Weather Porn.

The Blind Squirrel's Monday Morning Notes, January 15th, 2023.

Summary

At risk of jokes about the inability of Brits to talk about anything else, this week we are going to talk about the weather.

Having a variant perception around medium and longer-term weather trends may still have alpha.

Certain commodities (such as natural gas and grains) are priced as if supply is infinite and demand in terminal decline. This may turn out to be a mistake. The 🐿️ certainly sees some potentially mis-priced risks.

The audio companion to this week’s note will be uploaded to Substack on Tuesday to allow me to incorporate comments and feedback from this note. It will also be available as a podcast on Apple, Spotify and the other usual podcast apps.

Weather Porn.

One of the challenges of choosing a topic for this front section on a weekly basis is trying to anticipate what will be discussed elsewhere, and then trying to take the note in a different direction!

As such, we shall not be discussing the following topics this week: Bitcoin ETF launches; Taiwanese elections; the bond market’s response to last week’s inflation releases; Houthi rebels and Red Sea container shipping traffic; uranium spot hitting ‘triple digits’; or indeed US bank earnings.

Instead, this week we are going to talk about the weather. At risk of jokes about the inability of Brits to talk about anything else, regular readers will know that the 🐿️ has spent a large amount of the time in recent months obsessing over color-coded weather maps of North and South America.

Drier and hotter summers in the US and Brazil, a wetter than expected Australian summer and a late starting (but now very aggressive) North American winter have all played out as we suggested might be the case.

To be clear, the 🐿️ is not a trained climate scientist or meteorologist. However, the long cycle climate work of Shawn Hackett and others has been central to our thoughts on grain markets and, more recently, natural gas positioning over the past 12 months.

Shawn’s long-term forecasts have been non-consensus but ‘spot on’ in the past year and I strongly recommend you catch up on his latest thoughts.

The current El Nino cycle is already weakening, and yet many media outlets are still stuck with a narrative around “Super El Ninos”. Fears of a repeat of the devastating drought and bushfires that took place during the last El Nino in Australia have been forgotten as we now focus on excess rainfall and flood damage. However, the 🐿️ is slightly at a loss as to why the ABC evening news down under is still talking about the damaging effects of El Nino.

Extreme cold temperatures have only just started to garner the attention of natural gas markets that had been battered by supply growth and (misplaced?) expectations of a “blowtorch warm” winter. The ‘winterized’ football jersey that Taylor Swift was wearing this weekend for the Chiefs/ Dolphins NFL playoff game seemingly got a lot more attention than the readiness of Texas’ electricity grid post its winterization upgrade efforts.

Last Friday, we published a new report on what we see as an interesting opportunity in the US oil refining sector.

The piece focused largely on the impressive balance sheet discipline and capital return potential of this group. However, there is also another (overlooked) climate angle associated with the opportunity. In this case, the possibility of an impactful Atlantic hurricane season later this year as La Nina conditions return.

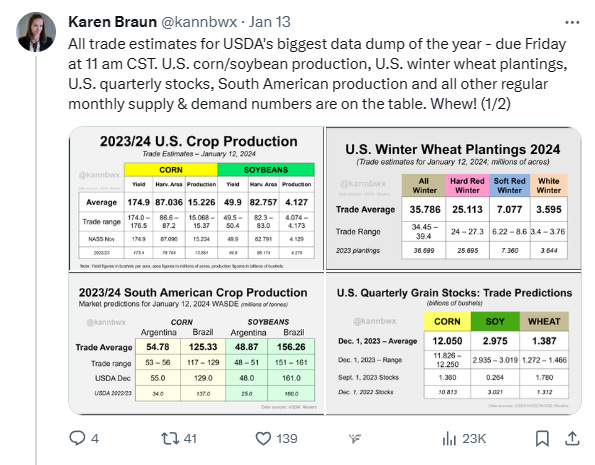

In agricultural commodity markets last Friday’s WASDE (bearish price) report from the USDA resulted in another battering of grain futures. The trading algorithms have now pushed corn and soybeans to fresh contract lows. According to Reuters’ much respected Karen Braun, corn had its worst January crop report day in 12 years! Recent optimism in wheat markets has also been rapidly reversed.

Futures positioning in the grains is now at record bearish levels.

The 🐿️ confesses to have been early wrong so far on our grains positioning. However, you have to be looking at some truly Panglossian assumptions (around yields and acreage…in 2 hemispheres!) to support this extreme level of negativity.

It should be noted that the USDA’s 156.26mMT estimate for Brazilian soybean production is a full 13mMT higher than the level estimated by Patria Agronegocios (respected private Brazilian agri-consultants) earlier in the week. One has to wonder whether or not the USDA data has gone the way of EIA’s energy supply/demand data and the BLS’s inflation inputs in terms of reliability.

Shawn Hackett makes an important related point: “I can assure you that Cargill, ADM etc. do not sit in a room and wait for the USDA to tell them what the truth on the ground in terms of grain supply is.”

The 🐿️ noted the volume spikes and remains in the same camp as those Friday afternoon dip buyers in the grain pits. Expect an updated ‘ags’ acorn in the coming weeks.

Sunday night futures markets are just opening as I write. It looks as though traders are trying to price a return of warmer temperatures in North America (10-15 days out - far right image below) back into NatGas prices. I am not going to take you down the rabbit hole that is the Polar Vortex and SSW events, but this may well be another example of a buyable dip.

As a decent proportion of the world’s private jets descend on Davos this week, we shall once again be treated to the usual diet of nuance-free pronouncements on ‘man-made’ climate change. Irony is not dead. I am of course sympathetic to the view that human activity has played a significant role in global warming.

The world should definitely be building more nuclear power stations and burning less coal (and don’t start me on wood pellets). One of the road trip podcasts that did not get a shout out in last week’s note was Erik Towsend’s ‘Broken Energy’ holiday special with Lyn Alden. This was an oversight. If you missed it, put it back in your podcast queue now. Everything is a derivative of solar energy.

We have sadly got to a stage of polarized political debate whereby any climate change narrative other than humankind’s carbon emissions (such as solar cycles, volcanic activity, Maunder Minimums etc.) are dismissed as fringe science at best, climate denialism at worst. This feels like a mistake, even if it makes messaging more complex. Nuance is hard.

The 🐿️ has no interest in being cancelled by either side of the debate. This rodent was brought up to be skeptical of anyone proclaiming certainty around any given topic. At the end of the day, I think that we can all agree that we have been witnessing a large amount of weather volatility in the past few years.

I suspect that we need to get used to ‘the unexpected’ when it comes to climate. When it comes to agricultural and energy commodities, trading is dominated by computers trained to react to micro changes in near-term weather models, ‘power burns’ or ‘barrel counts’. It is also human nature to extrapolate the current trend (which have certainly been negative of late).

Having a variant perception around medium and longer-term weather trends likely still has alpha. Certain commodities (such as gas and grains) are currently priced as if supply is infinite and demand in terminal decline. This may turn out to be a mistake. The 🐿️ certainly sees some potentially mis-priced risks.

That’s all for the front section this week. In the second section (for paid subscribers) we do a deeper dive into some of those mis-priced risks and review some of our recent acorn trades (specifically, our positioning in fixed income and long positions in energy, Brazil and UK midcap equities). We also give our updated thoughts on equity shorts.