Lost Umbrella?

The Blind Squirrel's Monday Morning Notes, 11th November 2024.

An incoming Trump administration that campaigned on isolationist policies means that the afterburners must now be ignited for a European defence apparatus that is already nervous about reliance on the US security umbrella.

Even after a strong 3-year run, the stocks Europe’s defence contractors offer value and powerful top line growth prospects. The 🐿️ digs in.

Lost Umbrella?

If Vladimir Putin’s tanks rolling across Ukraine’s sovereign border in February 2022 was a wake-up call for Europe’s defence ministers, this week’s reality of an incoming Trump administration that campaigned on an isolationist policy agenda justifies a couple of extra espresso shots in their morning cappuccinos.

For Europe, there is no point in trying to dismiss Trump’s February statements with regard to NATO as campaign rhetoric. It’s a bit like trade policy where I am being repeatedly assured that tariff threats are merely a negotiating ploy. If that argument is already ‘common knowledge’, then how will anyone take them seriously? My sense is that we should take the incoming administration at its word.

In matters of defence, even the vague suggestion of a downgrading of the US’s commitment to Article 5 of the NATO treaty (collective defence) should be sufficient to further accelerate Europe’s plans for increased military self-reliance.

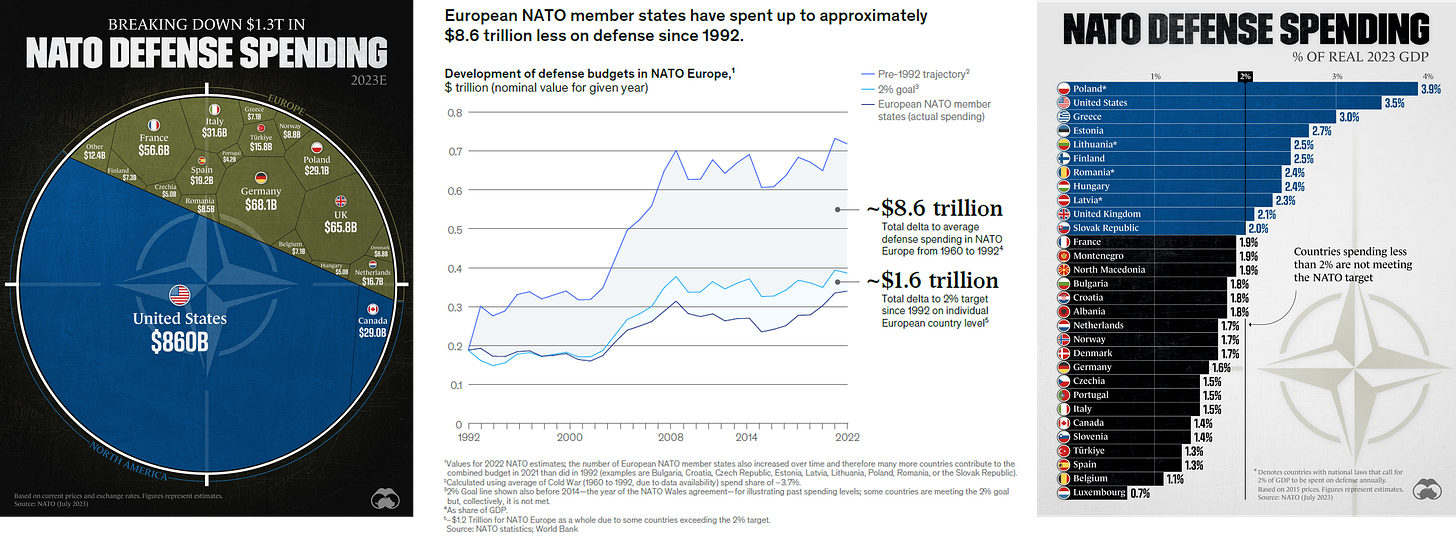

That ship has sailed. The reality of a nearly 3 year ‘hot’ war in Europe’s outskirts has reframed the political climate. The failure by so many of Europe’s NATO members to comply with the 2% of GDP defence spending treaty targets is no longer seen as an issue that can be parked or excused by the latest ‘fiscal emergency’.

To be fair, Europe has not been waiting for the latest change of US administration in order to take action. European defence spending has increased by 62% since Russia’s annexation of Crimea in 2014, jumping by 16% between 2022 and 2023 alone and forecast to accelerate significantly between now and the end of the decade.

This spending has started to show up in the income statements of the continent’s defence contractors. For example, analysts’ consensus revenues at Germany’s builder of tanks and armoured cars, Rheinmetall, are forecast to compound at 26% over the next 5 years.

Even after the recent growth EU defence spending is still only at 32% of the US budget. That number climbs to 41% with the inclusion of the UK spend. Britain may have left the European Union, but the island cannot be towed away from the European theatre of war however tempting the promise of better weather elsewhere might be!

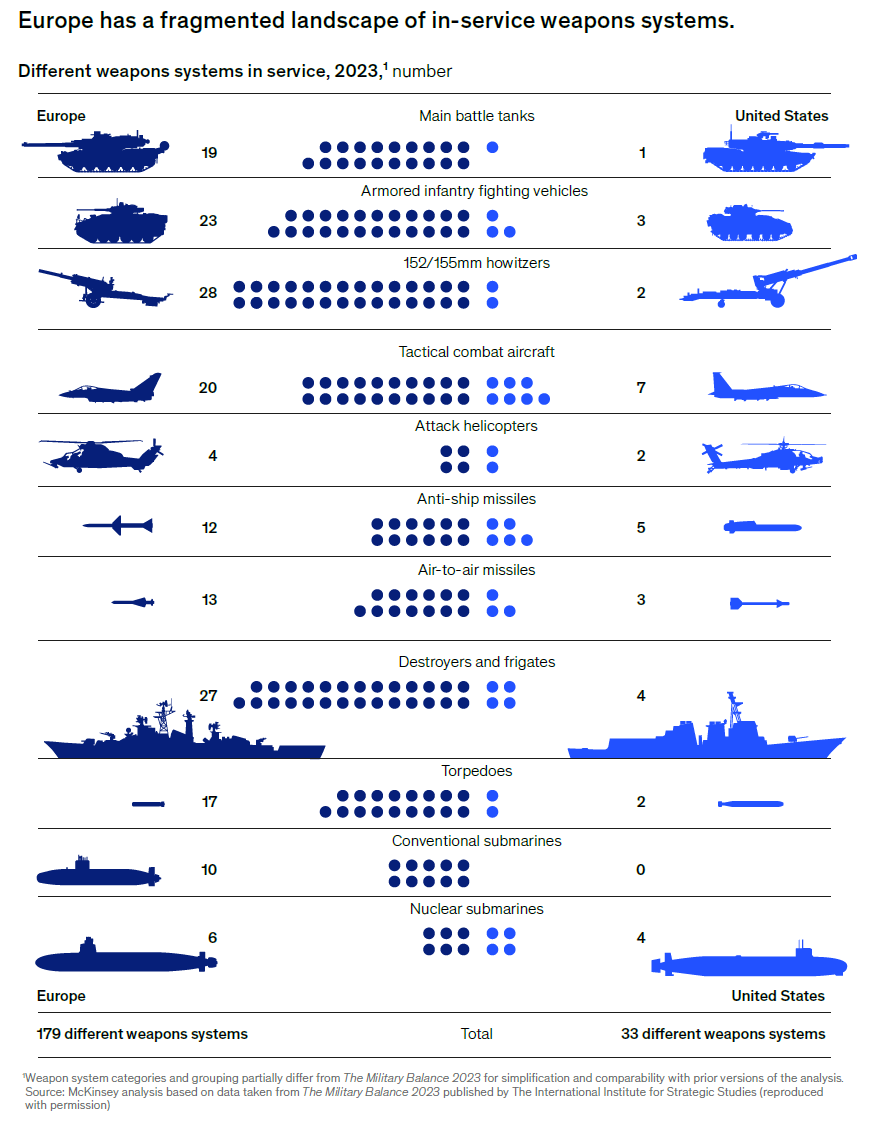

The extent of this spending gulf is exacerbated by the fact that the European budgets support 28 independent national armed forces. This group collectively operates 5 times as many weapons systems as the US.

This R&D duplication issue alone would imply that a ‘like for like’ European defence budget would need to be significantly larger when being compared to the US or China.

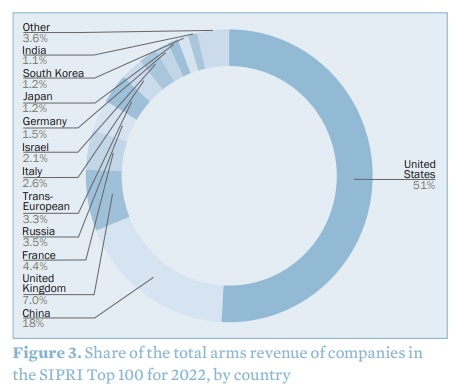

The US has already successfully consolidated its defence contracting around the 5 giants of military industrial complex (‘Team MIC’). By contrast European players are a patchwork quilt of national champions jealously guarding their own domestic markets.

However, Europe’s governments are a large and fast-growing customer base that currently gives a massive share of its business to Team MIC. The European Defence Industrial Strategy (EDIS), published in March 2024 sets out a goal for the EU to procure at least 50% of its defence needs from EU Member States by 2030 (rising to 60% by 2035). These are ambitious figures but make a great deal of sense from a longer-term industrial policy perspective.

There is conflicting data on the extent of EU defence procurement from outside of Europe. The EDIS claimed that only 20% of defence purchases since 2022 have been from EU contractors. This is probably a misleading figure once both domestic procurement and overseas contractors producing on EU soil are taken into account.

Nevertheless, data from SIPRI that tracks the reported revenues of the top 100 global defence companies suggests that only 18.8% of global arms revenues are being invoiced by UK and European contractors, with Team MIC accounting for a vast 51% share of the global spoils.

The more mischievous among my readers might suggest that Europe’s relative procurement handicap might be offset by the pricing advantage that the more concentrated US contractors enjoy with their large captive customer at the US DoD. Team MIC do of course enjoy some healthy margins even if they need to give some of that margin back to their regiment of service providers on Washington DC’s K Street.

Over the course of the past couple of weeks, the 🐿️ has been ploughing through Mario Draghi’s 328-page ‘The Future of European Competitiveness’ report so that you my loyal readers do not have to.

Yes, I am aware of the humour or irony that folk may find in the title of this document and please don’t send me any more plastic bottle cap ‘innovation’ memes - I have seen them all yet am still in the camp that prefers the private sector to ask for permission rather than for forgiveness when it comes to serious matters!

Although only Chapter 7 of Draghi’s weighty tome specifically covers defence, getting that issue correct should significantly assist with outcomes addressed in many of the other chapters of the report such as 1 (energy), 2 (critical raw materials), 3 (advanced technology) and 8 (space).

Draghi’s report highlights the very obvious problems of coordination and waste. Within the EU-27 defence is a national competence. The European Commission only created a slot for the first dedicated commissioner for defence (and space) this year. The role has just been filled by former Lithuanian PM Andrius Kubilius.

The harmonisation of military procurement (via a new centralised EU Defence Industry Authority) is the most obvious policy challenge but would bring with it significant rewards in terms of cost efficiency and industrial policy advantages.

In some areas, the industry fragmentation issues are less of a problem. For example, ‘in the air’ Airbus is already a bastion of pan-European cooperation and Leonardo has effectively rolled up the military helicopter market over the years. However, the efficiency Europe’s significant aerospace procurement activity with Team MIC could be greatly improved.

When it comes to naval ships, the level of coordination is almost zero. These are high ticket items with lots of (highly political) employment implications. Meanwhile, the world of tanks, guns, cyber, space and other materiel is currently a starburst of fragmentation.

However, if there is a positive to be taken from the recent proliferation of ‘hot wars’ around the world it is that the traditional model for military might may have been turned on its head.

A new European defence and industrial strategy can be shaped by these learnings and would be likely to come at a much more manageable cost.

Right now, the alphabet soup of EU funding and joint procurement initiatives may sound impressive but does not yet amount to a needle-moving amount of hard funding. Nevertheless, I suspect that Europe will find a way to make it work anyway. Three reasons:

It’s now existential. The US ‘security umbrella’ can no longer be taken for granted with an increasingly isolationist America coming into view at the same time as Russia appears to have reembraced some imperial ambitions.

Innovation dividend. Much of the US (and China)’s technology prowess exists as a direct result of military investment and R&D. As I noted in ‘To Boldly Go’, “the desire to more accurately target Moscow with ICBMs gave us the modern semiconductor industry”. Just being a customer of Team MIC comes not just at the cost of those $90k “bags of bushings” but also the loss of local investment in innovation.

Growth. Europe has been notably deficient in the economic growth department for too long. The scar tissue from post-GFC austerity policies is still very much in evidence. Turbo-charging investments in Europe's defence technology and industrial base can generate opportunities for skills upgrading, employment and promises to drive beneficial spillovers into the civilian economy (e.g. ‘dual use’ technologies).

The emergence of a European military industrial complex (‘EuroMIC’) may sound a bit grim and dystopian but could help to secure the continent’s future beyond what euro-doomer TripAdvisor writes off as ‘a cheap tourist destination with great food and historical monuments for American and Asian tourists. 5 stars!’

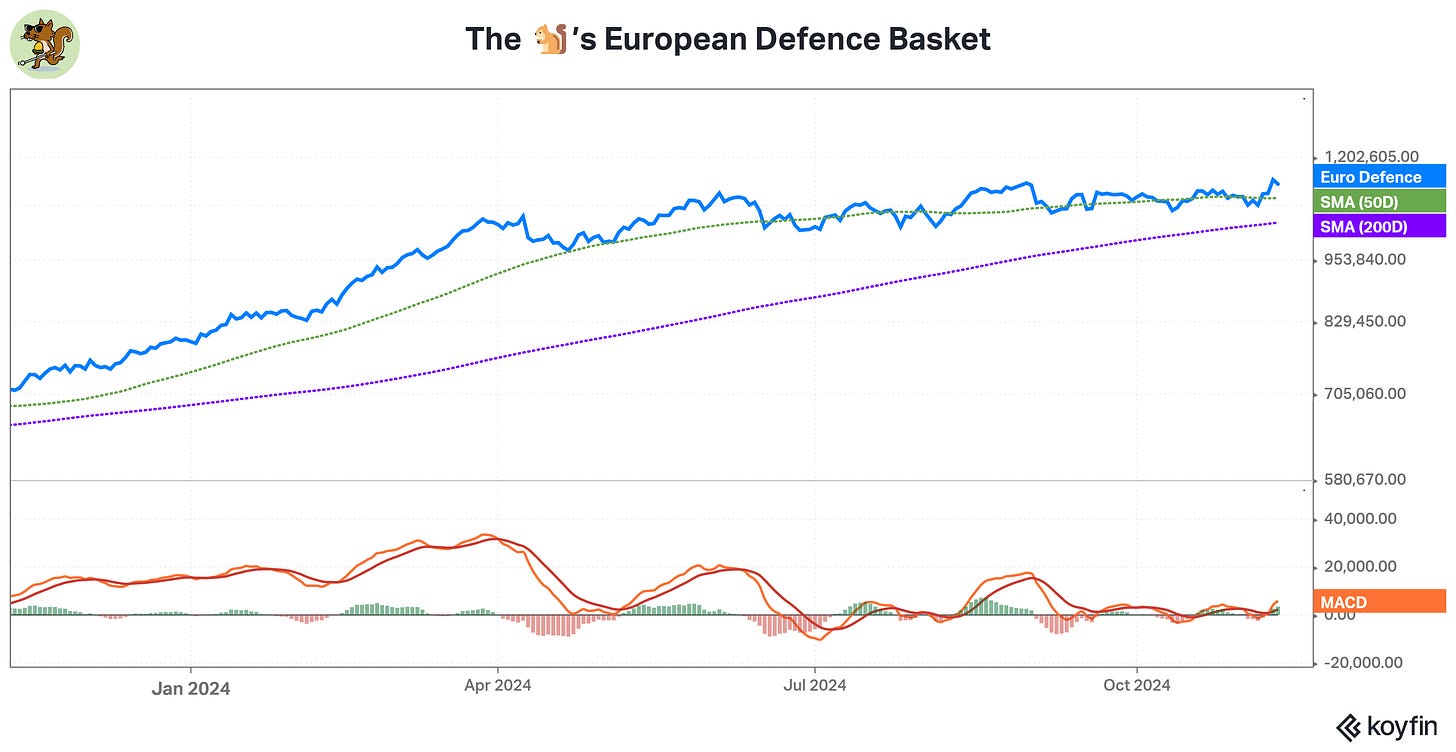

As observed above, the European defence stocks have had a decent run in the past 3 years but frankly the move has not been remarkable relative to other high-flying sectors given the clear growth opportunity.

Section Two this week completes the recruitment of the 🐿️’s EuroMIC team but I wanted to finish the front section on a personal note. Eagle-eyed readers may have noticed that I have written this week’s note in UK English. While this rodent is cool with most American spellings and the liberal use of the letter ‘zee’, but I physically struggle to type the word ‘defence’ with an ‘s’! There is a particular reason.

Like many kids of the 1970s, the 🐿️’s bedroom bookshelf was filled with Commando comics. However, I got to go one better than the ‘derring-do’ of ‘Union Jack Jackson’ and friends.

After leaving the army, my late father started a publishing business. One of his titles was a monthly magazine called Defence Attaché that served as an ‘industry rag’ for the defence specialists within London’s foreign diplomatic corps (quite a big market during the Cold War!).

Most small circulation specialist industry magazines of that type are essentially a vehicle for advertising. Defence Attaché was no different. It was the world’s armament manufacturers that paid the bills with their double spread ads. In a pre-digital era, all imagery for the magazine was couriered around in physical form ahead of typesetting and publication. As such, our house and this young 🐿️’s scrap books were always littered with glossy photographs of tanks, frigates and SAM missile batteries.

Don’t miss out! Please consider becoming a paid subscriber to receive the other 60% of 🐿️ content (including the line up of the EuroMIC team), member Discord access (The Drey) and even ‘limited edition’ merch!

Monthly subscription prices have now risen to $35 for new subscribers however annual subscriptions are still available at the original rate of $300/year.

Section Two

In general, I like to use well-constructed ETFs for theme implementation. The US names of Team MIC is well covered on that front via the ITA 0.00%↑ ETF from iShares and SPDR’s XAR 0.00%↑ (although the iShares vehicle is in dire need of a rebalancing).

There is one (very new) product, NATO 0.00%↑ which captures names on both sides of the Atlantic and looks to be sensibly constructed. Unfortunately, it is (i) far too US-centric for our specific EuroMIC theme and (ii) sadly not yet large or liquid enough to be useful.

Nevertheless, in a world of terribly constructed thematic ETFs, the 🐿️ wants to make a point of giving a shout-out to the index compilers that do a thoughtful job rather than trying to sneak in the latest index leader like Nvidia or Palantir.

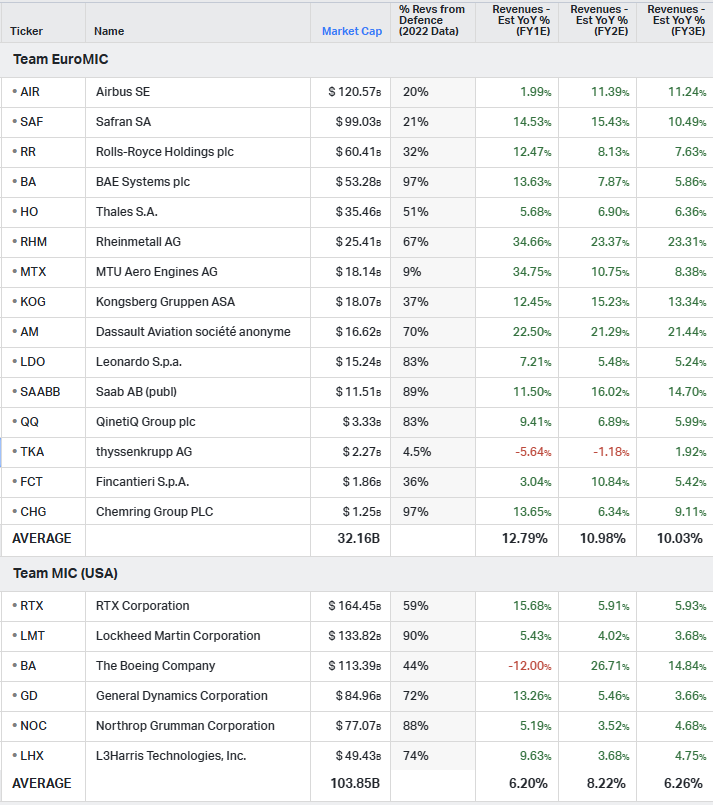

As mentioned above, the heavily consolidated defence market in the US gives investors plenty of large cap ‘pure play’ exposure to military spending. You have the ‘Big 5’ plus the part of Boeing that is probably the only reason that corporate entity has not yet been put out of its misery.

In Europe, with the exception of the UK giant BAE Systems, many of the region’s larger defence contractors are divisions of larger industrial conglomerates. Not a precise science, but if you multiply the market caps of these issuers by the percentage of revenues generated by their defence arms, the aggregate market cap for the group drops by almost 60%.

This group trades at a 28% discount to Team MIC on a forward EV/EBITDA basis and a vast 52% discount looking at PEG ratios (price/earnings growth). At the same time EuroMIC offers a much more attractive forward revenue growth profile.

There is a meaningful valuation premium for the Euro defence contractors versus major European stock indices. However, this feels justified given the relative earnings growth (a PEG ratio of 1.23 for EuroMIC versus a range of 2.2 to 2.8 for this selection of broad Europe ETFs).

In constructing the 🐿️’s EuroMIC basket, I have narrowed down the long list of publicly traded defence names to exclude issuers with a DefCap™ (% defence revenues * market cap) of less than $1 billion.

Introducing the 🐿️’s EuroMIC Basket

You can get lost for hours reviewing Jane’s Defence Weekly and the IR decks or websites of EuroMIC. While it was tempting to include lots of cool photographs and videos, this note is already getting long. Here is a short summary of the principal defence activities of the selected names:

BAE Systems: Major defence contractor producing military aircraft, naval vessels, land vehicles, electronics, and cybersecurity solutions. Key programs include F-35 components, Eurofighter Typhoon and nuclear submarines.

Airbus: Manufactures military aircraft including the A400M transport plane, Eurofighter Typhoon and helicopters. Develops unmanned aerial systems, satellites and is leading the Future Combat Air System program.

Safran: Produces aircraft engines, rocket propulsion systems, avionics, and optronics for defence applications. Key programs in helicopter engines and inertial navigation systems (INS) for missiles.

Rolls-Royce: Manufactures engines for military aircraft. Also provides power and propulsion systems for submarines and surface ships. Developing hypersonic technologies.

Thales: Specializes in defence electronics, radars, missiles, and cybersecurity. Produces communication systems, armoured vehicles, and provides training and simulation solutions for armed forces.

Rheinmetall: Manufactures armoured vehicles, weapon systems, ammunition, and defence electronics. Produces air defence systems as well as simulation solutions.

Leonardo: Produces military helicopters, aircraft, naval systems, and defence electronics. Develops unmanned systems, space technologies, and cybersecurity solutions. Key player in European defence programs.

Dassault Aviation: Manufactures Rafale fighter jets and combat drones. Develops military aircraft systems and provides support services to multiple air forces.

Saab: Produces Gripen fighter jets, airborne early warning systems, and submarines. Develops radar systems, combat management systems, and unmanned aerial vehicles for defence applications.

Kongsberg: Manufactures missile systems, naval systems, and defence communications. Produces remote weapon stations, maritime autonomy systems, and space and surveillance technologies.

Qinetiq: Provides defence research, testing, and evaluation services. Develops robotic systems, cybersecurity solutions, and space technologies. Offers training and simulation for military operations.

MTU Aero Engines: Develops and manufactures military aircraft engines and components. Key partner in European defence aviation programs, including the Eurofighter Typhoon.

Chemring: Produces countermeasures and pyrotechnics for defence applications. Develops sensors, electronic warfare systems, and cyber solutions for military and security markets.

After adjusting for DefCap™, I have capped initial basket weights at 10%. While there are plenty of reasons to be interested in the civilian activities of Rolls-Royce, Safran and Airbus, this is a defence basket. For this reason, I have also overweighted the mid-cap ‘pure plays’ relative to their share of DefCap™.

A chart of this basket over the past year looks to be coiling ahead of a further advance. The basket is being rebalanced to target weight quarterly in the chart below. Note that I do not plan on managing the EuroMIC with any systematic rebalancing. It will be a static basket of ordinary shares (no options).

Let’s have a look at the individual charts. I did not want to wear out your scrolling thumb by putting 13 charts in a row, so here is a (silent) 60 second video of all of them.

For those that did not press play, the individual charts are in pretty good shape. In many cases, there has been a sharp positive move off the back of the US election. I also think Commissioner Kubilius’s confirmation hearing at the European Parliament last week may also have had an impact.

We have our EuroMIC! As ever, if you have any questions, please message me via the button below or ping me in The Drey.

Acorn and Portfolio Update

I published a post-election trade update mid-week. Mainly the 🐿️ fleeing from tech-related short positions and election hedges.