Clipping Emerging Divvies

The Blind Squirrel's Monday Morning Notes, 9th December 2024.

This week, the 🐿️ wants to draw readers attention once again overseas. With all the political chaos in Europe and North Asia, did it not strike you as slightly odd that the rampaging US dollar index was only unchanged on the week?

In the medium term, your rodent sees a weaker dollar regime - as such we are going to want to hunt down some short duration foreign assets.

Before we dive into the world of emerging market dividend stocks, a quick plug for where you can get more recent🐿️ in the media. On Wednesday, I was delighted to be included by Team Grizzle in Toronto to join a great line up of corporates and analysts at their annual Commodity 1x1 conference.

I’m also going to be joining Maggie Lake after the US close (4pmEST) next Wednesday 11th December. Delighted to be joining as was a huge fan of the work she did on the RealVision Daily Briefing over the years. Please subscribe to her new YouTube channel (link via clicking on the image below) and then join us live next week!

Clipping Emerging Divvies

We are firmly in ‘the chase’ phase of the 2024 equity market. The plentiful distractions in the form of Bitcoin highs (a prairie dog?), Roaring Kitty redux and the #HawkTuah coin rug pull disguising the reality that the sector rotation into small caps triggered by the election results has now been fully reversed.

Last week, in Is Santa getting over his skis, we marveled at how the S&P 500 had just delivered the 7th best month in 4 years without a contribution from the major market ‘generals’. For the 1st week of December, the Magnificent Seven responded with a resounding ‘hold my beer’, tacking on a cool $935BN of market cap in 5 trading days!

Actively managed institutional money, staring down the barrel of another year of (existential) underperformance versus the passive machines, are responding in the best way they know how. Pressing the historical winners. Hard! For readers not dealing with the tyranny of annual benchmarking, it feels like a good time to watch from the sidelines. The air feels very thin up here.

This week, the 🐿️ wants to draw readers attention once again overseas. With headlines dominated by political vacuums in France and Germany and an ‘amateur hour’ coup in Seoul, did it not strike you as slightly odd that the rampaging US dollar index was only unchanged on the week?

Reading between the lines of the very mixed economic messages coming from the incoming Trump administration, it seems pretty clear that most of their primary objectives are likely best achieved with a weaker dollar. Even if the new cabinet is not being explicit, it appears that the FX market is starting to listen. In a weaker dollar regime, we are going to want to hunt down short duration foreign assets.

I was on the phone with an old fund manager friend in Hong Kong early last week. ‘OB’ was fairly despondent. The vocal China bears are once again out in force after late chasers of the October ‘David Tepper’ China equity mini boom are now nursing their rapid ‘told you so’ drawdowns.

OB is President of an excellent long-only Asian equity shop. As such, much of his non-investing day job involves talking to current and potential investors for his fund that then (unfortunately) go on to spend the rest of their day listening to the asset allocation consultants and the rest of the pundit class in the City and Midtown.

From these talking heads, the mantra is that Chinese assets are (still) basically ‘un-investable’ and only a short-term beta trade at the best of times. By the way, hat tip to OB’s and my mutual pal Louis Vincent Gave for his excellent mid-October pawnbroker meme on the topic (inset within the BABA 0.00%↑ chart above)!

The trouble with the ‘told you so’ China drawdown narrative is that its only real ‘victims’ appear to have been those unfortunate traders that rushed into the most obvious China tech ADRs when they were massively extended to the upside over the October ‘Golden Week’ holiday (during which time mainland bourses were closed and providing no local price discovery mechanism🤦♂️). Well played fellas!

Raising money for a China fund may be tough, but OB is pretty happy with his China investments (as is the 🐿️ for that matter!). Even after the latest pullback (which appears to have decelerated nicely within Fibonacci retracement zones), the MSCI China is up 32.6% for the year in dollar terms. This 171bps better than the total return for the Mag-7-laden S&P 500.

In August (in Psst! You're long China anyway!) the 🐿️ observed that a US index with Apple and Nvidia at the top of it was hardly free of China-related geopolitical risk. It’s ironic that those 2 stocks alone account for over one quarter of the S&P 500’s year-to-date 30.88% return.

While OB and I both have some exposure to the China ‘big tech’ names, there has been significantly greater breadth to the rally in Chinese equities in 2024 and the (shorter duration) value factor has been delivering appreciably better returns in the Orient than the Western value complex.

As such, it did not surprise this rodent at all to read on Friday that one of the best performing (+66% YTD!) domestic fund managers had been focused primarily on the Hong Kong-listed ‘H shares’ of Chinese state-owned entities.

In April, China’s State Council launched the “Nine Measure Plan” of market reforms to impose greater capital allocation discipline on listed companies. The CSRC (securities regulator) and Shanghai and Shenzhen exchanges also implemented new guidance on buybacks, minimum payouts and dividend frequency.

It was largely dismissed in the skeptical West as a ‘me too’ measure aiming to mimic similar corporate governance policies in Japan and Korea and designed primarily to juice up local investor confidence. The 🐿️ thinks that this cynicism is misplaced.

China’s tech giants were certainly quick to copy the strategies of their US peers with debt-funded buybacks. Furthermore, in a world in which investments are driven by marginal flows this buyback trend could provide a significant boost to market returns. There is also certainly plenty of scope for Chinese corporates to ratchet up their (already very well covered by cashflow) dividend payout ratios.

Price stimulative buyback and dividend activity is part of a package that regulators are seeking to use to lure some of the nearly $10 trillion(!) of net household savings that currently sit in (very) low yield bank deposits on the mainland.

Taking the iShares MSCI China FXI 0.00%↑ as a broad proxy for large cap Chinese equities, a trailing 12-month dividend yield of 2.25% (underpinned by FCF yields of nearly 7%) starts to look pretty attractive. And yes, the 🐿️ knows that a dividend is not a coupon!

The regression line below could of course always be steeper, but the market does appear already to be rewarding those FXI components with large payout ratios with better overall returns.

Then let us not forget that ultimately Chinese (and other North Asian) investors are momentum investors at heart. If the local equity markets start to look like they are back in a long-term uptrend, further buyers will emerge from the sidelines (including those Chinese exporters that are currently hoarding many hundreds of billions of dollars offshore (probably hiding out in the Nasdaq).

Then consider the impact of China’s increasing ability to pay for her imports (especially oil) in her own currency (up 26.5% in the first 8 months of 2024 according to the PBOC). A scenario in which Gulf energy exporters elect to recycle an increasing share of RMB proceeds (from their energy exports) into Chinese financial assets does not seem fanciful were the market to become more of a success story.

Finally, the 🐿️ is well aware that valuation alone is never a catalyst (if you do not believe that the market is already trending). However, it would be churlish not to observe that the margin for error on the value front is pretty compelling.

Regular readers will know that there is already plenty of China-related exposure in the acorn portfolio. Probably enough. However, in Section Two, the 🐿️ revisits an alternative exposure.

It is an ‘old friend’ that benefits from many similar themes to those outlined above but comes with further diversification benefits. I think it is a position that can act as a core component of the short duration, non-USD allocation that this rodent believes will serve investor portfolios well over the next few years.

Do check it out! Please consider becoming a paid subscriber to Blind Squirrel Macro to receive the other 60% of 🐿️ content (including the rest of this week’s letter and portfolio review), member Discord access (The Drey) and even ‘limited edition’ merch!

Section Two

I said “revisit” above but for 99%+ of 🐿️ readers, DVYE 0.00%↑ iShares Emerging Markets Dividend ETF is just a line item in the ‘Open Acorns’ table that I include in S2’s “Acorn Review” each week. I first wrote up DVYE before Blind Squirrel Macro was launched on Substack in February 2023. A link to the original PDF can be found below. Many of the themes I covered 2 years ago still ring true, but it is time for an update.

If you share this rodent’s desire to increase portfolio allocation to short duration, non-dollar assets, what if I told you that there was a ‘one stop shop’ product? A fund that gave you a highly diversified exposure (127 holdings) to large (average mkt cap $20bn) emerging market equities with the following characteristics:

Average PE (NTM) of 9.17x (6.7x at the fund level), with average net income growing at greater than 5% on a 2-year CAGR;

Average free cashflow greater than 220% of common dividends paid, with that average FCF growing at a 6.6% 2-year CAGR;

Average cash and equivalent holdings at 34.3% of market capitalization (the constituent universe currently has over $1 trillion of cash sitting on their collective balance sheet).

My friends at Koyfin have a tool that allows you to see where various ETFs rank relative to their peer group - in this case single country and regional equity ETFs. DVYE ranks very highly on valuation and income statement yield metrics. But for the Russia / Ukraine war (more on that later), DVYE would be top quartile across most multi-year total return measures.

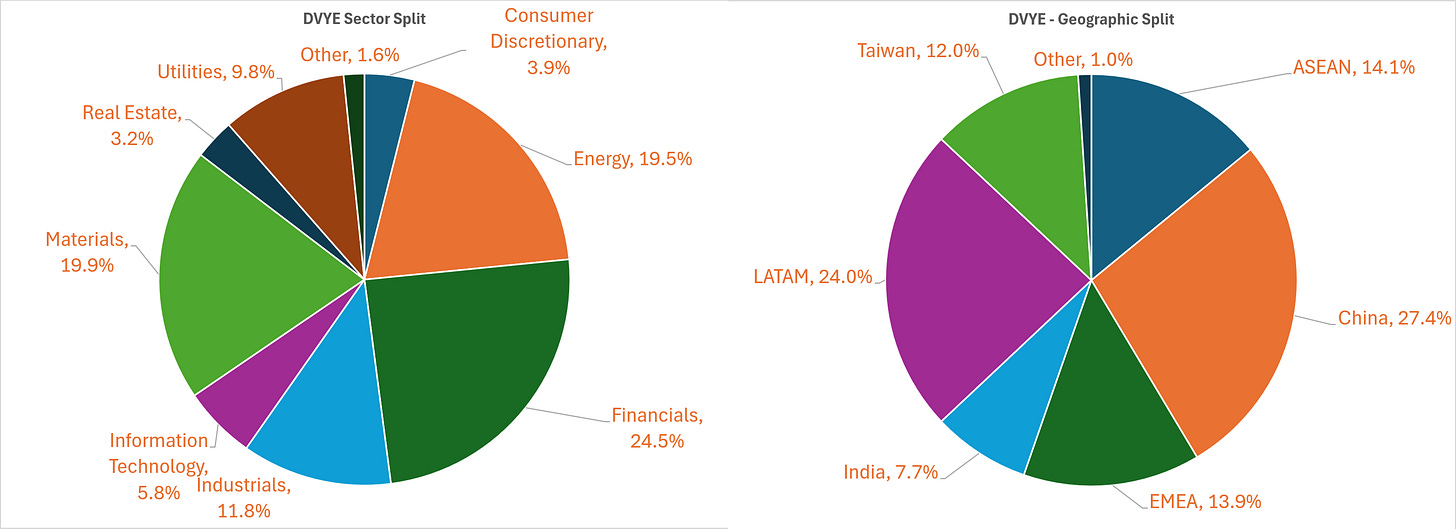

Let’s dig in on that ‘only free lunch in investing’ - diversification. The portfolio is broadly spread across (largely non-tech, shorter duration) sectors.

Then geography:

Asia. Over 60% of the holdings are weighted to Asia but HK-listed Chinese stocks account for less than half of that allocation (for those already too close to their limits for that market). I like the fund’s exposure to ASEAN markets (predominantly Indonesia and Thailand). Taiwan’s weighting (12%) is primarily tech hardware and a bit of shipping exposure. There is a 7.7% allocation to 4 Indian equities (Vedanta, Hindustan Zinc, Coal India and Indian Oil), but not the very expensive ones which, as you well know, this rodent is less of a fan of!

LatAm (24%). As you know, the 🐿️ is bullish on most Latin American equities. Unsurprisingly large cap Brazilian resource plays (Vale, Petrobras) feature strongly here, joined by some familiar Chilean (SQM, ENEL) and Colombian (Bancolombia) names.

EMEA and other (c.15%). A mixture of Polish, Czech, Turkish, South African and Gulf state exposures. Mainly industrials, resources, materials and some financial stocks.

Russia. DVYE had significant exposure to Russian assets at the time of the imposition of sanctions on Russian assets in 2022 (they were a significant part of the underlying index at the time). The shares are marked at zero by DVYE’s fund administrators but still technically form part of DVYE’s net asset value per Blackrock’s website.

At current market prices on the Moscow exchange and a USDRUB rate of 100.55, this Russian portfolio is worth $31.17m, equivalent to 4.56% of DVYE’s NAV. The 🐿️ has no view as to whether or not these shares are ever unfrozen in a way that accrues value to DVYE holders, but the fact is possibly worth keeping in the back of your mind.

Time to look at some more metrics.

Time for some crayons! DVYE’s chart has been trending beautifully since the October 2022 lows. Similar to the FXI chart we looked at above, DVYE has pulled back from the ‘David Tepper’ highs in October but key long-term moving averages look like they are being respected.

DVYE is very much a long-term ‘buy and hold’ product (as well as a ‘go to’ shopping list for single stock and EM thematic ideas for the 🐿️). There is an option chain on the ETF, but it is very illiquid. However, some of the momentum and divergence indicators on the daily chart appear to be suggesting a reasonable entry level at current prices.

DVYE is already a core holding for the acorn portfolio. However, I suspect it might be of interest for readers that are intrigued by the high yield EM story but do not want to add significant length in China or who thematically like the story for Brazilian assets but cannot bring themselves to catch the ‘falling knife’ that is the EWZ 0.00%↑ (iShares Brazil) ETF chart.

As ever, if you ever have any questions, please ping me in The Drey or via the button below.

Acorn and Portfolio Update

Original write-ups for all Acorn trades are available in the archive section on our Substack site. Following a request from a handful of readers, I have set up a section on the website Live Acorn Updates that allows paid subscribers to opt-in (via notifications in Substack) to emails for updates to our live trades during the week. I will continue post live updates in The Drey but many of you do not use Discord.

After last week’s extended Acorn review, I will keep this week shorter. The new digital payments basket was initiated on Monday.