'Stock Take' (Part 4) - The Wash-up

The Blind Squirrel's 'Monday' Morning Notes. Year 3; Week 26.

Big changes coming to Blind Squirrel Macro TOMORROW. If you missed the earlier emails, details can be found in the post linked below.

During June, before Blind Squirrel Macro moves completely behind the paywall, we have been going through the process of re-underwriting all of the live Acorn trades and revisiting the 'bull pen' of themes that we have closed out the trade but continue to monitor.

The Wash-Up

The "wash-up" period at the end of a UK Parliament refers to the final days after the Prime Minister announces a general election and before Parliament is formally dissolved. During this brief window, the government attempts to pass as much outstanding legislation as possible, focusing on bills that have sufficient cross-party support.

In this final edition of the annual ‘stock take’, the 🐿️ is going to cram in a random assortment of acorns and themes that did not fit into part 1 (mainly industrial and energy, part 2 (emerging markets) or part 3 (financials).

By the time this note hits your inboxes I should be on my way home from watching the new F1 Movie at Melbourne’s IMAX theatre. Last time I was there was in 2022 to get briefed 3 full years in advance on the details (minus Maverick) of the United States’ plans to bomb Iran’s Fordow uranium enrichment facility.

Do you think that Joseph Kosinski is mentally preparing us for a US driver to win the F1 Drivers’ Championship in 2028? In a Cadillac? Yup, we are going to start with FWONK 0.00%↑, our recently revisited position in Formula One Group!

Formula One FWONK 0.00%↑

Last week Formula One Group received regulatory clearance from the European Commission to complete the $4.95bn Moto GP deal which is now expected to close (ahead of schedule) by July 3rd. Let’s see how the ‘Brad Pitt effect’ drives US interest in F1 ahead of the 2 remaining US-based Grand Prix of the season (Austin, 10/19 and Las Vegas, 11/22).

FWONK 0.00%↑ is a tricky stonk for a rodent with a strong value bias! The shares are now trading within a couple of % of my base case DCF valuation for the business.

In the May note, I floated the idea that global intellectual property assets are long-term, potentially inflation-busting stores of value? The trophy assets of the US’s NBA NFL and MLB franchises never lack for a queue of multi-billionaires and private equity shop buyers when one comes up for sale. Are they just an ego trip or in fact a new anti-fragile asset?

I currently have very little exposure to long duration assets (negligible US tech holdings or long-dated Treasuries) in my portfolio. My DCF valuation for F1 is highly skewed by terminal value and thus highly sensitive to discount rates - a 2% reduction in WACC (mainly driven by long-term risk-free rates) adds 50% to my fair value per share. If rates are going to come down by 2%, frankly the 🐿️ would rather be hitched to Formula One than owning those long bonds.

Goodyear Tire & Rubber GT 0.00%↑

From an ultra-long duration asset, we stay in the world of automotive, but with our acorn at the other extreme of the duration spectrum - Goodyear GT 0.00%↑.

In May, the 🐿️ decided that a combination of tariff tailwinds (yes, it can be a thing!) and some major progress on the ‘Goodyear Forward’ restructuring was enough to revisit the opportunity at America’s iconic tire brand.

Since the May note, Goodyear has successfully divested the specialty chemicals business, completing the full disposal plan. Sell-side analysts have started to raise their EBITDA forecasts marginally.

Even if this is not the beginning of a major earnings upgrade cycle, the tire manufacturer only needs to hold its current trading multiple and meet current consensus forecasts in order to be a $20+ stock. The best thing is that you have not yet missed any of the move!

After a rapid move to $12, GT 0.00%↑ ran into a large seller. There has been plenty of discussion of the price action in The Drey (Note: only a small subset of my paid subscribers has signed up to the member Discord - you are missing out on a great community of sharp thinkers!). In the last few sessions, that seller does appear to have been cleaned up. Goodyear is probably the 🐿️’s favorite single stock idea.

‘Boyz Toyz’

Sticking with vehicles, after just over 3 months it’s time to revisit the world of RVs and Choppers.

Back in March, the 🐿️ reviewed his concept of ‘UberLux’ versus ‘AlsoLux’, the former being my name for the category of consumption for ‘the 0.01%’, the latter describing the consumption of the ‘next few hundred’ basis points of mere mortals.

High ticket discretionary items, from campervans to snowmobiles, firmly fall into the ‘AlsoLux’ category. Even in the absence of a bone-crunching recession, the claw forward effect of the pandemic purchases continues to impact sales and earnings of the manufacturers of big boys’ and girls’ toys.

I was pretty blown away to learn from the NMMA, the leisure boat industry association, that an estimated 61% of recreational boat buyers have an annual household income of $100,000 or less. Not that consumer sentiment by income cohort is diverging dramatically at the moment:

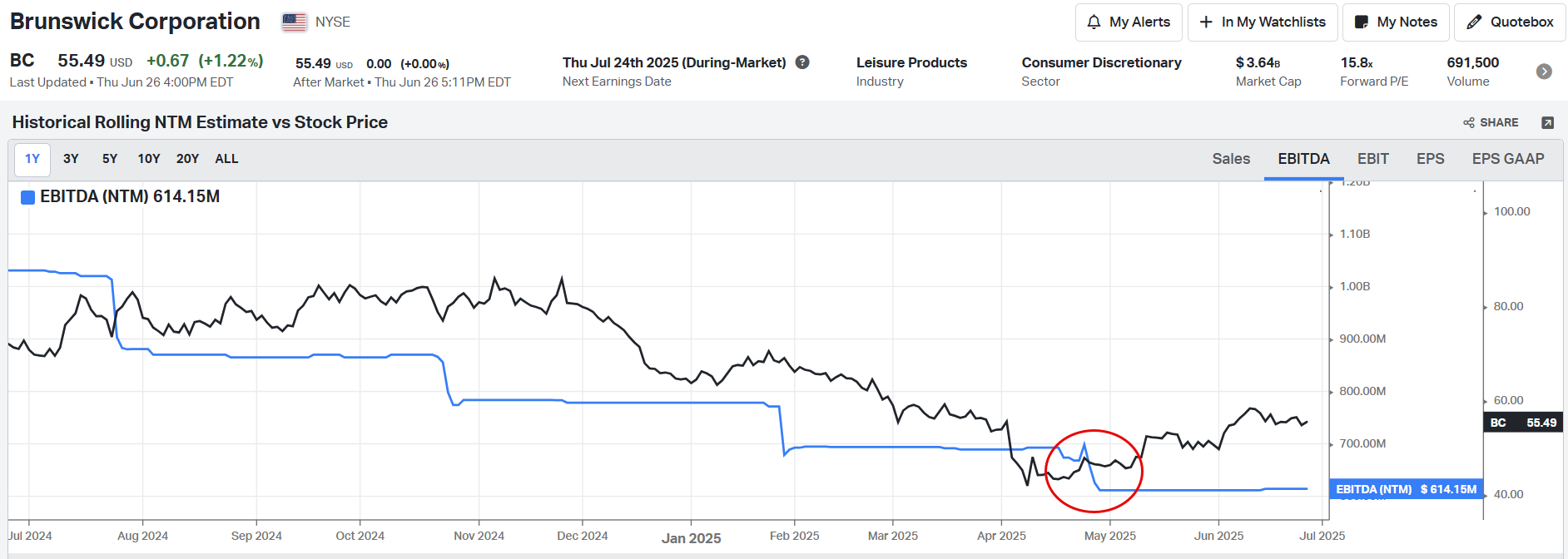

In the March report, I was focused on the prospect of negative earnings revisions coming for the ‘BoyzToyz’ basket and that they might start to get some close and unwelcome attention from the equity long/short pod shops that focus on that earnings revision factor.

I assembled a shopping list of ‘Boyz Toyz’ shorts. In the end, I only took positions in Brunswick Corporation BC 0.00%↑ and Harley-Davidson HG 0.00%↑.

Specifically, both Harley-Davidson and Brunswick had meaningful downward revisions to consensus NTM EBITDA forecasts on the back of Q1 earnings. I think it is notable that Winnebago WGO 0.00%↑, which has had the steepest downward revisions over past 3 months (and weakest share price performance) has already released its quarter. Can we expect another leg down from HOG 0.00%↑ and BC 0.00%↑ as they both approach earnings on 24th July?

The ‘Boyz Toyz’ is on average essentially flat over the past 3 months against the backdrop of stronger midcaps over the same period (the Russell 2000 is up just over 5% over the same period). So far, we have caught a decent move on Harley-Davidson. Nothing yet on Brunswick to write home about.

The charts are showing no signs that would yet scare me away from these shorts.

Happy to sit in these positions over the summer.

China and EVs

The 🐿️’s only current direct exposure to the China EV theme is via the inclusion of Xiaomi as a mainstay in our ‘Guochao’ basket of Chinese consumer stocks. I came for the smartphones and home appliances but stayed for the EVs!

Xiaomi’s new YU7 compact SUV is priced ‘on the road’ for $35,300, that’s $1,400 less than a locally built Tesla Model Y. Within 3 minutes of its sales launch last week, Xiaomi sold 200,000 of them, breaking all records for a new model launch in China. The news took the stock (1810.HK) to fresh highs on Friday.

This share price move puts Xiaomi on a punchy 32x forward earnings, albeit with a PEG (price / earnings growth) rate still below 1, and the sell side analysts continue to chase higher with their estimates.

Catching Xiaomi makes up for the disappointment at not being a shareholder of BYD. By the time that Mrs. 🐿️’s job-change finally allowed me to own BYD, the stock had already doubled from when I first had that unhappy encounter with her compliance restricted list.

From a valuation standpoint, BYD still trades attractively at less than 1x NTM sales and on a NTM EV/EBITDA of 7 times. However, the stock has been chopping around since March, and I am a bit wary that it might be starting to put in a topping formation.

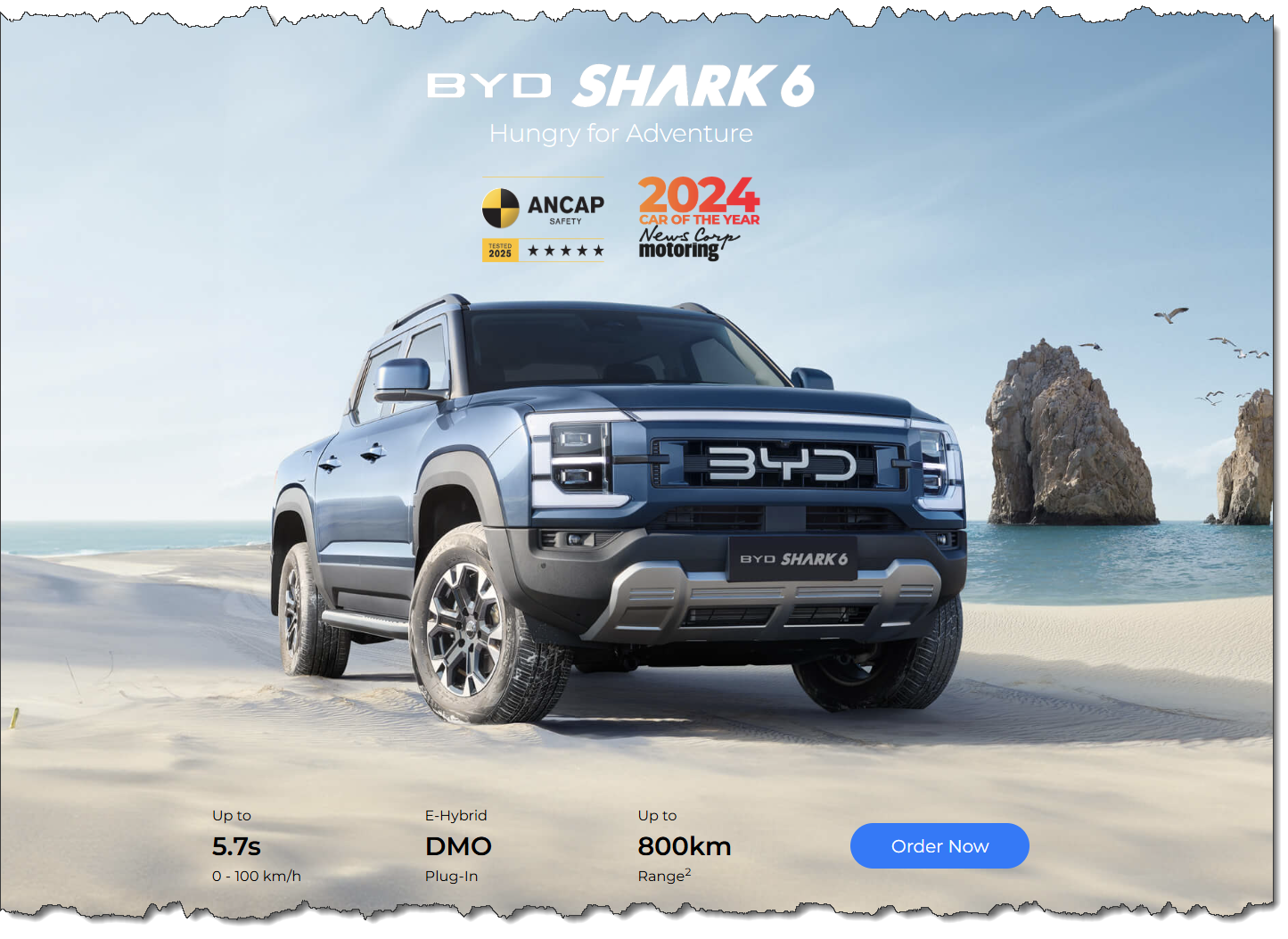

My good friend Tu Le pointed out in his latest SAI (Sino Auto Insights) Weekly note that rumors that BYD was slowing down production and expansion might be a sign of “some saturation of their brand in the domestic Chinese as well as international markets”. We are certainly overrun with them down here in Australia.

BYD has been knocking the stuffing out of domestic competition in recent months, and the Chinese government is starting to get concerned about the price war and its knock-on impact among the Tier 1 suppliers to the local OEMs. Tu observes that a production slowdown will allow them to “bleed the excess inventory at the dealers”.

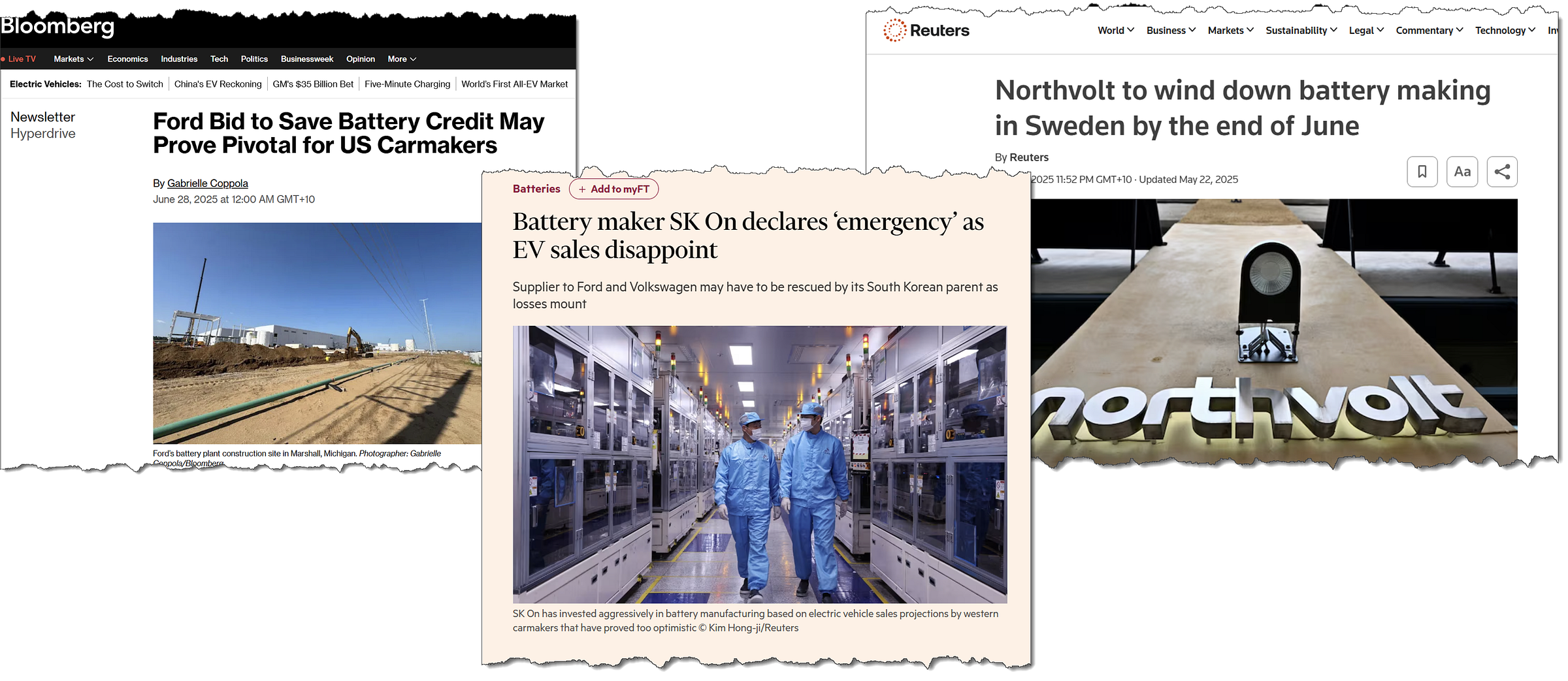

The risk in BYD shares feels asymmetric to the downside at the moment. One Tier 1 supplier to the Chinese EV OEMs that is, however, not feeling the pinch from predatory payment terms is the 800-pound gorilla of global lithium battery market, CATL.

Contemporary Amperex Technology (CATL)

Having watched the battery giant’s A-share listing from afar, admiring its 5x rise during 2020/21, I finally added a position at the time of its Hong Kong IPO in May.

Back in 2020, CATL had a staggering 58% (now c.47%) market share of domestic EV installations. I saw first-hand how the company had a stranglehold on the market that had domestic EV OEMs behaving like diamond dealers at a De Beers’ (pre-2000) ‘Sightholder Sale’. There was very little scope for negotiation. For the OEMs it was about just getting an allocation to kWh capacity!

The gross profitability of CATL’s domestic business dipped to RMB125/kWh of production in 2024 (it’s expected to increase moderately to around RMB135/kWh this year). However, CATL’s international business (primarily Europe / Rest of World) is the ‘jewel in the crown’ and is significantly more profitable at over RMB280/kWh.

The company has a c.80% market share with Europe’s OEMs, with market position likely to be enhanced once operations commence at the company’s new plant in Hungary.

EV batteries represent the bulk of CATL’s business. However, its ESS (storage) business is already up to 20% of the top line. The storage business enjoys superior margins to the OEM business and is growing faster.

At face value, a forward (NTM) EV/EBITDA multiple of 10.5x does not scream deep value. However, this is business that is generating near to 14% returns on invested capital in a capital-intensive industry with very modest balance sheet leverage (2.5x Net Debt / (EBITDA-Capex)).

Analyst consensus sees CATL business doubling in size by the end of the decade, compounding revenue and EDITDA at 14% and 16%, respectively. CATL’s board expects this growth to be internally financed and has set a dividend policy to pay out at least 50% of retained earnings as dividends going forward (payout ratio for the past 12 months is already at 56%).

On this basis it would not be hard to justify a forward EV/EBITDA multiple in the mid-teens. CATL could end up becoming a monster compounder. I expect the shares to be in the portfolio for a long time.

Agribusiness

As a transition away from wheels, we should touch briefly on tractors. The 🐿️’s agribusiness basket from May 2024 contained a couple of tractor names, Deere & Co and AGCO Corp alongside 2 fertilizer plays (CF Industries and LSB Industries) and the grain traders (Bunge and ADM).

There is not much left of that basket. Losing Deere from the portfolio was a ‘miss’ but frankly, at over 5x forward EV/Sales, the company has gone from fully valued to what is now wildly expensive.

Deere’s multiple feels even more extreme when you consider what is happening to US farm incomes. With record fertilizer cost to grain price ratios; the recent cancellation of many subsidy programs by the USDA; and ongoing trade war concerns (even though ‘gas and grains’ are a useful tool to help balance trade deficits), it is tough to see 2025 /26 being bumper years for sales of agricultural equipment.

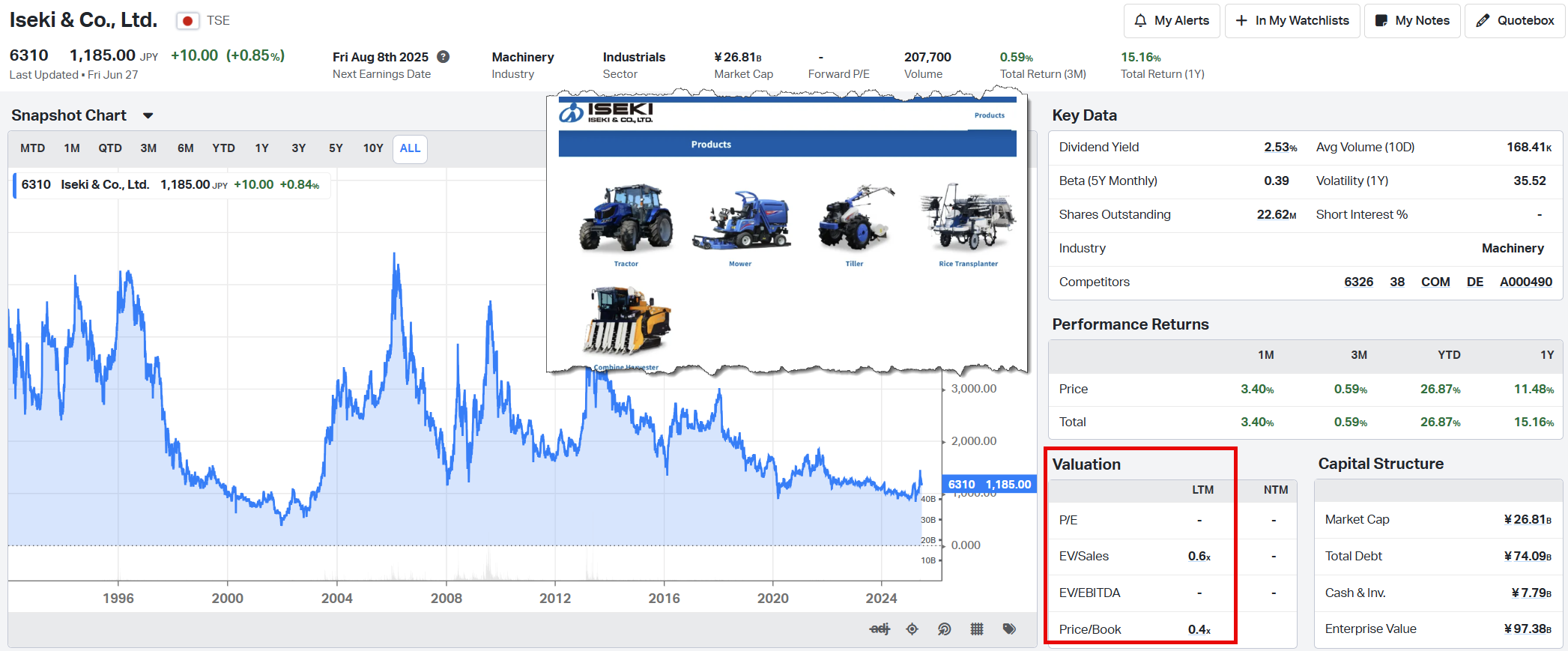

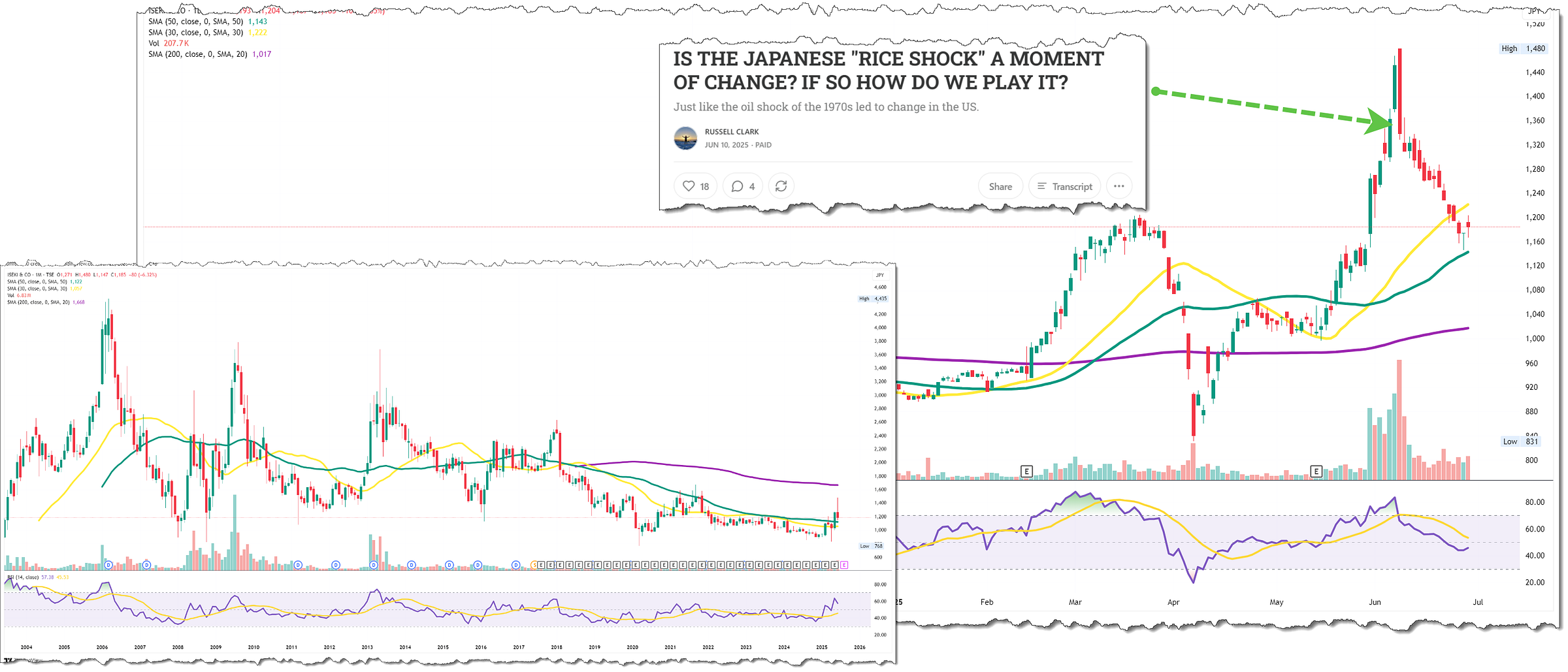

There is one tractor story that does intrigue me though. A couple of weeks ago, Russell Clark published a fascinating piece on rice prices in Japan (track down a copy!). Russell highlighted Iseki & Co., a microcap manufacturer of (mini) tractors and planting and harvesting equipment for rice paddies.

He positions the company cleverly as a call option on the value of farmland in Japan. The company has zero research coverage. Until recently the share price had done nothing for decades. It is highly indebted (9.1x Net debt / EBITDA but interest cover is ok at 5.2x EBITDA / Interest Expense). But - wait for this - its current market cap of $128m represents a mere 12% of 2024 revenues.

The chart looks like it has woken up (possibly with a bit of help from Brumby Capital and Russell’s (much larger than mine!) readership on ‘FinStack’)!

Russell has added a “worthwhile punt” position to his new fund. The 🐿️ reckons this is a pretty interesting idea and will be taking a small position too. I will set a stop at the 200-day SMA which is currently just above JPY1,000 per share.

Tractors to drones (and space)

This may seem like a crazy non-sequitur but bear with this curious rodent! There is one company that cropped up across my work in the Agribusiness, drones and space sectors.

Last October, we took a position in the Procure Space ETF - with its fabulous ticker UFO 0.00%↑.

In that note, I broke down the “messy” public space sector into 3 broad segments (extract below from the October report):

Team MIC (US Military Industrial Complex). Given the state of the world (and the power of the ‘K Street’ and overseas equivalent lobbying forces) it is sadly tough not to see these as strong contenders to own ‘their fair share’ (tone intended) of the ‘Space TAM’. A topic for another note but Team MIC is most certainly not a pure space play.

Legacy Satellite and PNT (shorthand for the GPS-based consumer-facing spin-offs). Many of these names are the current iterations of some of the ‘All-Star’ names of credit market crises of the past. Satellites (like under-sea road tunnels) traditionally only ever make money for the 3rd owners of the equity tranche. Of the PNT plays, Trimble would certainly appear to merit a closer look than Garmin or TomTom (but let’s also leave that for another day).

Pure Space. The list is not exhaustive. For example, I do not include Branson’s (Chamath bailed out ages ago of course!) Virgin Galactic SPCE 0.00%↑in this cohort (the 🐿️ has standards after all) but many of the names similarly found their way into public markets via the SPAC frenzy of the early 2020s.

The 🐿️’s tentative trip into orbit with UFO 0.00%↑ was curtailed in early March. It was a pure momentum trade as my core thesis around space was that a combination of Space-X and ‘Team MIC’ would have a stranglehold over the economics of space, leaving other companies to fight over scraps (if they survived).

While I avoided a nasty drawdown into early April, the space stonks are now up over 50% since the ‘Liberation Day’ lows.

Much of the ETF’s most recent climb to orbit can be attributed directly to geopolitics and to office politics within the White House.

The Vance speech at the Munich security conference triggered a rush by European governments to explore alternatives to SpaceX in the world of satellites.

The public spat between Musk and Trump has so far added $15bn of market capitalization to AST SpaceMobile ASTS 0.00%↑ and Rocket Lab RKLB 0.00%↑ since the beginning of June.

The 🐿️’s allocation to the European defense theme is already too high for me to add additional exposure. However, my pals Le Shrub and PauloMacro’s podcast last Friday contained a very interesting discussion on the topic of Eutelsat’s recent French government-sponsored capital increase (and related military contract / revenue guarantees).

Eutelsat has just transformed from being a low-cost (but very high risk) call option on a European Starlink alternative to effectively becoming a convertible bond with a sovereign guarantee from the French state. I am not even beginning to try and pretend that Eutelsat is yet worth anything close to Starlink but if you think (as I do) that Starlink accounts of the bulk of SpaceX’s valuation of $384bn, then perhaps a few bucks on Eutelsat at a market cap of EUR1.7bn does not sound insane.

The share price has barely reacted to the news. Yet… I trimmed my European defense basket at the beginning of the month. I would probably rather add this idea than more stock in Rheinmetall at 6x NTM revenues.

Trimble

Let me close the loop on that non-sequitur. The common thread between agribusiness, drones and space was Trimble! Charlie Trimble was one of the first pioneers of the GPS industry and Trimble brought the technology to precision agriculture in the early 1980s.

Trimble sold the majority of the Ag business to AGCO in 2024, part of a program that has seen 22 business disposals by the company, representing about $1bn of revenue since 2020. When it comes to drones, Trimble sold its ‘Gateway’ UAV hardware business to France’s Delair-Tech back in October 2016. The company has really now transformed into an enterprise software and systems integrator.

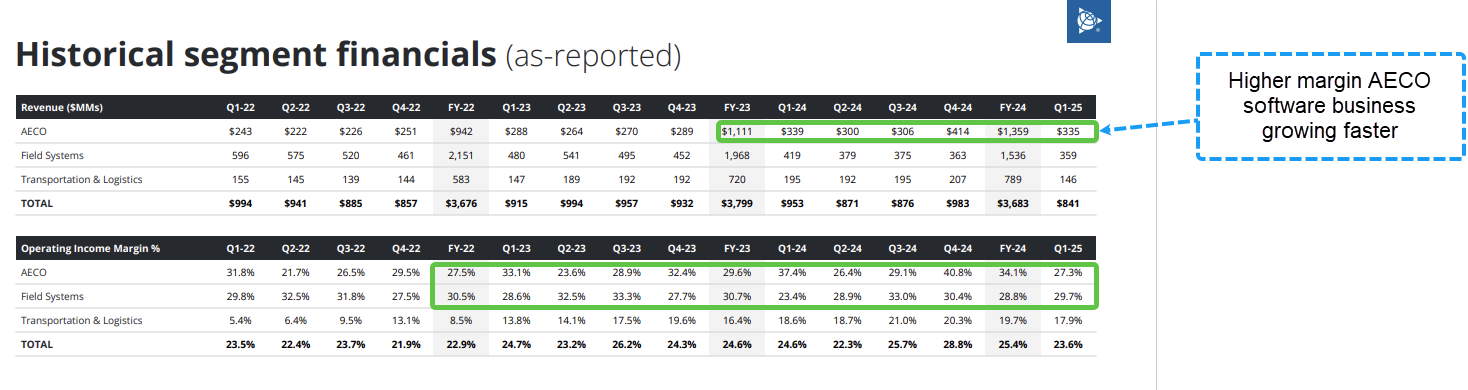

The slimmed down Trimble is now increasingly focused on perpetual and recurring software revenues in its AECO and Field Systems divisions.

Trimble’s Field Systems division (42% of FY24 revenues) now focuses on hardware and software for surveying, civil construction, and geospatial applications, while the ‘AECO’ division (37% of FY24 revenues) focuses on recurring SaaS opportunities in the Architecture, Engineering, Construction, and asset Owner markets.

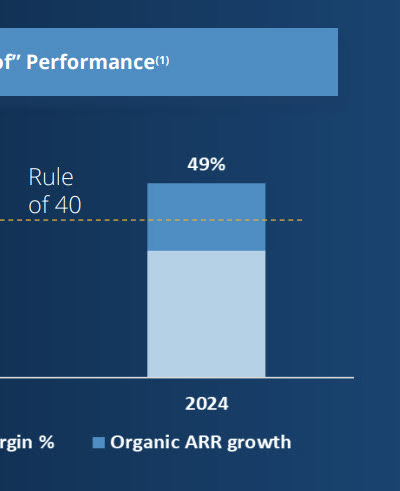

Management is now guiding for continued organic growth in Annualized Recurring Revenue of 13-15%, with operating income margins targeted above 30% for the 2 major divisions.

Management has set a budget target of $3bn of ARR (accounting for 75% of total revenue) by FY 2027.

For the 🐿️, Trimble feels like an interesting play on continued fiscal largesse by governments around the world as on reshoring efforts within the United States. Think of all that new civil infrastructure and those new factories…

In addition, and in the words of CEO Robert Painter, “I feel like owning a share of Trimble is owning a call option on a data company… we own a unique corpus of data… at that intersection of the physical and digital worlds.”

The full transcript of last December’s Investor Day (including Q&A) is linked below and well worth reviewing:

From a valuation standpoint, at 5.6x Forward EV/Sales TRMB 0.00%↑ trades a discount to most of its competitors and peers (on 7.6x) and by an even wider margin to the Enterprise SaaS giants like Oracle, Adobe and Salesforce (on 8.6x).

I would argue that Trimble’s more specialist software and services are considerably more ‘sticky’ in its specialist end user markets. Furthermore, as ARR comes to represent an even greater share of total revenue, the market should start to assign a higher multiple to these cashflows.

Following the policy uncertainty that many companies faced in Q1, analysts have started to revise up EPS estimates for TRMB 0.00%↑.

Trimble’s chart excites the 🐿️’s inner technician. It has recently recaptured positive trend after the ‘Liberation Day’ correction (which also helpfully closed an earning gap from last November). RSI is slightly extended after last week’s strong advance, but Trimble looks to have its eyes set on new highs.

Trimble made it to the ‘watch list’ in our March drones report but the chaos that ensued during the following weeks kept the 🐿️ out of any of those names. It feels like time to fix that. Will set out the execution plan in tomorrow’s ‘Start the Week’ note.

This brings the final edition of 4-part ‘acorn stock-take’ to a close. There are a few themes that I did not get to cover (mainly clustered around winners and losers in the AI and energy thematics). I will get to those in the coming weeks.

As ever, please get in touch if you have any questions - via comments below, in The Drey or privately via DM (link below):

Squirrel out!

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

Hi Rupert, you wrote..."With record fertilizer cost to grain price ratios..." I didn't know this.

I would have thought with natty so cheap fertilizerwould be cheap here. I get it the europeans have are upside down in an amonia nat gas kerfufle but here... But its not that it's that big a deal to your thesis.

Just curious about another pieces of your writing recently... have you ever ridden in or driven a BYD? it's a myth in the states. Never seen one on the road. The clips on X make it look like it's made in outer space by supreme aliens.

At , Any , Rate... the rodent is almost to smart for the ordinary mind! Maybe I should eat more nuts...