A Cracking Sunset

An opportunity in refiners, the cannibals of the energy market.

The ‘sundowner’ is the best drink of the day (unless you are a natural gas trader, in which case a shot of absinthe on your breakfast cereal probably fits the bill). The topic for this acorn is oil refiners. For many, the ultimate sunset industry.

It’s a grubby business, but someone has got to do it. In the past decade, oil refining has been up there with the clubbing of baby seals as far as the ESG crew is concerned. The super-majors have been divesting their oil refining assets like a mutual fund manager trying to disguise her ‘shitco’ trading proclivities at quarter end.

We have got to a situation in which the fleet of oil refineries of North America has not been added to since the 🐿️ was in short trousers (1977 was the last newbuild) and yet this fleet is still largely not designed to process the light crude that is produced domestically. Do not even start me on the commonsense hurdles created by the Jones Act! Some of the weirdest arcs in the life cycle of an energy molecule take place because of the politics and geopolitics of hydrocarbon refining.

I get all of the bear arguments for refiners. Let’s re-rehearse them:

Vehicle electrification and increased efficiency of modern internal combustion engines will ultimately massacre demand for gasoline and diesel. Fair, but I suspect that the EV share of the US and global vehicle parc will disappoint relative to the optimist ‘hockey stick’ adoption curves in many industry forecasts. We are already seeing the signs. In the meantime, the ultimate demise of the gasoline pump pretty much ensures that there is no queue of people looking to spend 10 years and US$10bn building new refining capacity. It’s actually a moat!

Refiners enjoyed a windfall from capacity reduction due to the pandemic and the industry has been over-earning in recent years. Perhaps, but current valuations imply that the market has already dismissed those windfall earnings as a one-off. Growth stocks they are not, but then again, neither is Apple these days!

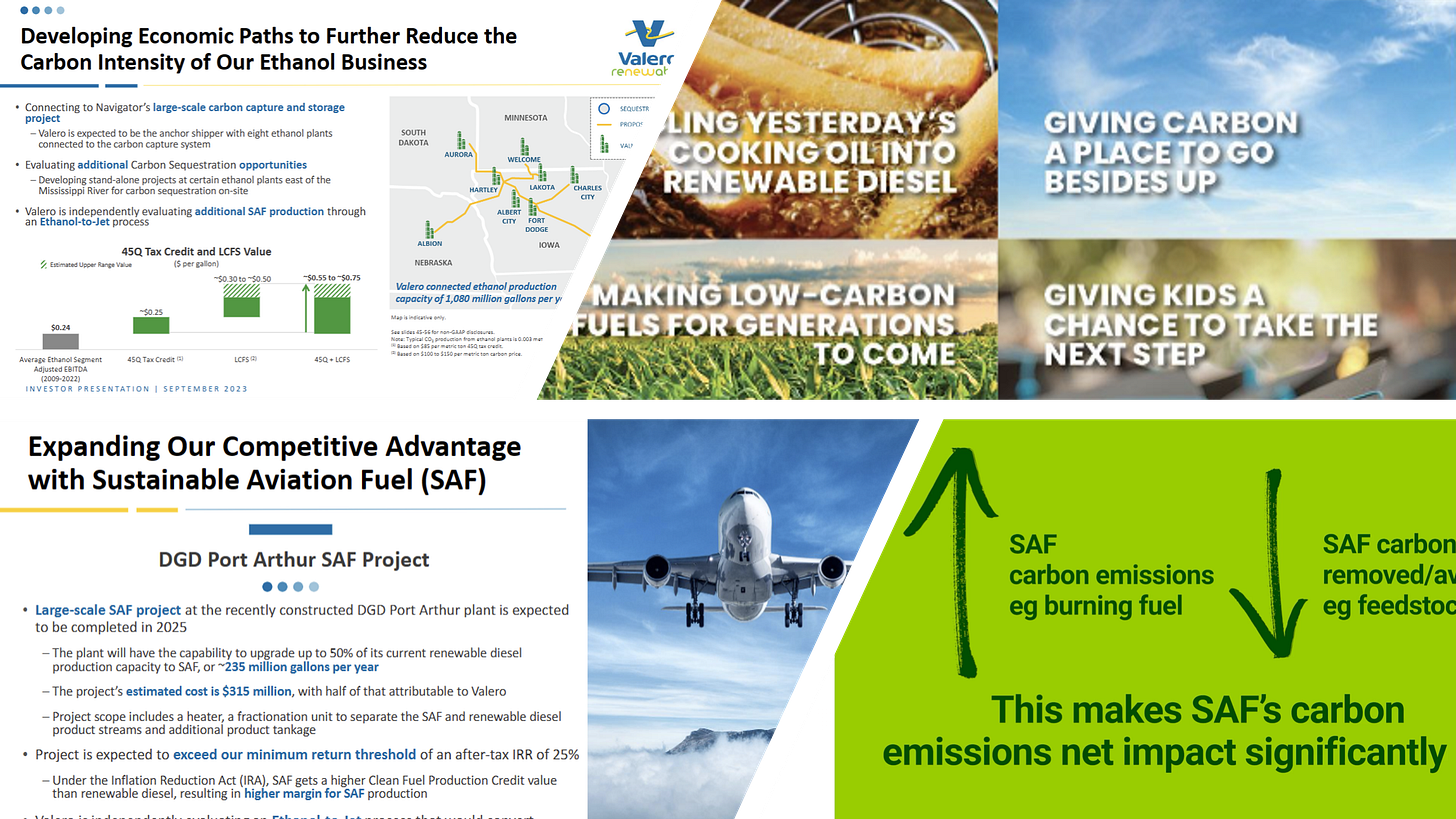

ESG. Refiners are a ‘no go’ in too many investment mandates due to ESG policies and screens. Sure, there are many institutions that will never own another refiner, but then I suggest you take a look at Valero’s IR deck (these guys know their audience - just click on the image below - they are giving investors plenty of green reasons to adjust that stance with their pivots to renewable fuels). These pivots may be enough to get refining stocks off the ‘naughty step’ as the ESG cause starts to get de-emphasized in certain quarters (looking at you Blackrock!).

I have owned refining stocks on and off since the COVID lows but after the fireworks of 2021 and 2022, had my attention diverted by other exciting themes in the energy sector (uranium, offshore etc.). Then, in the way that many ideas start to get formulated, the pieces of a mosaic started to fall together.

Regular readers will know that the 🐿️ has a long energy bias, but also that my view has shifted from being sympathetic to the views of the “WTI $250” baseball cap crew towards what I called my “Crude-ilocks” (i.e., not too hot, not too cold) thesis.

Refiners, with their defensive yield characteristics (dividend plus buyback) also sit comfortably with my macro outlook for stable / falling interest rates in 2024 (versus the hiking bias of the previous 2 years). I suspect they will also continue to outperform versus producers if spot energy markets continue to chop.

Then we have margins (crack spreads). Looking at a monthly chart of a generic 3:2:1 crack spread we can see that spreads have settled back to their multi-year gentle uptrend after the volatility madness created by the pandemic (break below) and the Ukraine war (break above).

Next up, my friend Erik at YWR: Your Weekend Readingsent out the latest run of his factor screening model in December. It scores global stocks on the basis of earnings momentum, price momentum and valuation. Refining stocks all over the world were rocketing up his leaderboard. Interesting.

Natty. The capitulation in US Natural Gas prices in mid-December finally drew me into that market after a (healthy!) break of almost 2 years. Cheap gas is a key advantage to US-based nitrogen fertilizer manufacturers (that I have been itching to buy again) and, of course, to the domestic refiners. Valero measures this advantage as being the equivalent of $2.50 per barrel of crude throughput (i.e. about c.10% of a current $24 3:2:1 crack spread and 2.5x the spread from 2019). Handy! Not to mention a nice hedge if I am adding length to NatGas positions.

Orange Juice. One of the reasons that we were bearish (too early) on OJ last year related to a view that a repeat of Florida citrus grove damage from the 2022 storm season (Hurricane Ian) was unlikely to be repeated in 2023, an El Nino year. That part of the call was spot-on. Those of you familiar with our grains thesis, will know that we expect an early return to La Nina conditions this year. Conditions which bring highly elevated Gulf coast hurricane risk. Storms always get us thinking about refiners (and will feature in how we structure the trade).

Finally, on Monday one of my favorite energy analysts, Paul Sankey (@crudegusher), published a video wrap-up of his mini refining conference in Miami last week. He did a great job of reminding the 🐿️ just how well managed the US refiners have become in the past decade.

“[Refiners] were really the first to take their medicine in the oil sector 10 years ago and now have become very focused on operational excellence; on running the refinery safely; constraining capex; and, within that context, and returning as much cash as they can to shareholders”. Paul Sankey.

Think there a plenty of smart ways to play it. Let’s dig in.

Industry Structure

The map below is 14 years old, but it does not matter. The EIA has not updated the map on its website. Presumably this is because no new refineries have been added.

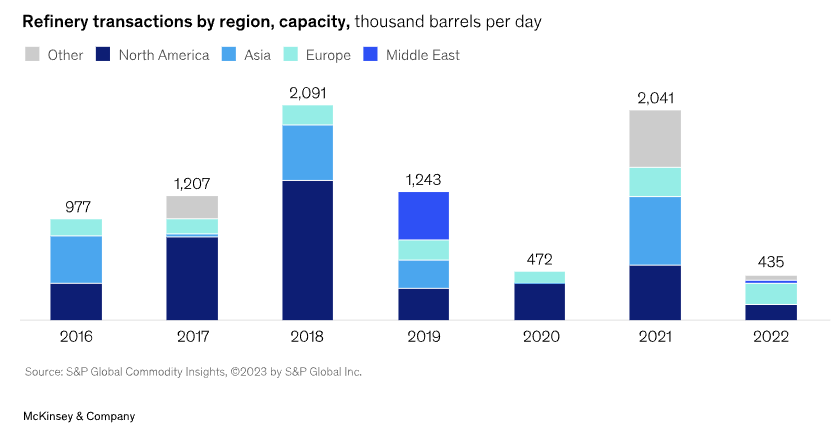

While we have seen capacity addition in Asia, the Middle East and Africa, there has been a net reduction in distillation capacity in North America.

…and the remaining capacity within the US gets run pretty much ‘at the max’ particularly once you take into account regular maintenance schedules:

Leading to refined product (gasoline, distillate and jet fuel) production being pretty constant for the past decade.

As mentioned above, the industry has largely consolidated around a small handful of independent players.

Those players remaining in the game are laser-focused on operational and capital efficiency. Valero’s ‘New Paradigm’ slide from the IR deck is a good summary of the current playbook for the sector (🐿️ emphasis highlighted in yellow).

On the renewables front, there are a lot of green color schemes in the industry’s IR and PR materials. Try finding a picture of an oil barrel or a gas pump!

The reality is a little bit more prosaic…

The reality is that these businesses are now being run for shareholders. Renewable diesel (RD) and sustainable air fuel (SAF) projects (greenfield or brownfield conversions) will only proceed if they satisfy minimum hurdle rates of return (only achieved via subsidies (such as “blender’s credit”; tax breaks and carbon credits (aka renewable identification numbers or RINs - which help manage compliance costs of the core business).

A cynic might observe that these projects also serve to expand the universe of institutions and creditors that own their shares or lend them money. But let’s be clear that the biggest buyers of shares (apart from the 🐿️ and his friends) are going to be the companies themselves.

The Players

I have put together a universe of the purest plays on US refining market. Some have other business lines (logistics, pipelines (usually within MLP structures) and specialty chemicals). Links to latest investor decks1.

Consensus analyst forecasts sees median EBITDA estimated to fall by 10% in 2024, 28% in 2025 and 11% in 2026. Not great prima facie, but the group trades on very unchallenging EV/EBITDA multiples.

Forward EV/EBITDA multiples over time. Note that the chart below is on a log scale (a linear scale chart is not legible).

The stocks are cheap. However, this acorn is not a mean reversion or indeed a multiple expansion story. This is about balance sheet strength and share count cannibalism!

At the end of the day, these companies are now being managed for shareholder returns. The investor decks are not written in a way that is trying to persuade the market to attribute any kind unicorn-style growth multiples to the stocks. That was never going to happen anyway in the current investment climate.

Apart from the numerous nods to their RD and SAF businesses (which justifies the color schemes, and which have, to be fair, an accretive financial goal in their own right), the focus that screams from these presentations is 100% one of capital discipline and investor returns.

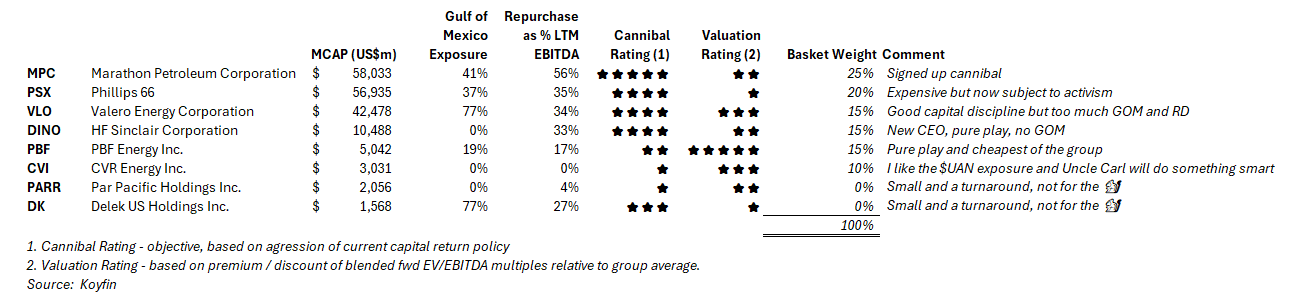

The group is at varying stages of the capital return journey, from Marathon Petroleum MPC 0.00%↑ (fully signed up to the Elliott plan) and Phillips 66 PSX 0.00%↑ (starting down the MPC / Elliott path); HF Sinclair DINO 0.00%↑ and Valero VLO 0.00%↑ (very much on message); CVR Energy CVI 0.00%↑ (figuring out a path post the CVR Partners UAN 0.00%↑ spin off cancellation); to the turnaround situations (Par Pacific PARR 0.00%↑ and Delek US DK 0.00%↑).

These management teams know that if they do not, they will soon hear from the activist billionaires (who have a similar plan, but who are probably in even more of a hurry than the current management teams are!).

One more thing to keep in mind. Hurricanes (apologies for the next clip, but we need to find someone who can re-make it for Gulf coast ports!). Unlike the ‘Home Counties’ of England, hurricanes happen in the Gulf of Mexico rather a lot!

And we all know how much damage a direct Cat 4 or Cat 5 storm hitting the Gulf Coast can do to refinery infrastructure.

…and the “PADD3” (Gulf Coast) share of national refining capacity is massive:

Let’s see how geography effects individual names.

In addition to factoring storms into our basket structure, the market cap / refining capacity column also gives you an interesting insight into which stocks have the most torque to a positive pure refining story.

Implementation

We are going to start with a basket of common stock exposure to the group. We have weighted the basket factoring in geography, valuation and the aggression of capital return policies.

Paul Sankey appears to really like the 2 stocks that I have excluded. He is a smart guy and almost certainly on to something there. However, I have not done enough work to justify placing these small cap names in the basket. If any of you have, please do get in touch!

Let’s have a quick look at some charts for our basket:

The Kickers

Elliott Activism at Phillips 66. Elliott’s letter to PSX (dated 11/29/23) sees fair value for PSX above $200 per share. In the hope that they make a dent in that price target we are adding a January 2025 $150/$170 bull call spread to the basket for $4.19 (4.8: 1 payoff).

More of the same at Marathon. We are expecting another year of aggressive capital returns at MPC 0.00%↑ and are hoping to juice the return on this part of the portfolio with the addition of a vanilla January 2025 $170 call option.

The Hurricane hedges. If we do get the hurricane season with the La Nina transition that we are expecting DINO 0.00%↑ and PBF 0.00%↑ have the potential to outperform the group. We have added January 2025 call options (PBF with a $50 strike, DINO with a $65 strike) to the basket.

Links to the OptionStrat worksheets can be found via the option structure descriptions above.

Execution

Given the volatility in energy stocks (and spot markets) at the moment, readers may prefer to average into the stock basket over the next couple of weeks. For acorn tracking purposes I will use today’s close and the execution levels in the OptionStrat models.

The total package works out as follows (after adjusting the target weights for real world share prices and making room for the option basket):

A quick word on a (global) ETF alternative: CRAK

I realize that this acorn has been all about the US refinery opportunity. The US market has some unique advantages (cheap crude (relative to Brent); dirt cheap natural gas; and limited risk of future capacity). However, deglobalization has created some real value for refiners in other jurisdictions around the planet.

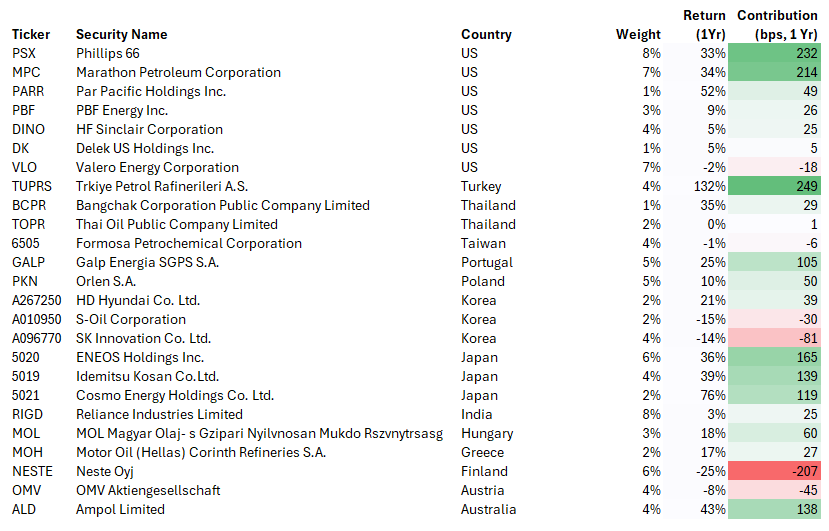

Van Eck has a one stop shop for the exposure in the form of CRAK 0.00%↑

Sorting by post-Covid / post-Ukraine war total returns, you can see that most of the names in the basket have been among the ‘champs’, but there are some ‘honorable mentions’ for the Turkish, Korean and Japanese names that found their way into Erik Renander’s screens.

Also, a nod to the ‘winners’ from the Russian / Iranian crude embargoes from India, Greece and Thailand…😉. Finally, the most expensive refining stock on the planet makes it to (the bottom of) the leaderboard - Formosa Petrochemical (see 🐿️ footnote2)

With a 30% exposure to our core US basket, these feels like an interesting exposure to the broader global theme.

The chart looks like it wants to do more too on the upside. In interesting alternative for those looking for a long-only exposure and do not want to do the single stock basket.

Welcome to the world of the energy cannibals!

See you next week. Squirrel out!

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

One of my great mates in Asia has spent most of his life as a litigator dealing with the will disputes of the Wang family that founded this Taiwan group. 20 years of legal fees! The stock has always been expensive notwithstanding the queue of potential sellers. The 🐿️ used to cringe every time a Taiwanese coverage banker asked me for a price on a block of stock. I tended to make polite excuses and hang up!

Excellent stuff Rupert… not a fan of PBF. Just me.

The Squirrel is in fine form!