Is Santa getting over his skis?

The Blind Squirrel's Monday Morning Notes, 2nd December 2024.

We got a Santa rally. With bells on! But is the old boy now out over his skis?

Section Two this week is a ‘deep dive’ review of the current portfolio and the ‘Bull Pen’

Is Santa getting over his skis?

At risk of making a statement of the bleeding obvious, it has been an(other) extraordinary year for US equities. November closed at yet another all-time-high for the S&P500 and the fervent post-election embrace of risk left this rodent almost surprised that the monthly candle was only the 7th largest percentage advance for the ‘Spooz’ since the Covid lows. We got our Santa rally. With bells on! But is the old boy now out over his skis?

What is even more remarkable is that this move was pulled off notwithstanding a negative contribution from most of large cap tech giants that have dominated index returns for the past few years.

Wall Street’s recent track record in calling US recessions has been utterly abysmal. The 🐿️ is also guilty of resolutely being with that 60%+ ‘doom consensus’ at the end of 2022 / beginning of last year. However, I am gradually finding myself once again in the ‘concerned’ camp when it comes to the economy.

If you did not catch Adam Taggart’s excellent interview with Bloomberg’s economist Anna Wong at the end of last week, do try to fix that. Anna is concerned about the disconnect between the optimism in financial markets and what she sees as a potential weakening trend in the labor market. A softness which may see a surge in unemployment before any of the pro-growth policies of the new administration can be implemented and take effect. The 🐿️ found himself nodding vigorously.

Indeed, these animal spirits are not to be found in all financial asset classes.

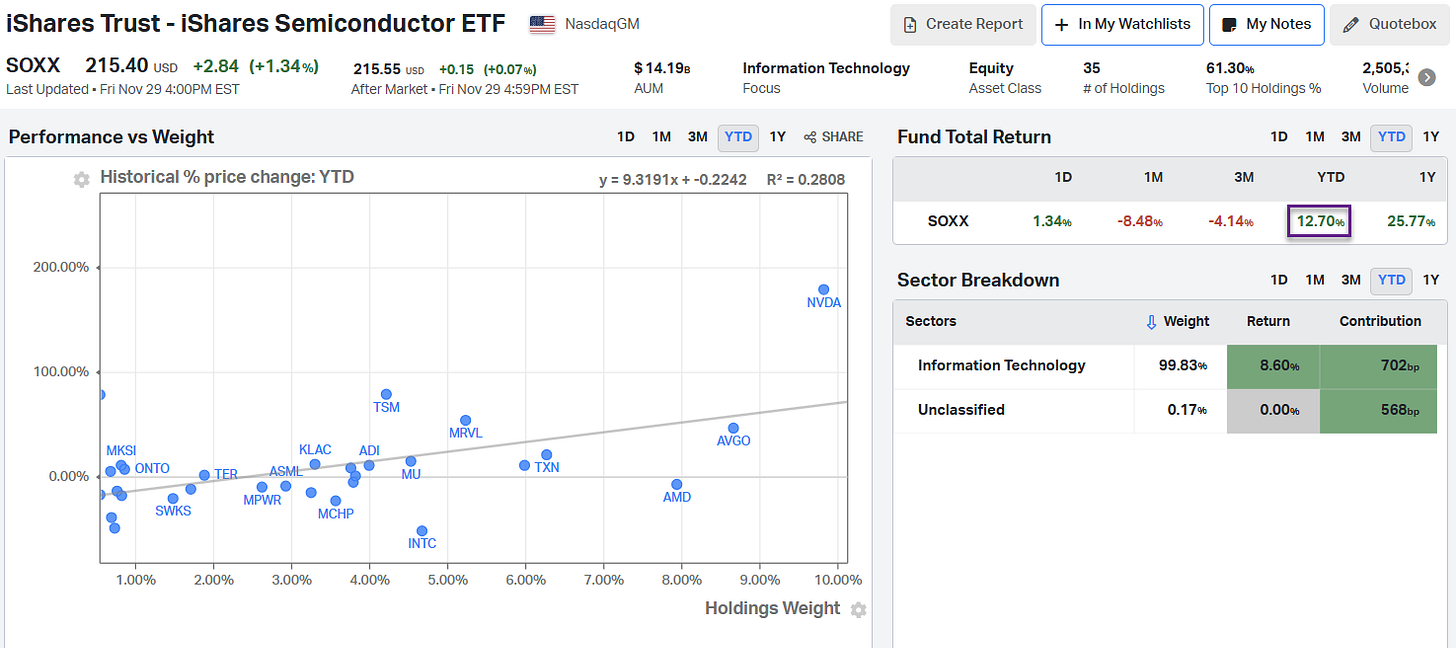

There is one traditionally cyclical sector that does appear to be giving signals of a negative shift in economic conditions. Semiconductors. Nvidia’s heroic 179% year-to-date move accounts for an enormous 53% of the contribution for the underwhelming (relative to the broader market) 12.7% advance by SOXX 0.00%↑ iShares semiconductor ETF this year. Even Jensen Huang’s distant cousin and ‘AI darling’ competitor Lisa Su over at AMD 0.00%↑ is down on the year.

Nevertheless, promises of tax cuts, deregulation and general ‘Trump Trade’ feel good factor is seeing a reanimation of the rotation trade (into small caps) versus the tech giants of the Nasdaq that we saw play out following that excruciating debate at the beginning of the summer (‘You can't face it, but bonds are watching’).

Your favorite rodent is not saying that this outperformance cannot charge onwards in the short-term (particular if fueled by strong seasonal effects and some interesting dealer positioning in Russell and S&P option complex).

The image below highlights 2 things:

On the left-hand side, some very significant open interest in the SPX December 19th 6050 calls. This happens to be the call strike of the famous JP Morgan ‘whale trade’ - a put spread collar embedded within its jumbo ‘Hedged Equity’ mutual fund. I refer to my good friend Kevin Muir as the ‘Captain Ahab’ of this particular large marine mammal. He has written on the topic multiple times over the years. He also discussed the trade this weekend with Imran Lakha on The Market Huddle. The TLDR is that hedging activity around that large 6050 call position (where dealers are long options, short the underlying index futures) could create significant overhead resistance for the S&P500 over the next 2-3 weeks.

The right-hand side shows the open interest in (out of the money) call options on the Russell futures and IWM 0.00%↑ ETF - again for the regular December expiry. In this case, the dealers are short the call options and need to add to long underlying equity and futures hedge positions as the market rises - a move that could get dynamic.

As discussed at the beginning of the month in Zombie Beta, if you do want to chase some small caps, by all means go for it but just be careful to know precisely what you own. For what it’s worth, in that report, the 🐿️ had a forensic look under the hood of the Russell 2000 index and concluded that is “is basically a random ‘rag bag’ of economically unrepresentative, SBC-incinerating ‘sh#tcos’ with an ‘inverse Darwinian’ selection bias”.

To be crystal clear, while the 🐿️ is no fan of Russell 2000 futures or the IWM as a long term buy and hold investment, I am in no way suggesting that it would be a good idea for readers to place themselves in front of this potential runaway train into year end.

Potential small cap outperformance into Christmas is one thing but moves in other parts of the capital markets have this rodent’s whiskers twitching even more violently.

In a polarized world in which certain stocks have adopted a cult like status with their tickers being cheered on like a favorite sports team, I keep the composition of the 🐿️’s ‘Garbage’ portfolio a fairly closely guarded secret. Regular readers will have a reasonably good idea of the types of names that I see as good candidates for short positions (as and when the time finally comes for Chase Taylor’s Financial Justice Warriors™!).

Enough column inches and podcast hours have already been dedicated to the topic of the insanity machine that is Microstrategy’s MSTR 0.00%↑ attempt to corner the bitcoin market. Instead, I just want to quietly remind you that this rodent’s distant cousin and MAGA avatar Peanut the Squirrel’s altcoin continues to have a market cap of north of a billion dollars. And let’s not start on ‘HawkTuah’ coin! Like the Murphy’s, I’m not bitter. Well, maybe just a little bit.

Keeping the front section brief this week as I need to take the time for an extended review for paid subscribers of the current Acorn portfolio in Section Two of this week’s note.

Don’t miss out! Please consider becoming a paid subscriber to Blind Squirrel Macro to receive the other 60% of 🐿️ content (including the rest of this week’s letter and portfolio review), member Discord access (The Drey) and even ‘limited edition’ merch!