The 🐿️'s Annual Acorn 'Stock Take'

The Blind Squirrel's Monday Morning Notes. Year 3; Week 23. Part 1 of 4.

Big changes coming to Blind Squirrel Macro at the end of June. If you missed the earlier emails, details can be found in the post linked below.

For the next 4 weeks before Blind Squirrel Macro moves completely behind the paywall, we are going through the process of re-underwriting all of the live Acorn trades and revisiting the 'bull pen' of themes that we have closed out the trade but continue to monitor.

For this week, we are tackling European Defense stocks, US refiners, Lithium miners, Offshore services, the 🐿️’s crude ‘SPR’ and the uranium theme. Strap in!

Time for the 🐿️'s Acorn 'Stock Take'

Mrs. 🐿️ is in Europe on a business trip for 10 days leaving me in charge of The Drey. Miss 🐿️ announced on Thursday that she wanted to start economics at school next year. The educational evening movie viewing list is set for the next week! We will get to Margin Call and The Big Short in due course but last night I thought we would ease into the process with Trading Places.

This ultimate Christmas movie (it does edge out Die Hard - sue me!) once again did not disappoint and prompted me to revisit my own Christmas predictions for 2025 as I settled down to write my annual ‘stock take’ of the ‘Acorns’. So far, they have aged like one of Coleman’s finest Eggnogs!

We did indeed get that (transient) rally in the long bond (TLT) in Q1 (even if I could certainly have traded it better!). Outperformance by international equities has indeed played out and ‘Liberation Day’ certainly delivered the spike in equity volatility that rewarded perseverance with our rolling SPY 0.00%↑ straddle strategy (which we re-entered for a second time this year in mid-May). That 27% year-to-date move in gold is hardly shabby either!

But we need to start with a close look at what has been the 🐿️’s ‘trade of the year’ so far - European defense stocks.

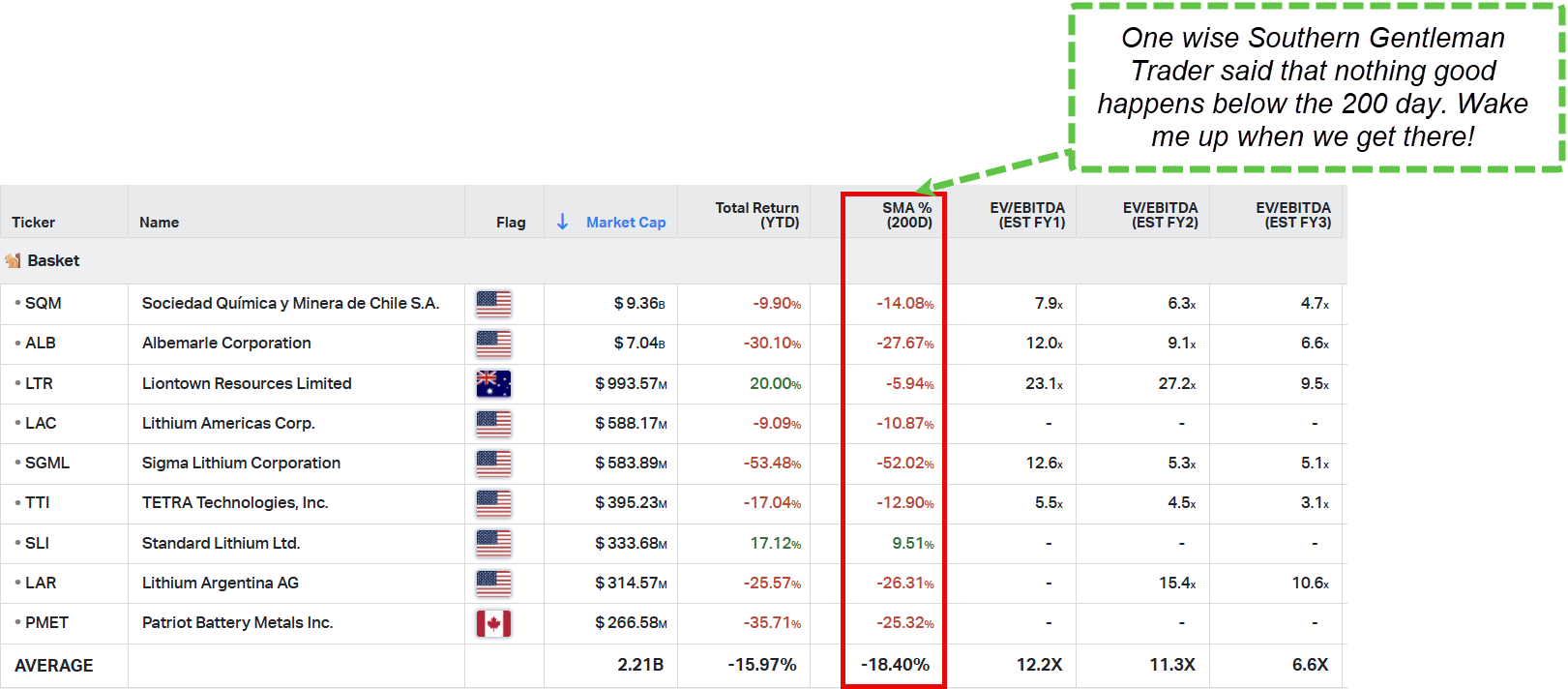

The European Military Industrial Complex ‘EuroMIC’

In Lost Umbrella? last November I argued that Europe faced an urgent and existential need to accelerate its military self-reliance in response to both the ongoing Russia / Ukraine war and the potential, under the Trump administration, for reduced US commitment to the NATO security umbrella.

JD Vance’s speech to the Munich Security conference, followed by that infamous Zelenskyy Oval Office meeting lit a fire under the sector. It is clear that Europe has reached a ‘no turning back’ phase when it comes to security. UK and European politicians have doubled down on spending commitments, with a strong local procurement focus.

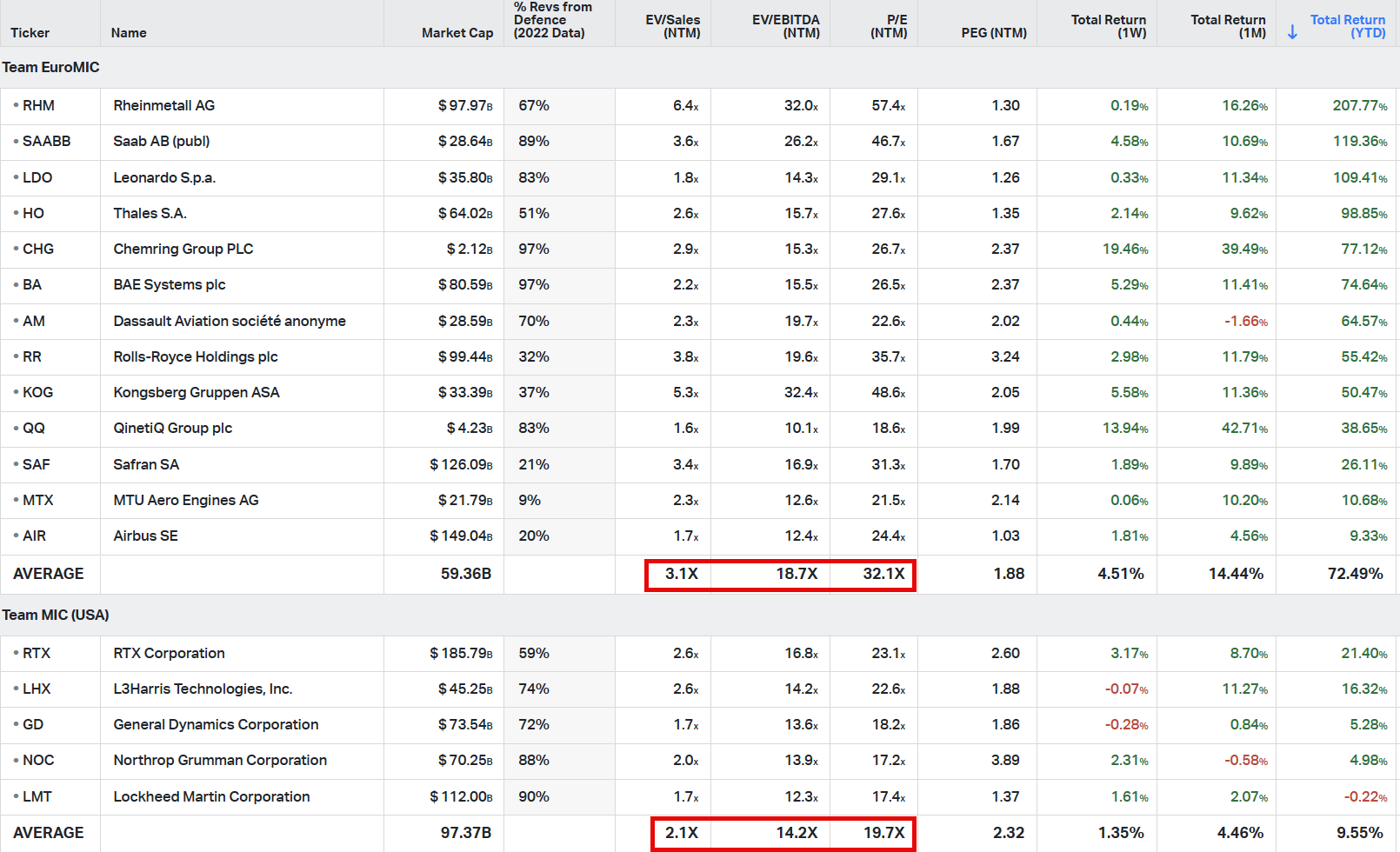

Back in November the European contractors were trading at a 28% discount to the giants of the US Military Industrial Complex on a forward EV/EBITDA basis. After this year’s moves, they are now trading at a 32% premium!

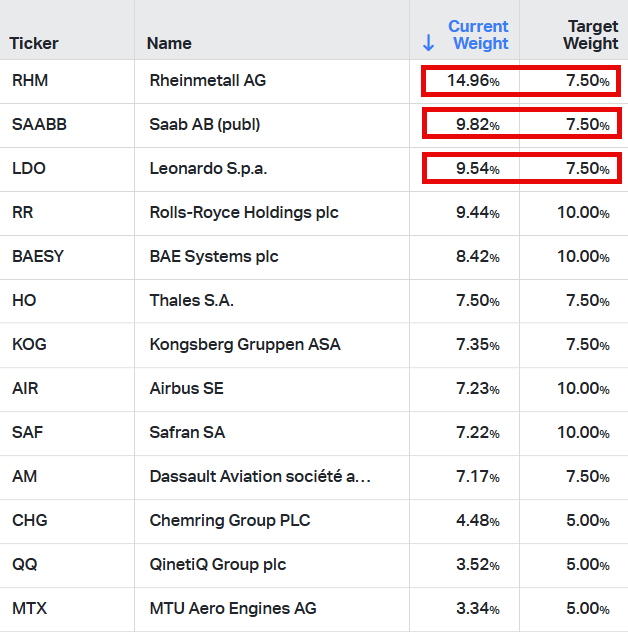

In some cases (Rheinmetall, SAAB and Kongsberg) these new multiples require some Herculean revenue growth in the underlying businesses to be justifiable. The high-flyers have now become significant overweight positions in the 🐿️’s EuroMIC basket.

The only risk management I have performed to date was to sell some covered calls on Rheinmetall in March (mercifully the post ‘Liberation Day’ dip prevented my underlying stock from being called away). However, the basket now represents a percentage share of NAV with which I am getting increasingly uncomfortable.

While it sadly does not seem imminent, any ceasefire or truce in Ukraine could lead to a violent correction in these names. Furthermore, Operation Spider’s Web has further highlighted the fact that drones (and counter drone technology), as opposed to more conventional ‘Air, Sea and Land’ forces should now probably account for a great share of procurement focus.

There is plenty of drone exposure in the EuroMIC basket, but in March, in Drones: Crashin' or Cash in? I did consider adding some direct exposure to (pretty racy) pure drone plays but never pulled the trigger. Incidentally, here has been some hot debate about breakouts in a couple of the names recently in the #defense channel of The Drey. Am watching.

As to EuroMIC, I am not minded trying to restructure the basket on a ‘more drones, less frigates and battle tanks’ type manner. I am, however, going to minimize the risk of hindsight regret and plan to trim the exposure over the coming weeks. I will reduce gross by c.40% and rebalance the basket in line with the initial weightings (selling more of the likes of RHM, SAAB and LDO). If we do get a correction, I may add back exposure. This still feels like a multi-year opportunity.

The 🐿️ does not wish to repeat the mistakes made with the next 2 Acorns we are going to review in this note, namely the US refiner and the offshore oil services baskets.

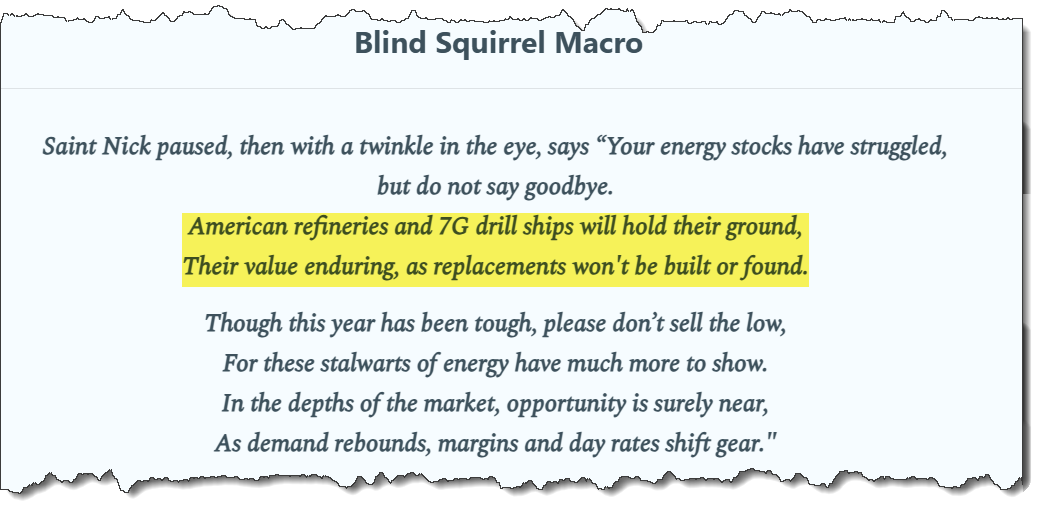

Both of these acorns share a replacement cost thesis around owning hard to replace cash flow generating assets that are unlikely to face competition absent a massive shift in market conditions from which they would themselves benefit greatly.

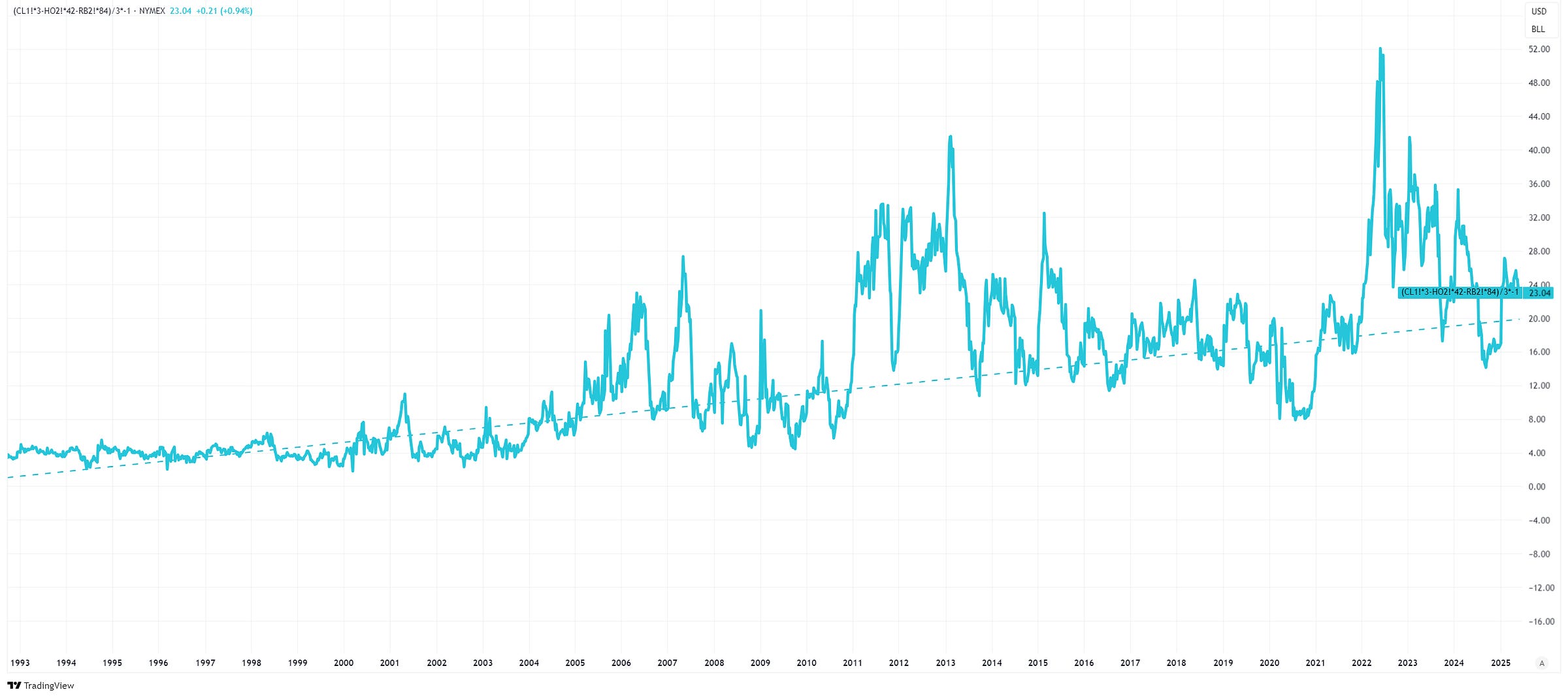

US Oil Refiners

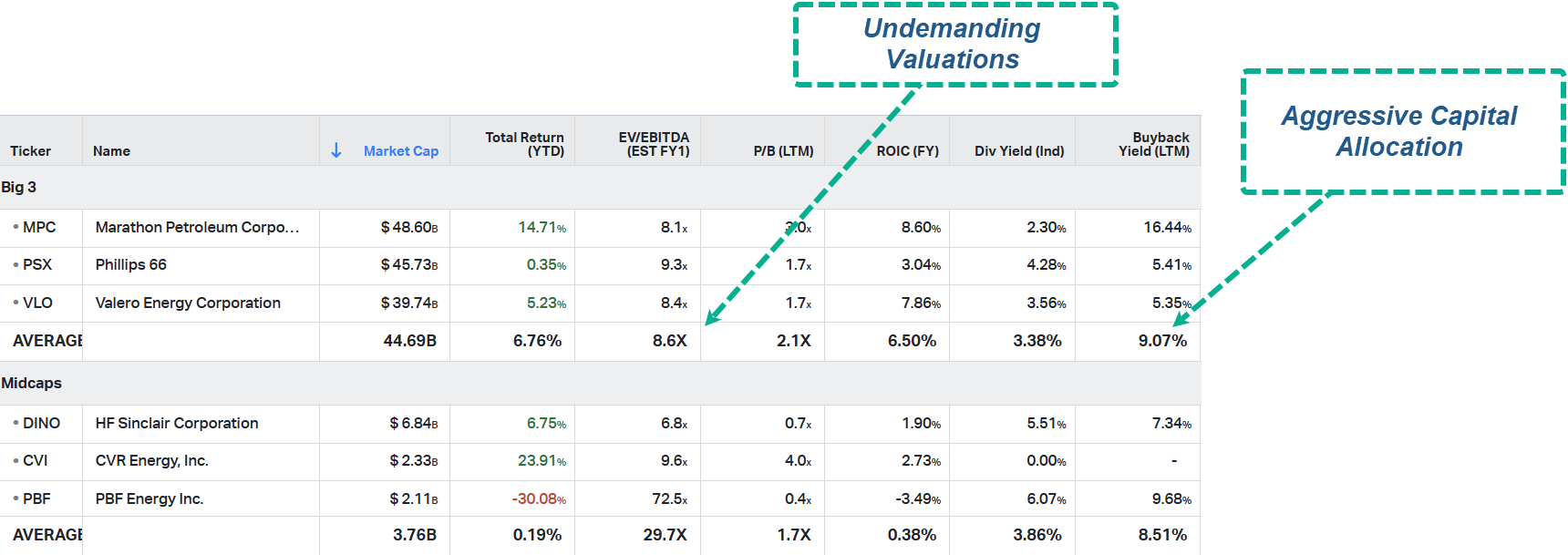

The current ‘Acorn’ exposure to US refiners is now limited to the ‘Big 3’ US players, Marathon MPC 0.00%↑ Valero VLO 0.00%↑ and Phillips 66 PSX 0.00%↑. When I initiated the basket in January 2024, I also included 3 midcaps (CVI 0.00%↑ DINO 0.00%↑ and PBF 0.00%↑), largely on a weather thesis (I was expecting an active Gulf Coast hurricane season).

I removed these 3 from the basket in early January (way too late given their performance and the fact that the hurricanes had not materialized 6 months earlier!).

Given the chart above, you will not be surprised to learn that the 🐿️’s exposure is under water. However, the loss on the position is currently only around 1.2%. This is due to that fact that the initial basket contained several option positions which were monetized in April 2024 after an initial surge for the whole group.

Unless we are on the cusp of a deep, gasoline and jet fuel demand destroying recession (which is absolutely not my base case), I am sticking with the (smaller) group for the following reasons:

Margin dynamics. After the windfall profitability seen during the pandemic, it was inevitable that the 3:2:1 crack spread would mean revert. However, it has repeatedly found support at an upward sloping trend line that has been in place since the early 1990s (chart below) as domestic refining capacity has shrunk. In recent years, cheap and abundant natural gas has also helped to support operating margins. In due course, there is a risk that (especially PADD 2 - Midwest) refiners will start to lose the economic advantage of their current quasi-exclusive access to (cheap) Canadian heavy crude imports (as Canada targets new export markets).

Without repeating the full (largely unchanged) thesis from last year, the US refiners own assets that will never be replaced (cost / payback and permitting challenges) and are incredibly well operated by management teams with a laser focus on shareholder returns (helped by activists like Elliott monitoring their every moves).

Valuation. While I expect total returns to be delivered via aggressive capital allocation (buybacks and dividends), the ‘Big 3’ are still attractively valued on a forward EV/EBITDA basis.

A level which is in line with long term average multiples:

Apart from macro headwinds, one thing that I am also keeping a close eye on is any policy shifts from the Trump administration around renewable fuels (biodiesel and sustainable aviation fuel) and IRA-related tax credits. The Trump EPA has resumed granting small refinery exemptions (SREs) at a higher rate, shifting compliance burdens to larger refiners like MPC, VLO, and PSX.

I am sticking with the refiners but will revisit if the charts break down much further from here.

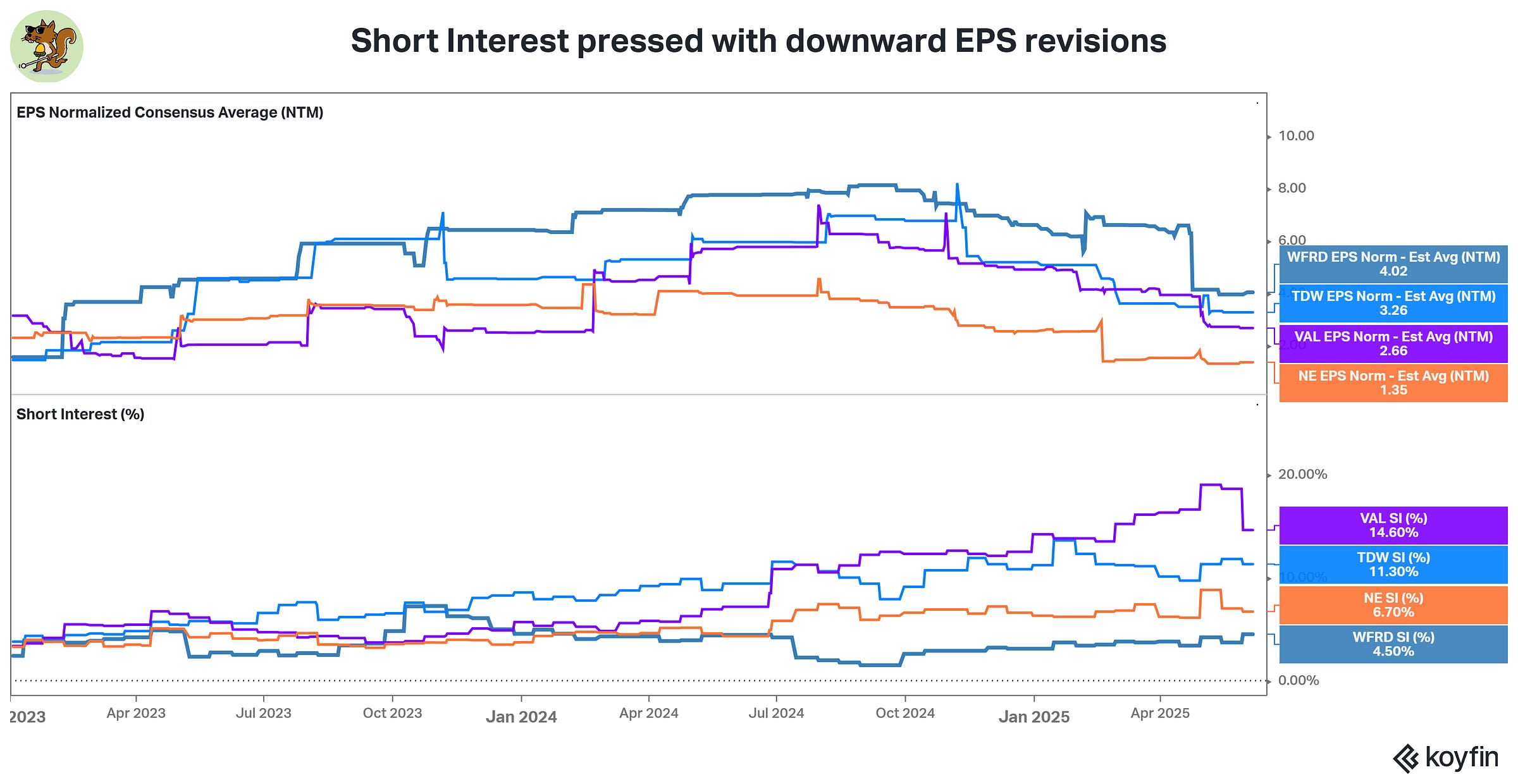

Offshore Oil Services

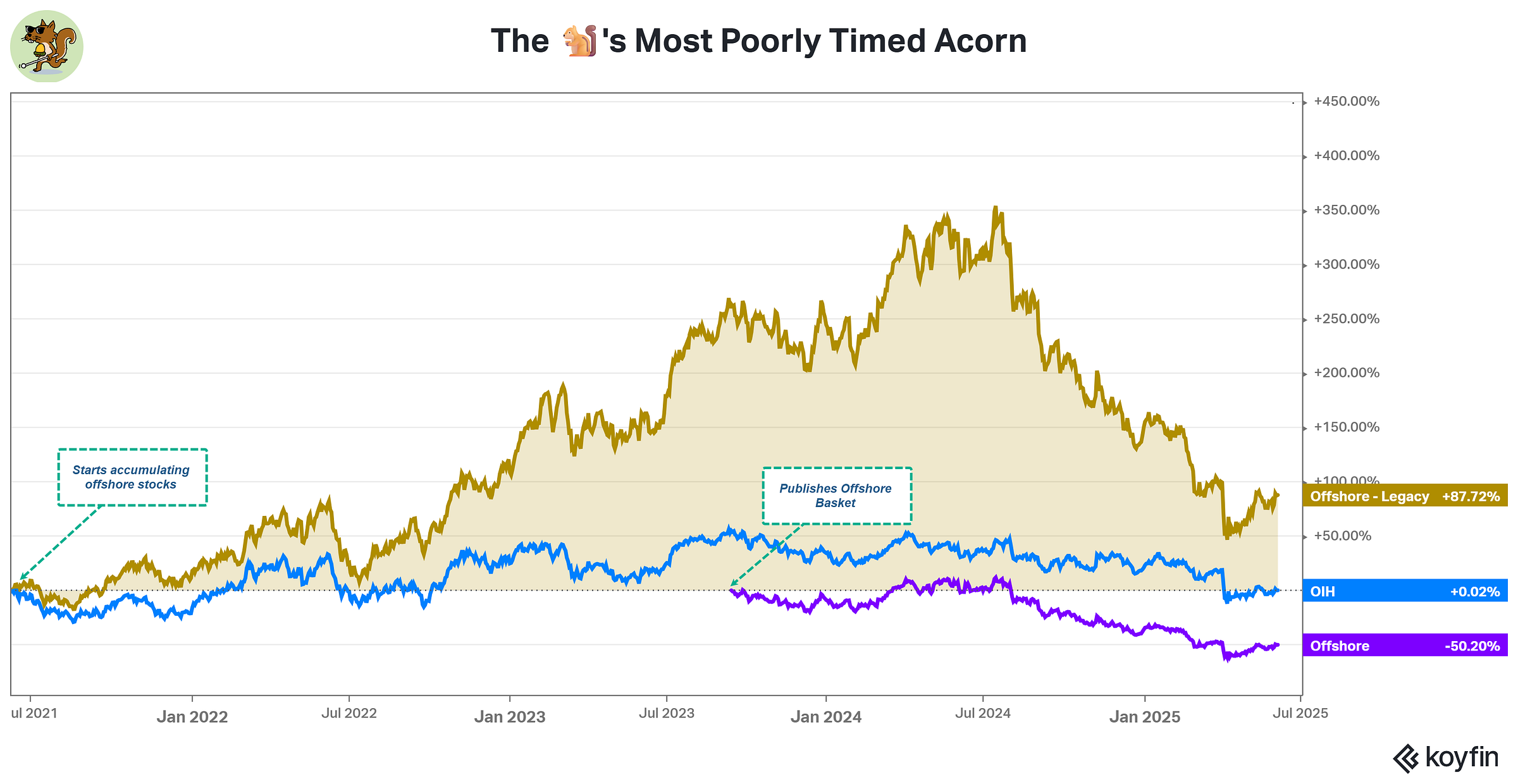

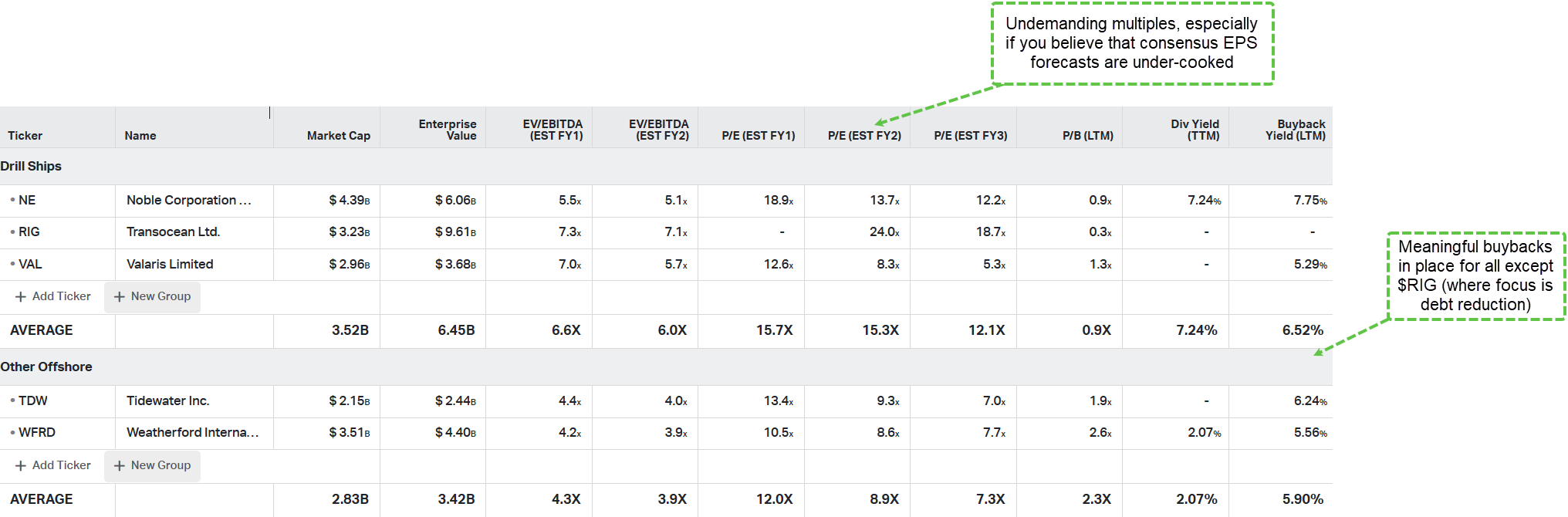

One of the most frequent questions I get from new subscribers is asking my why my Acorn basket of offshore oil services is still in the portfolio. The position has drawn down 80% since publication in September 2023 (the purple line above does not include evaporated option premium!) - so, it’s a completely fair question!

I have made this confession before. Having owned the drill-shippers since Valaris and Noble emerged from bankruptcy in 2021 (as well as Transocean, Tidewater and Weatherford), I am still up significantly on the trade. It is a source of considerable ongoing embarrassment that I managed to publish on the group at an almost perfect interim top for the sector!

The fact that - at the time - the report was the most widely liked, shared and commented upon piece that I had ever written should have told me immediately that my premise that the offshore trade was not yet crowded back then was deeply flawed.

For a while strong performance from TDW 0.00%↑ and WFRD 0.00%↑ took the sting out of the continued drawdowns in VAL 0.00%↑ NE 0.00%↑ and RIG 0.00%↑(I don’t think Transocean has ever traded a penny higher than it was on the day I published the note).

Then the earning revision factor came to the sector. Anticipation of a weaker earnings in 2025 (a dip in utilization rates) quickly made the sector a prime target for the short books of the pod shops (as well as scare off any longs that monitor this factor closely).

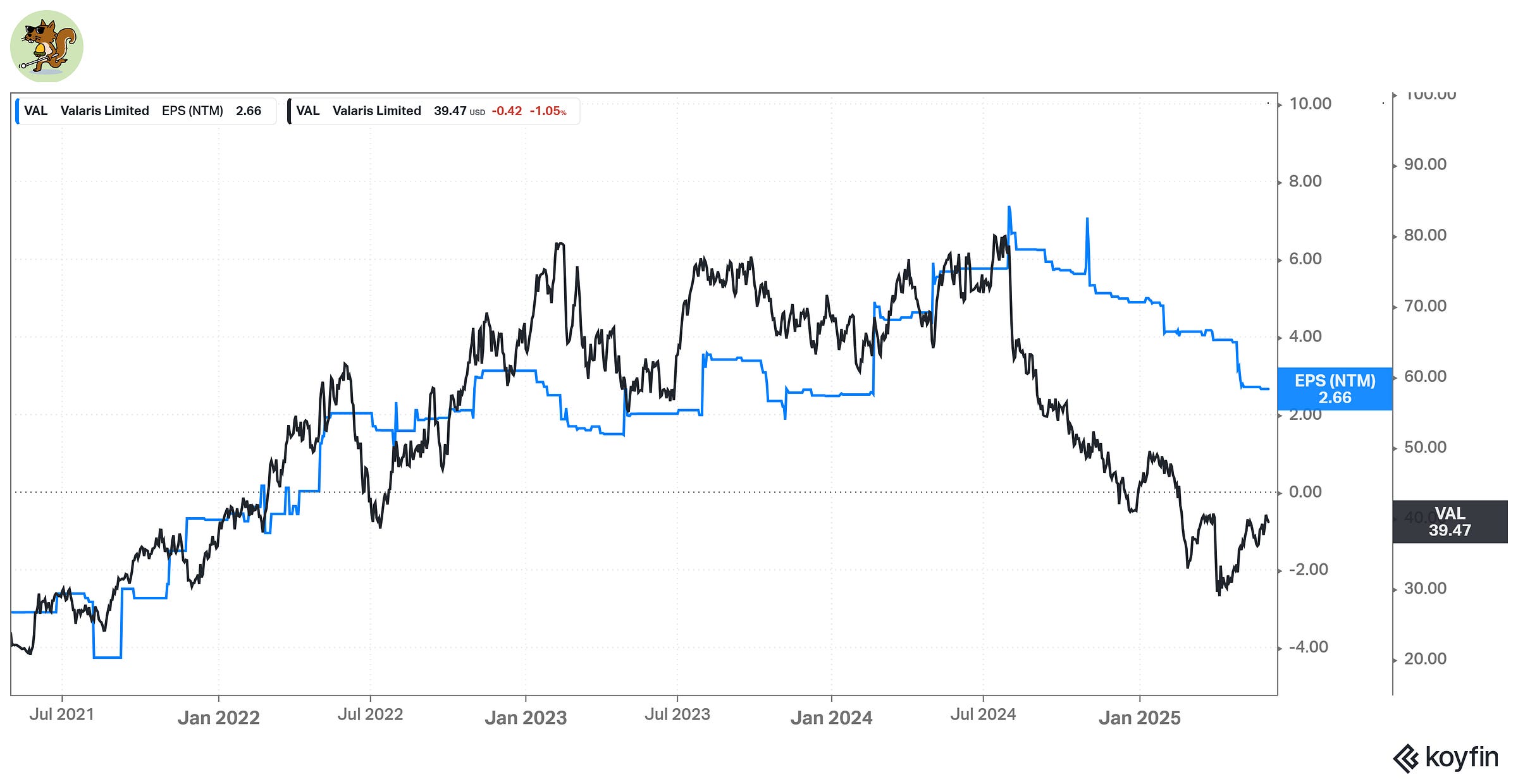

The effect was particularly pronounced in the case of Valaris…

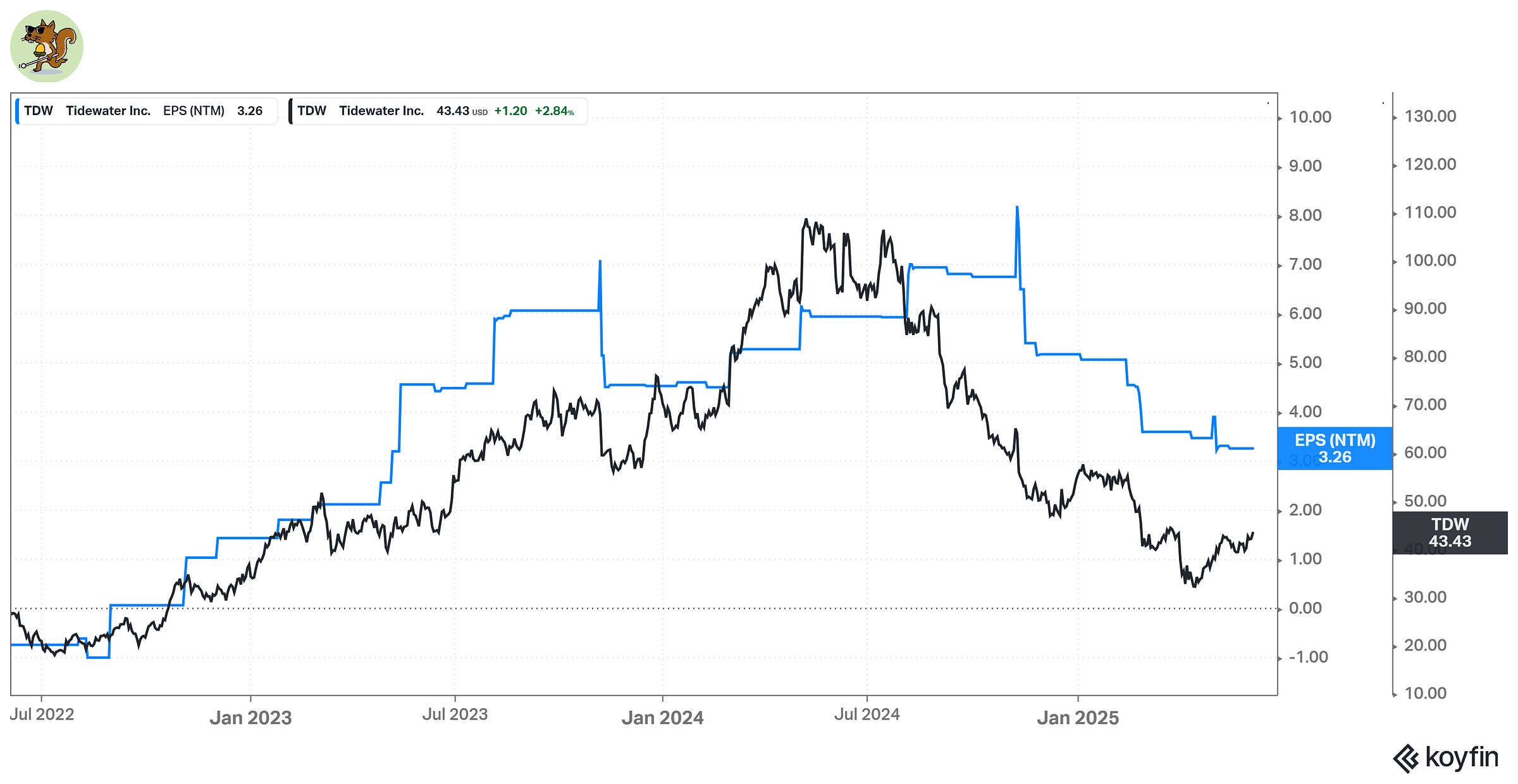

… and Tidewater:

Readers that would like a more detailed explanation of the earnings revision factor should read Kevin Muir’s note on the topic from last November - unlocked link (thanks Kev!) here, but you should all be MacroTourist subscribers!

I wish he had written it earlier last year! A 2 quarter ‘time out’ from the trade would have allowed me to potentially size up the trade as this factor looks set to move into reverse gear soon. As I have written many times, analysts’ earnings projections have a tendency to be high influenced by prevailing share price action. Narrative follows price! The 🐿️ reckons that they have overdone it.

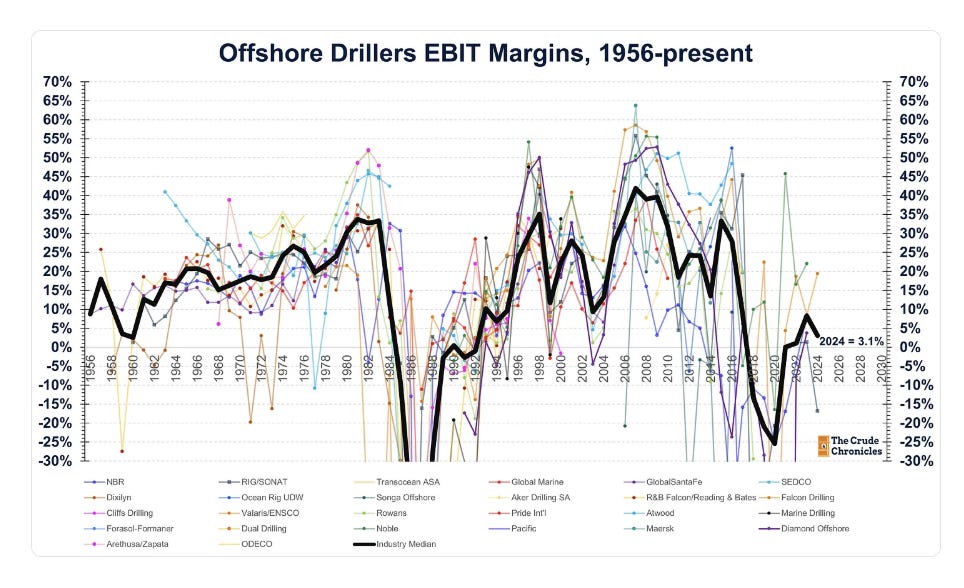

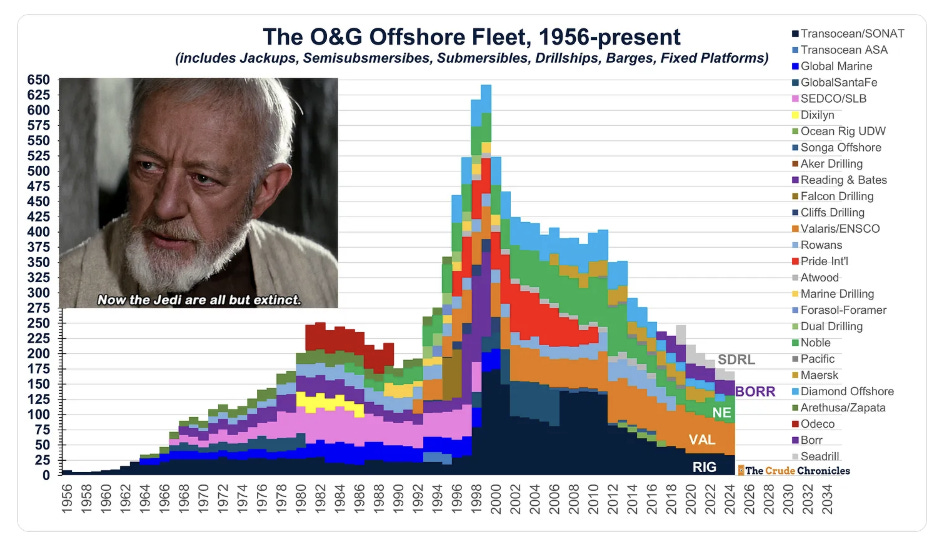

The excellent chart below from Rob Connors of The Crude Chronicles shows that offshore profitability still at a fraction of long-term cycle averages. Even a modest pick-up in utilization rates from a recovery in E&P budgets by the oil majors should see a violent inflection in earnings for an industry which has now consolidated into an oligopoly.

With Noble acquiring Diamond Offshore last year, 5 players now control the entire offshore fleet. Day rates and shipyard availability (let alone interest - the yards got completely rinsed by the last offshore bankruptcy cycle) are still miles away from a time when investors in the sector should be concerned about newbuild risk.

Increased utilization of jackups and drillships will deliver a similar earnings inflection to other players in the offshore ecosystem (Tidewater and Weatherford). A combination of reversal of the EPS revision cycle and aggressive buyback strategies could create a dynamic situation to the upside.

The drawdown has been painful but drillships and their ‘little boats’ (PSVs) are keepers for this rodent!

Staying with energy we need to consider the 🐿️’s strategic petroleum reserve.

Long Dated Crude Futures

Regular readers will know that this rodent is constantly in the hunt for alternatives to bonds for portfolio diversification. Last summer, we introduced the concept of the 🐿️’s SPR.

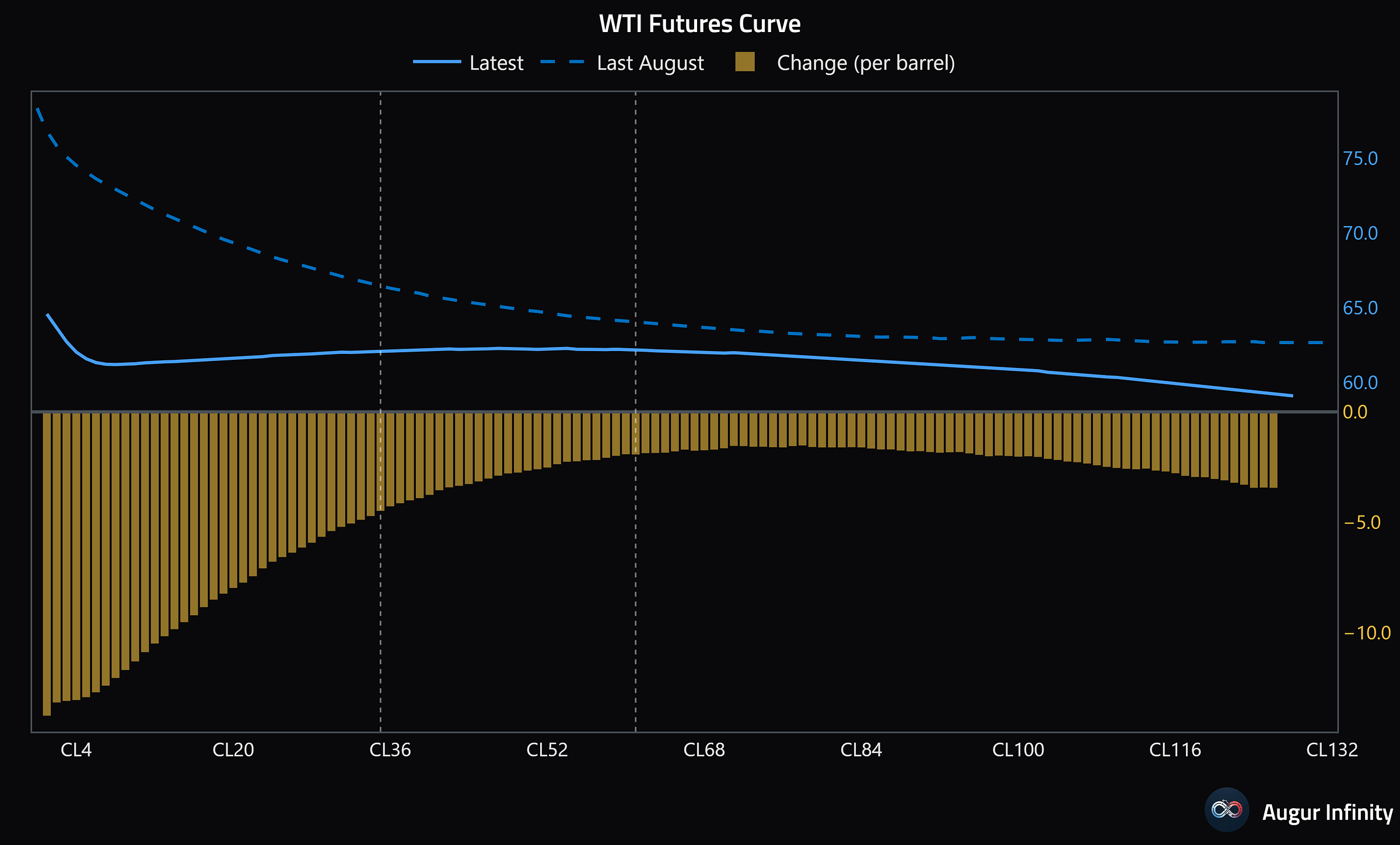

I firmly believe that long dated (3 to 5 years out) crude futures contracts should keep up with inflation in the system. The crude futures strip is priced in nominal dollars. In theory, these contracts should operate as an effective hard asset (without the volatility of the front months of the curve). These contracts also have the benefit of exhibiting very limited correlation with equity returns over time.

Since last August, we have seen almost $15 / barrel come out of the front end of the curve, whereas our strip of WTI and Brent contracts has only impaired by a few dollars per barrel.

After booking our roll yield last December (December 2026 WTI to December 2029 and December 2026 Brent to December 2027), the SPR has delivered a small negative return. At the same time, long duration fixed income (TLT) is down almost 8% in a stable / declining inflation environment. USO, an ETF that rolls front month WTI contracts is also shown below for comparison purposes.

It is still way too early to make a final judgement whether or not this strategy will perform well through multiple market regimes. However, I have seen enough to encourage me to stick with it. Given that there is no longer such steep backwardation in the curve, I am unlikely to collect as generous a roll yield as last December, but I do believe that crude oil prices are closer to the low end of their medium-term trading range.

We stay with the SPR! Still much preferred over long dated Treasuries!

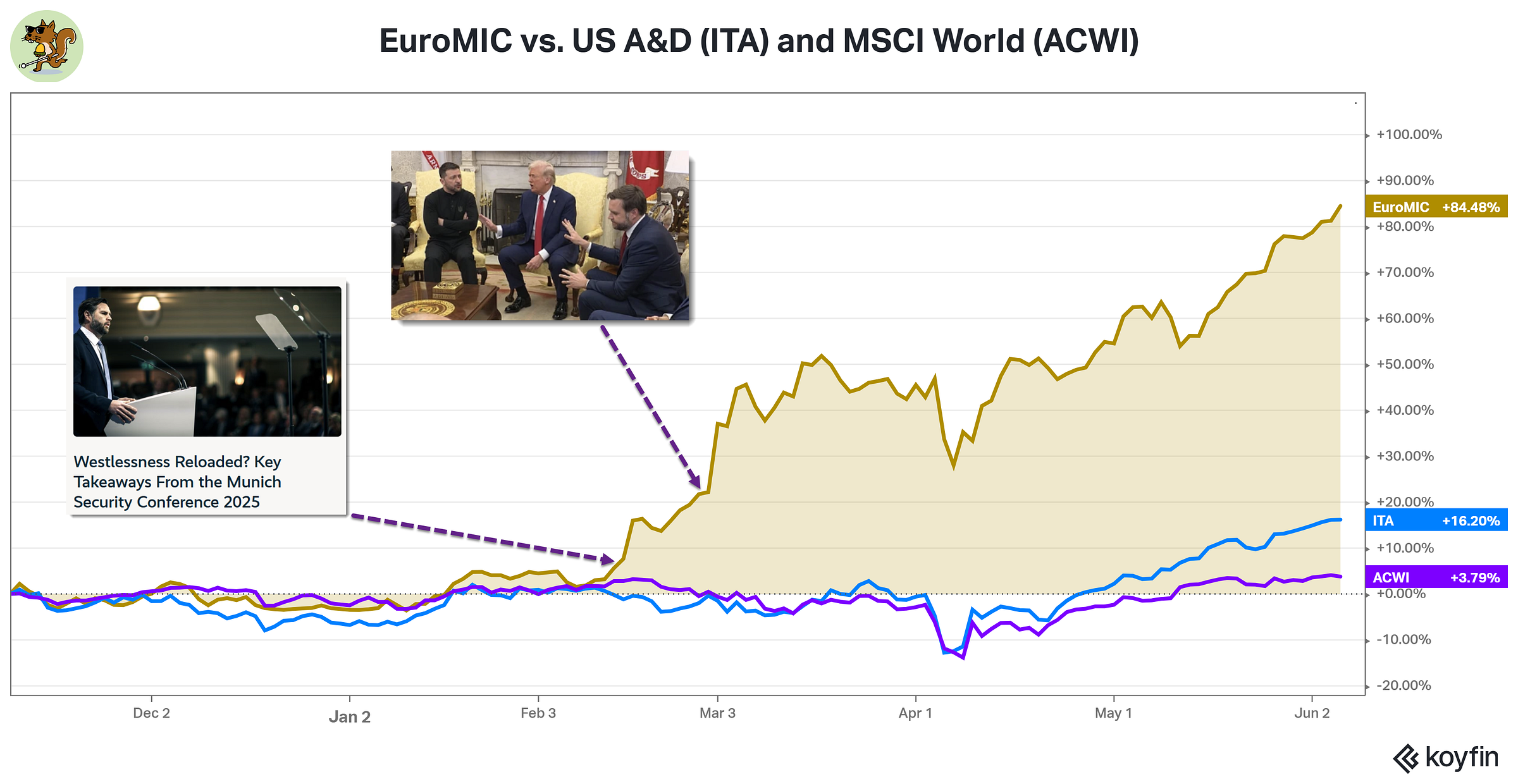

Lithium Miners

When writing about lithium miners last October in the wake of Rio Tinto’s bid for Arcadium Lithium, I felt that the pain might finally be over for the long-suffering fans of ‘the other white gold’.

It appears that further time is required in the penalty box for the lithium bulls after all. Apart from moments of excitement about Arkansas brine assets, the sector continues to struggle to attract and hold investor attention.

Ultimately this basket was a play on the ‘ex-China’ lithium supply chain (i.e., potential reshoring / friendshoring winners). Theoretically, if the US is serious about diversifying critical supply chains away from China (and battery metals should certainly be deemed critical) then this group should perform well.

Nevertheless, if we are to learn anything from the current US / China standoff around rare earths it is that these supply chains are unlikely to get rearranged comprehensively any time soon (if at all). That is certainly what the share price charts of lithium miners are telling me for now.

We finish Part One of the ‘Stock Take’ with another perennial heartbreaker of a commodity story, yellow cake.

Uranium

The 🐿️ has been a nuclear / uranium fan for years. It’s been a rollercoaster.

Since early last year, this rodent has sworn off leverage (no more options) in the uranium trade and has been avoiding the large cap miners (especially Cameco, whose earnings are inversely correlated with the spot price of U3O8 until long-term supply contracts roll off). Ironically, CCJ 0.00%↑ has fared pretty well (provided that you just closed your eyes and held).

I have also shunned the ‘bright shiny objects’ of small modular reactors or new enrichment technologies. Some wild recent rallies, but the likes of OKLO 0.00%↑ SMR 0.00%↑ and ASPI 0.00%↑ are too meme-y, volatile and hard to value for this rodent.

My uranium investments in aggregate over the years are well in the green but relative to my expectations for the market, I sometimes feel like I lost money in the trade! My current (2%) allocation to the theme is 83% to the Sprott Physical Uranium Trust (aka SPUT) and 17% to URNJ 0.00%↑ the Sprott ETF for junior uranium miners (seeking to avoid Cameco and Kazatomprom exposure).

My plan is to stick around until something really happens. My man PauloMacro thinks we may be close. In his recent note he outlines a tight physical / spot market (no speculative longs left); a long-term contracting market by utilities that has been artificially paused for the past year; “rinsed” institutional and retail positioning in the equities; and he is excited about the nuclear-related Executive Orders emanating from the Trump Administration.

Stepping back and looking at the weekly chart for URNM 0.00%↑ the main Sprott ETF whose holdings in the large miners (CCJ and KAP) and SPUT total more than 40% of assets, the retake of the 200-week SMA has my interest.

Given that I already have decent skin in the game with existing positions, I am happy to wait and see how the chart tackles the potential ‘congestion zone’ I have marked with a pink box above (at around $48/ share).

This box coincides with the start of a Fibonacci extension of the advance from late 2020. I will be prepared to risk another heart break (by adding uranium exposure) if URNM 0.00%↑ breaks $52 per share. We will know by then whether or not U3O8’s historically vocal retail fan club was really “rinsed” or just keeping quiet (like this rodent!).

That’s it for Part One of the Annual Stock Take. Next week will be emerging markets heavy, focusing in on our China / Asia positions. We will also cover our LatAm allocations and revisit the Agribusiness and UK Midcap themes that are currently being monitored in the ‘Bull Pen’.

As ever, please get in touch if you have any questions - via comments below, in The Drey or privately via DM (link below):

Thanks for your readership. I hope that as many of you as possible will be joining our great community in The Drey this month.

Squirrel out!

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.