SaaS Unicorns 'X' Glue Factory?

The Blind Squirrel's Monday Morning Notes, 30th September 2024.

This week’s note is ‘China stimulus’ fireworks free. While the news has been terrific for many of the 🐿️’s favorite themes (and I am certainly not fading it), we did not want to add to the column inches already dedicated to the topic.

Instead, we contemplate the outlook for the Surry Hills Canvanauts (not a sports team) and whether some of the original SaaS unicorns might be destined for the glue factory.

Pod edition:

SaaS Unicorns ‘X’ Glue Factory?

Last Wednesday’s long form Bloomberg profile piece on Canva, the Sydney-born graphic design software unicorn, got this 🐿️’s whiskers twitching. There is a lot riding on this deal ‘down under’. Everyone from the largest superannuation (pension) funds to the constellation of family offices of Sydney and Melbourne own this one in size and a lot of performance track records are built around its (so far only on paper) valuation.

For the past 3 years, Canva has promised to be ‘the next Afterpay’ for Australia’s startup and capital markets community. Faint echoes of the chinking champagne glasses celebrating the A$39bn acquisition of the ‘Buy-Now-Pay-Later’ business by Jack Dorsey’s Square SQ 0.00%↑ in August 2021 can still be heard in Circular Quay.

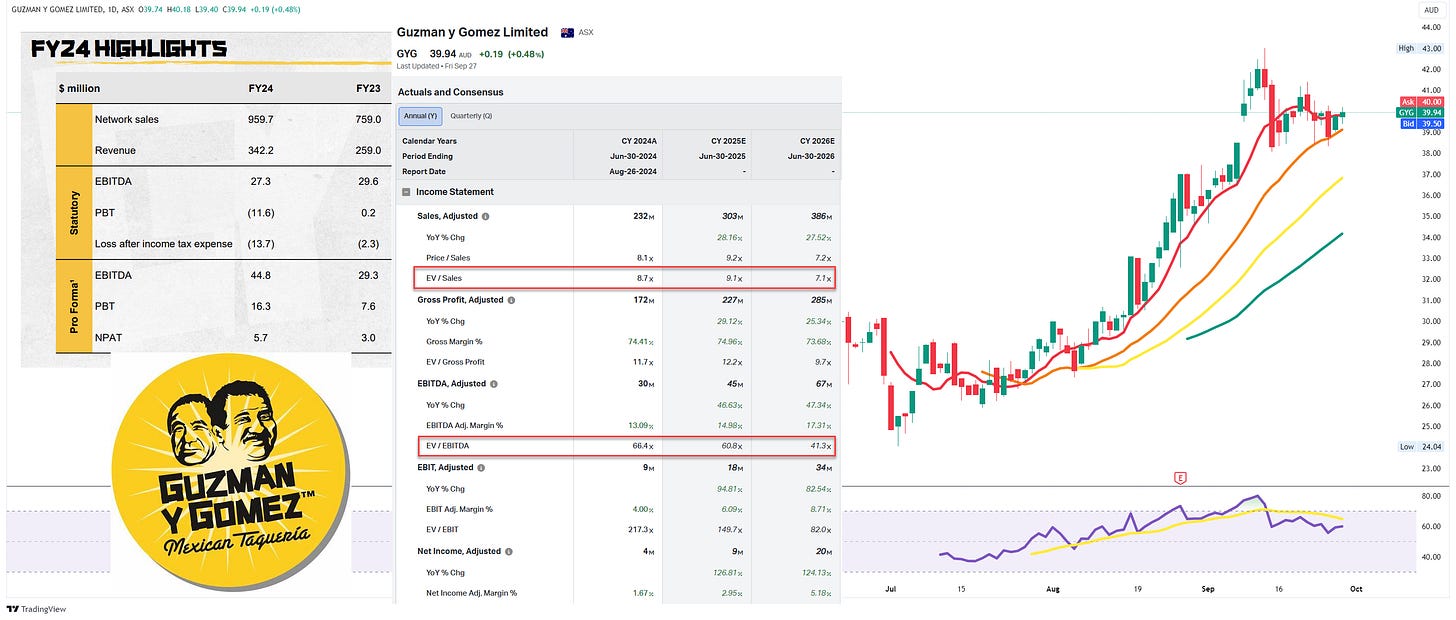

The world of Australian private market assets is on a bit of a roll at the moment. June saw the Australian IPO market re-opened in style by Guzman y Gomez (ASX:GYG). The successful debut of the local answer to the America’s Chipotle Mexican Grill CMG 0.00%↑ carries with it the hopes, dreams and prayers of all private equity and investment bankers down here after a multi-year deal drought.

They had better keep both their fingers and toes crossed, as this purveyor of finest breakfast burritos to the nation’s tradesmen community is currently trading at the kind of ‘spicy as a Jalapeño’ valuation (A$20 million per restaurant outlet (!); 9x forward sales; 61x forward EBITDA) that will be unlikely to survive any execution slip-ups by management!

Afterpay’s lofty A$39 billion price tag also happens to be the same number as the most recent (secondary) private funding round for Canva. However, the September 2021 print at US$40 billion is the one that really gives you an idea of the FOMO that was generated around Aussie startups by that Afterpay deal!

Regular readers will know that the 🐿️ tends to get pretty grumpy about Silicon Valley ‘Yogababble’ (™Prof Scott Galloway) but I will let readers draw their own conclusions about the fact that Canva (adorably) refers to their 4,500 (what?!) employees as ‘Canvanauts’ and also has a ‘Chief Evangelist’ and ‘Head of Vibes’ on the payroll. Am sure that there are Labradoodles and beanbags everywhere at their hip Surry Hills HQ!

What I am not, however, prepared to let slide for a company with aspirations to be a large US-listed public company soon is that it is currently missing a CFO! Public market investors are likely to require some first-class hand holding to get comfortable around the financials and the company’s heady valuation.

Whenever the new ‘Numbers Canvanaut’ eventually gets on board, he or she will at least have a great story to tell about top-line growth.

I have not been able to review a detailed financial model but there are few nuggets of selected unaudited financials that are available online.

Let’s do some (very basic)🐿️ valuation math.

Canva’s MAU growth is soon going to have to do battle with some addressable market physics (hence the deceleration in my forecast). We will come to my static ‘plug numbers’ for paying user penetration and for annual revenue per user (ARPU) in a minute. The valuation of May’s secondary share sale puts Canva at a EV/Sales multiple of 11.4x the rumored 2024 revenues of US$2.3bn (10.2x 2025).

Those ‘whisper’ revenue numbers also imply that Canva has an impressive 15% share of the $15.4bn global creative software market. That is not the market share number that Bloomberg has come up with! 🤷♂️

According to the Bessemer data, just the ‘Design and Collaboration’ cloud start-ups have a collective valuation of US$108bn - i.e., 7x the addressable market in creative software sales. That addressable market also happens to have an incumbent (and public) 800-pound gorilla in the form of Adobe ADBE 0.00%↑. Gulp!

When that particularly large primate is installed on pretty much every PC and MacBook on the planet, I am reminded of a certain ‘milkshake’ problem. A cursory review of Adobe’s recent conference call transcripts will not make great reading for the Canvanauts:

“So certainly, we look at some of the numbers that have been published [by Canva], and it just validates the opportunity at the low end of the market, right?” Ashley Still, SVP & GM of the Creative Product Group at Adobe.

And I am afraid that it is not just Adobe that is the potential problem for Canva here. See that Office logo in the upper left quadrant of that competition quadrant above? Surprised me too. In fact, I was ‘yesterday years old’ when I realized that something called Microsoft Designer was bundled (for free) with the 🐿️’s $99 per year ‘Office 365’ subscription. A live demo!

Then I read over the weekend that Microsoft may now be planning to drop these AI Copilot 365 bundles. I wonder why. Is it perhaps because they are too expensive to be ‘thrown in’ to this poor rodent ‘for free’?

Canva has been upping its game to compete with the AI-powered offerings from Adobe and the hyper-scalers, most recently with the acquisition of Leonardo.ai in July.

This feels to the 🐿️ like a defensive move as some kind of AI co-pilot feature appears to have become a minimum ‘cost of entry’ to the creative software game (even if the features are a bit gimmicky).

[Important🐿️ digression: I still find it incredible that there is not a consumer AI app that I have found that can convert HTML pages (like this letter!) into a usable (i.e. printable!) PDF document. So much for AI graphics technology! Perhaps Hewlett Packard has bought them all to close them to maximize printer ink usage! Note: This is missing in this rodent’s life, so please get in touch if you know of a product that works!]

Anyway, these expensive-to-run features surely cannot be added for users without a (possibly substantial) charge? ARPU up but also costs up by even more? The customer pushback is already showing up.

This also presents a challenge for a business that is trying to increase its percentage of paying subscribers from a current c.12% of monthly active users. A feat that looks even harder when you consider that a breakdown of Canva’s current users does not look great in terms of potential propensity to pay.

Historically, an exit from the unicorn stable was for founders and their VCs to either IPO or sell to one of the large cloud services providers that was seeking to bolt on ‘value added services’ as a customer retention strategy. Much to the frustration of the engineers at those hyper-scalers (as evidenced by the ‘feedback’ from this IBM Cloud employee last week - “Why build innovative cloud solutions when we can just acquire something decent and slap our logo on it?”).

This becomes problematic when you, like Canva, are ‘burdened’ with a US$26bn price tag and when the path to a profitable future is challenged by increasing customer acquisition costs and larger competitors offering ‘freemium’ / bundled alternatives.

However, the point of this week’s report is not to pick on the Canvanauts. Perhaps we are now in the kind of ‘risk on’ environment that will allow this ever so slightly long in the tooth unicorn to get to finally (after 12 years) ring the bell on the floor of NASDAQ. Time will tell. We wish them well (but please please no more rapping!).

What I think requires closer scrutiny is the path forward for the cohort of SaaS businesses that are already public. Ed Zitron recently published one of his (hugely entertaining) rants in which he describes the SaaS market as the tech industry’s “own growing commercial real estate bubble”.

“…the tech industry's desperate attachment to artificial intelligence is largely fueled by the SaaS industry, because AI is the first meaningful new "thing" they've had to flog to customers in quite some time, and because so many of these solutions are sold in bulk on annual contracts signed by people who aren't the end user, artificial intelligence feels like something that they can put on top of another solution and claim it's new.”…Ed speculates that this could result in a “race to the bottom, where growth-hungry SaaS companies either deeply discount or don't charge for AI, pushing their competitors to lower the price on their already-unprofitable products.” The Other Bubble (wheresyoured.at)

Now this is a trend that your rodent thinks is most definitely actionable. In Section Two (for paid subscribers) this week, the 🐿️ lays out a (sensibly risk managed) plan. You are not going to want to miss it.

Section Two

Let’s start S2 with my favorite AI-related comedy tweet of the week:

The SaaS businesses are not a new topic for the 🐿️. They are among the worst offenders in the ‘SBC Recycling’ game and their ‘modus operandi’ in public markets is to ‘wow’ investors with top line revenue growth and elevated gross margins, while remaining very quiet indeed about longer-term profitability.

Arguably, gross margins can be whatever a CFO wants them to be in the software business. Growth (especially when you are less concerned with cost) can also be toggled with inorganic growth (by acquisition). Sell side analysts on Wall Street are happy to play along and model that consistent double-digit compound revenue growth rate.

The big beasts of the SaaS jungle are Salesforce.com CRM 0.00%↑ (60 acquisitions in the past decade explains so much growth at a company where it is rumored that sales teams prefer to use Excel to log client calling activity!) and Adobe, the ‘Goliath’ to Canva’s ‘David’.

My suspicion is that these giants will continue to roll-up the sector via acquisition (and by outspending their smaller competitors on AI) while their equities benefit from the ‘size effect’ of passive / index fund flows.

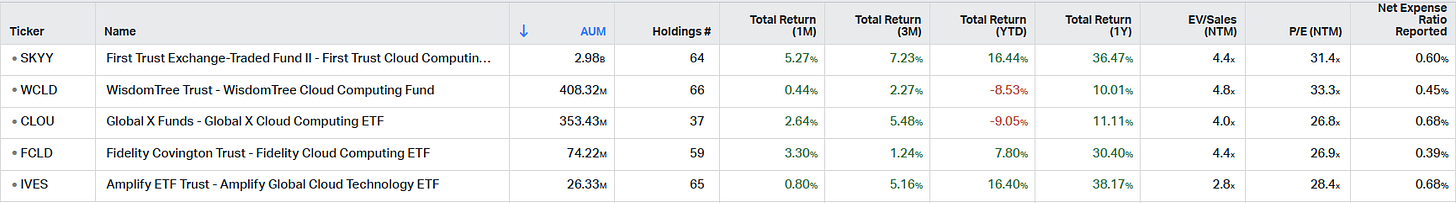

The part of the SaaS market which I consider to be very vulnerable is the long tail of software unicorns that escaped the VC stable while capital was still plentiful, and while discount rates were zero. The acquisitive nature of the large players makes me nervous of taking too much idiosyncratic single stock risk, so I went on the hunt for a ‘one stop shop’ ETF.

There is a problem in that thematic fund ‘manufacturers’ can often be found guilty of ‘style drift’.

ETF providers are no different. Cloud computing has been a hot theme for the asset gathering complex, but it is vital to ‘lift the hood’ to ensure that you are not buying (or in this case selling) a high-cost version of the Nasdaq 100 index (with perhaps a cheeky overweight in the stock that happens to have been doing well lately).

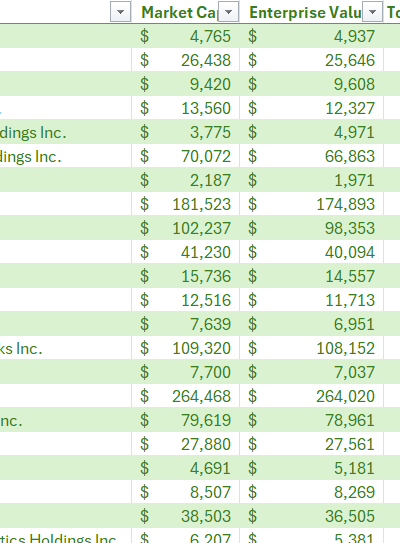

The 🐿️ did a deep dive on 5 of the larger ETFs focused on the ‘cloud’/SaaS theme. A holdings summary can be found in the PDF linked below:

I was looking for a broad-based exposure to the smaller SaaS players that I feel will struggle in this next phase of the cycle, without too much exposure to the SaaS giants (CRM, ADBE, ORCL, IBM) or the hyper-scalers (AMZN, GOOG, MSFT). I took a fairly dim view of Fidelity sneaking MicroStrategy MSTR 0.00%↑into their cloud software basket…

WisdomTree’s WCLD 0.00%↑ jumped out of the pack as the most appropriate for our purposes. Let’s take a closer look.

Effectively it is overweight the ‘belly’ of the SaaS space with a median market cap of $8.24bn and where the valuations would appear - in the view of this rodent - to be most vulnerable.

Any outperformance by the majors will be diluted by their relatively small weighting in WCLD and the fact that the ETF rebalances every 6 months. Link to full comps sheet in Excel below:

Time to break out the crayons.

WCLD 0.00%↑ is our weapon of choice for seeing if these SaaS unicorns are due for a ‘collab’ / X with the glue factory!

Don’t miss out! Please consider becoming a paid subscriber to receive the other 60% of 🐿️ content (including this latest acorn idea), member Discord access (The Drey) and even ‘limited edition’ merch!