You can't face it, but bonds are watching

The Blind Squirrel's Monday Morning Notes, 1st July 2024.

I do not think that the bond market liked the look of that Presidential debate.

Neither a red nor blue win offer the prospect of shrinking deficits. The economic and foreign policy implications of an increasingly likely second Trump term need to be considered.

The bond market does not seem to care about fiscal excess for now. Did it wake up on Friday?

Don’t miss out! Please consider becoming a paid subscriber to receive the other 60% of the content and plenty of other good stuff!

You can't face it, but bonds are watching

It was terrible, wasn’t it? Looking at two octogenarians squabble over golf handicaps while auditioning for a second term in the most important job on Planet Earth should have tested everyone’s patience.

It feels as though the bond market was pretty fed up with the spectacle too. Instead of cheering a Core PCE inflation release at the lowest level since March 2021, did we just witness the starting pistol for a ‘bear steepening’ in US interest rates?

This was the same bond market which completely shrugged off the Congressional Budget Office’s latest deficit forecasts only a week earlier. The forecast included an increase to the 2024 fiscal deficit of over $400bn. Let’s not forget that final size of 2009’s Troubled Asset Relief Program (TARP) to rescue Wall Street from the subprime meltdown was $426bn. The bond market does not seem to care about fiscal excess for now. Did it just wake up on Friday?

Political nerds like my pal Mat Casey of Pozières Consulting have a busy summer ahead of them analyzing the potential DNC responses to the collapse in Biden’s odds of winning in November. He was generous to share his excellent client note on the topic here.

I have no edge in predicting whether a last-minute candidate switch by the Democrats will improve their chances versus the DNC’s current El Cid strapped to his trusty war horse Babieca strategy.

Certainly, neither a red nor blue win offer the prospect of shrinking deficits. However, the economic and foreign policy implications of an increasingly likely second Trump term need to be considered.

The economic policy team of a second Trump administration is unlikely to be led this time by a posse of former Goldman Sachs partners. The name of Robert Lighthizer continues to be mentioned in the context of the Treasury Secretary seat. Whether or not he gets that specific job, his influence on economic policy is likely to be significant.

Mat has (re)read his book so that you don’t have to! Lighthizer believes that the reversal of trade deficits is the universal panacea for the curing of America’s economic woes. Seems a bit simplistic to this rodent.

Mat has also coined the term ‘Mar-a-Lago Accord’ to describe what he sees as a likely concerted effort by a future Trump administration to weaken the US dollar. That does not sound great for foreign owners of US Treasuries. Let’s remind ourselves who they are.

Let’s focus on the biggest single country holder, Japan. I really like this (slightly out of date) chart from Macrobond. Since the middle of 2022, FX hedged investments in US Treasuries have looked like an increasingly bad deal from the perspective of your typical Japanese saver!

Since the start of 2024, 30-Year yields on JGB’s have nudged up to almost 2.25%. That’s real money in Japanese fixed income! For the rare unhedged investor, why take the risk that the Yen might actually finally start to appreciate?

Reminder to regular readers that the 🐿️ is a (very offside) JPY bull. Do not miss the great Vincent Deluard on this topic on this weekend’s Market Huddle (was unable to disguise his excitement at having his biases tickled😉).

The great Russell Clark put this Japan dynamic more pithily this week when he wrote: “For me personally, if JGBs are in a bear market, then that’s all I need to know that sovereign bonds everywhere are in trouble. We have already had the BOJ sell reserves to try and strengthen the Yen and now the Norinchukin being forced to sell foreign bonds due to capital losses. Governments are running the biggest deficits outside of war ever, and the biggest buyer is being forced to sell - what else do you need to know?”

Now if the biggest overseas buyers of US Treasuries are in danger of going on strike, perhaps we need to think about domestic audiences. Here we have a bit of a problem. US banks are already sitting on over $500bn of unrealized losses on their fixed income holdings.

The only way that Mrs. Yellen or Mr. Lighthizer will be able to make them defy Paul “only losers average losers” Tudor Jones and support issuance will be via some kind of combination of accounting sleight of hand and a sweetener. Guess what. Sweeteners just equate to yet more bond supply!

Regular readers will know that the 🐿️ likes to keep a close eye on the robots. By that I mean the trend-following CTAs. In fact, in an act of betrayal to ‘merchants of narrative’ like this rodent, we recently made a strategic allocation to trend-following ETFs and mutual funds as a replacement of fixed income as a portfolio diversifier.

Importantly, trend-followers do not watch Presidential debates. However, CTAs have an uncanny habit of looking like geniuses in hindsight. Price has been telling the machines that the multi-decade bull market in fixed income has been over for quite some time. DBMF 0.00%↑, Andrew Beer’s trend-replicating ETF has been short all maturities of US Treasuries for most of the past year.

The quant miracles of Andrew’s replication engines are confirmed when you look at 10-Year futures positioning within the KMLM 0.00%↑ trend ETF. A consistent short position for over a year now. I think ‘the robots’ are sensing the same thing that causing this rodent’s whiskers to twitch.

Students of the work of Ben Hunt will inevitably shudder when they read headlines like this one:

It would be no surprise to anyone that treasury market liquidity has improved with the implied volatility crush that we have seen in the rates markets in the past 15 months. However, anyone that has ever traded knows that liquidity can be ephemeral and will disappear at the stroke of a risk manager’s pen. Did Jamie Dimon send out some cheerleaders for a reason?

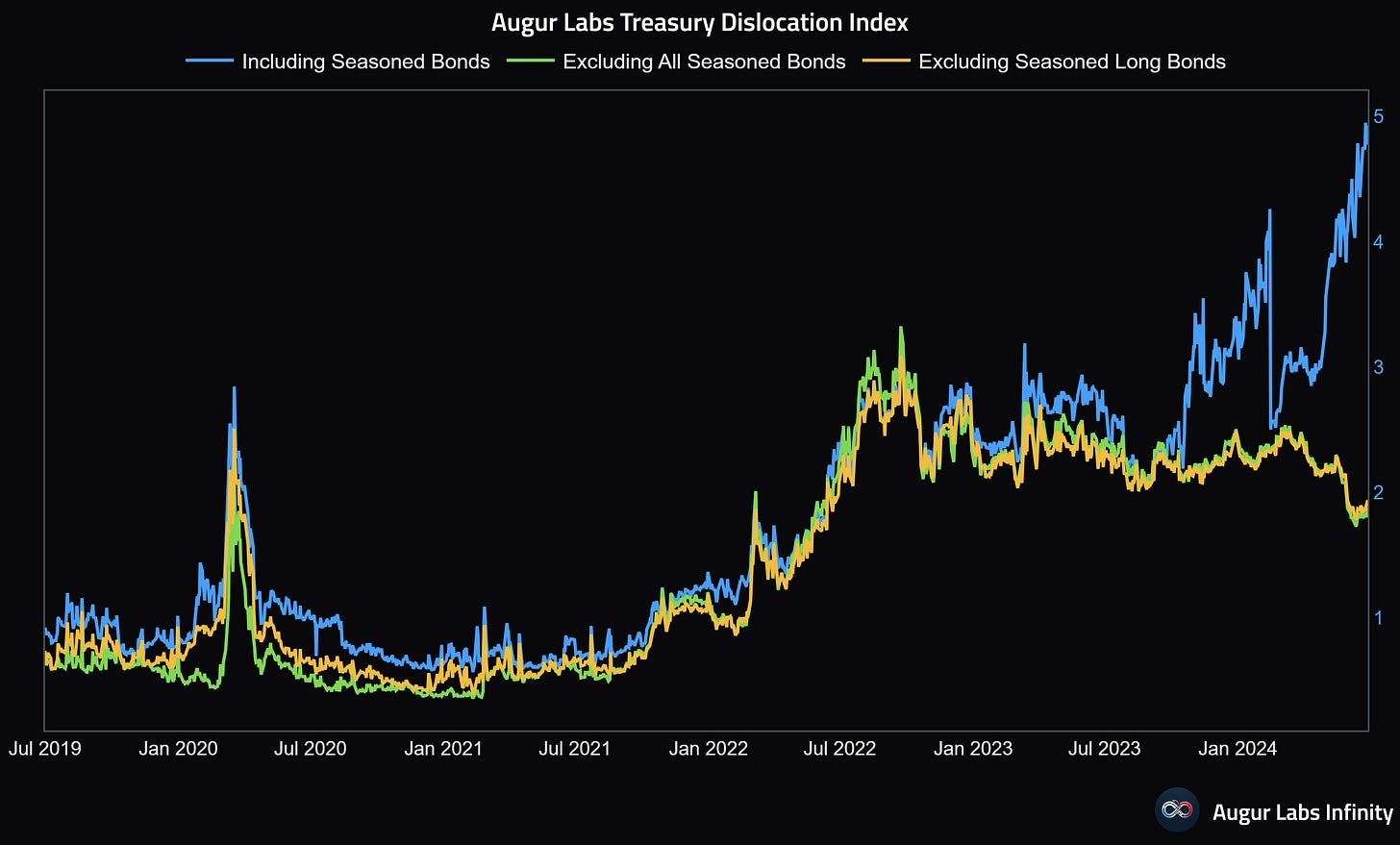

It’s now time to explain this week’s cover art. My friends at Augur Labs (whose powerful Infinity Platform produces many of the 🐿️’s coolest charts) were quoted in the Bloomberg / JP Morgan treasury market propaganda piece explainer:

“The broad market is functioning well,” said Helin Gai, president of Augur Labs. “The forest is fine” but for a few “rotten trees.”

I am going to put a full explanation of how Augur’s index is compiled in a footnote1 as it is possibly too ‘inside baseball’ for most readers. Note that the large "dislocation" apparent (blue line below) since mid 2023 is not because bonds are illiquid. Quite the opposite. These are the bonds that command a liquidity premium and/or financing advantage. To butcher George Orwell, all treasuries are equal, some are more equal than others.

This is all well and good, but in a world where the universe of bond buyers is shrinking, there have to be questions asked about where the market really is for issues that do not represent ‘best in class’, pristine collateral. Maturing ‘off the run’ inventories inevitably test ‘on the run’ demand (when refinanced). The 🐿️ is not convinced that this article calmed as many people as it intended. Those ‘few rotten trees’ may end up being a stored problem.

I believe that the long bond does not like the long-term picture for inflation under either El Cid, his potential replacement or that notable fiscal hawk Donald Trump. The buyer universe for treasuries is challenged (understatement) and the smooth functioning of the rates market would appear only to be a true reality at the surface of the market.

Anyone reading last week’s note (Red Markets in Red Wine) may have been left with the impression that I was giving over some strong recession vibes. The Pavlovian instinct that has been beaten into the average investor over the past 40 years would be to reach for the haven of fixed income until the economic storm has cleared.

Not so fast! Bonds (particularly long duration) feel like a very risky asset to this rodent. Unfortunately, our traditional low-cost fire insurance structure does not work at current levels in TLT 0.00%↑. Explainer here:

In ‘Section Two’ we will walk through how to implement a ‘Plan B’. If you have some spare time this weekend, please also check out my recent conversation with Nadine, Ben and Larry Episode 1 of the new Wall Street Beats show ‘Just Think About It’. Fun conversation - particularly if you want a break from the bond chat!