Dumpster Diving in 'Blighty'

If it's good enough for Boaz Weinstein...

I warned on Monday that I was “working on a new Acorn for next week that may take those of you that know me well by surprise…I wish to assure all readers that I am not on any new medication!”. I am however (perhaps surprisingly for some) turning positive on UK risk assets.

The toxic political climate that has existed in the UK since the Brexit referendum in 2016 has crowded out any serious focus on the fate of British business and industry which has suffered from neglect and underinvestment just as it struggles to grapple with the consequences of leaving a customs union with its largest trading partner (the EU).

It has been over a year since the UK Gilts crisis and Liz Truss’s besting by a salad ingredient. ‘Blighty’ continues to pull itself apart with culture wars, egged on by an exhausted and discredited administration that is devoid of ideas and which limps towards a general election in 2024 that could almost be viewed as a form of mercy killing. End of rant.

Unsurprisingly, UK equities have spent a great part of the past decade in the global investment ‘penalty box’. Transitory excitement about the global energy and resources sectors can on occasion provide some buoyancy to the FTSE100 and M&A activity can cause a stir in the mid-caps of the FTSE 250, but in general UK shares have done nothing.

It’s not all Brexit. To make matters worse, UK shares have been deserted by the UK’s own pension schemes in a steady exodus of capital since the mid-1990s. Even the UK Parliament’s MP pension fund only has 1.8% of its assets in UK equities. This shift was principally a function of the move towards Liability Driven Investing (LDI) which itself provided a very painful sting in the tail during last year’s gilts sell-off.

Valuation discounts can stick around for a long time. However, big money is finally starting to take notice and act. We have seen an acceleration in strategic and private equity backed M&A activity. It looks like we may have the makings of a catalyst.

The M&A activity was surely notable, but the news of Boaz Weinstein’s Saba Capital Management parking its trust-busting tanks on the shores of the UK’s investment trust sector really got this rodent’s whiskers twitching. The 🐿️ has form in this department…

Back in the mid 1990s, when I was not busy privatizing Egyptian banks or raising money for Turkish retailers, I spent quite a bit of time as a junior corporate financier defending UK investment trusts from the hostile attentions of activist investors.

It’s very easy to see why the asset management industry are keen on their closed-end funds. Unlike ETFs, where assets can be redeemed on a daily basis, closed end funds cannot be redeemed for cash and are evergreen fee machines for the asset gatherers.

In return for this quasi-permanent capital, the understood quid pro quo is that boards of these funds should seek to ensure that the shares of these trusts do not trade at excessive discounts to NAV. This is usually achieved by share buybacks, dividends in specie (i.e., distributing underlying assets directly to shareholders) or, in extreme cases, by the winding up of the trusts via a ‘continuation’ vote.

UK investment trusts are typically owned by a combination of retail investors, wealth managers and smaller pension funds (those funds did not catch the LDI bug). The thing that these investors have in common is that they do not have a very loud voice when it comes to standing up to the likes of giants like Blackrock or JP Morgan. And then someone like a Mr. Weinstein enters the scene…

To be clear, the genesis of this acorn is not simply about riding the coattails of Boaz’s activism - even if that might be helpful at the margin. His focus is primarily on arbitraging the NAV spread (he is most likely to be ‘market neutral’, having hedged the underlying exposure to the equities). It did however prompt me to do some work on ‘dumpster diving’ opportunities in UK mid-caps.

Important Note: the punchline to this acorn will not be a UK small cap single stock idea. If you want to invest in that space, you want to follow people whose livelihoods depend on it (and not some gobby expat rodent living down under). We are taking a broad-based approach. This took my research to the website of the eminent (UK) Association of Investment Companies and its screener tool to start our ‘Black Friday’ shopping exercise.

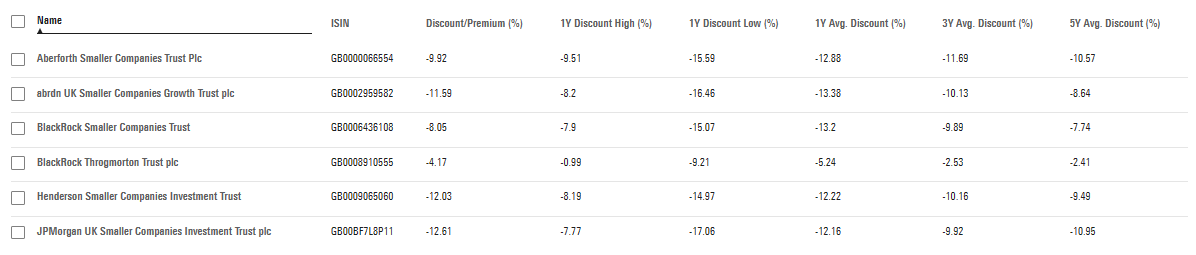

The 🐿️’s UK Investment Trust Screen: UK Small Cap mandate; Market cap > £100 million; reasonable liquidity; shares trading at a discount to NAV; with a ‘household name’ investment manager; and no extra financial engineering (e.g. split capital trusts - a UK financial engineering phenomenon that is a very long and messy story for another day).

The AIC website is excellent. Each fund has a profile page where you can track liquidity, NAV discount history, top holdings, fees and portfolio manager details.

Easy links for our 6 chosen funds are below:

Aberforth Smaller Companies (ASL: LN)

abrdn UK Smaller Companies (AUSC: LN)

Blackrock Smaller Companies (BRSC: LN)

Blackrock Throgmorton (THRG: LN)

Henderson Smaller Companies (HSL: LN)

JPMorgan UK Smaller Companies (JMI: LN)

Largest individual holdings in these trusts are seldom more than 3-4% of total fund assets, but I extracted the top 10 holdings of each fund to take a look at the characteristics of the top holdings for the 6 funds as a group. I removed bonds, crossholdings (funds holding funds) and duplicates.

To preempt the inevitable question (I know you lot!), there were actually very few duplicate Top 10 holdings among the 6 funds. For the record, the duplicates were 4imprint Group (FOUR: LN, they make ‘corporate merch’!)) in 4 of the funds (!) and Gamma Communications (GAMA: LN), Ashtead Group (AHT: LN), Vesuvius plc (VSVS: LN), Oxford Instruments (OXIG: LN) and Hill & Smith (HILS: LN) - each in 2 out of the 6 funds.

The Top 10 Holdings

A balanced group in terms of sector exposures, with a bias towards ‘real world’ / ‘hard asset’ businesses. Very few Cathie Wood ‘dream’ stocks in here…

The six trusts have bounced convincingly off their October lows and 3 of them are now clear of their 200-day SMAs. Note that much of this move has been the impact of narrowing NAV discounts.

The Plan

The plan is embarrassingly simple. We have bought an equal-weighted basket of the 6 investment trusts, with a medium-term holding objective, hoping to see NAV appreciation and perhaps a further narrowing of the NAV discounts with Mr. Weinstein snapping at the heels of the investment trust boards. We have bought the exposure ‘on the mark’ but some readers may prefer to average into the position over time, give the extent of the recent moves.

One consideration (at least for me) is the currency exposure. My UK-based readers need not read on, but those of you concerned with USD or other FX-based return considerations need to stick around for the next bit.

GBPUSD had an epic run from the ‘Liz Truss low’ in September of 2022. After spending much of the summer giving back some of the gain, Sterling bounced almost perfectly off the first expected support level at $1.20 (a ‘classic’ 38% Fibonacci retracement of the advance from the lows of last year). The pair now looks to have re-established an uptrend.

As you can see from Brent Donnelly’s table below, GBP’s recent momentum has not yet been reflected in positioning. That suggests to me that it has possibly has room to run, especially if the ‘peak’ US interest rates narrative continues.

A quick word on biases. Candidly, the 🐿️’s default sterling outlook has traditionally been pretty consistently bearish, and I have no wish to suck my readers into this doomist outlook. So much so, that I want to take FX hedging decisions off the table for this trade on a completely systematic basis.

So, we are going to channel our inner turtle trader and take a purist trend following approach. Specifically, if GBPUSD is in an uptrend, defined (for this purpose) as when the 30-day EMA trading above 50-day EMA, we shall own our basket of UK investment trusts unhedged (i.e., with the Sterling risk). In a downtrend, we will hedge the position dollar for dollar (short GBP versus USD). No use of options, just a simple ‘delta 1’ hedge.

In Summary

UK equities are looking very cheap on a multi-decade timeframe.

Corporate and private equity-backed buyout activity is starting to accelerate. Catalyst 1.

Playing UK midcaps via listed investment trusts allows us to acquire exposure at a discount to NAV. This provides a small value cushion. Catalyst 2 comes in the form of recent activist activity by Saba Capital. We may see those discounts to narrow further (though this is a nice to have, not a have to have).

We are taking FX out of the equation, with a plan to only hedge the GBP currency exposure if Sterling is in a downtrend versus the dollar. Out trigger with be a 30/50 EMA crossover on the daily chart (a signal which I hope will not trigger too frequently).

Rule Britannia!! Please don’t deluge me with any pro-Brexit propaganda. I lost. I got over it. Well, ish 😏 (IYKYK).

See you next week! Squirrel out!

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.