Waiting for the Big One

The Blind Squirrel's Monday Morning Notes, July 31st, 2023.

The Bank of Japan’s ‘big move’ on YCC (Yield Curve Control) was more of a whimper than a bang. We think that, like the energy trade, the Old Bull, Young Bull also applies to positioning for a stronger Japanese Yen.

A gradual shift in BoJ policy is, on balance, a positive for global asset markets. A sudden repatriation of Japan’s enormous stock of overseas savings risked creating major supply demand imbalances in global bond markets.

We now see Yen revaluation being a multi-quarter process and feel confident that the seeds of that process have now been sown.

Acorn Review: Is the China trade back on? Will the Aussie Dollar join that party? Copper looks like it is trying to run. Plus, some thoughts on uranium, Mercedes (and China EVs, grain markets (DBA 0.00%↑ , WEAT 0.00%↑) ,COIN 0.00%↑ and GS 0.00%↑.

Waiting for the Big One

I have no doubt that the performance of the 🐿️ portfolio benefits greatly from the fact that I am not tempted to over trade live markets. This is for the simple reason that, being based ‘down under’, I am asleep for most of the hours that US cash markets are open.

Of course, futures markets are available nearly 24 hours a day but the pace of news flow “tape bombs” is much more leisurely in our oriental time zone.

It is ironic that, at the end of last week, this trend extended to the one “tape bomb” that you might have expected to have hit squarely during my waking hours. A leak from the BoJ at 2am Tokyo time ensured that my phone notifications were lit up like a Christmas tree by the time I woke up about 2 hours later.

Was this finally ‘The Big One’? The Bank of Japan’s potential abandonment of YCC (Yield Curve Control) was supposed to be the defining macro event of 2023. That may well end up being the case. However, Friday’s monetary “tweaking” was met with a whimper rather than fireworks in asset markets.

I am happy to concede that we had been clearly put on notice by Governor Ueda and his predecessor that any transition away from Japan’s loose monetary conditions would be gradual. The mistake this 🐿️ and others made was to view Japan’s YCC as being like a (binary) currency peg. Well, it turns out that you can be ‘half pregnant’ after all! Ueda-san threaded the messaging needle.

The BoJ pulled off the amazing feat of announcing that the yield on their 10-Year bond could be allowed to slip up to 1% but that it is unlikely that it would need to. This announcement completely short-circuited the machines and algorithms trying to interpret the news! Probably a win for humanity. We are not now dealing with a binary event. Nuance is required.

The bonds ended the trading week yielding a mere 0.07% above their old 0.5% cap. The currency was almost unchanged versus the US dollar.

We have been building positions in Japanese equities and the yen over the course of the year. I share many of my views on Japan with Chase Taylor of Pinecone Macro. He has just kindly taken down the paywall for his excellent March and May country reports on Japan. You can access them here.

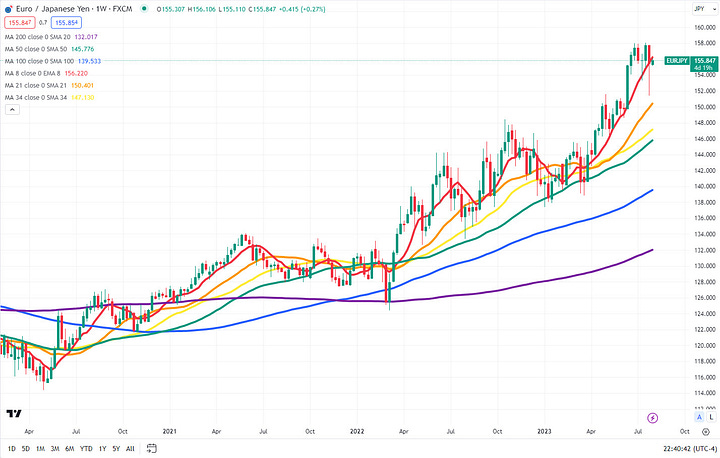

In our view, the fundamental bull case for Japanese equities is now approaching fully formed. We were adding to positions as recently as recently as the beginning of last week. To be honest, the equities have been working beautifully all year (we just wish we had bought more!). On the currency, we view the Japanese Yen as screamingly cheap. However, so far this year, we would have been 2.5x better off taking the equity exposure on a currency hedged basis.

So, the bad news is that we were ‘early’ (code for wrong) on the currency. However, the good news is twofold: (i) we do now believe that the starting pistol (on its revaluation) has now been formally fired with last week’s BoJ ‘tweak’; and (ii) the process of yield curve steepening will likely now be a gradual, incremental process.

This second point is of particular importance. A violent (upward) revaluation of the Japanese Yen was a major potential risk to the health of global macro markets. Even a small portion of Japan’s US$25 trillion of financial savings rushing to repatriate could create major supply demand imbalances in global bond markets.

Back in April, we discussed the implications of such a move in “Can I get a Squ-ISDA from JP Morgan” and shared the chart below. Japanese savers are huge players the bond and stock registers of the West. Market stability would certainly be at risk in the event of any sudden change to the status quo (and related removal of liquidity).

Traders and investors fantasize about making gains on major inflection points / turns in markets. A sudden inflection may well have been a case of ‘be careful what you wish for’. A win on your Yen trade would almost certainly have been negated by losses elsewhere in your portfolio. Did we get a flavor for what could have been with the post-Nikkeileak sell off in US equity markets last Thursday?

I was joking last week about the importance of being patient with the (long) energy trade.

I think the same thing now applies to the Long Yen trade. The Yen is the funding currency for global carry trades. With gradually rising rates a strengthening Yen, many of these trades should start to be unwound after a great run (particularly if some of the higher yielding currencies like the Brazilian Real start to enter a rate cutting cycle).

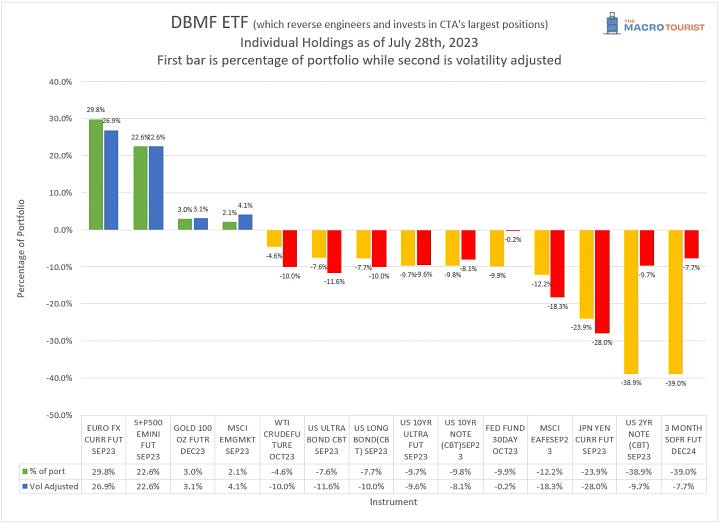

Once the carry trades start unwinding some of major multi quarter moves latched on to by the trend following CTA funds will start to reverse, triggering further major positioning unwinds. Kevin Muir is a fellow student of Andrew Beer’s CTA-replicator ETF, DBMF 0.00%↑ and fellow subscriber to DBMFwatch.

I have commented on DBMF’s massive JPY futures short before, but Kev went the extra step this week by volatility adjusting the fund’s weightings. The CTA community has a LOT of Yen to bring back in (and Euros to sell!) if the strong FX trends of the past few years start to go into reverse.

We now see Yen revaluation being a multi-quarter process and feel confident that the seeds of that process have now been sown. Up until now, our Yen trades have been excessively skewed towards a bet on a major macro event around individual BoJ meetings. We will continue to buy (more) Japanese equities unhedged. Going forward, we will play the currency via much longer dated options structures (readers can expect a new Acorn on this).

The 🐿️ is still waiting for ‘The Big One’ but is now going to be more patient.

++++

That’s it for the front section this week. In case you missed it, I joined Kevin Muir on The Market Huddle Plus last week, where we chatted about PE and the US Treasury market. Full Acorn Review and Portfolio Update below.