Time to Bank on Japan!

The Blind Squirrel's Monday Morning Notes. Year 3; Edition 6.

With every passing day and data point, Japan is headed towards being a more ‘normal’ economy. If that view plays out, the banks will be in rude health.

Time to Bank on Japan!

City of London, sometime during the early summer of 1995. A very junior 🐿️ returns back to his desk with a fresh cup of coffee to find an orange telephone message slip sitting on the keyboard of his PC. It had been left there by one of the corporate finance team secretaries.

“URGENT: Rory needs you in his office by 10am. Sounds urgent - he said: “Tell him to drop everything!””

A nervous gulp from the 🐿️. Rory was Barings’ Head of Syndicate, a patrician (and occasionally scary) former Army officer. A veteran of the 1982 Falklands War and rumored to have once dated Diana Spencer (yes, that one!).

Up to that point, Rory and I had barely exchanged a word (analysts should be seen and not heard), and our team had only that morning sent him the (very rushed draft) of a pitchbook for review. Sounded like trouble. To make matters worse, it was 9.58am and his office was certainly more than 2 minutes away.

No time for the lift. I raced down several flights of stairs to the trading floor and sprinted across to his corner office.

“Just in time, Mitchell! You damn nearly missed out on an excellent lunch at The Dorchester and a brand-new Mont Blanc pen!” I was confused, but all soon became clear.

You see, Rory had not yet read that draft deck and had simply asked my boss that morning for ‘a body’ to go and represent the firm at a closing lunch and signing ceremony for a new capital markets transaction out of Japan.

It had been over 5 years since the Nikkei had peaked but insane volatility in Japanese equities as the market bumped around its multi-year lows ensured a steady trickle of convertible bond and ‘bond with warrant’ deals from Japanese issuers. This market was a ghost of its former self but still a nice fee annuity stream for London’s syndicate desks.

The Japanese equity-linked boom of the late 1980s, however, involved some very large numbers indeed. Former IFR Editor, Keith Mullins’ article on the topic is a fun read for market historians. The Japanese brokerage giants dominated the flows of a market in which both issuers and the buyer base of this market were pretty much an all-Japan affair.

The involvement of foreign brokers like Barings in these deals’ enormous syndicates was largely decorative and ceremonial. Rory had only become aware of the firm’s involvement in this deal (and the requirement to send a ‘body’ to the closing event) that morning via a fax from Tokyo. I doubt that the firm had even sold a single bond in the deal.

An hour later, armed with a power of attorney authorizing him to sign the underwriting agreement for Barings’ minuscule share of the syndication (bottom right-hand corner of the ‘Tombstone’), the🐿️ was in the back of black taxi en route for the West End.

By the time I had arrived, the ceremonial toasting was already in full swing. I chatted to other junior ‘bodies’ from the non-Japanese brokers in the syndicate as we ploughed through a 3-course lunch (against a backdrop of lengthy speeches and yet more toasts).

After lunch, we were ushered forward by a small army of corporate lawyers to sign 24 copies (yes, the syndicate was that large!) of the definitive agreements with our brand new Meisterstück pens. After a bit more bowing and nodding, I returned to office and settled in for a long night of fixing that (now heavily marked up by Rory) pitchbook.

The world of Japanese banks and brokers has always been an enigma even for those of my many non-Japanese friends that have spent time working at them during their careers. To be honest, even dealing with Tokyo arms of the US and European banks the 🐿️ worked at required getting used to a very different way of doing business. These challenges aside, now is the time to get back up to speed on Japanese banks.

Your rodent has been a fan of broader Japanese equities for at least the past couple of years. However, with the wild party raging over at the Nasdaq during the same period Tokyo stocks have struggled to garner the same investor attention enjoyed by the US Tech giants during the AI feeding frenzy.

Cheap stocks (in even cheaper currencies) can remain that way for a long time, but I have now seen enough evidence to convince me that Japan is finally managing to shrug off the deflationary albatross that has kept JGB yields at rock bottom levels for so long (and creating headwinds for yen appreciation).

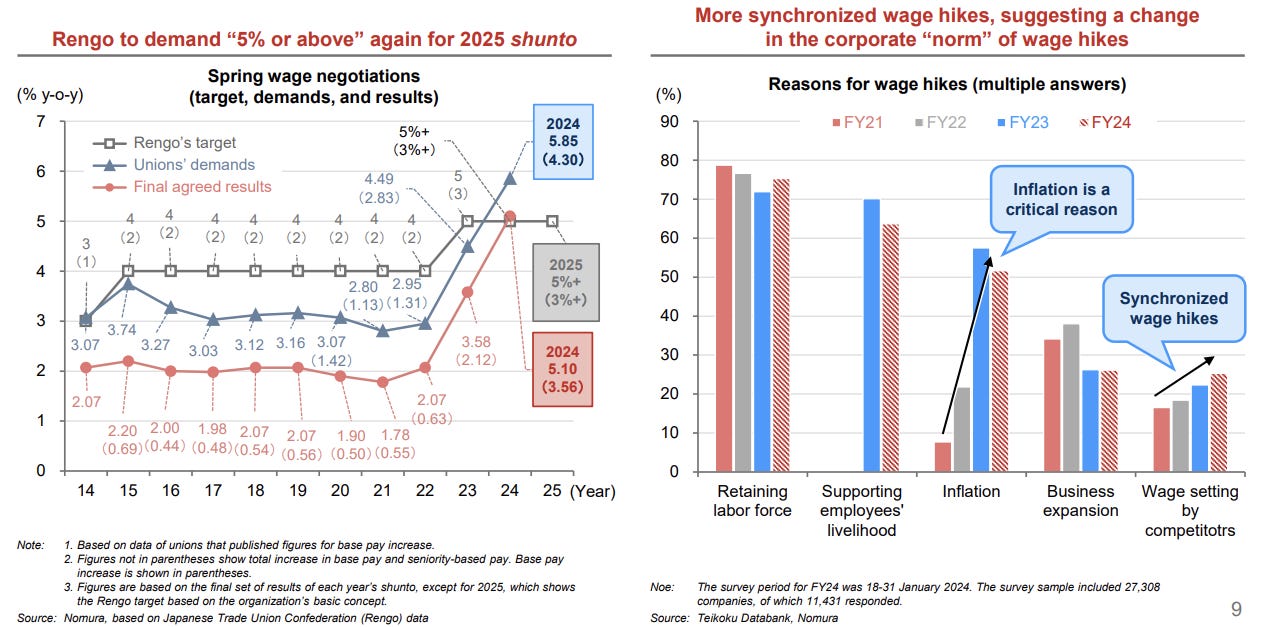

Rising food prices pretty soon need to have a knock-on impact on wages. Until this time last year, the word ‘Shunto’ 春闘 which roughly translates as ‘spring wage offensive’ was something that rarely captured an international newspaper headline. For 2 years in a row now, the labor union wage demands have been waived through with little resistance from major employers.

This inflation started to be reflected in the yields of longer dated Japanese government bonds a couple of years ago.

However, it was only recently that the BOJ has been prepared to concede that its multi decade battle with disinflationary forces might indeed be coming to an end. BOJ ‘outriders’ like Hideo Hayakawa are starting to ‘out hawk’ the sell side economists, calling for a terminal policy rate for this cycle of a consensus-busting 1.5%. So much for that 0.5% ‘ceiling’ on policy rates!

Hayakawa: “My base view is that there is a lot more coming…there is little logical reason to believe that rate hikes will stop early.” Not words that anyone in finance under the age of 55 is used to hearing from Japanese central bankers…

"There are four kinds of countries in the world: developed countries, underdeveloped countries, Japan, and Argentina" Simon Kuznets, Nobel Prize economist

Just as the chainsaw-wielding Javier Milei appears to be transforming Argentina’s economy, is Japan also about to ditch its macroeconomic ‘exception’ moniker and move towards having a more ‘normal’ economy?

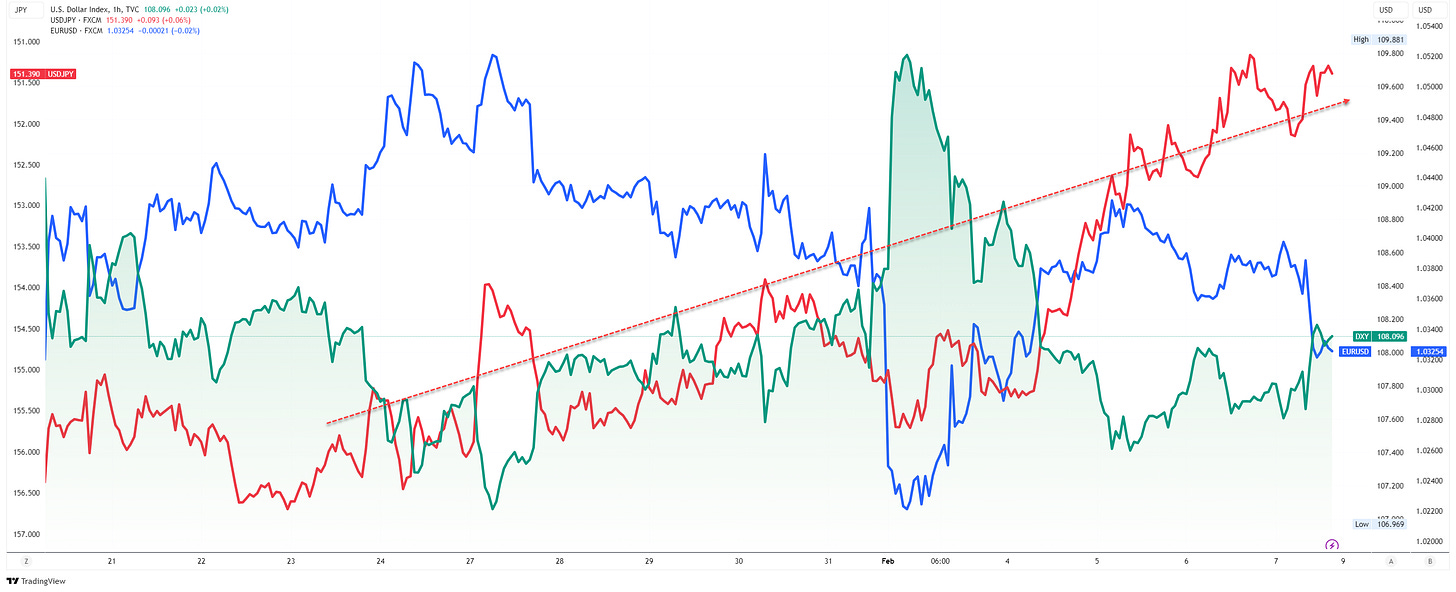

A normalized yield curve for Japan should stimulate an acceleration in capital repatriation by Japanese savers and trigger the Yen-funded carry traders to think twice about position sizing.

Japanese PM Ishiba’s fleeting visit to Washington DC last week cued up the predictable ‘who won the alpha male handshake?’ analysis. But what was interesting about the diplomatic read-outs was what was missing.

Much fanfare about “trillion-dollar investments” (including taking credit for Softbank’s role in the ‘Stargate AI’ financing); LNG purchases and increased defense spending. However, no mention of the weak Yen. Is this the deal that has already quietly been done?

Currency has certainly been the headwind for foreign investors in Japan in the past year.

The 🐿️ thinks that these headwinds may be about to become tailwinds in 2025. In combination with a normalizing yield curve, Japan’s banks look particularly attractive. In Section Two this week, we build out that argument and how to play it. Better than a free lunch and an over-priced ballpoint pen! Come and join us!

Join hundreds of smart investors, market watchers and upstanding citizens by becoming a paid subscriber to Blind Squirrel Macro and receiving the other 65% of 🐿️ content, members’ Discord access (The Drey) and even ‘limited edition’ merch!).