Tough times for Financial Justice Warriors

The Blind Squirrel's Monday Morning Notes, December 18th, 2023.

Summary

Pour out a large glass of Scotch (or even better Absinthe) for the Financial Justice Warriors. It’s been rough going for them.

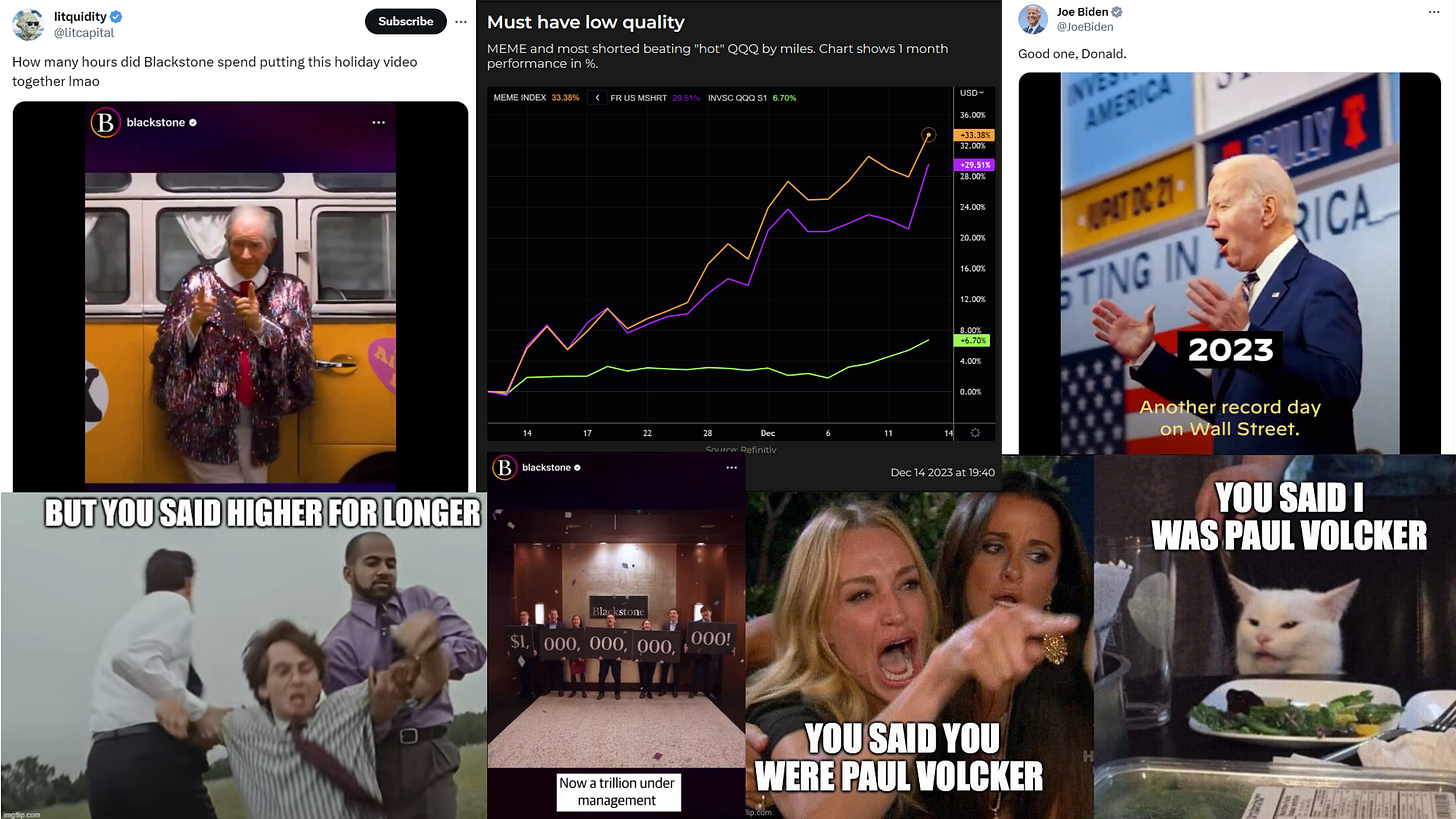

If the general behavior of markets since the pandemic has taught us anything, the ‘top’ in this current risk rally will not look so obvious. Cringe inducing videos from ‘Big PE’ and bankrupt companies such as Carvana pushing new 52-week highs is ‘sooo 2021’.

Right now, there is a bull market everywhere. We suspect that 2024 will be more discerning. I have no doubt that the Market Gods saw that Blackstone video too. Retired Financial Justice Warriors keenly await the consequences.

For paid subscribers, this week’s portfolio update covers a couple of new trades in #NatGas and Palladium/ Platinum. The Acorn review looks at #fertilizers #uranium #bonds #ags #energy #offshore #tankers.

The audio companion to this week’s note will be uploaded to Substack on Tuesday to allow me to incorporate comments and feedback from this note. It will also be available as a podcast on Apple, Spotify and the other usual podcast apps.

Tough times for Financial Justice Warriors

Pour out a large glass of Scotch (or even better Absinthe) for the Financial Justice Warriors (©Chase Taylor ). It’s been a very rough few weeks for them. This week’s (hate the word!) pivot by Jerome Powell was the cherry on the sundae.

The “End the Fed” crew, busy YouTubing from their basements with their burning building backdrops, had only just recovered from the brutal Sunday night ‘gap and crap’ in their beloved precious metals at the beginning of December when Powell came to the podium on Wednesday. Powell applied salt to their wounds, announcing his imminent (and possibly premature) conquest of inflation. And he was not messing around!

To be fair one can only tease those that you know and understand the best. Regular readers will know that this rodent is really an inflationista at heart; is known to be partial (on occasion) to the ‘barbarous relic’ that is gold; and is much more likely to salivate over a mining stock trading on 2.5 times free cash flow than any cash-incinerating dog walking app.

2023 has seen legendary short seller Jim Chanos close his fund (before getting to cash in on the demise of ‘The Golden Age of Fraud’); the passing of ‘value deity’ Charlie Munger; and most professional money managers getting comprehensively outperformed by their mother’s unopened Charles Schwab account. Even the invincible ‘Magnificent 7’ have been shown a clean set of heels by the ‘meme’ stocks over the past month. For many, 2024 cannot come soon enough.

I have to confess that your 🐿️ was also triggered by the excruciating Blackstone ‘holiday video’ released last week (link - for masochists only - you have been warned!). My views on the excesses and shenanigans within private asset markets are firmly on the record. However, I fear that the take below from my friend Le Shrub may be closer to the truth than any of us would like to believe.

The market certainly thinks that the party in ‘long duration’ assets is set to continue. Our ‘Taking on Omar’ trade (bearish Blackstone) is clearly still not ready for prime time.

At some stage this trade will make sense (and we should benefit from a better ‘entry’ level). However, this is not a trade for when financial conditions are being actively eased so aggressively.

Short selling activity generally is currently a ‘career limiting’ activity at the moment. Rumors of vast P&L destruction last week in the equity long/short and ‘Pod Shop’ communities are widespread. To use the words of a true Financial Justice Warrior, all the “wrong” (dangerous word that!) stocks have been going up.

If the general behavior of markets since the pandemic has taught us anything, the ‘top’ in this current risk rally will not look so obvious. Cringe inducing videos from ‘Big PE’ and bankrupt companies such as Carvana pushing new 52-week highs are ‘so 2021’. I am happy to wait for price action to confirm to me the opposite of what it is telling me now.

As discussed in ‘Scooby-Doo and Vincent Vega walk into a bar’, we have been accumulating long dated index puts given their relative cheapness. They have only got cheaper in the past fortnight. We have room to add more of these puts at these prices or lower. Somewhat incredibly, the sell side quants are saying that bullish positioning in equities is not yet at extremes.

Otherwise, we are afraid to even think about fading the impressive strength of this Fed-easing fueled ‘Santa rally’. I have no desire to chase the winners of 2023. In fact, it actually looks as though the ‘Magnificent 7’ might appear to be running out of steam here.

We are, however, adding risk elsewhere. There are places where we see plenty of value. This week, following on from the addition of UK mid-caps, we published a new Acorn report (long Brazilian equities).

Right now, there is a bull market everywhere. We suspect that 2024 will be more discerning. I have no doubt that the Market Gods saw that Blackstone video too. Retired Financial Justice Warriors keenly await the consequences.

That’s all for the front section this week. For paid subscribers, this week’s portfolio update covers a couple of new trades in #NatGas and Palladium/ Platinum. The Acorn review looks at #fertilizers #uranium #bonds #ags #energy #offshore #tankers.

Final Thought

In honor of the (Retired) Financial Justice Warriors’ burning YouTube backdrops, the 🐿️’s ‘holiday gift’ to you this year is some suggested new lyrics to Billy Joel’s “We didn’t start the fire”. They might need some work. Let me know where you think they can be improved, and we will release it as a Christmas single in time for next year! Maybe.

I will not be sending a note next Monday (it’s Christmas Day) but will send an Acorn Review and Portfolio update (to paid subscribers) ahead of the new year. The 🐿️ will be also lurking in The Drey (in between glasses of red wine). Normal publication schedule will resume on Tuesday, January 2nd, 2024. Wishing all my readers a very happy and prosperous new year! Thank you for all your support so far.