Contemplating the Defensive Puzzle

The Blind Squirrel's Monday Morning Notes, 23rd September 2024.

The Fed’s rate cut has signaled a ‘green light’ for risk. However, the 🐿️ is not chasing yesterday’s party. Defensive sectors look stretched, and cyclicals look like they are ready to run.

Contemplating the Defensive Puzzle

As a long-term uranium bull, the breaking news on Friday that Constellation Energy CEG 0.00%↑ was planning to apply to restart Pennsylvania’s ‘Three Mile Island’ nuclear facility (‘TMI’) was undoubtedly bullish news. The fact that this move was facilitated by a jumbo 20-year purchase agreement to power Microsoft’s AI data centers was somewhat inevitable.

The 🐿️ has been puzzled by the ‘utilities as AI stonks’ narrative that has been advanced this year. However, back in April, in ‘Fading the Utes’ I conceded that “our West Coast based tech overlords have finally woken up to the fact that their new AI toys are going to require more electrical power than the grid has to offer them.”

I was struggling to see how this realization would be a universal positive for the electricity generation sector. Of course, certain independent power producers (such as Constellation and Vistra) could serve a role in meeting the increased demand from AI’s large language models but the rest of the sector would struggle to capitalize on the theme (with their regulated assets).

As such, we have been short the US utilities via XLU 0.00%↑ since May. To be honest, this has not been fun so far! However, I continue to think that there is strong merit in the thesis, especially at the end of a week in which long bond bulls had not received the first rate cut move they were expecting. More on that later.

I had expected a short-lived bullish reaction to the news from the Utes (again, apologies to my Aussie readers who think that the 🐿️ is constantly obsessing about pickup trucks). However, we live in the age of market extrapolation, and I woke up on Saturday morning to see that the entire utility sector had run like it had just stolen something!

Constellation CEG 0.00%↑ , already up over 100% on the year, had quietly tacked on 22% to its market capitalization during the Friday session while I slept (to the consternation of even someone who puts the word “Nuke” in their Twitter handle!):

To be fair, the numbers above reference the original estimated construction cost for Georgia Power’s new reactors (the final cost was more than double those numbers, but that is a conversation for a different day). But still…

To say that the US utility stocks have been suffering from a bit of an identity crisis this past year would be an understatement. In recent weeks, they have been struggling to decide whether they are an integral part of our AI-powered future or instead a safe equity sector in which to hide as we enter a slowing economy in need of the support of easier monetary conditions.

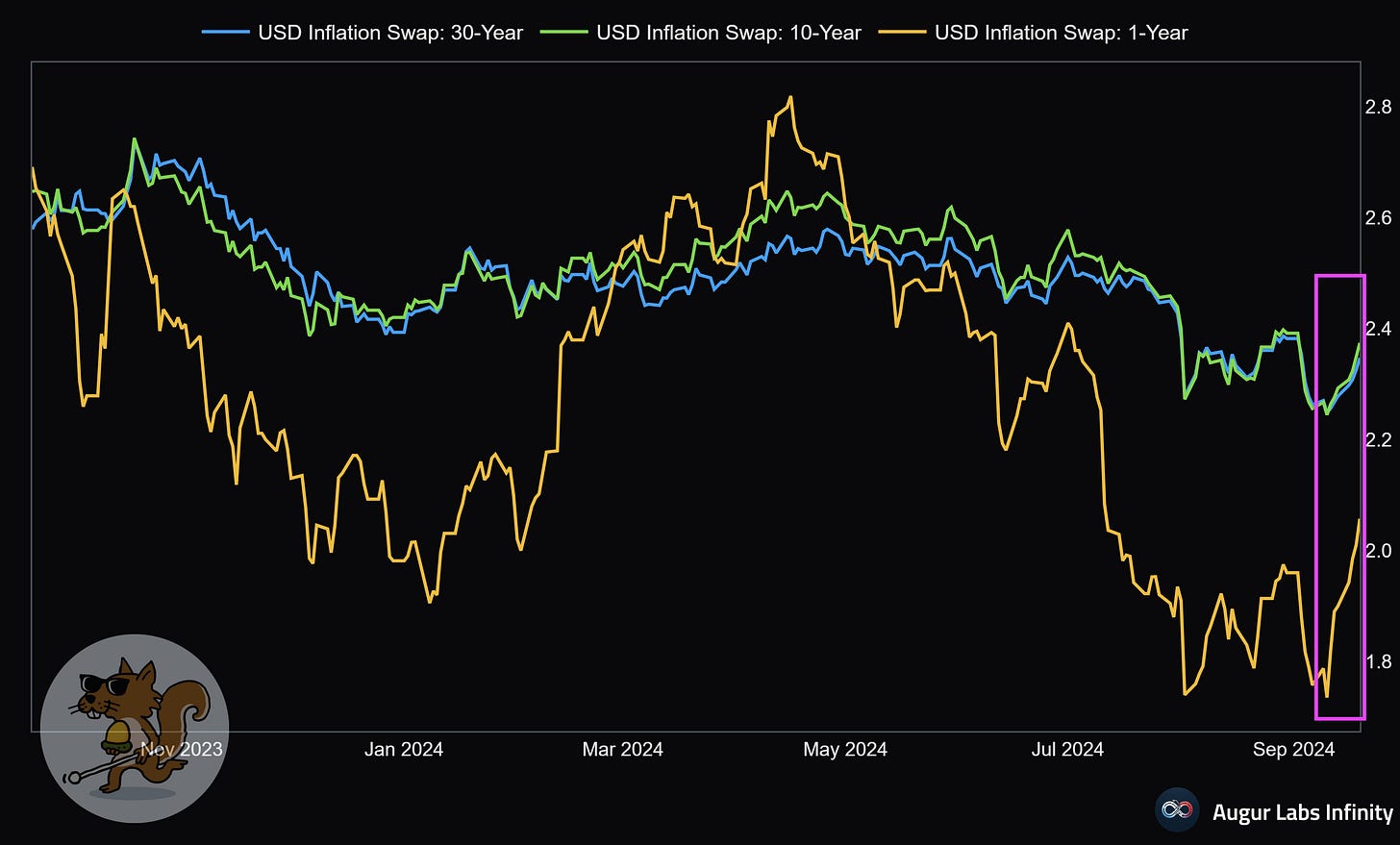

This brings us on to Wednesday’s 50 basis point rate cut from the Federal Reserve. Regular readers of the rodent will know that I have been concerned that the investors crowded into long duration fixed income investments such as TLT 0.00%↑ would be disappointed by the reaction of the long bond to Mr. Powell’s first cut. This turned out to be the case.

This rodent does not consider himself sufficiently qualified to judge whether or not the Fed has made a ‘policy error’ in cutting rates so forcefully with growth above trend and inflation above target. Central bankers will be rated in due course, with the usual ‘50:50 hindsight’.

What I do know, is that (i) long duration yields do NOT appear to be completely relaxed about the long-term outlook for inflation and that (ii) risk assets clearly love the look of that rate cut!

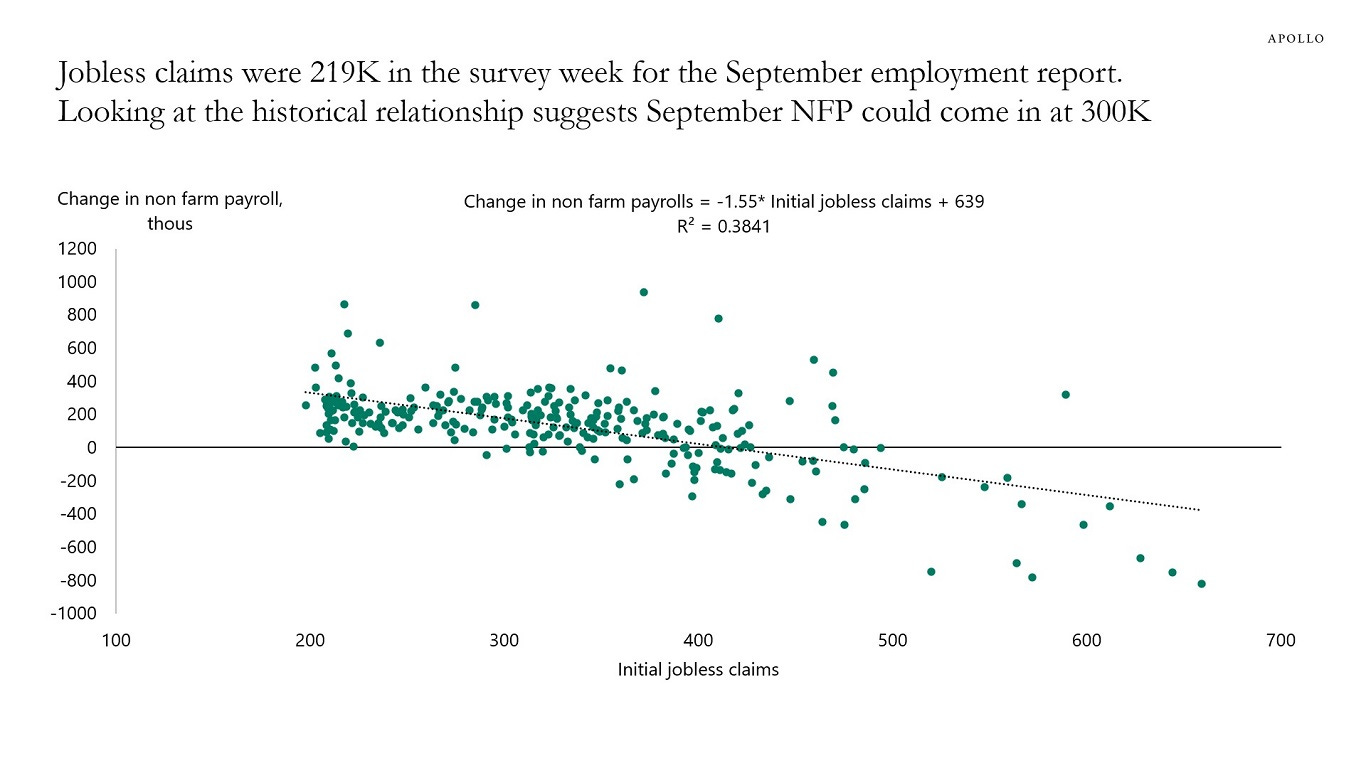

I hear the (strong) arguments about low-income consumer weakness and the ongoing fragility in rate sensitive sectors like commercial real estate. However, at the headline levels of growth and employment, it is a struggle to find data points that point to a near-term recession (although last week’s Fedex FDX 0.00%↑ earnings call - “weakness in the industrial economy pressured our B2B volumes” did raise the 🐿️’s eyebrow).

With record fiscal deficits and (now) monetary easing driving the US economy, this new love for risk should clearly not be fought.

Does that mean we should all be piling into profitless tech companies or the latest meme coin in the crypto sphere? Should the 🐿️ be swallowing pride, waiving the white flag of surrender and joining the crowds chasing the AI dream with large cap ‘hyper-scaler’ technology stocks? Well, by all means, ‘you do you’ if that is your thing!

This rodent is a great believer in ‘regret minimization’. To lose money having been a late arrival at the profitless technology and AI equity party would be inexcusable (not to mention a source of plenty of regret)!

We have spent much of this year thinking about the role and nature of the ‘classic defensive’ equity sectors for this market cycle. In April, we ran through the reasons why so-called defensives might struggle to play their traditional portfolio role in the event of an economic soft patch.

If we are not indeed staring down the barrel of a weaker growth backdrop, holders of this exposure find themselves at risk of owning assets at peak cycle valuations with heightened risk of becoming political ‘footballs’ and strategic moats that are significantly narrower and shallower than they used to be.

You are also at risk of having way too much company alongside you in these assets just as we enter a pro-cyclical market regime. ‘MC’, new friend and author of MacroCharts included the slide below in his excellent piece from last Thursday. The extreme flows from cyclical to defensive equity assets appear exaggerated relative to the recent pull back in long-term Treasury yields (which the 🐿️ thinks could well be overdone).

I suspect that we are already at peak shine for the sparkly AI datacenter narrative as relates to utilities. Remember that this luster only applies to the independent power players (those unconstrained by regulated assets). The consumer staples and healthcare sectors are also trading at racy premia to long-term average multiples if portfolios are indeed incorrectly positioned for economic headwinds.

The narrative and valuation arguments for a portfolio rotation away from defensives and into cyclicals are compelling but is your rodent in danger of overthinking it? If we are in risk-on mode, why not just pile back into the market cap weighted indices dominated by technology giants?

Without re-rehearsing all of the arguments (the 🐿️’s views are largely unchanged from ‘It 'AI'-n't Necessarily So!’), I believe that the risk of investors taking fright over perceived capex ‘malinvestment’ by the AI hyper-scalers is high.

I also worry that large cap technology stocks are where many of the foreign investment flows have been hiding in recent years.

A trend that has only accelerated since the pandemic.

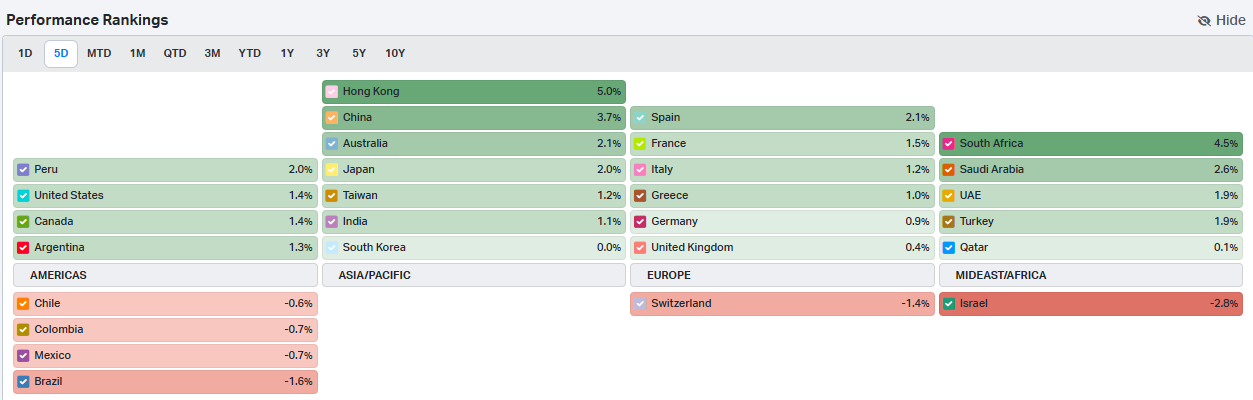

Yet we so far have one Presidential ticket advocating the potential taxation of foreign investment assets in the US. With the race as it currently stands, that (terrible) idea would end up on the second ticket in a heartbeat if it looked like it may garner some votes! It certainly did not escape this rodent’s notice that, while US equities had a decent ‘Fed week’, most of the rest of the world’s equity markets had an even better one. Will foreign capital start to go home?

It feels as though risk / reward of a late chase of the market leaders of the past decade stacks up unfavorably when compared with the opportunity in more classically cyclical assets. The 🐿️’s whiskers are twitching, and my pal MC’s technical launch signals are screaming at him.

MacroCharts and the 🐿️ are recording a special podcast / presentation for subscribers on this potential asset rotation in the next 24 hours. We will release this into your feeds later in the week. MC has traded global macro assets on the sell and buy sides. We both started our careers in the markets in the early 1990s. I am sure it will be a great conversation and hope that it will be a regular collaboration!

The 🐿️ already has a reasonable amount of cyclical exposure (energy, commodities, EM) in the portfolio. However, we plan on making some room for more. In Section 2 this week, we sketch out part of that plan.

Don’t miss out! Please consider becoming a paid subscriber to receive the other 60% of 🐿️ content (including this latest acorn idea), member Discord access (The Drey) and even ‘limited edition’ merch!