The full Monday note can be found at www.blindsquirrelmacro.com

The Monday Note:

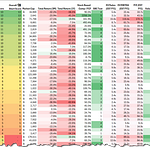

Show Note Visuals:

SpotGamma note the vanna and charm effects of the index options market.

Dispersion explainer: These days everyone is a seller of volatility and the dispersion trade (long single stock volatility, short index volatility - explainer here) continues to be crowded.

David Dredge’s excellent April Risk Update - “Wittgenstein’s Ruler” elegantly points out some long-term patterns from the past, highlighting how extreme compression in FX vols often acts as a harbinger for major (unforeseen) risk events. With hindsight it all looks so obvious!

es.

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.