Now, Sid James and Ueda-San walk into that bar. Carry On?

The Blind Squirrel's Monday Morning Notes, December 11th, 2023.

Summary

We return to the role of Japanese savers and the yen as a funding source for global asset markets. Can it “carry on”?

Carry trading is a ‘short volatility’ business and you know how the 🐿️ feels about that type of risk! We take a look at what happens when it goes wrong!

This week’s portfolio update and Acorn review (for paid subscribers) covers #copper #uranium #bonds #gold and silver #ags #energy #offshore and #PrivateCredit.

The audio companion to this week’s note will be uploaded to Substack on Tuesday to allow me to incorporate comments and feedback from this note. It will also be available as a podcast on Apple, Spotify and the other usual podcast apps.

Now, Sid James and Ueda-San walk into that bar. Carry On?

The ‘Carry On’ series is the second longest running British movie franchise after James Bond. The franchise’s simple cocktail of ‘musical hall’ stand-up gags and sexual inuendo has not stood the test of time in the same way as 007. However, with 31 films between 1958 and 1992, ‘Carry On’ put up a powerful trend. Something that the Japanese Yen is also very good at.

The influence of Japanese savings (the legendary yield-hungry ‘Mrs. Watanabe’) has been a lynchpin of global capital flows for decades. However, the Yen’s role as the funding (or ‘carry’) currency of choice has been a constant for pretty much the entirety of the 🐿️’s adult life (let alone his career in finance). A role that has intensified in the ever-more-financialized world that we have lived in since the GFC.

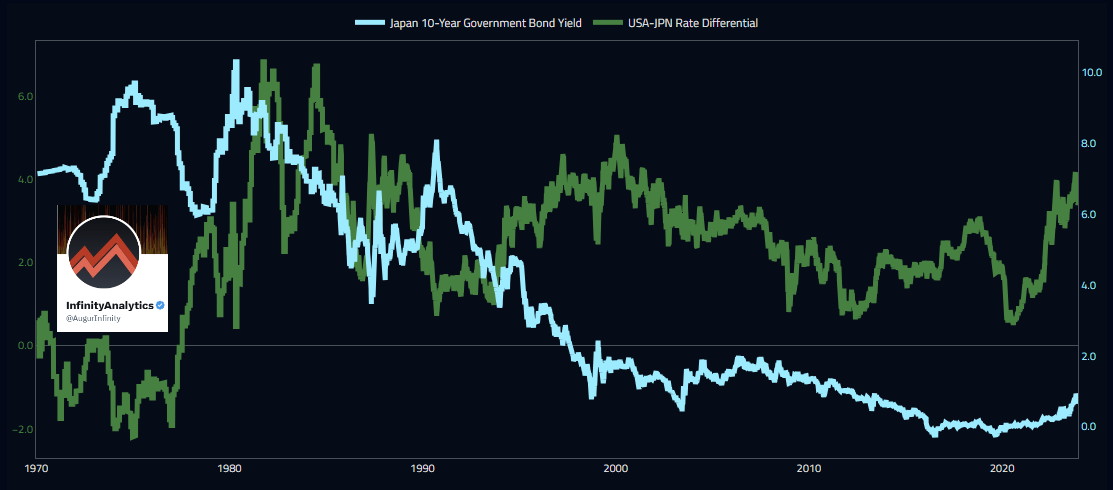

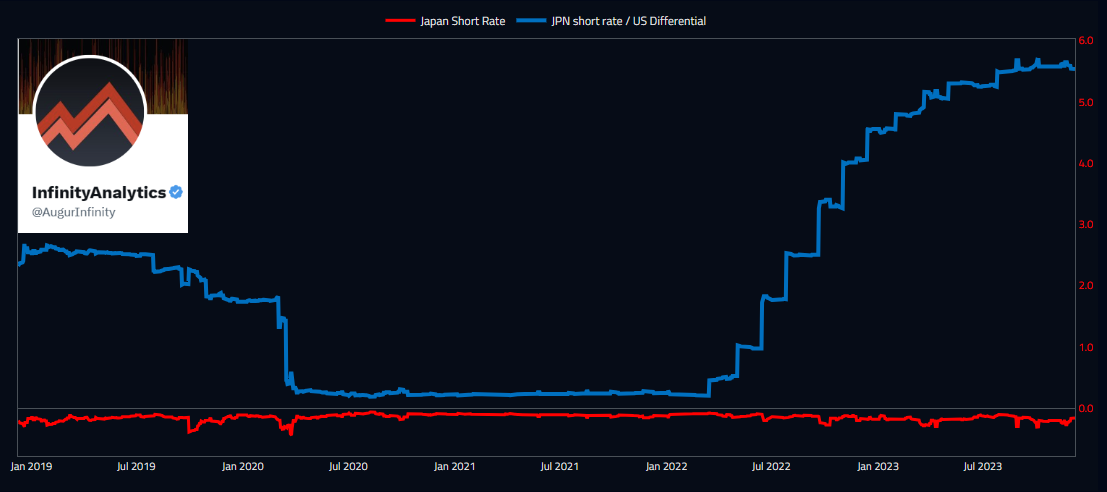

Put simply, ‘carry trading’ involves borrowing in nations (and currencies) where interest rates are still low and investing in those where yields are higher. As US interest rates were hiked off the ‘zero-bound’ in 2022 those ‘carry’ returns started to accelerate. In a big way!

If this looks like an attractive rate differential in US dollars, imagine what it feels like to use your Yen sale proceeds to buy Brazilian or Mexican front-end rates! Returns start to look favorable versus even that juggernaut that is large cap US tech equities!

So far so good, but what happens when carry trades go wrong? I vividly remember the day in 2015 when the Swiss National Bank de-pegged the Swiss Franc from the Euro. Carry trading is a ‘short volatility’ business (and you know how the 🐿️ feels about that type of risk!).

That January afternoon, I was supposed to underwriting a large secondary block of Chinese financials shares in a block trade. There was a sudden gasp on the trading floor as the SNB news broke. In an instant, an ‘OG’ macro hedge fund (Everest) was out of business and several hundred thousand Polish borrowers saw their (CHF denominated) mortgage balances climb by 40% in a case that, to this day, is still trundling through the courts. Fortunately, the 🐿️ got the news in time to ‘bid to miss’ that block!

Fast forward to last week. We contemplated the implications of the end of Japanese yield curve control earlier this year in “Waiting for the Big One” and “Can I get a Squ-ISDA from JP Morgan?”. Back in July, a 2am Tokyo time “Nikkei-leak” rattled JGB and currency traders. Thursday’s comments from BOJ head Ueda-San fortunately took place while I was awake this time!

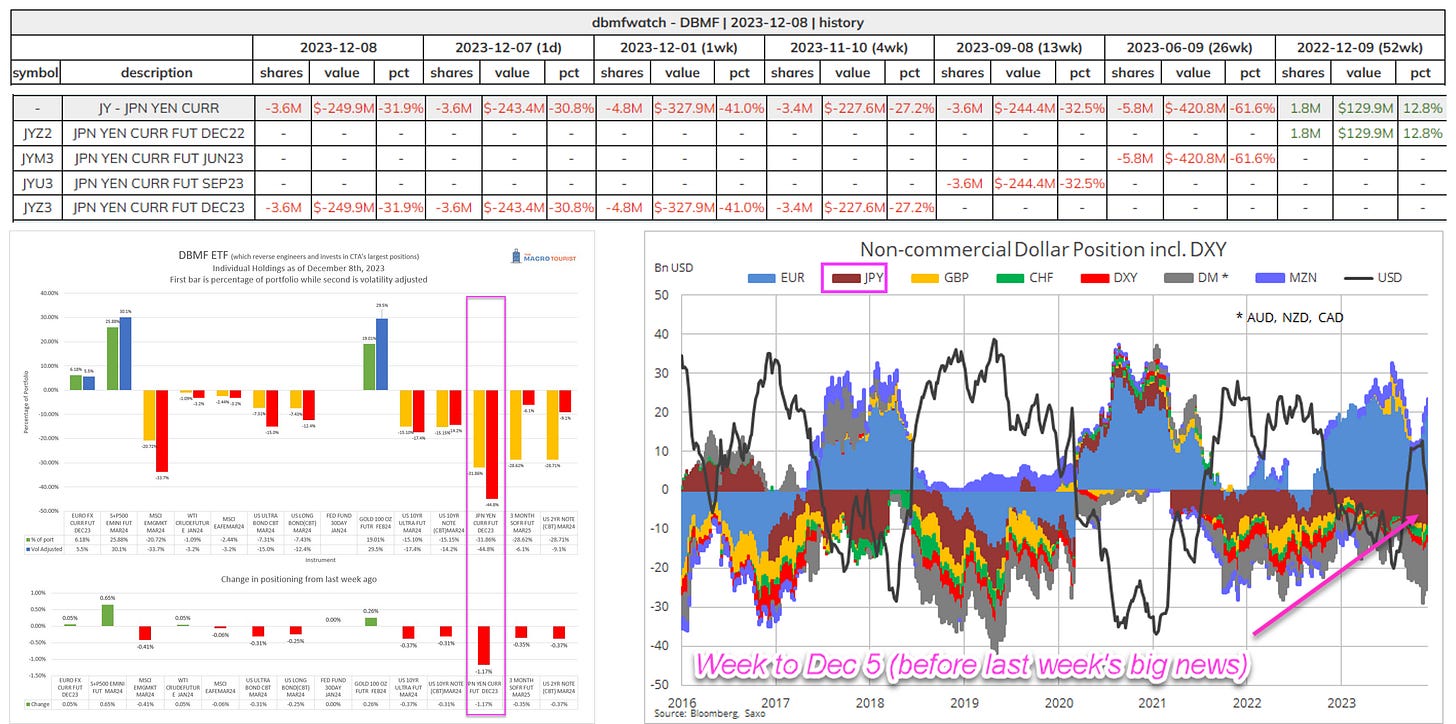

Reactions in the currency were exacerbated by positioning in the JPY futures call options (it was the day before a major expiry with significant out-of-the-money open interest). Weston Nakamura wrote an excellent blow by blow account of what took place. Legendary macro trader Jim Leitner always counsels against the closing out of broken option positions simply for the sake of cleaning up your position sheets.

I was more than happy to oblige as market makers frantically sought to cover their risk.

Whether or not the next BoJ meetings (December 18th and January 22nd) are now ‘live’ (in terms of a formal change in yield curve control policy) is somewhat moot. Interest futures now imply a 50% chance of a rate hike. However, as we wrote before, we now expect evolution rather than revolution when it comes to this important shift in Japan’s monetary policy.

There is of course the small matter of the spring ‘shunto’ wage negotiations to get through first. Surely a central bank that has been fighting deflation for so long will want to get the measure of wage inflation before making such a big call? Other inflationary factors must also be considered.

Nevertheless, risk assets should be on watch - the importance of Japanese savings and the Yen as a source of cheap leverage to global fixed income and equity markets (via the multi trillion dollar carry trade complex) cannot be understated.

Futures positioning and CTA data points capture an incomplete picture of Japan’s leverage role in global capital markets (which is vast) but it’s important to watch from a directional perspective. Regular readers will know that I track the activity of the DBMF 0.00%↑ CTA replicator (even if Kevin Muir produces the prettiest charts on that content!).

However, the 🐿️’s starting biases are clear. On a real (REER) basis, the Japanese Yen is cheaper than it has ever been in my adult life versus a trade-weighted index. A cheapness that has only accelerated since the beginning of the pandemic.

As ever, the brilliant Russell Clark provides that intelligent nagging doubt. He has been writing up some fascinating thoughts on the Yen recently. He notes that globalization and lower tariffs were traditionally good for the Yen, given the mind-blowing productivity of the country’s manufacturing base. However, he counsels the need for a geopolitical overlay (i.e., the return of tariff (and non-tariff) trade barriers globally, ‘friend-shoring’ etc.) for modern day currency analysis. If Russell is right, the Yen can still stay weak.

We have been Japanese equity bulls for some time. Our mistake has been to be too early on our expectations for Yen strength. The currency-hedged ETFs (WisdomTree has a couple) would have been much superior plays this year. Worth noting that recent tax changes to encourage domestic M&A activity is triggering a renewed 🐿️-focus on the Japanese midcap opportunity (as discussed with members in The Drey last week).

We will continue to maintain (and continue to build) our unhedged equity exposure to Japanese equities, notwithstanding the YTD underperformance (in USD terms.

The 🐿️ is keeping an eye on the latest political corruption scandal emerging in Tokyo in the past few days. The power struggle between the militarist and pacifist wings of the LDP is tricky for outsiders to pick through. However, I understand that the scandal is likely to resolve in favor of PM Kishida’s dovish camp, with a ‘doubled down’ focus on economic regeneration that does not blow Ueda-San’s monetary plans off course.

Net net, I am coming to the view that a truly destabilizing monetary ‘shock and awe’ style ‘rug pull’ by the BOJ is getting less likely. With July and last week, the carry traders have now had 2 significant ‘shots across the bow’ and you would hope that risk managers around the world have Yen appreciation at the top of their ‘big risks for 2024’ list.

This gives me additional confidence to add risk in places where a massive and unruly global carry trade unwind might have had potentially ugly market implications.

Final Thought (100% Optional)

I realize that the ‘Carry On’ references will have gone over the head of many of my readership around the world. Probably about as successful a British export product as Marmite (look it up!). You can only imagine what the modern-day Ivy League Presidents club would make of it 😉. However, a clip of highlights (possibly lowlights!) can be found below 👇. Sharing for educational purposes only. Sid James is the one on the left. We continue to watch Ueda-San instead!

That’s all for the front section this week. This week’s portfolio update and Acorn review (for paid subscribers) covers #copper #uranium #bonds #gold and silver #ags #energy #offshore and #PrivateCredit.

Members only past this point.