Just waitin' for the maturity wall

The Blind Squirrel's Monday Morning Notes, 5th February 2024.

Summary

Pink Floyd’s ‘The Wall’ is the ‘backing track’ to this week’s note.

Last week’s ‘big week in macro’ did not disappoint. Rate cuts postponed, runaway performance in US large cap tech and a hot jobs numbers have us rethinking the risk of a blow off top in US tech equity markets.

The second section previews a new right tail hedge as well a new theme in an AI-related space; reviews a week of mixed fortunes in the various energy equity sectors; takes another look at food inflation and Ags; and updates on a couple of portfolio adjustments.

Welcome! I'm Rupert Mitchell aka The Blind Squirrel and this is my weekly newsletter on markets and investment ideas. If you've received it, then you either subscribed or someone forwarded it to you (add yourself to the list via the button below). Please also consider becoming a paid subscriber!

The audio companion to this week’s note will be uploaded to Substack on Tuesday to allow me to incorporate comments and feedback from this note. It will also be available as a podcast on Apple, Spotify and the other usual podcast apps.

Just waitin' for the maturity wall

Well, it would possibly be fair to say that last week’s ‘big week in macro’ did not disappoint.

Facebook META 0.00%↑ started the week accused in the Senate of having “blood on its hands” and ends the week setting a record for the largest single day market cap gain in market history.

Meanwhile, Friday’s payroll blew the doors off consensus expectations and was accompanied by major upward revisions to December’s data as well as stubbornly uncomfortable inflationary indicators in the hourly wages data.

Even another regional bank scare was not enough to prevent 10-Year US Treasury yields closing the week on their highs.

With US economic growth continuing to look perky according to the GDP nowcasts, must we now prepare ourselves for a few more quarters of elevated interest rates?

Are we now back in a ‘Goldilocks’ world of above trend growth paired with falling inflation?

The 🐿️ freely confesses to his ingrained ‘inflationista’ biases, but there can be no doubt that the indicators pointing are now pointing back down while oil prices remain depressed. How long does this remain the case (particularly in the context of resurgent US growth)?

The last of the major Wall Street bears, Morgan Stanley’s Mike Wilson may be throwing in the towel. Other influential strategists such as Jefferies’ David Zervos are urging investors to ‘strap back on the risk’ as (i) a ‘soft landing’ has been achieved; (ii) inflation ‘is tamed’; and (iii) the Fed has 5% of rate cutting and balance sheet firepower (“as a backstop”) if markets do end up rolling over.

The trucker caps are a bit of a trademark for Zervos. Last year’s headgear was adorned with the word “Junk” as he exhorted clients to embrace the risks of high yield debt. Turns out that that was a pretty good call.

The 🐿️ has written about ‘Vodka Red Bull’ and twin tracked economies before. There is no doubt that the current state of the economy feels very different whether you are a motorman or ‘mud man’ in the Permian basin oil patch or instead of a Manhattan-based commercial real estate executive.

The former is living his best life, life for the latter is getting pretty existential. Time is the killer. As my friend Chase Taylor likes to say, interest rates do not matter until you have to pay them.

For the US consumer, exposure to the higher rates is largely discretionary (unless circumstances force a new house or new car purchase). Compared to consumers elsewhere in the world, US borrowers are much less exposed to variable rates.

In the corporate world, $200bn of fixed rate debt needs to be rolled over this year. According to Apollo data, this is only a marginal increase on the (fixed rate) amount that rolled off in 2023 as c.60% of the 2024 total is already floating.

We are not yet in a position whereby we could safely forecast any kind of ‘buyers’ strike’ for this new paper.

And buyers are indeed returning to credit markets judging by Bank of America’s fund flow data:

But will the refinancing cohort be able to afford the new rate environment (assuming we stay up here for longer)? Total and net leverage levels for this universe is down from the pandemic peak but still elevated relative to the past 25 years.

The 🐿️ has not done a line-by-line analysis of the high yield refinancing candidates (and analysis of private borrowers is harder). However, a quick analysis of the IWM 0.00%↑ Russell 2000 ETF constituents shows 7% with a negative Altman Z-Score and 8% with interest cover (EBITDA-Capex/Interest Expense) of less than 1.0x.

It’s tough not to imagine some kind of increased pick up in default rates. Is this the chink in the maturity wall? Ah! Finally, the 🐿️ is going to explain the random Pink Floyd reference in the title of this note!

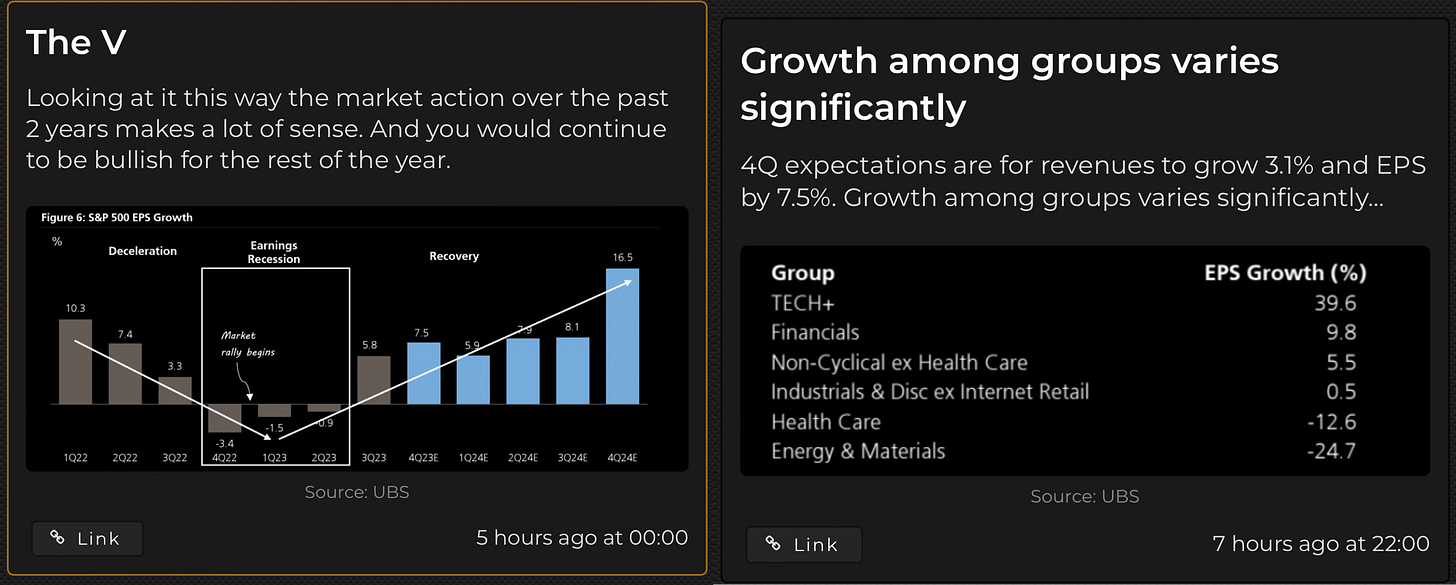

So, growth would appear OK and risks of imminent credit events (outside of the commercial real estate / regional banks complex) seem manageable. What about the much-anticipated roll over in corporate earnings? Not so fast!

Having got through the guts of Q4 earnings season, it is clear that those looking for a collapse in corporate profitability will once again have to wait.

This earnings growth is supported by that overwhelming effect in the passive investment dominated markets of today. The unrelenting and largely price insensitive bid from corporate share buybacks.

Last week in ‘Gonna need a bigger narrative’ we discussed how market strategists were reaching for new valuation paradigms to justify chasing the market leaders in semiconductors and large cap technology. The previous week in ‘Handling the FOMO’ we even outlined a specific hedge against ‘right tail’ risks in semis.

My friend Kuppy eloquently wrote last week about the existential risks facing managers of benchmarked money that do not chase those marching hammers.

“Did my friend ever buy NVIDIA?? I assume he did. It was probably the day of a local peak when he couldn’t take the pain any longer, right before a nasty pullback. He likely swept the book and then got drunk. I’m almost sure the pain of missing got the better of him, and he paid up. One can never underestimate the pain of underperformance.” Kuppy: The Blowoff.

The 🐿️ is in the fortunate position of not being enslaved by a benchmark and is pretty much 100% certain that you do not read Blind Squirrel Macro for my detailed views on the ‘Magnificent Seven’ and their earnings. However, it looks increasingly like 2024 will be another year in which this asset class is ignored at your peril (or at least at risk of serious FOMO). We have already learned that high interest rates are not necessarily a headwind for this group.

Shorting US equities remains a landmine rich environment! I know that none of you would forgive yourselves for ‘piling in at the top’ but a proactive hedging strategy against missing out on further gains in this group has to be taken seriously. There will be an additional acorn report outlining my preferred hedging approach published later this week.

The recommended diet may be unpalatable but is probably necessary.

That’s it for the front section this week. In the second section, I preview the new right tail hedge as well a new theme I am working on in an AI-related space; review a week of mixed fortunes in the various energy equity sectors; take another look at food inflation and Ags; and update on a couple of portfolio adjustments.