The SaaS Suck!

The 🐿️'s 'Start the Week' note. This week - software and 'Saddlebags' as well as regular review of the BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2026, Week 2.

The weekend note hit inboxes on Sunday morning and revisited the trade in Japanese Banks. Link below in case you missed it.

My pal Mateen Chaudhry’s brand new Japan-focused research service, Kabu Japan, published their debut weekly note overnight. For those looking for racier plays (i.e., smaller & cheaper regional banks) in Japanese financials, Mateen and his team have done the work. Strong recommend!

Due to the MLK holiday and Ben’s travel schedule, Benny & The Squirrel we will record our ‘Sunday show’ late on Monday night EST - you will have pre-open on Tuesday.

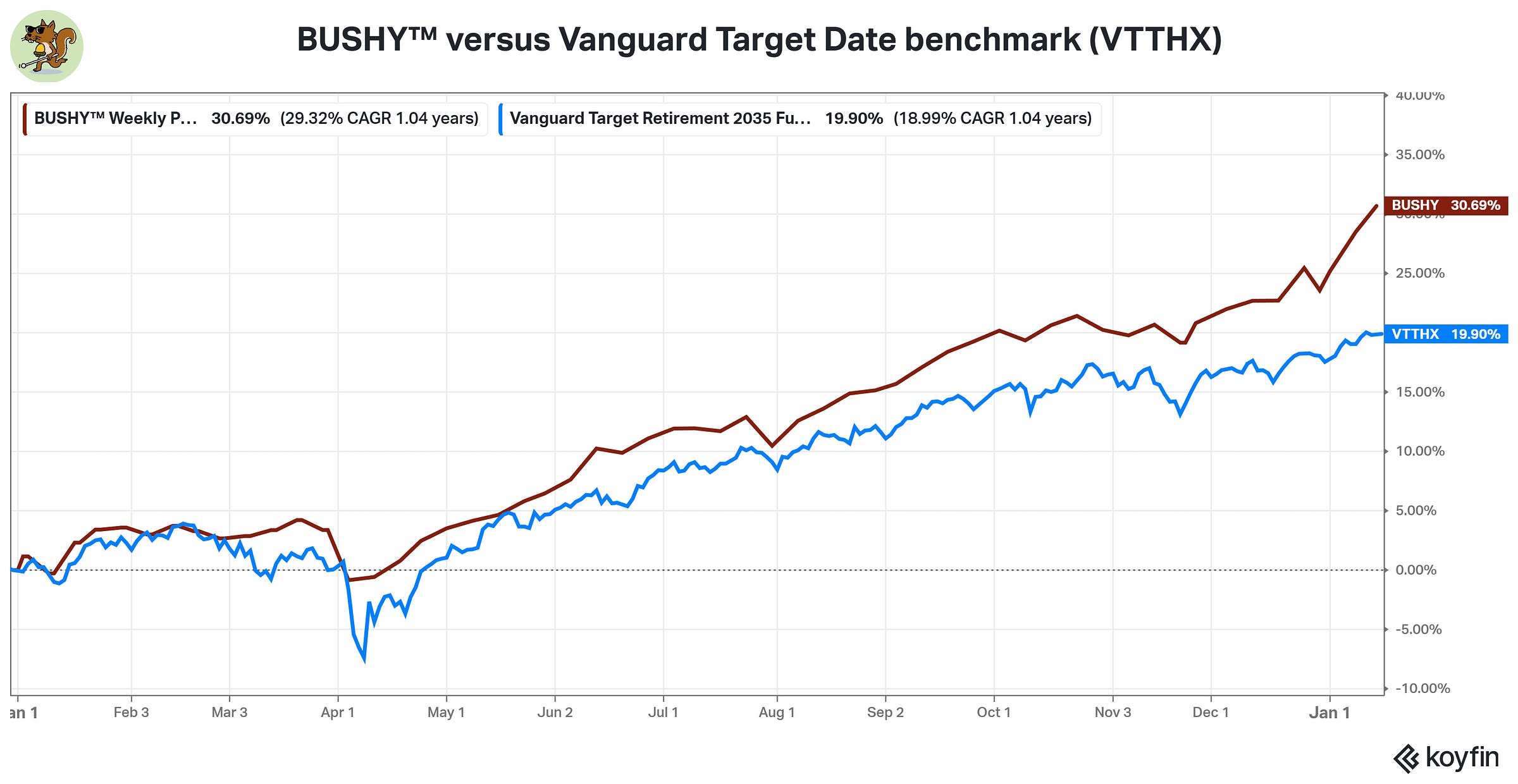

Yes, it is still too early in the year for portfolio return stats to be meaningful, but BUSHY™ benefited from a solid ‘Week 2’ of 2026.

BUSHY™ now has over 10.8% of outperformance versus its ‘classic Big Retirement’ benchmark since I started sharing BUSHY™ with subscribers at the beginning of 2025.

The normal BUSHY™ and Acorn portfolio review will follow below but I first wanted to spend a bit of time returning to a theme that the 🐿️ has been fixated on for quite some time.

We are returning to the topic of…

The SaaS Suck!

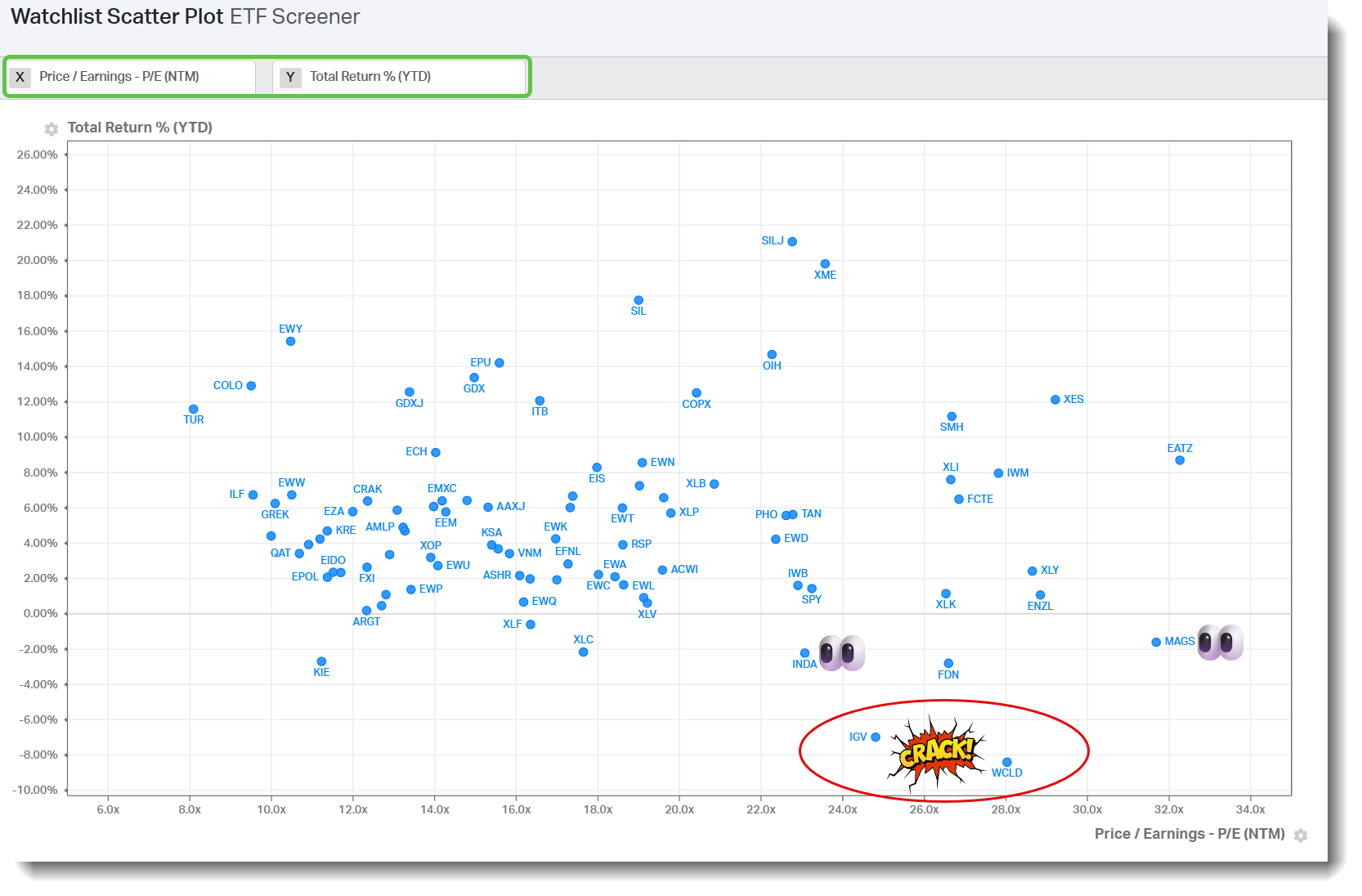

In the middle of last week, I shared this Koyfin screen in The Drey (members please DM me if you would like a link to shareable watchlist). This is a universe of just under 100 single country, regional and sector ETFs that I track every day.

The scatter plot illustrates YTD performance for the group versus a simple forward PE (NTM) metric.

My initial observation was that cheaper, short duration assets were faring much better than more expensive sectors and markets year to date (I cut off the PE multiple axis at 35x PE (NTM) for legibility - hence no biotech!). The next thing that jumped off the screen was the weakness in software stocks.

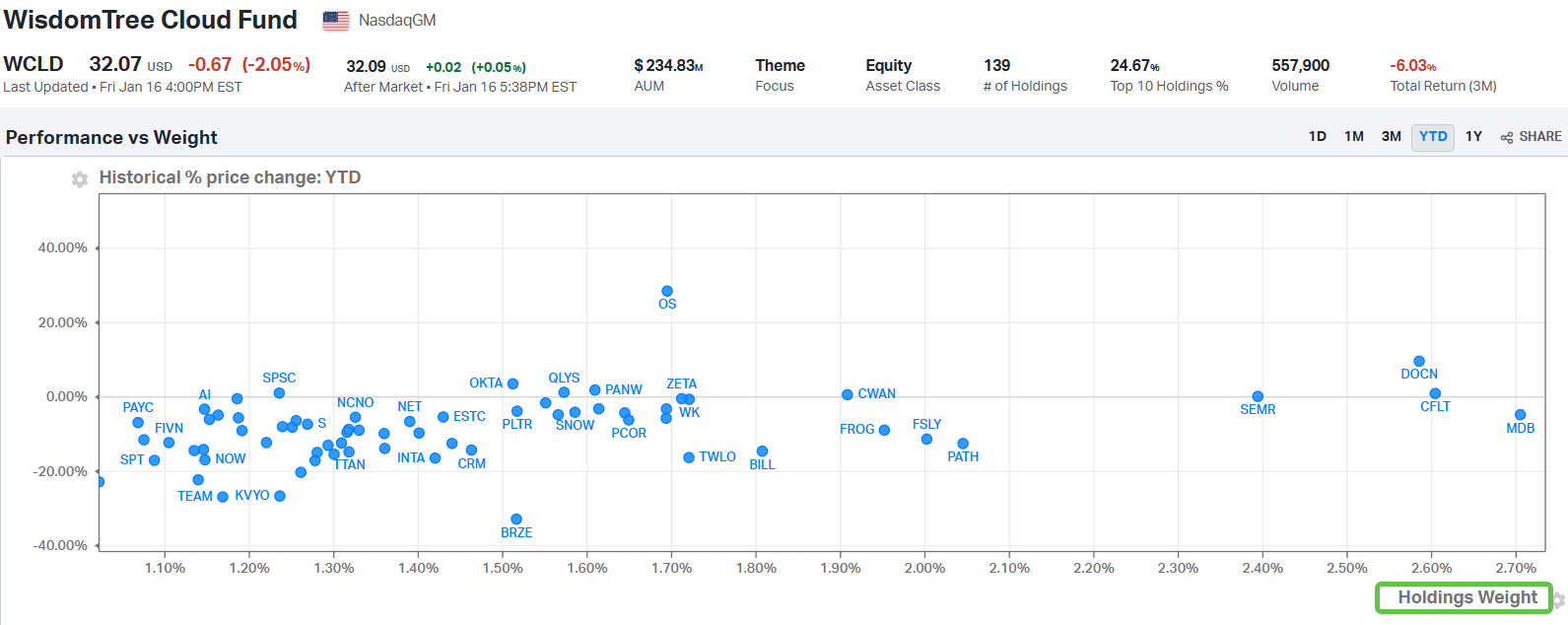

The WisdomTree Cloud ETF WCLD 0.00%↑ has been a regular feature of my short book for much of the past 18 months. It is a one-stop shop for excesses in voodoo accounting, high levels of stock-based compensation and idiotic valuations.

WCLD operates for me as a form of low volatility, equal-weight exposure to ‘SaaS beta’ - a sector that I see getting de-rated massively in the coming years. It has been a pretty decent ‘funding’ short but I now think the dam has finally broken. We have reached a ‘common knowledge’ moment with this sector. Let’s dig in.