The Layaway Fallacy

The Blind Squirrel's 'Monday' Morning Notes. Year 3; Week 42.

The Layaway Fallacy

A handful of my readers may recognize the happy couple in the cover image. They are Pauline and Arthur Fowler from the long running BBC soap opera, Eastenders. The late 1986 plotline centered around a financially desperate Arthur robbing the ‘Christmas Club’ savings scheme for the residents of Albert Square, the fictional East London neighborhood where the drama is set1.

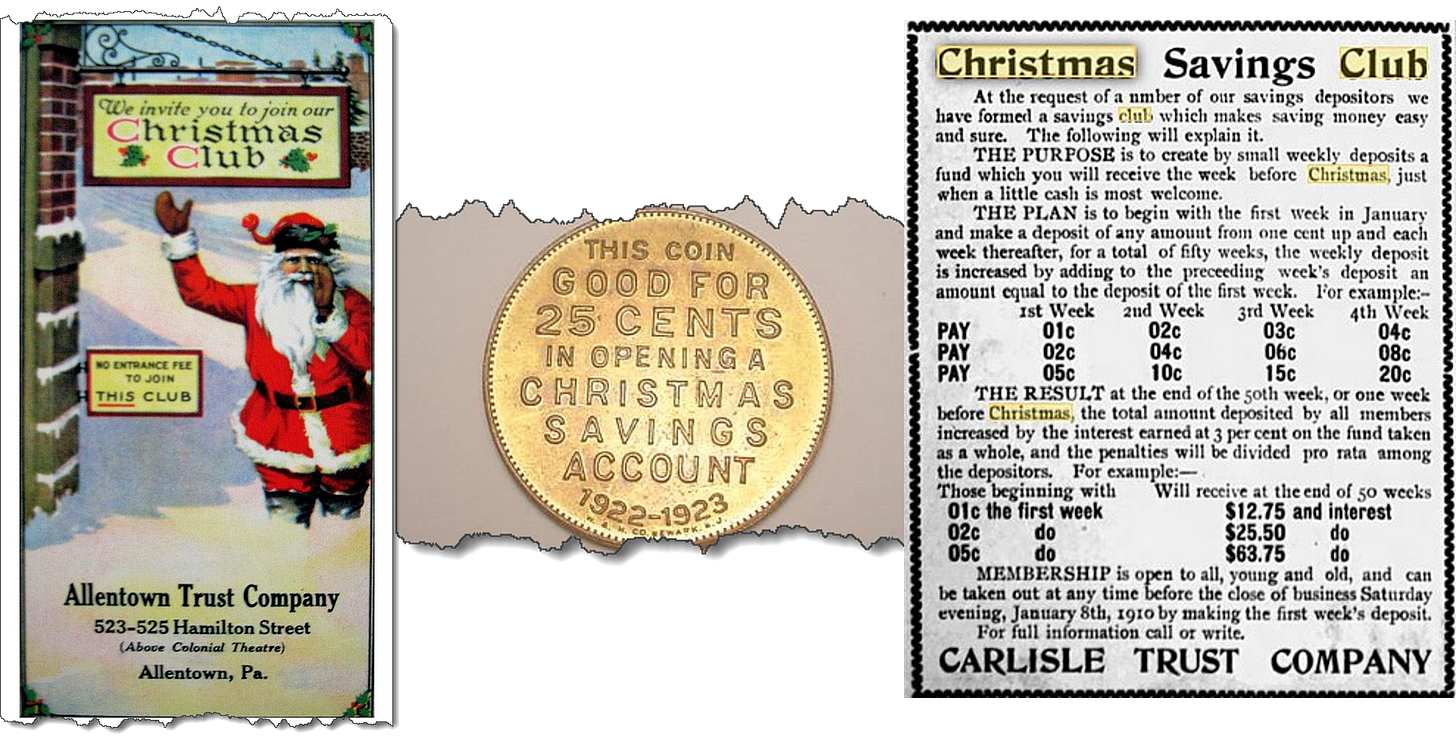

Christmas Clubs had deep historical roots in the UK, dating back to the ‘Goose Clubs’ of the 19th Century, a scheme whereby working-class families would pay small weekly amounts to butchers, pubs or farmers in order to save up for their traditional Christmas goose. Turkeys came way later. By the 1980s, these had evolved into comprehensive savings schemes covering Christmas expenses (from turkeys to toys).

This type of layaway scheme became popular in the US following the Great Depression. Retailers would offer customers ‘down payment plus regular cash instalments’ schemes to cover the purchase of household budget busting seasonal merchandise (from winter coats to Christmas hampers).

Layaway schemes allowed retailers to manage cash flow, control inventory and increase customer retention (all those weekly payments of cash instalments drove repeat foot fall). The programs enabled families to purchase non-essential items despite the severe economic constraints of the economy without having to resort to credit. However, it was very much SNRL, or Save Now, Receive Later concept - regular readers can probably tell where the 🐿️ is going with this theme!

Over time, the financial services sector - on both sides of the Atlantic - elbowed its way onto the scene. Those cunning bankers spotted that merchants were receiving interest free credit from their shoppers and naturally fancied a piece of that action! Banks and credit unions popularized Christmas Savings Clubs which offered de minimis or zero interest to their hapless (and mainly unbanked) savers.

From SNRL to BNPL - The inverse layaway program

I promise that the 🐿️ is not about to launch a tirade or moralizing lecture about the instant gratification needs of modern society.

I have, however, been grumbling account the world of ‘BNPL’ or ‘Buy Now Pay Later’ for a while. At the beginning of the summer I wrote that it was “one subsector of the fintech world that I was definitely keen to avoid”.

“BNPL is a classic example of one of the classic truisms in corporate finance - namely, that one should always be wary of a high growth financial. Fueled by tie-ups in hyper-discretionary spending segments - from ‘DoorDash-ed’ burritos to Botox jabs and Coachella tickets - the BNPL originators have generated some wild top line growth.”