Stock Take: Part 2

The Blind Squirrel's Mid-Year Position Review, 9th July 2024.

Welcome to Part 2 of the 🐿️’s mid-year theme and portfolio review. I think it is important to return and give a status update (and postmortems where necessary!) on some of the key themes that we have been investing in and writing about in the past 18 months.

In Part 1 we covered the ‘elephant in the room’ that is AI. We also updated our thoughts on agriculture, energy and uranium:

Next up, our consumer-related exposures.

What shape is the global consumer in?

The distortions created by government spending around the world have made it very hard to have a confident view on where we are in the economic cycle. The 🐿️is fast coming to the conclusion that real world economic conditions are driven not by income or wealth strata but by where an individual or a corporation is positioned relative to that fiscal firehose.

If you are an engineer or construction worker that is going to be well employed for years on projects funded by the Inflation Reduction or CHIPs Acts, you are living your best life. If you are a commercial real estate executive or small business owner, higher interest rates are already biting hard.

In ‘Red Markets in Red Wine’, I observed that “Basically, it is now pretty much only those on the waiting list for a Birkin bag or a Ferrari electric supercar that are not feeling a roll over in the economy. The impact of fiscal spending over the past 4 years has created a mirage of economic prosperity in the official data. The reality is very different.”

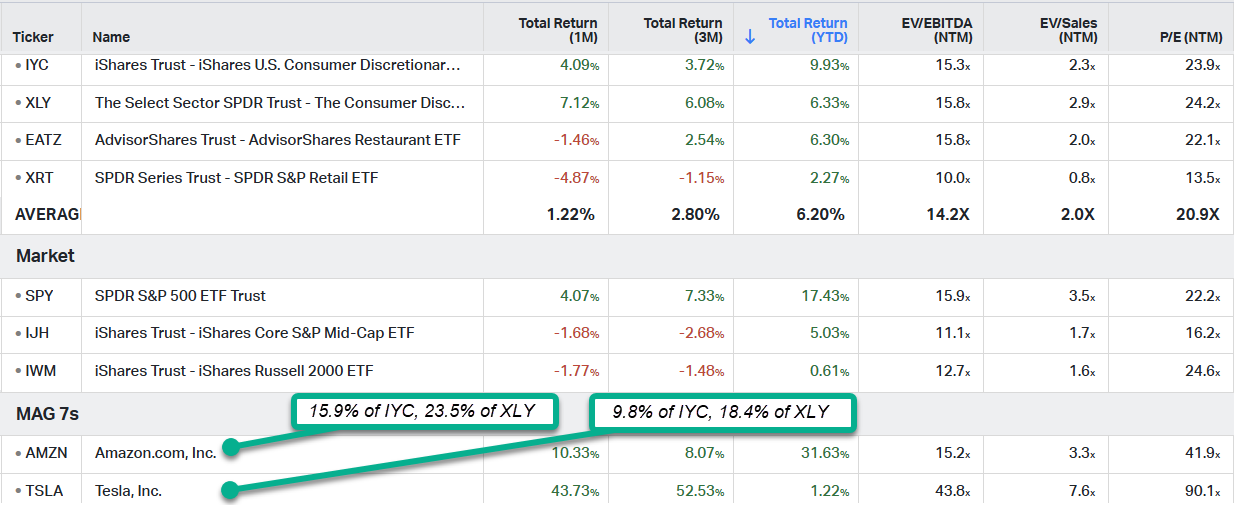

I do believe that there is sufficient evidence (largely from sentiment surveys) to suggest that the median consumer is starting to feel the pinch. Yet consumer discretionary stocks - even though left out of the AI party - have still put in creditable performances since the Fed’s pivot last October.

A crude ‘eyeball’ of trading multiples sees the consumer discretionary sector trade a surprisingly modest discount to S&P 500 (although it should be acknowledged that Amazon and Tesla both have chunky weightings in both IYC 0.00%↑ and XLY 0.00%↑- the multiples need to be diluted!).

Having said that, who would have thought that the restaurants and retailers would be holding up so well relative to the broad market?

In Part 2 we dig into our consumer-related acorn positions (from car tires and Formula One to Louis Vuitton handbags).

Don’t miss out! Please consider becoming a paid subscriber to receive these ‘Stock Take’ updates as well as other 60% of the content we produce, Discord access and even merch!

Some feedback below from happy readers that have already taken the leap.