Blind Squirrel Macro: The Pod (Episode 87) - Recorded May 15th, 2025. Audio-only edition embedded below and also available in the usual ‘Blind Squirrel Macro: The Pod’ feeds on the podcast apps.

“Amazon.com is the leading online retailer of books. Since opening for business as "Earth's Biggest Bookstore" in July 1995, the Amazon.com bookstore has quickly become one of the most widely known, used and cited commerce sites on the World Wide Web.”

Introducing Jim Miller

Jim enjoyed an illustrious multi decade investment banking career starting in the mid 1980s at Merrill Lynch, cycling through Deutsche Morgan Grenfell, and Lehman Brothers before establishing an equities business for Dresdner after Bruce Wasserstein’s eponymous boutique had been ‘acqui-hired’ by the German bank to create Dresdner Kleinwort Wasserstein.

Like the 🐿️, Jim spent much of his banking career as an equity capital markets specialist. He has some extraordinary stories to share but I wanted to dig into one particular tale. The Amazon IPO.

Podcast summary below the charts. 👇

Podcast Summary:

00:01:10 – Deutsche Bank’s US Expansion and Recruitment Drive

Discussion of Deutsche Bank’s strategic push into US capital markets in the mid-1990s, led by Edson Mitchell and Carter McClelland.

Jim describes joining Deutsche to build its US ECM business and meeting Frank Quattrone, a star tech banker newly recruited from Morgan Stanley.

00:03:20 – The Amazon IPO: Background and Context

The conversation shifts to Amazon’s 1997 IPO, led by Deutsche Bank-a surprising choice at the time.

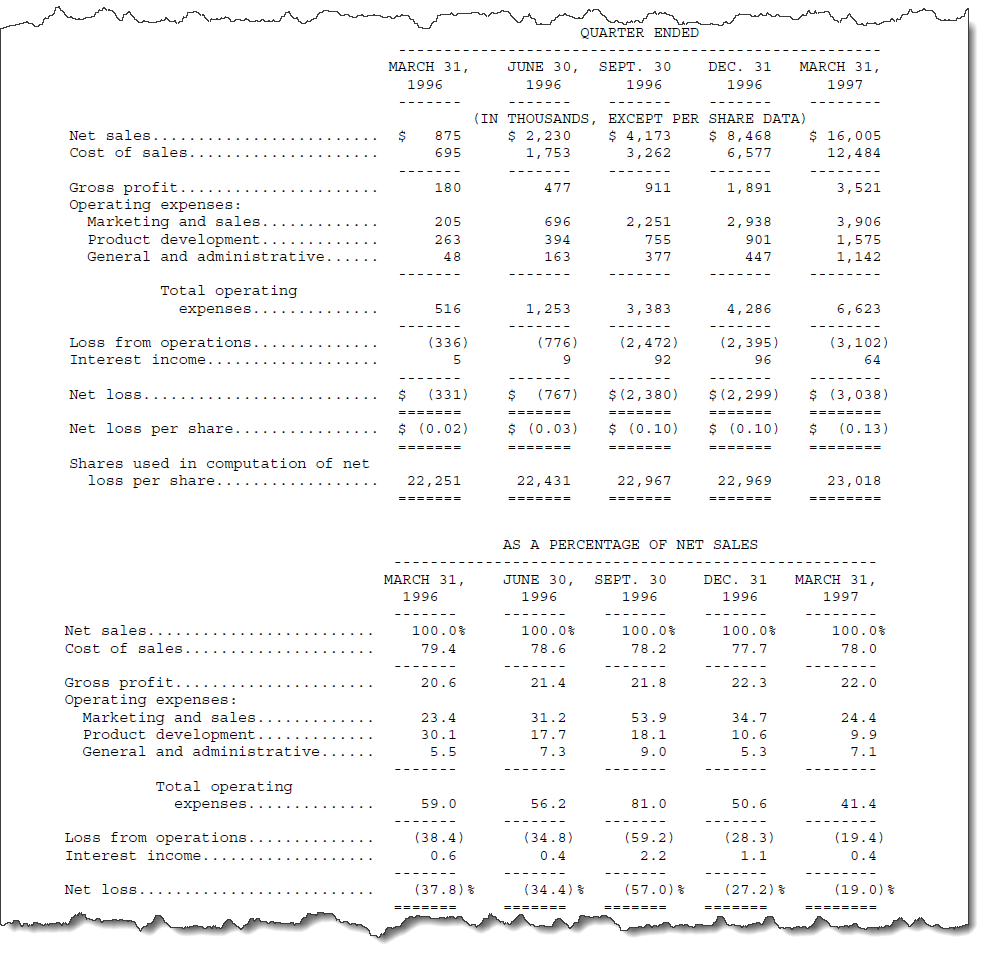

Jim provides context on the tech IPO boom of 1996, with 244 deals raising $13 billion, and Alan Greenspan’s “irrational exuberance” speech marking a turning point in market sentiment.

Why Amazon chose Deutsche Bank (Frank Quattrone’s charisma and hardcover pitch books).

00:07:58 – Valuing Amazon: Challenges and Approach

The challenges of valuing Amazon, a small but high-profile business.

The DCF-based research valuation came from a young analyst called Bill Gurley - yes that one!

00:11:02 – The IPO, Aftermarket Trading and Stabilization

Detailed account of the 3-hour pricing meeting, where the price was set at $18 per share after much debate.

The trading debut was attended by Jeff Bezos’ mum!

The retail ambush that stripped the register of all the institutional names.

The stock quickly declined post-IPO, underperforming the NASDAQ. Deutsche Bank intervened, buying a third of the float to stabilize the price and protect their new franchise.

00:24:14 – Frank Quattrone and the “Friends of Frank” Scandal

Discussion of Frank Quattrone’s subsequent move to Credit Suisse and the controversial “friends of Frank” IPO allocation practices.

Jim explains how these practices differed from stricter protocols at other banks and the eventual legal scrutiny faced by Quattrone and his team.

00:29:39 – Reflections on the Modern IPO Market

The conversation shifts to the current state of the US IPO market, characterized by limited deal activity despite buoyant equity markets.

Jim attributes this to excess liquidity in private markets, distorted valuations, and a lack of pricing discipline among venture and private equity firms1.

00:36:23 – Closing Thoughts and Future Topics

Final reflections on the challenges facing dealmakers in 2025 and the persistent issues in the IPO and private equity markets.

Please do sign up for Jim’s excellent occasional blog on Substack, Comments from Connecticut, here and active users of The Drey will know him as one of our regulars, Jim.

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.