Bringing it together

The Blind Squirrel's Monday Morning Notes, 15th July 2024.

In this (very early) Monday note, we are returning to (close to) our usual weekly format. After a 3-Part mid-year theme and portfolio review, we are going to bring together the 🐿️’s high level thoughts on asset markets as we enter what promises to be dynamic few months for markets.

In Part 1 of out ‘Stock Take’ series, we covered the ‘elephant in the room’ that is AI. We also updated our thoughts on agriculture, energy and uranium:

In Part 2 we tackled our consumer-related exposures:

In Part 3, a review of a selection of our international equity exposures:

Bringing it together

Economic forecasting is a tricky business at the moment, but this 🐿️ is definitely feeling some stagflationary vibes. Most of my current thinking on the topic was covered in ‘Stock Take: Part 2’ and in the previous 2 regular Monday notes:

On the ‘stag’ front, I have not been surprised by the coverage given to this week’s Delta and PepsiCo earnings calls. The consumer is being squeezed pretty hard unless he or she is a direct beneficiary of deficit spending. This is not a deep recession call from the 🐿️. If a bone-crushing recession was on the cards, surely commodity markets would have ‘got the memo’ and shown a bit more weakness by now?

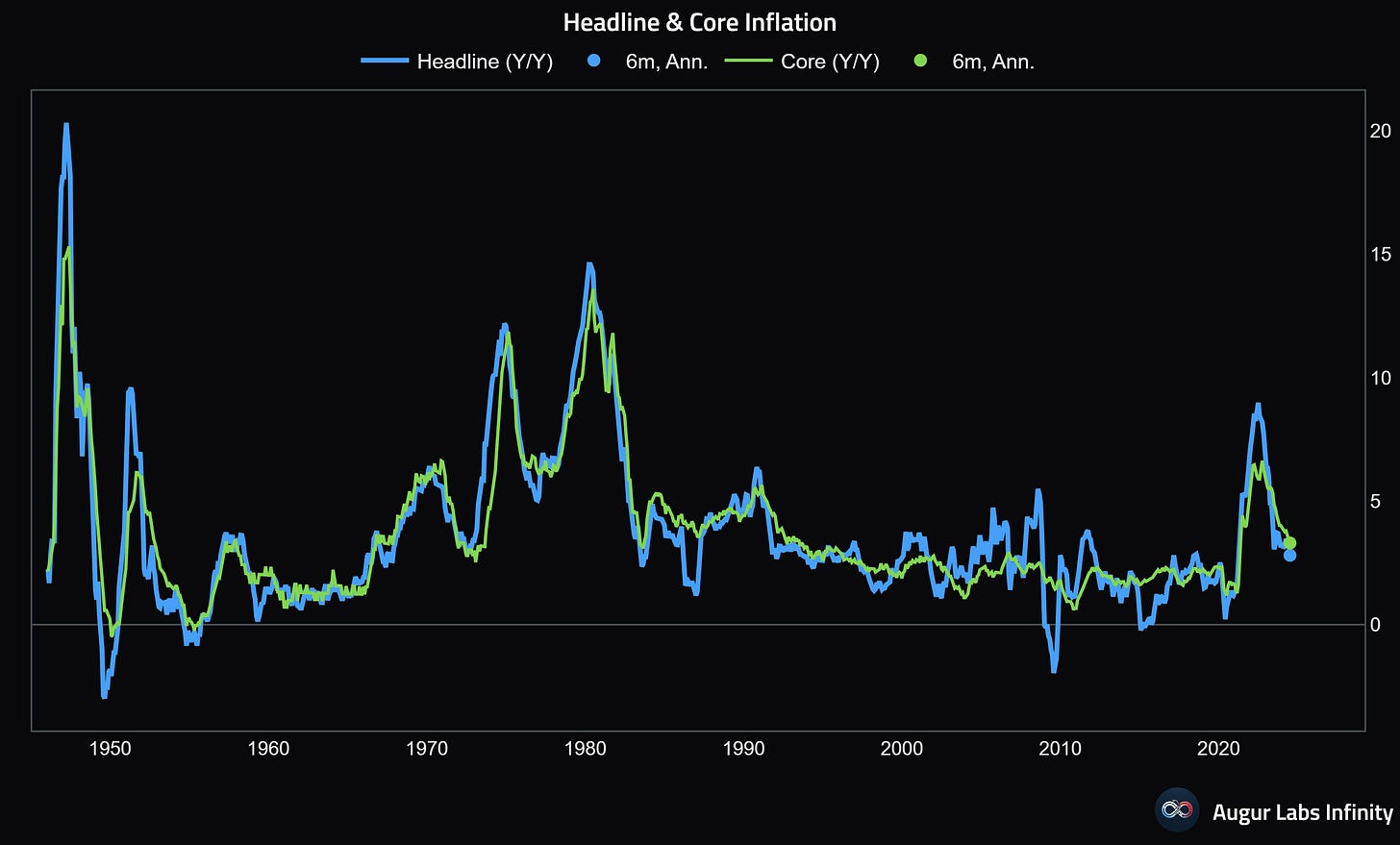

But, what about the ‘flation part? On Thursday, bond markets celebrated the cooler than expected CPI print. A September rate cut now seems baked in. Regular readers will know that this inflation print will not tempting the 🐿️ to reach for long duration fixed income.

I remain very much in ‘Inflation Guy’ Michael Ashton’s camp. In his excellent blog this week he highlighted the loose relationship between wages and prices. He sees median inflation ultimately settling in the “high 3s, low 4s”. This feels about right to me. US 30-Year yields are currently hovering at 4.43%. How much TLT 0.00%↑ upside do the ‘cult of St. Bart’s’ want to interpolate from that?

In post-war history, inflation has never materialized in ‘once and done’ spikes. The pandemic shock may have created a genuinely unique set of circumstances, but history does not support that view. In this rodent’s opinion, multiple waves should probably be your base case.

My pals PauloMacro and Le Shrub recorded another of their excellent chats on Thursday. Paulo was arguing that because a ‘bear steepener’ in bonds is the intellectually correct trade to put on at this time, it is probably crowded and probably requires a ‘positioning rinse’ before it can work properly.

This kind of ‘Summer of George’ (position for the opposite of what should happen) view certainly appeals to this rodent. For example, we are not really short bonds…yet! However, a quick eyeballing of US T-Bond futures positioning (admittedly not the full picture) does not suggest to me that there is an enormous short position to flush, at least when compared to this time last year.

Which brings us to equities. Equities may be another case where something that feels like it should happen but may not - i.e., a rotation away from the dominant growth and momentum factors that have dominated the past 18 months. Such a move would of course be helpful to many of the 🐿️’s positions.

I lifted this meme below from Kevin Muir’s terrific Substack chat. A perfect follow-up to (mutual reader) Bob Bedford’s priceless interjection on the same theme earlier in the day: “If you're having a good day today, then it means your entire year so far has sucked a**.”

It is hardly surprising that there was some fist pumping among the value investment community on Thursday. The unrelenting dominance of the Magnificent 7 over the year has been the torment of most active investors. Thursday’s reversal was indeed spectacular.

A return to the prevailing trend - or shall we call it ‘The Great Rotation Failure’? - would be heartbreaking for many. The past few years has taught us to prepare for a return to the prevailing trend of momentum dominance. However, if large cap tech weakness does indeed persist, I suspect that it (temporarily) takes the rest of the market with it before we can discover where the new leadership is going to come from.

For factor domination to ‘turn on a dime’ without some kind of choppy mess first is possibly too much to hope for. The 🐿️ is keeping his risk tight.

Section 2 wraps up our Stock Take series. We review our fixed income positioning; the new strategic role for trend-following in the portfolio; and the 🐿️’s approach to hedging the positioning ‘tinderbox’ in the equity volatility complex. Gold somehow manages to sneak in too - I must be getting old!

Don’t miss out! Please consider becoming a paid subscriber to receive the other 60% of the content we produce, Discord access and even merch!

Some feedback below from happy readers that have already taken the leap.