Career Risk and the Sirens' Song

The Blind Squirrel's Monday Morning Notes, 17th June 2024.

Cracks are beginning to appear in nearly every corner of global stock indices with the exception of AI-related large cap US equities.

Whether via extreme dispersion in equity markets or selective carry trade blow-ups, significant market events are certainly making themselves felt, but nothing has really broken yet.

The cumulative underperformance from carrying tail hedges and from sensible diversification is now starting to create career risk for many market participants.

How long can we ignore the Siren songs offering tail hedges at bargain prices?

Welcome! I'm Rupert Mitchell and this is my weekly newsletter on markets and investment ideas. While much of this letter is free (and I will never cut off any punchlines), please consider becoming a paid subscriber to receive the other 60% of the content and plenty of other good stuff!

Career Risk and the Sirens' Song

It’s a well-known fact that wealth managers generally lose their clients not for inflicting losses on them but for the failure to participate in bubbles. The incentive structure of ‘Big Retirement’ is such that it is preferable for a manager to fail ‘with the crowd’ than to risk allowing your clients to underperform in a bull market.

As such, not being currently overweight the winners - or let’s be honest the winner - of the AI boom represents very real career risk for many in the investment industry. The 🐿️ set out his views on the risks associated with that position last week in ‘It AI-n’t Necessarily So’.

This week’s cover pitches the 🐿️ as Odysseus trying to ignore the Sirens’ calls to gorge on Nasdaq 100 puts and other forms of event protection. The continued rise of US equities to new all-time highs is tough to fade notwithstanding the fact the move is powered by such a small handful of stocks. According to JC Parets, only 12 NYSE listed stocks (out of over 6,300!) joined the index at fresh 1-year highs on Friday.

The (very) crowded ‘dispersion’ trade (long single stock volatility, short index volatility) remains firmly in charge.

We wrote about this trade extensively back in March. I continue to think that positioning in this trade represents a major potential fragility for the market. Our decision to hedge against a ‘dispersion bust’ via an actively managed index straddle strategy has allowed us to generate positive P&L versus the continued bleed of a long volatility position in VIX futures or options.

Are we finally seeing sign of damage in the (hitherto bullet-proof) credit markets. When ‘Lord of the Dark Matter’ James Aitken decides to draw attention to a tick up in high yield spreads this rodent takes notice.

This may be interesting to note, however running a credit hedge via say, a short position or puts against the HYG 0.00%↑ iShares High Yield Bond ETF has now been just a world of ‘negative carry’ pain for well over a year. Not much better if you are institutional and have the ability to trade credit default swaps.

Hedging ‘tail risk’ in the world of FX volatility has been a similar bloodbath. Back in late May, I highlighted David Dredge’s excellent work on the implied volatility crush in FX markets.

The (expected) electoral surge by populist parties in the recent European Parliament elections triggered an (unexpected) second snap election for the continent in France. This handed out the second beating in a week (after Mexico) to the rates carry trade complex.

The severity of the sell-off in French government bonds (and domestic equities) has been attributed largely to concerns that a win by the France’s populist RN would bring the sort of unfunded fiscal largesse that was the undoing of UK Gilt market (and the Truss government) in 2022.

You might have expected that to trigger something more disruptive in FX volatility markets, especially in a week in which the Bank of Japan once again surprised on the dovish side to the frustration of the Yen bulls like this rodent. Nope!

Whether via extreme dispersion in equity markets or selective carry trade blow-ups, significant market events are certainly making themselves felt. However, the cumulative underperformance from carrying tail hedges and from sensible diversification is now starting to create career risk for many market participants.

The beeswax that has prevented the Sirens’ (tail hedging) songs from penetrating this rodent’s ears has done its job. However, cost of protection must now be getting to levels that cannot be ignored. The 🐿️ is assessing his options.

If not owning enough Nvidia has been the career risk for US equity managers in the past 2 years, luxury giant LVMH has certainly been the European equivalent for the past 5 years. However, last week’s sell off in France’s CAC 40 has driven LVMH’s chart pretty close to some ‘must hold’ technical levels on the chart.

When it comes to the (domestic) ‘A share’ market in China, another ‘luxury’ stock, Kweichow Moutai, has also performed a similar role in the market. As such, this tweet from CN Wire certainly caught the 🐿️’s attention last week.

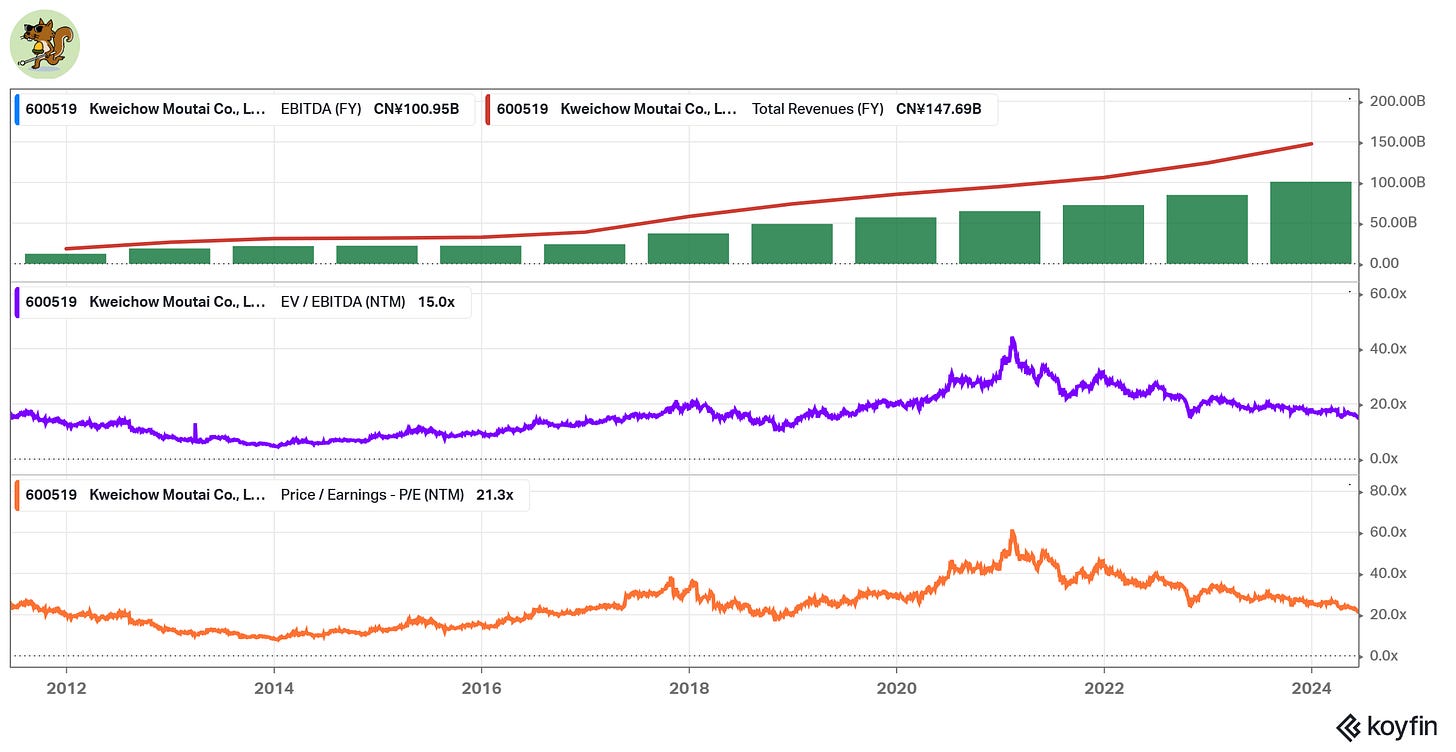

Ever since foreign institutions have been able to access the domestic Chinese equity market, Moutai has been the top allocation in any QFII portfolio. Based on the company’s ‘beast-mode’ financial performance, it is tough not to see why this has been the case.

Incidentally, much of the company’s growth since 2020 is attributed to brand switching away from the fine cognacs of the European luxury houses to the prestige local digestif. However, Moutai is also closely associated in the 🐿️’s head with a couple of other forms of career risk. Let me explain.

The phrase ‘Ganbei!’ (干杯) literally meaning ‘dry cup’ but really meaning ‘finish the glass’ is a word that may trigger some PTSD for readers that have ever experienced ‘the business end’ of a Chinese business banquet. Moutai is the most prestigious brand of ‘Baijiu’, the grain-based liquor preferred for toasting.

Failing to learn the tricks of the trade necessary to survive a typical night of ‘Ganbeis’ certainly represents career risk for a foreign visitor without either an iron constitution or an exit plan! However, the various bottles and vintages of Moutai (which vary in cost between $100 and over $2,000) have evolved into clearly understood units of value over time.

In a country in which the average civil servant earns CNY9k per month ($1,400), salary ‘supplements’ have often taken the form of these bottles of firewater (hence its role as a leading indicator for infrastructure investments referenced in the tweet above).

While a senior official might take the ultimate career risk and accept supplementary compensation in more traditional units of exchange (cash, gold, property), further down the ranks, the compensation would often come in an alternative ‘liquid’ form that held its value effectively in real terms.

It is largely for this reason that when President Xi launched his ‘Tigers and Flies’ anti-corruption campaign in 2012, one of the hardest hit domestic equities was Moutai.

I remember wondering out loud back in 2012 as to how the fortunes of the recently IPO-ed Tenfu Tea (6868.HK) could have reversed so violently the year after going public in 2011. Tenfu went from growing its revenues by 80% in 2011 to revenue contraction in 2013. Why? It turns out that Tenfu’s tea ‘gift sets’ were also a common form of ‘salary supplement’, albeit at a lower price point!

Moutai may be underperforming the likes of BYD, CATL and Tencent this year. However, on a 10-year view, the company remains a giant among Chinese stocks.

The lack of excitement in the stock since the highs of patriotic ‘buy China’ period during the pandemic is most likely a function of fund flows (it was a very crowded trade for foreign institutions). It probably also speaks to the form in which China is seeking to derive its growth going forward.

The role that the ceremonial bottles of baijiu played in oiling bureaucratic cogs during the Chinese infrastructure investment boom that bailed out the global economy post the GFC is unlikely going to be replaced in the country’s drive towards consumption-led growth. At least if it did, then this rodent would have grave concerns about the state of the median Chinese liver!

That’s all for front section this week. Ganbei!

Programming note. The 🐿️ is currently en route back to Europe where I will be based for the next 4 weeks. As such the Monday Morning Notes (and the podcast) will be dropping 12-24 hours later than usual until late July.