Psst! You're long China anyway!

The Blind Squirrel's Monday Morning Notes, 12th August 2024.

Psst! You're long China anyway!

On a couple of recent podcasts, I have committed the cardinal sin of daring to make a positive case for Chinese assets. Cue the rush of ‘flying monkeys’ to the comments section on YouTube. The keyboard warriors’ charming epithets are boringly predictable: “Idiot! China is uninvestable!”, “Your guest is a CCP stooge!”, “Tesla is not a car company!”. You get the general idea.

What these latest incarnations of Stan Druckenmiller fail to realize is that with their overweight positions in that AI/Robotics car company, Nvidia and Apple, they are already up to their neck in China risk. They arguably just own that same risk at the wrong price.

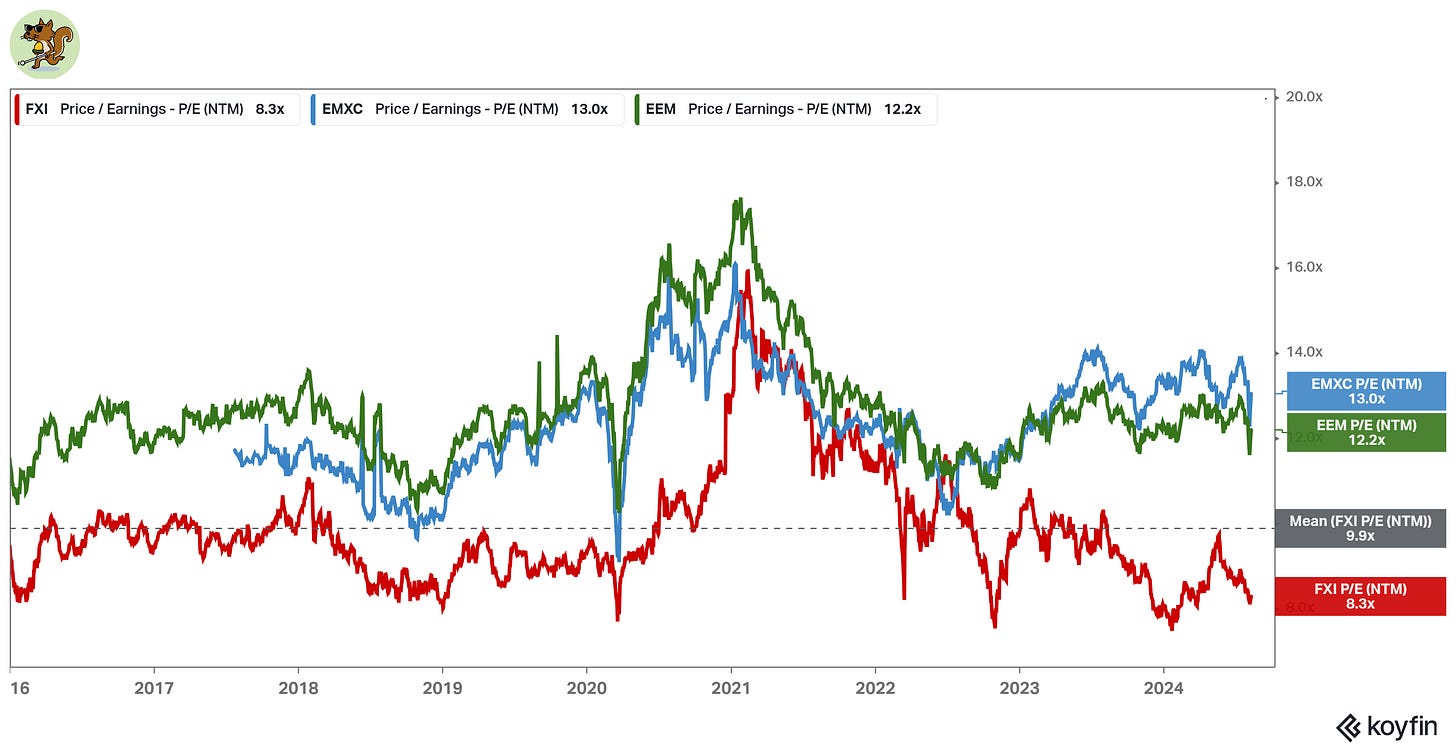

More on value later. Nobody owns Chinese equities. They are the untouchables of the institutional investment world. At its peak in late 2012, EEM 0.00%↑, the iShares MSCI Emerging Market ETF had assets under management of $53bn. That AUM is now down to $17bn. Its crime? Its benchmark weighting in Chinese stocks.

In the past 2.5 years, EMXC 0.00%↑, the iShares MSCI Emerging Market Ex-China ETF has gone from almost total obscurity to 86% of the size of its more established relative.

Emerging market investors would simply rather crowd into Indian equities at eye-watering absolute (and relative) valuations.

The rationale: Well, it’s “the next China”. Wait, what?! 😉.

Let’s be clear on my ‘priors’ at the outset. Greater China was a home and place of work for a big chunk of my adult life. I was involved in taking a large number of its best-known companies public and have first-hand experience of working in the world’s most (arguably only?) complete industrial supply chain.

No, the 🐿️ did not ‘go native’. Neither am I a ‘CCP stooge’. I have been lectured by the same chorus of ‘Midtown Manhattan’ voices forecasting (incorrectly) an imminent bust for the Chinese economy or break of the Hong Kong dollar ‘peg’ for over 20 years. Ironically, it was helping to clear up after a failed attempt to break that ‘peg’ (by the predecessors of those voices) that took me out to Asia in the first place in 1999.

Let’s roll through some of the big narratives:

#1. China is drowning in a sea of indebtedness after a years of real estate and infrastructure malinvestment. A deflationary bust and the ‘Japanification’ of China is inevitable.

🐿️: Heavy indebtedness is hardly unique to The Middle Kingdom. I would argue that, so far, China has done a pretty good job of managing the controlled demolition of its real estate sector and of replacing the lost GDP with other sectors of the economy. Domestic consumption growth will come in due course.

#2. China is a communist country that cannot be a trusted as a safe steward of capital.

🐿️: In the West, we have seen way too much ‘you get to keep the gains (at a preferential tax rate) but as to the losses? No, those need to get socialized’. The claim to the moral high ground on the capitalism front is getting a bit sketchy (Silicon Valley Bank anyone?). The rationale behind Beijing’s rejection of the IMF’s suggested real estate bail-out plan last year was perfectly described by Twitter’s Shanghai Macro Strategist (am a big fan - he knows of what he tweets!):

“Chinese policymakers have clearly adopted a different philosophy for managing financial risks. In the West – particularly the US – money printing and government balance sheet expansion have become the policy path of least resistance in responding to financial risks since the Global Financial Crisis. “Too big to fail” is essentially an acknowledgement that financial stability will be prioritized over the prevention of moral hazard. In contrast, Beijing aims to solve financial risks by tightening regulations, launching anti-corruption campaigns, and inhibiting financial sector balance sheet expansion. From Beijing’s perspective, a systemic bailout in the form of QE and government balance sheet expansion will not only create systemic moral hazard, but it may also lead to rampant corruption in the state-dominated financial sector.”

Sure, China has had its fair share of corporate governance scandals over the years and the a long-running standoff between Beijing and Washington over auditing compliance on US-listed Chinese firms was a terrible look. However, this does need to be lined up against the utter nonsense and the shareholder mugging-fest that we saw in the US SPAC mania of the early 2020s!

#3. The emasculation of China tech giants by Beijing (creating massive losses for Western investors in Alibaba, the original apex predator of hedge fund hotels).

🐿️: Let’s be honest. Do we really think that the human and monetary capital that has been channeled into the tech empires of the West has delivered optimal outcomes for our societies? It’s not just cat videos and teen depression! Look what other goodies we got!!

China wants its best and brightest working on hard technology like semiconductors and nuclear fusion, NOT video games and dog walking apps. When it comes to AI, China’s focus would appear to be on leveraging AI technology for practical applications within manufacturing and other industrial supply chains as opposed to making datacenter space available for the latest Andreessen Horowitz-funded AI virtual assistant!

Furthermore, are we really happy with the political power that Silicon Valley has bought accrued? Is it really ok that Elon Musk feels sufficiently above the law to become a player in a military conflict (Starlink in Ukraine) or to rabble rouse in the UK? I certainly know where I stand.

#4: Trade Wars, Part II. China bashing is now a bipartisan pursuit in the US in an election year. Tariffs will crush China’s export economy, delivering the fatal ‘coup de grace’ to the country.

🐿️: Maximum noisy narrative anticipated BUT also, in this rodent’s humble opinion, fully priced. The US is of course a crucial market for global consumption, but China is already figuring out ways to expand end markets for its output. Think sub $10k cars - EV, hybrid or internal combustion! - they are already being sold in high volumes in markets outside of the US and the EU.

#5: The big one. Actual Wars. China is going to invade Taiwan, and any investments in mainland equities will get ‘zeroed’ by sanctions.

🐿️: Ever since Putin rolled his tanks over Ukraine’s border in 2022, Western fiduciaries have been terrified of a repeat of the career risk of having their Russian equities placed into suspended animation. I have no edge in predicting Xi’s intentions but please try to name a risk asset on the planet that survives the impact of military conflict in the South China Sea unscathed!

I have no interest in watching golf, tennis or football at the Olympics (they all have their own ‘higher’ trophies). But speed climbing finals - sign me up all day! Watching 18-year-old American Sam Watson warmly embrace Wu Peng of China after being knocked out of a place in the final by him (the picture from above) was a moment of pure hope for this soppy rodent.

I think this was more than a Jesse Owens and Luz Long thing. The fighting age population of the 21st Century have the internet (even if they might need a VPN from time to time) and they have more in common with one another than their parents. This is Nancy Pelosi and Peter Navarro’s grudge match, not theirs! Kevin Xu reminded me this weekend that a certain late great investor also had some wise words for us all on US China relations:

“I think both China and the United States would be crazy not to collaborate and increase trust. I don’t think there’s anything more important that we could do for our respective safety and for the general benefit of the world.” Charlie Munger (Berkshire AGM, 2015).

There is no doubt that globalization has reshaped the manufacturing economies of the West with damaging societal consequences. China is now fully embedded as the home of high-value manufacturing. It’s been 40 years since ‘rubber dog shit out of Hong Kong’ has been a useful descriptor of China’s manufacturing value add.

Yet the populists on both sides of the aisle would have people believe that this is reversible. It is not that easy. I suspect that much of the necessary muscle memory has gone and do we really want the inflationary impact of all that supply chain duplication?

Let’s face it, everyone is long China risk already anyway! Most just own it at the wrong price. The same asset allocators that have wholeheartedly embraced the volatility laundering of the private asset markets have determined in their wisdom that the equities that represent 19% of global GDP should be shunned on fiduciary grounds. Oh, the irony!

This has created some bargains. The table below is the constituents of FXI 0.00%↑, the iShares large cap China ETF. I have excluded financials and companies with a market capitalization of less than $25bn. No other adjustments. This group is trading on just over 12x forward earnings, a 9% free cash flow yield and with extraordinary levels of net cash on the balance sheet.

China’s valuation discount relative to the rest of emerging markets is also at multi-year extremes.

I can already hear the ‘value trap’ pushback, so let me address that. For an asset class to break out of a value trap, it needs new buyers and a catalyst. I am not holding my breath in anticipation of Western pension fund consultants changing their mind too quickly about Chinese equities. We don’t need them.

Chinese risk assets have a new audience. Little by little, China is starting to pay for its commodity imports in its own currency. What do those commodity exporters do with the Yuan? Chinese rates have outperformed US rates dramatically in recent years. Seems like a decent parking spot for those commodity exporters. Next stop (very cheap) equities? Quite possibly.

One of the constant refrains I have heard over the past 18 months is that China is about to devalue its currency and export its deflation to the rest of the world.

Instead of a knee jerk flight to the safety of US dollar cash in response to the volatility of the past 10 days, the offshore Yuan caught a massive bid. Has the signaling of an easing cycle in the US triggered a green light for China’s exporters to stop hoarding their cash offshore?

A recent sharp strengthening of the Yen versus the Yuan is also a valuable release valve for the Chinese economy.

A spectacularly cheap Yen has created strong competition in key export markets and shifted significant high end consumption activity offshore. Could China be about to get some of that back?

There is a problem with ‘greatest hits’. They are all that anyone ever wants to hear. Just because China’s fiscal bazooka bailed out the global economy (yes, it’s true) following the ‘08/’09 financial crisis does not mean that it will be repeated.

Reams of nonsense was written ahead of the most recent ‘Third Plenum’. Some kind of blunt fiscal or monetary stimulus measure is unlikely. Rate cuts and the cheap money trade is a game that the Chinese economic planners do not want to play. The fabled ‘hukou’ reform may indeed happen (and should be truly transformative) but will not happen with an overnight stroke of the bureaucrat’s pen.

I know that valuation is never a catalyst for a re-rating of a market. I often wish it were the case! Nevertheless, this rodent sees plenty of capital returning to Chinese shores just as it appears that the earnings cycle might be turning. Now that is a catalyst.

We have a plan…