Going Fishing

The Blind Squirrel's (delayed) Monday Morning Notes. Year 3; Week 10.

Further troubling times ahead for the manufacturers of Boys’ Toys.

Going Fishing

When I started writing this note last week, I included a long section on US macro containing a bunch of recessionary data points which have been flagged by many of my peers and the press in the interim. Noise from gold imports has made the GDP nowcasts harder to parse and sentiment surveys appear to behave increasingly like political favorability polls these days. That section is now in the bin.

It now appears that an economic slowdown is in fact the de facto policy of the new Trump administration as they seek to tempt buyers back to the long end of the Treasury market in their quest to lower 10-year yields (alongside torpedoing energy prices).

I think it is prudent to simply listen to what they are saying and act accordingly. I will, however, retain one macro chart because it demonstrated that CEOs are certainly listening to what Bessent, Lutnick and Silicon Valley’s newly discovered macro gurus (irony intended) are saying.

2 weeks ago, I concluded the front section of the Acorn update with some ‘anecdata’ from my favorite reader in Missouri, specifically a report on his visit to the St. Louis boat show. HR reported that “the only things on display were priced at $250,000 and up. Absolutely nothing in the $40-$70,000 metal boat range. Definitely two different economies these days.”. 🐿️’s response: “if the bottom falls out of the S&P, the top strut of the ‘K-shaped’ economy stops spending too”. Then came Monday!

But your favorite macro rodent wishes to talk about the consumer. It is now common knowledge that the top decile of US earners accounts for half of all consumption. Excess savings for the other 90% have collapsed from their pandemic peaks.

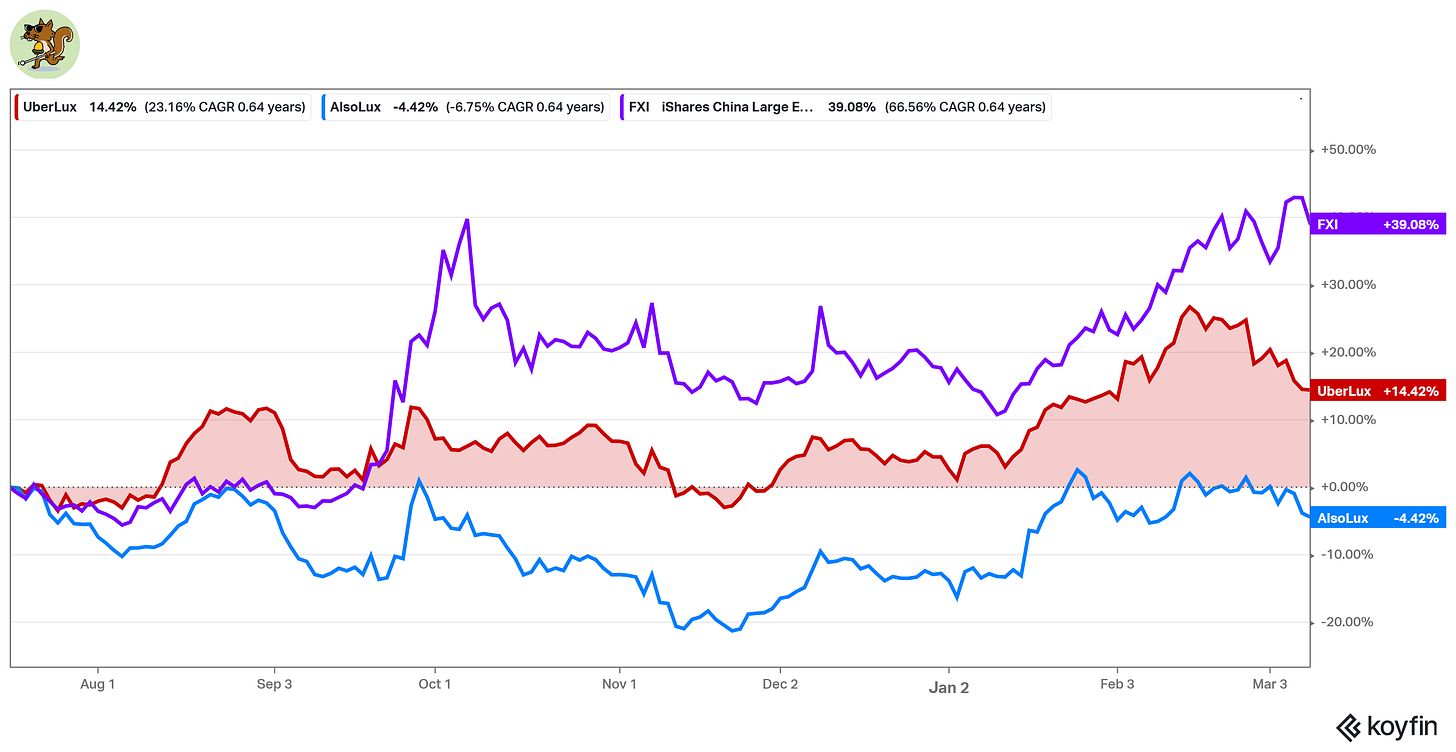

Last year, this trend was very much at the front of my mind when I sought to distinguish between the ‘Uber Lux’ category of consumption for ‘the 0.01%’ and what I called ‘Also Lux’ (consumption for the ‘next few hundred’ basis points).

Let’s catch up on that chart (but with an extra line). ‘AlsoLux’ has staged a couple of mini rallies, generally timed to coincide with periods of optimism about consumption in China.

Another lesson learned. Proxy trades seldom work better than the main event. I guess the message is that career risk dictates that it is safer for many to own some of the second derivative ‘GRANOLAS’ instead of buying China directly. It’s just not as effective.

The 🐿️ covered (in the money) the short leg of a long EXOR (the Agnelli holding company that controls Ferrari RACE 0.00%↑) / short LVMH pair at the early stages of the Tepper rally in September. Last week, I tapped out of the ‘long Ferrari’ leg. It looks like consumer confidence reaper might be coming for the 0.01% as well.

This appears to be a situation which will only accelerate if we see further damage to equity (and crypto) portfolios. After all, I am not convinced that the Only Fans creators alone can support the bid under supercar sales!

But let’s get back to boats. One of the 🐿️’s more random memories of the pandemic was the explosion of activity in the leisure boat and RV markets. Images of PPE-clad RV sales staff are still fresh in my memory. It is human nature to extrapolate from the present, but the assumption at that time was that people would never get on a plane for an overseas holiday again.