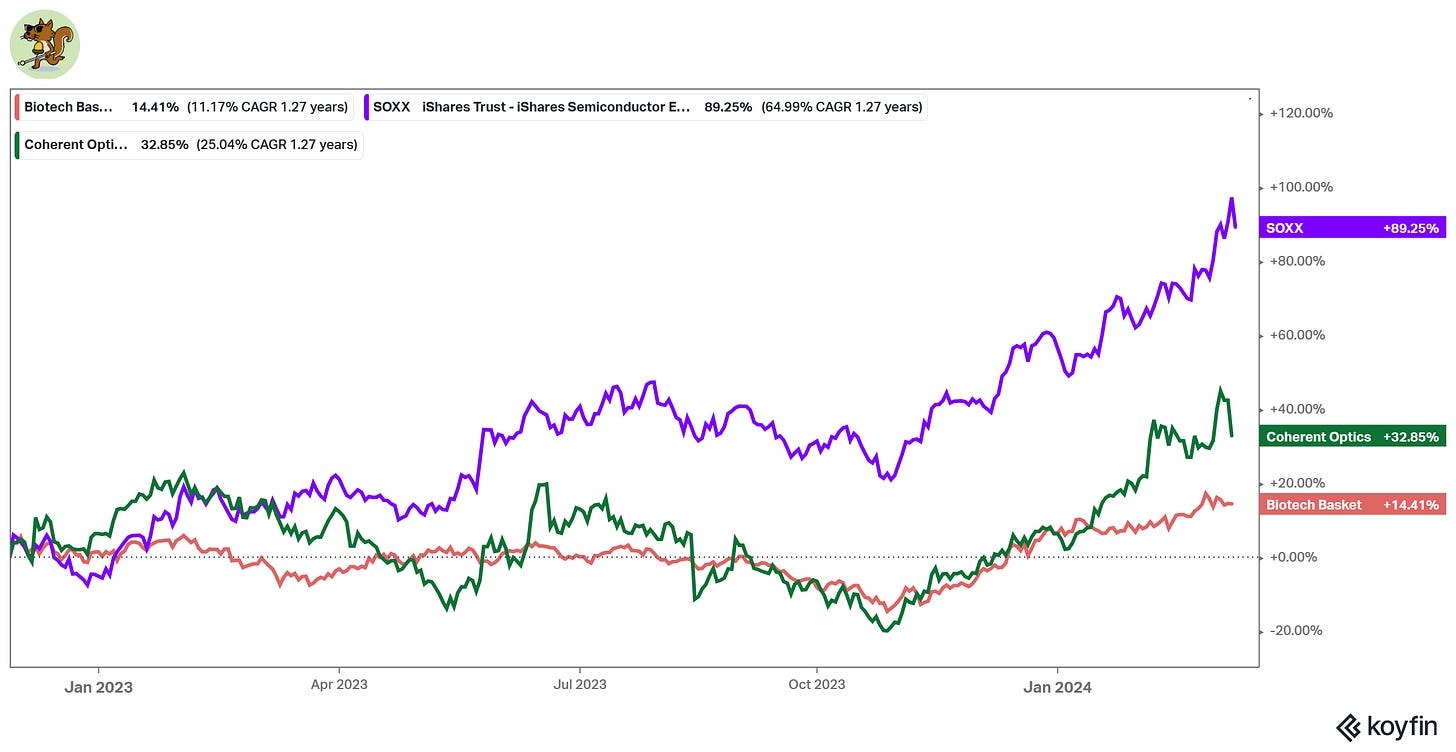

However, this is not to be a note about a single semiconductor stock. Of course, Nvidia is the leading light of the current AI-led market frenzy, and yes, the whole market would take a major hit from a proper correction in the name. I just think it would be useful to take a step back to assess where the true effects of AI have been over or under priced in other corners of the market.

Earlier in February we looked at non-GPU data center capex in our ‘Seeing the light’ on coherent optics. Last week, the 🐿️’s thoughts turned to the potential impact of the use of LLMs in the biotech sector (‘A(i) Prescription’). I can make persuasive arguments that both sectors are yet to fully price the opportunity.

Then there are the other parts of the semiconductor industry and its supply chain that are arguably yet to see some proper AI love. My ‘man in Monaco’ Le Shrub has been writing interestingly about the opportunity in custom silicon and tin. Yes, you read that last word correctly! #TinTwitter is a thing, and it has even more messianic fervor than another corner of financial social media…the uranium bulls!

The excellent Arjun Murti has been highlighting the fact that the hyper-scalers of large cap tech are soon going to be sounding the alarm on energy policy. They know just how power hungry the AI revolution promises to be.

As we have discussed before, large cap tech has the capital as well as the political power to sway outcomes on energy policy, but they recognize that policy moves at a glacial pace and have decided that they are not going to hang around.

So, what about the losers from AI (apart from the benchmarked fund managers that were underweight the likes of Nvidia and SMCI)? During the GLP-1 fervor of last year, people were quick to extrapolate negative outcomes for companies in a world where obesity no longer existed. In The Dangers of Extrapolation, we contemplated how “the cure for obesity has confined several industries and sectors to the garbage bin of history:

Companies in the sleep apnea (Resmed and Inspire), organ transplant (Transmedics) and aesthetic (aka ‘plastic’) surgery (InMode) areas have seen their share prices halved in 90 days!

The obituary is being prepared for the whole of ‘Big Food’s snack food and fizzy drink industry (Coke, Pepsi, Hershey & Mondelez)!

Apparently, our drug-improved physiques imply the beginning of the end for iPad-enhanced exercise bikes (Peloton) and gym memberships (Planet Fitness)!

Even the ‘Golden Arches’ and other fast-food outlets (Wendy’s, Domino’s, KFC) are one the verge of disappearing from our streets and shopping malls!”

We have not yet really seen the same response to the mainstreaming of AI in investor consciousness. I am still doing my work on this, but it strikes me that some of the most obvious losers from LLM and AI development lie in the IT services and BPO sectors. I put together an equal-weight basket of leading sector names using Koyfin’s (very cool) new Model Portfolio function.

Like everything else, the group has underperformed the semiconductor group since the launch of ChatGPT by a significant margin. But nothing to be alarmed about yet.

One thing that certainly jumped out at the 🐿️ was the extent to which the major Indian ICT names have underperformed significantly during a massive recent bull run in Indian equities. Something else to keep an eye on.

One topic that has got much more airtime of late is the implication of the rise of AI Chatbots on the dominance of Google’s search business. I mentioned last week that Google’s PR mess with the launch of Gemini had tediously managed to open up yet another new front for societal culture wars!

Anyone shorting Google on the back of some kind of partisan ‘go woke, go broke’ narrative needs to loosen the knot of the ‘team scarf’ that is tied too tightly around their neck. It is choking off the oxygen supply to the brain and clouding judgement. Politics and investing rarely mix.

Scott Galloway is absolutely correct when he concludes that the leaders of Silicon Valley are in it for the money, not the politics.

Sure, Google has infuriated a few folks but the idea that the group’s dominant position in internet search is somehow now under threat seems at best ‘early’ and at worst over-simplistic. Search is “so much more than just 10 blue links”:

Yes, it may be ex-Google software engineers that are leading the charge at the AI startups like OpenAI, Anthropic, Stability and Perplexity but it is Google that has ALL the data as well as the decades of institutional muscle memory in operating LLMs. To cite Scott again (from his 2024 Predictions podcast that came out several weeks ahead of the Gemini public launch):

“Gemini has access to proprietary data including your Gmail and YouTube accounts and your calendar. This is going to give them a leg up and have all sorts of really interesting applications that'll get people excited again about Alphabet…YouTube is effectively the fastest growing media platform outside of Tik Tok and they are taking share basically from everybody else. YouTube is now bigger than any cable channel it's growing double digits. It attracts that elusive Great White Rhino that is young men…Alphabet still has the largest toll booth in the world in the form of search has growth vehicles in the form of YouTube. I think that [the market is] about to recognize that they should not be left out of any AI inspired ‘bump’ party.” Scott Galloway, Prof G Markets.

To point it out before you do, Prof G also did not see Nvidia’s share price momentum continue into 2024. But then again, neither did many of us! However, I think that his directional take on Alphabet having one of the most promising consumer runways when it comes to AI is the right one.

The 🐿️ sometimes likes to think that he has managed to dodge becoming one of Google’s data drones. I have the privacy of an Apple phone; do not use Gmail or Google Docs; and am one of the weirdos that uses Microsoft’s Bing browser (on the strictest security settings). Then I realize that I elect to use a Chrome browser / Google Maps on my iPhone and spend plenty of time on YouTube (I identify as a grey rhino). I am afraid that CEO Sundar Pichai knows exactly who the 🐿️ is! Well, at least he could easily ask an intern to find out.

Alphabet is also now fast becoming a pretty cheap stock in absolute terms and certainly is already relative to its own valuation history.

Remember what happened the last time one of the large cap tech giants got ‘written off’ by the market on a corporate strategy ‘error’? The 🐿️ certainly does.

Alphabet has seen almost $300 billion shaved off its market capitalization since the end of January. To be fair, Nvidia lost that amount of value on Friday alone! Anyway, I am guessing that this is not going down well in the board room at Mountain View, California. The emperors of large cap tech do not like to lose.

I would argue that the Gemini ‘event’ may end up being a blessing in disguise for Alphabet’s shareholders. It may well serve to wake up the inner activist within the company. Alphabet has the data to dominate in the world of consumer facing AI applications. It also has plenty of ‘dead wood science projects’ in its corporate portfolio that could be sacrificed to fund that roll out before even touching its $25 billion per quarter share buyback program!

To be very clear, the 🐿️ is no fan of the power that these tech giants have acquired over both society and the economy. I celebrate the attempts by the FTC and the European Union to curb their monopoly positions but suspect that these efforts largely come to naught.

However, the idea that this company is a ‘short’ because its ‘beta’ AI image generator produced a picture of stormtroopers with the wrong skin tone sounds like an easy way for a fool to be parted from his, her or gender neutral (😉) money. I have a funny feeling that Alphabet will be retaking its position in the ‘Fantastic Four’ soon enough.

But what about fading ‘The Highlander Effect’ 🐿️, I hear you cry. Yes, that was indeed a truly vicious reversal in Nvidia’s stock price on Friday, but I do not believe that Jensen Huang’s $1000 per share party is likely to be cancelled prematurely. This weekend, social media has been desperate to call time on the stock’s stellar run (and with it the bull market).

I have 3 (somewhat unscientific) thoughts:

Do you really want to fade this and the big reveal of Nvidia’s new ‘Grace’ AI processor next Monday? Probably not.

Do you REALLY want to fade this one! Track record linked.

We still have not seen a 5:1 stock split!

Not my highest conviction opinion, but I suspect that we can wait for a bit of time for the ‘Hammer to Fall’ on our swordsman, Jensen Huang! The animal spirits are still alive in this market. Just watch the positive price action in crypto over this weekend.

Fun fact: Queen wrote 9 tracks for the original Highlander movie. Who does not have this particular banger from the Live Aid concert seared in their brain? If it’s not, thank the (boomer)🐿️ later!

That’s it for the front section this week. In Section Two (for paid subscribers), we focus on our tactical equity positional as we go in to a critical 6-week period. There is also plenty to discuss in fixed income, energy and precious metals markets.