They think it's all over!

The Blind Squirrel's Monday Morning Notes, 27th May 2024.

Readers will have to forgive my second soccer commentary reference in two weeks. For some reason, the 🐿️ could not get the line out of his head last week.

We make a rapid assessment of which trends, cycles and politicians might be close to ‘all over’.

In Section 2 this week (for paid subs), we focus on the UK. Beyond the irony of the timing of a UK general election being set for US Independence Day, an early ballot may provide an additional tailwind to a trade that is already working well for us.

Welcome! I'm Rupert Mitchell and this is my weekly newsletter on markets and investment ideas. While much of this letter is free (and I will never cut off any punchlines), please consider becoming a paid subscriber to receive the other 60% of my content and plenty of other good stuff!

They think it's all over!

Readers will have to forgive the second soccer commentary reference in 2 weeks, but we are only a few weeks away from the start of EURO 2024. The BBC’s Kenneth Wolstenholme’s iconic line as Geoff Hurst scores the final goal of the 1966 World Cup at Wembley has been seared into the collective British memory. For some reason, the 🐿️ could not get that line out of his head last week.

Wolstenholme completes the phrase with “It is now!” as Hurst’s strike smashes into the top left corner of the West German goal. Traders and investors went into the Memorial Day long weekend feeling better than they might have felt at market close on Thursday but still wondering whether or not ‘it’s all over’ for a number of major market and economic trends.

It’s all over…for the bull market in equities

The prevailing narrative going into Wednesday evening was that the hopes and dreams of all risk assets hung on the ability of a single semiconductor company to exceed already lofty expectations. The company delivered (even playing the inevitable stock split trump card). The rest of the market (bar that one stock) slumped in response in what looked like a classic ‘news failure’ event.

The tone to Friday’s market was clearly more positive.

Next up, we are entering a period of structurally bullish flows for US equities (via the vanna and charm effects of the index options market). Based on the large current open interest in June SPX put options, dealers have plenty of delta hedge positions to cover (in light volume markets and over public holiday shortened trading weeks) as we approach the quarterly options expiry.

Finally (not that we could forget), we are in a presidential election year. Excellent seasonality charts from Nautilus going back over 100 years point to strong summer moves in an election year. These are even more pronounced when an incumbent is running for office. They are tracking pretty well so far!

🐿️ ‘it’s all over’ conclusion: Expect some chop in the coming weeks, but positive structural flows and election year seasonality suggests that we are not yet done with the current bull market in equities.

It’s all over…for volatility

At the beginning of April in The Squirrel and the Leprechaun, the 🐿️ speculated that we might finally be seeing a pickup in implied correlation and equity volatility. This looked like a great call…for all of 2 weeks! These measures have subsequently continued on with their multi-year grind lower.

These days everyone is a seller of volatility and the dispersion trade (long single stock volatility, short index volatility - explainer here) continues to be crowded. Even retail is getting in on the act, with a flurry of new ‘yield enhancing’ covered-call ETFs getting launched and receiving inflows.

🐿️ ‘it’s all over’ conclusion: Cries for a single digit VIX by the summer are becoming deafening. Continued crowding will only make the inevitable mean reversion that much more explosive. It feels like it is ‘all over’ for volatility but it we all know it never is!

It’s all over…for FX traders

Same story in FX markets. Brent Donnelly has been musing that it is only a matter of time before the lack of volatility in foreign exchange markets leads to widespread FX trader headcount reductions (probably just before the market gets interesting again).

David Dredge’s excellent April Risk Update - “Wittgenstein’s Ruler” elegantly points out some long-term patterns from the past, highlighting how extreme compression in FX vols often acts as a harbinger for major (unforeseen) risk events. With hindsight it all looks so obvious!

🐿️ ‘it’s all over’ conclusion: Similar to my view on implied equity volatility and correlation. The tinderbox gets bigger and drier. Insurance policies with highly convex payoffs are especially cheap in FX volatility markets.

It’s all over…for the credit cycle

Pundits have been calling for the demise of the commercial real estate market since interest rates started rising in 2022. Last week saw the first loss absorption by the AAA tranche of a CMBS since the GFC. We also saw Starwood’s SREIT follow Blackrock’s BREIT into ‘survival mode’.

I still find it staggering how the regulators are yet to take a close interest in these illiquid private REIT vehicles and how they have been stuffed into retail hands on a dubious prospectus and with questionable mark to market valuation practices.

Instead, government agencies look like they are trying to lend a hand to the property boys. We are beginning to see the signs of some earnest intervention to assist with office occupancy levels via (direct and indirect) restrictions on remote working practices. It feels like ‘they’ feel that this situation is getting more urgent.

No signs yet of any contagion into broader markets. Spreads continue to tighten in corporate credit markets as public debt investors, crowded out by all the new competition from (you guessed it!) private credit funds, reach for yield.

🐿️ ‘it’s all over’ conclusion: It is not too hard to believe that we are only seeing a fraction of the pain that exists beneath the surfaces in credit markets as lenders frantically ‘extend and pretend’ while praying for rate cuts. Identifying a catalyst for a true break is hard, but a mean reversion in credit spreads could be violent from current levels.

It’s all over…for inflation (and the reflation trade)

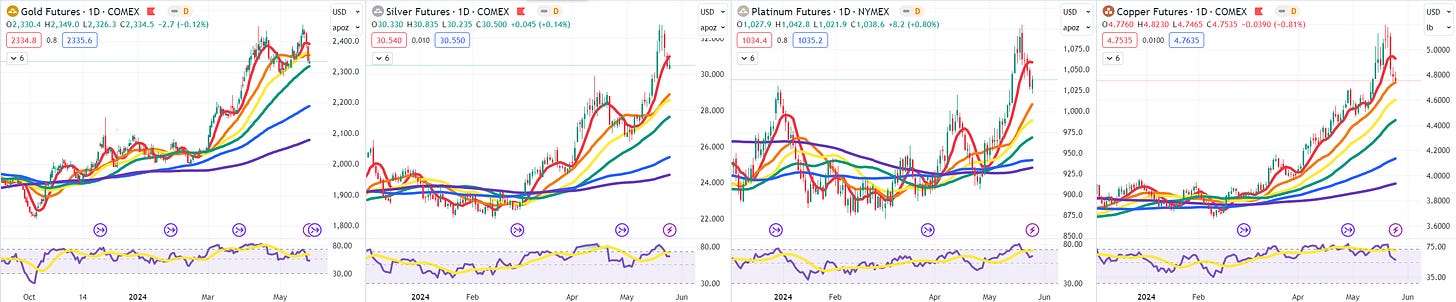

This week saw a (possibly overdue) pullback for the reflation trade, with momentum finally stalling in the metal futures pits.

On the other hand, inflation, as measured by fixed income breakeven rates, would have us believing that we should be less concerned about long-term inflation becoming entrenched.

Possibly positioning got over-crowded in the silver and copper trades but one interpretation of last week’s correction is that the metals finally started to take notice of the correction in breakevens. This rodent is not buying it.

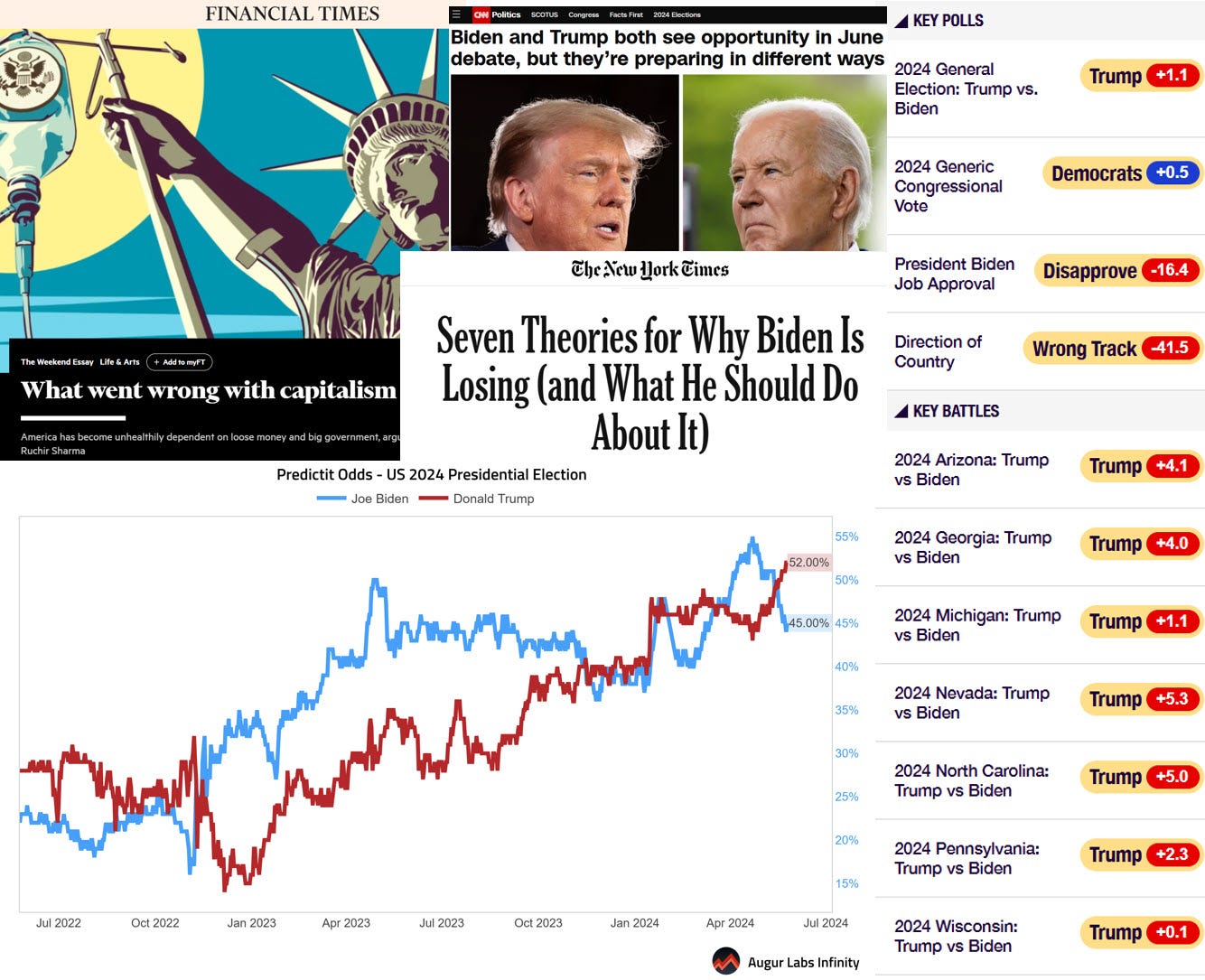

The market move certainly sits uneasily with trends in consumer sentiment. A recent Harris poll for The Guardian sees a US voter base convinced that inflation risks are rising and that the economy is already shrinking.

Cue a chorus of complaints about ‘the dire quality of polling data these days’ (to be fair to the critics, 49% of the same group of respondents thought that the S&P500 was down on the year instead of up 12%(!) and that unemployment was at a 50-year high as opposed to near a 50-year low). Never let facts trump vibes.

🐿️ ‘it’s all over’ conclusion: This one is easy for this inflationista rodent. There is always a Mark Twain quote to retread. As far as inflation is concerned, reports of its death are greatly exaggerated. Especially when you consider what comes next.

It’s all over…for political incumbents

Incumbent political leaders would appear to be an endangered species at the moment. Is it ‘all over’ for them? The inflation expectations embedded in the sentiment surveys referred to above embed an expectation that election outcomes are inflationary either way the ballot breaks. Fiscal incontinence will continue under both Biden and Trump.

🐿️ ‘it’s all over’ conclusion: In the US, this rodent has no edge beyond to say that November will be close, and that every organ of power will be employed with the intention of improving the odds of the incumbent. You need a very good excuse (or structure) to be short risk assets into this backdrop.

On the other side of the Atlantic, the demise of the Conservative administration after 14 years in power has more of a ‘mercy killing’ vibe to it. Not the 🐿️’s bravest call, but it is now! for the rain-sodden Rishi Sunak’s Tories.

Final Thought

The reality of that 1966 World Cup final was that with England 3-2 up and only 30 seconds left on the clock, suspense as to the final result was not really in question. A bit like this summer’s UK general election!

However, for a final thought this week we briefly consider English international soccer tournament official anthems. Historically these musical specimens, often excruciatingly recorded with the assistance of the actual playing squad, require an extreme health warning for sensitive listeners.

The only one that (sort of) broke out of this cringe-making mold was Three Lions recorded by The Lightning Seeds (plus comedians Frank Skinner and David Baddiel) ahead of the Euro 1996 competition hosted in England.

1996 was also marked by the dying days of a tired out Conservative administration. The imminent electoral landslide of Blair’s ‘new’ Labour project was as inevitable as England being knocked out of an international tournament via a penalty shootout.

This 🐿️ was actually at Wembley for the England vs Spain quarter final. Miraculously, England actually managed to win a penalty shootout in that game! Natural order was however restored in the semi-final with a loss to Germany (via penalties again!). The hapless ‘villain’ of that day was a young Gareth Southgate who these days manages the national team.

28 years later, Southgate’s miss is all forgiven and Three Lions remains a bit of an anthem (but only when sung by professionals!).

That’s all for front section this week. In Section 2 (for paid subscribers), we stay in the UK. Beyond the irony of the timing of a UK general election on US Independence Day, an early ballot may provide an additional tailwind to a trade that is already starting to work well.