Gaman (我慢) & The Art of Holding

The Blind Squirrel's 'Monday' Morning Notes. Year 4; Week 2 of 2026.

Quick scheduling update. This week’s Benny & The Squirrel ‘Sunday Show’ will air on Monday night at 7pm EST (MLK holiday and Benny is ‘on the road’ in the Middle East).

Gaman (我慢) & The Art of Endurance

It’s time to talk about Japanese banks again. This week’s note was already in the works before Benny & I sat down with Dave Dredge on Thursday evening (full show). Dave is a deeply experienced Japan watcher and you can see from the clip below that his discussion on the BoJ’s negative real rate problem was putting the 🐿️ in a pensive mode.

I had a chance to chat with him straight after recording about the implication of his prescribed macro medicine for Japan - to invert the JGB yield curve - on one of my favorite macro trades of the past 3 years.

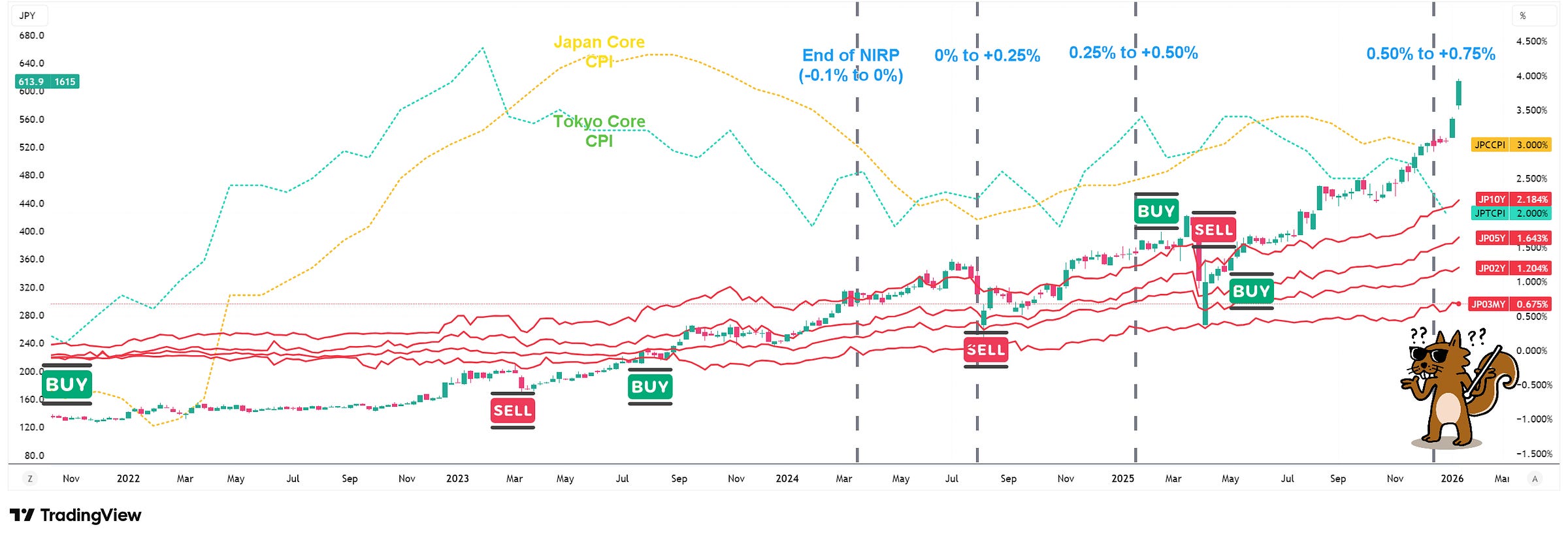

Japanese bank equities have been a staple in the 🐿️’s portfolio since late 2022 - via the Next Funds TOPIX Bank ETF (1615.JP). Early returns from November 2022 were unremarkable (but certainly better than my Yen trades!) and I was shaken out temporarily during the SVB crisis (March 2023). I got back in as the ‘End of NIRP’ came into view in mid 2023. That was a great run until the ‘Yen carry crash’ of August 2024 swept me out again.

By February of last year, I felt sufficiently emboldened to share my thoughts on the topic with you all. I added back a position which got immediately stopped out of by the ‘Liberation Day’ risk asset correction.

But the initial fundamental thesis remained intact and I was now used to observing the elastic recovery properties of this asset class. I was back in the trade by late April, and rewarded handsomely for the persistence. The +15% start to 2026 has been extraordinary. The question is what comes next?

Back to Dave’s medicine. An inverted yield curve is typically ‘no bueno’ for banks, right? We will come back to that in moment. Let’s start with how we got here.

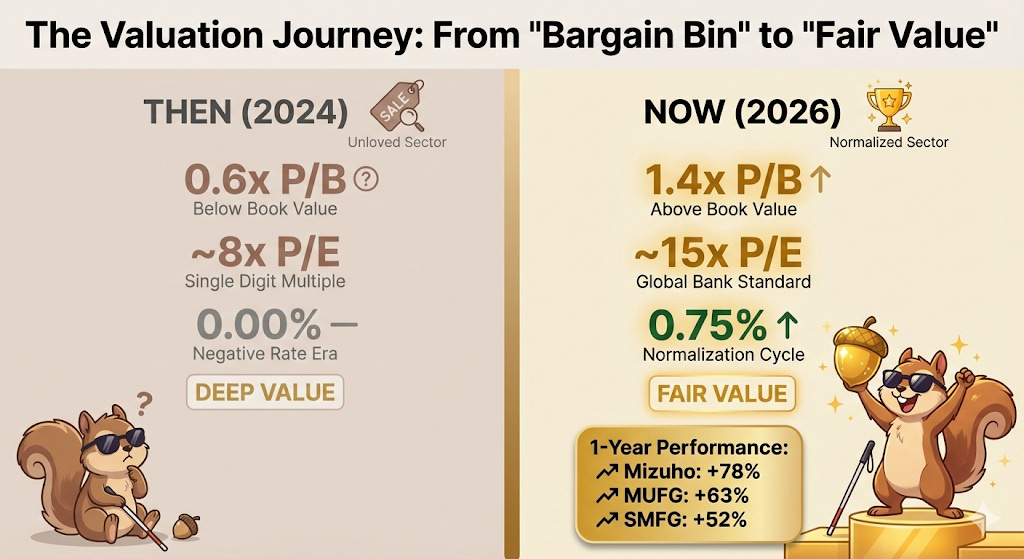

No surprise for this curmudgeonly rodent, my initial thesis was value-led (with an irresistible ‘long Yen’ kicker that of course ended up eroding my USD returns - once a Yen bull, always a Yen bull!).