Rampant speculation ahead of Tuesday’s Bank of Japan meeting has most macro eyes trained eastwards. If meaningful yields are coming to Japanese government bonds as a result of a shift in BOJ policy, we have plenty to think about.

The results of last week’s ‘shunto’ spring wage negotiations surprised markets to the upside. One of the employers that did not even counter the RENGO union’s ask on wage hikes was Toyota. We look into the recent meteoric share price rise of the Japanese auto giant.

In Section Two (for paid subscribers), we expand on the auto theme and consider some portfolio changes in the sector. There is also plenty to discuss on FOMO hedges, bond risks, coherent optics and the energy complex in this week’s Acorn Review.

Welcome! I'm Rupert Mitchell aka The Blind Squirrel and this is my weekly newsletter on markets and investment ideas. If you've received it, then you either subscribed or someone forwarded it to you (add yourself to the list via the button below). Please also consider becoming a paid subscriber or gifting to a friend!

The audio companion to this week’s note will be uploaded to Substack on Tuesday to allow me to incorporate comments and feedback from this note. It will also be available as a podcast on Apple, Spotify and the other usual podcast apps.

Big in Japan

Rampant speculation ahead of Tuesday’s Bank of Japan meeting has most macro eyes trained eastwards. If meaningful yields are coming to Japanese government bonds as a result of a shift in BOJ policy, we have plenty to think about.

If shorting Japanese Government Bonds therefore suddenly becomes a profitable endeavor, do Natural Gas futures trading and shorting Australian Bank stocks (on a ‘propadee’ bubble thesis) get left as the last remaining ‘widow-maker’ trades in global macro?

Does an unwind of the carry trade complex finally upset the best trend-following trades of the past few years?

We have seen this ‘high expectation’ movie before. Last summer, we covered some of the bigger implications of such a change in policy.

We revisited the topic again in December.

Back in July, fever pitch expectations were met with some minor monetary ‘tweaking’ by the BOJ. The ‘defining macro event of 2023’ turned out to be a damp squib rather than fireworks for global asset markets. In December, it was positioning (aka gamma) squeeze in JPY futures options that set the hares running. This time is different is of course a dangerous expression in markets, but here we are again!

The results of last week’s ‘shunto’ spring wage negotiations surprised markets to the upside. Large employers like Toyota (more on them later) apparently did not even ‘put up a fight’ as collective bargaining by the RENGO union saw average wages boosted by 5.28% (a 33-year high).

This came only days after a 2% drop in Japanese equity prices was not met with customary ETF buying from the central bank. A signal that a ‘new sheriff was in town’ and that Japan is finally starting to favor labor (as opposed to capital) friendly economic policies or just a recognition that buying stocks at new all-time highs was perhaps excessive stimulus? 🤷♂️

These moves even inspired the excellent ‘FX Poet’

to deviate from his standard rhyming couplets and compose an authentic(ish) Japanese haiku on the topic!However, in the context of rising US treasury yields driven by yet more ‘hot’ CPI and PPI inflation data, the Japanese Yen chose to move with yield differentials rather than try and front-run revolutionary developments on the domestic policy front. For now, US interest rates would appear to matter more for the Yen.

The shunto developments were certainly eye-catching but must be viewed with a dose of pragmatism. Wage bargains at the large cap employers do not necessarily mean that SMEs (that employ 70% of Japan’s workforce) have the pricing power to be able to follow suit (especially with local PPI also rising more than expected last week). Real wages in Japan have actually now fallen for 22 months straight!

I think that we find ourselves in a position that markets are now not expecting fireworks from the BOJ this week. Having said that, Japan continues to be the swing liquidity provider to the world’s risk assets - at the cost of the value of its currency and the relative wealth of its workers. The implications of a shift in policy remain significant and probably underpriced.

I mentioned Toyota earlier. On Thursday evening, ‘Team 🐿️’ went to the MCG to support our beloved Carlton (‘The Blues’) against the Richmond Tigers at our first live ‘footy’ game of the AFL (‘Aussie Rules’) season.

We (Carlton) won the game in our traditional ‘by the seats of our pants’ fashion (aka less than 1 goal). But let’s zoom in on the title sponsor for the AFL, the 🐿️’s new favorite winter sport (and his second favorite sport played at ‘The G’ after cricket🏏):

In a country which ceased to have a domestic automotive industry with the shuttering of (GM-owned) Holden in 2017, Toyota’s much loved Hilux pickup trucks (or ‘Utes’ as they are called here) are almost viewed as a trusted Aussie ‘domestic brand’ as much as a ‘Maccas’ (McDonalds to most 🐿️ readers) ‘Royale Quarter-Pounder with Cheese’. Note that the same Japanese auto giant also happens to be the principal automotive partner of America’s NFL (just ask Americans about their Tacoma trucks - it’s the same thing!).

I know that The Oscars ceremony was last Sunday (the 🐿️’s Oppenheimer predictions crushed it btw) but MotorTrend came out with its annual ‘Power List’ of ‘Movers and Shakers’ of Global Auto at the beginning of March.

The rise to ‘top of the hit parade’ of a US auto union boss (UAW’s Shawn Fain) is another macro topic in its own right which the 🐿️ is going to save for a later date! As a child of the 1970s, I remember a time when union bosses were household names. Is history about to rhyme? An analysis of the pack behind him is even more interesting.

From (insanely!) ‘unranked’ in 2023 you have BYD’s founder and president moving into the #3 spot. The rise of BYD is also another macro story in its own right. I highly recommend

’s excellent article on the topic: “Wang Chuanfu, a Name Everyone in the West Should Know”.Part of Wang’s ‘superhero origin story’ revolves around his admiration for (and emulation of) Toyota:

As regular readers will know, your 🐿️ had a post-investment banking ‘recovery spell’ in the automotive industry, working for a Chinese electric car startup. During my time there, I was constantly mystified by the Japanese auto sector’s apparent ‘slow walk’ on passenger vehicle ‘BEV’ electrification.

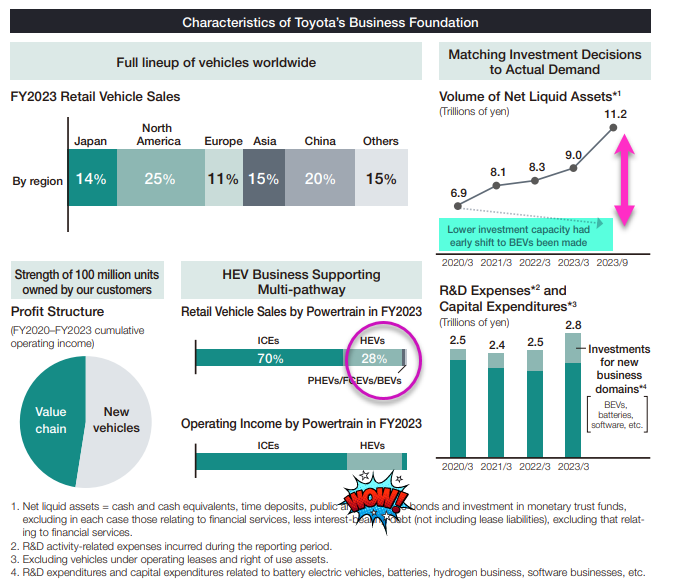

Toyota had led the world with ‘Phase 1’ of vehicle electrification with hybrids (HEVs). The Toyota Research Institute (‘TRI’) was the world leader in terms of the understanding of lithium battery and hydrogen fuel cell technology. Part of me was (lazily) thinking that Toyota’s reluctance to champion battery-electric vehicles (BEVs) was simply a function of their (highly commercial) HEV dominance with the Prius.

I even went as far as to thinking that their attendance at car shows profiling their hydrogen-fueled cars (the Mirai) was some kind of gaslighting or attempt at distracting the market from their disinterested stance when it came to lithium-based BEV solutions!

For a (definitely) older and (marginally) wiser rodent, it all now makes complete sense. Toyota has figured out the math on EROEI earlier than anyone else and was brave enough to stand its ground as it faced the torrents of abuse from the (very shouty) ‘it’s not a real EV if it does not have a plug’ crowd.

They also understood that it is naive to ‘assume away’ sourcing and supply chain issues in the arena of battery metals and compounds essential to a pure BEV solution to passenger vehicle electrification.

Am going to forgive TRI’s Dr. Gill and his mildly completely outrageous ‘chart crime’ (with the scale adjustment of his g/km emissions bar on the right-hand side) but his point about the accelerated advantage of hybrids vs. BEVs in terms of Co2 emissions is well taken. It did, however, make certain folk very angry indeed! Judge for yourselves (link to full presentation from Davos).

Guess what, Toyota’s focus on HEVs has certainly paid off financially and the market has started to cotton on. And let’s not forget that the company actually has a very solid BEV offering if turns out that ‘Barry’ wants one after all:

The almost doubling of its share price in 15 months now makes Toyota the best rated among diversified (i.e. not pure luxury or EV-only) auto OEMs globally.

I have written before about the multiple ‘trap’ that traditionally faces the auto sector. As you can imagine, raising money for a car company forced the 🐿️ to study a lot of ‘trading comps’ tables. Pretty quickly you realize that typical, mature automotive OEMs consistently trade in an EV/Sales multiple range of 1x to 1.3x over time. A status quo that has prevailed for decades.

In a statement that am sure will be viewed as blasphemous in certain quarters, Russell attributes the ‘turbo charge’ behind the success of these investments to canny policy watching. He concludes that a combination of share repurchases by the trading houses and the BOJ’s ETF purchases (as part of its QQE program) - as well as the yen-denominated funding - have been the biggest drivers of Berkshire’s returns on the trade. Is that possibly what we are looking at with Toyota’s current valuation premium?

I can assemble multiple narratives to support Toyota’s premium valuation among the diversified OEMs, but what if the truth behind the most recent performance is more prosaic (i.e., that it is benefitting from the same tailwind supporting as Buffett’s ‘sogo shosha’ bet - a stimulus punch bowl that may be in the process of being partially removed)?

And because you know the 🐿️ cannot resist a 1980s German synth-pop cultural reference, it certainly helps these days to be ‘Big in Japan’! I will let myself out.

That’s it for the front section this week. In Section Two (for paid subscribers), we expand on the auto theme and consider some portfolio changes in the sector. There is also plenty to discuss on FOMO hedges, bond risks, coherent optics and the energy complex in this week’s Acorn Review.

Keep reading with a 7-day free trial

Subscribe to Blind Squirrel Macro to keep reading this post and get 7 days of free access to the full post archives.