Twitchy Whiskers

Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 40.

Reminder to RSVP for the London 🐿️ subscriber drinks on October 9th (this coming Thursday) if you have not already done so.

Yesterday I published a new Acorn trade idea around Natural Gas. Do check it out if you missed it:

Twitchy Whiskers

Everybody is winning at the moment. The physiotherapy clinics are overrun with patients exhibiting rotator cup injuries (from all the air punching). Last week, unless you were foolish enough to be short the semis (not guilty) or long energy stocks (definitely guilty), it was hard to lose money. Even US Treasuries got a bid just as the US Treasury lent $20 billion to bail out Argentinian soybean farmers (or was it their crushers?).

However, the 🐿️’s whiskers are twitching. Interesting to see that the relative losers of the week (energy aside) were:

The ‘momentum’ factor - represented by the MTUM 0.00%↑ iShares USA Momentum ETF. Are we beginning to run out of marginal buyers now that CTAs and vol-targeting funds are ‘full’ as we enter corporate buyback blackout season?

US financials -XLF 0.00%↑ (broad based financials), KBE 0.00%↑ (big banks) & KRE 0.00%↑ (regional banks). The yield curve stopped steepening at the beginning of September and we finally saw some credit spread widening last week - ‘Making sense of Junk’.

In the past couple of weeks, the BDCs (publicly listed private credit vehicles) have emerged from obscurity and are starting to become household names. I had a painful experience wearing the negative carry of shorting these things in 2023 (early = wrong!) and have been out of the broader ‘Team Saddlebags’ trade since the early summer.

BIZD 0.00%↑ (VanEck’s BDC Income ETF) is the ‘one-stop shop’ if you want to look at the names within the BDC sector. The ETF has drawn down over 12% since peaking in July but shorting them involves funding a 11.9% dividend yield (of course, that is for only while those dividends are still being paid…)

The outlet valve currently would appear to be the dollar. My portfolios have a strong USD-negative bias and I have been adding to hedges to protect me from a face ripper of bear market rally. So far this summer, it has been the dog that didn’t bite.

Last week saw the DXY give back most of its advance from the previous week. Perhaps another PM resignation in Paris this morning and the surprise election of Takaichi in Tokyo over the weekend will be the catalysts for the move we have been bracing for…

This FX fail comes at an interesting juncture for the 🐿️’s ‘Chart of Truth’ - we are now seeing repeated failure by the S&P 500 (SPY 0.00%↑) / MSCI EAFE (developed markets ex-US IEFA 0.00%↑) to break back above the 200-day SMA. It now looks like it wants to fail the Fibonacci retracements zones from the ‘Liberation Day’ lows.

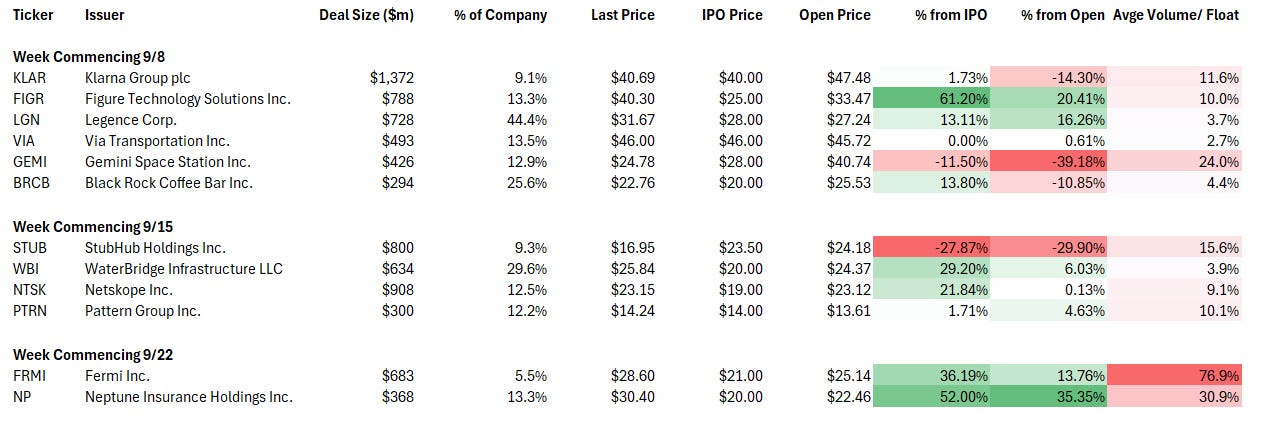

The crop of benchmark-sized (>$250m) US IPOs is shrinking with each week of the post Labor Day ECM launch window. This week’s harvest included the ‘red flag heavy’ FRMI 0.00%↑.

Both deals popped but feel like they were fueled by winners from the prior weeks. The crop from the week commencing 8th September was down almost 5% on average for the week. Both IPOs from this week (Fermi and Neptune) closed down sharply on Friday (reluctance to take weekend risk?). This is not a healthy picture.

Many argue that we cannot have market tops without a vibrant frothy IPO market. I might suggest that the bubble is simply taking place behind closed doors these days. Exhibit A: 👇

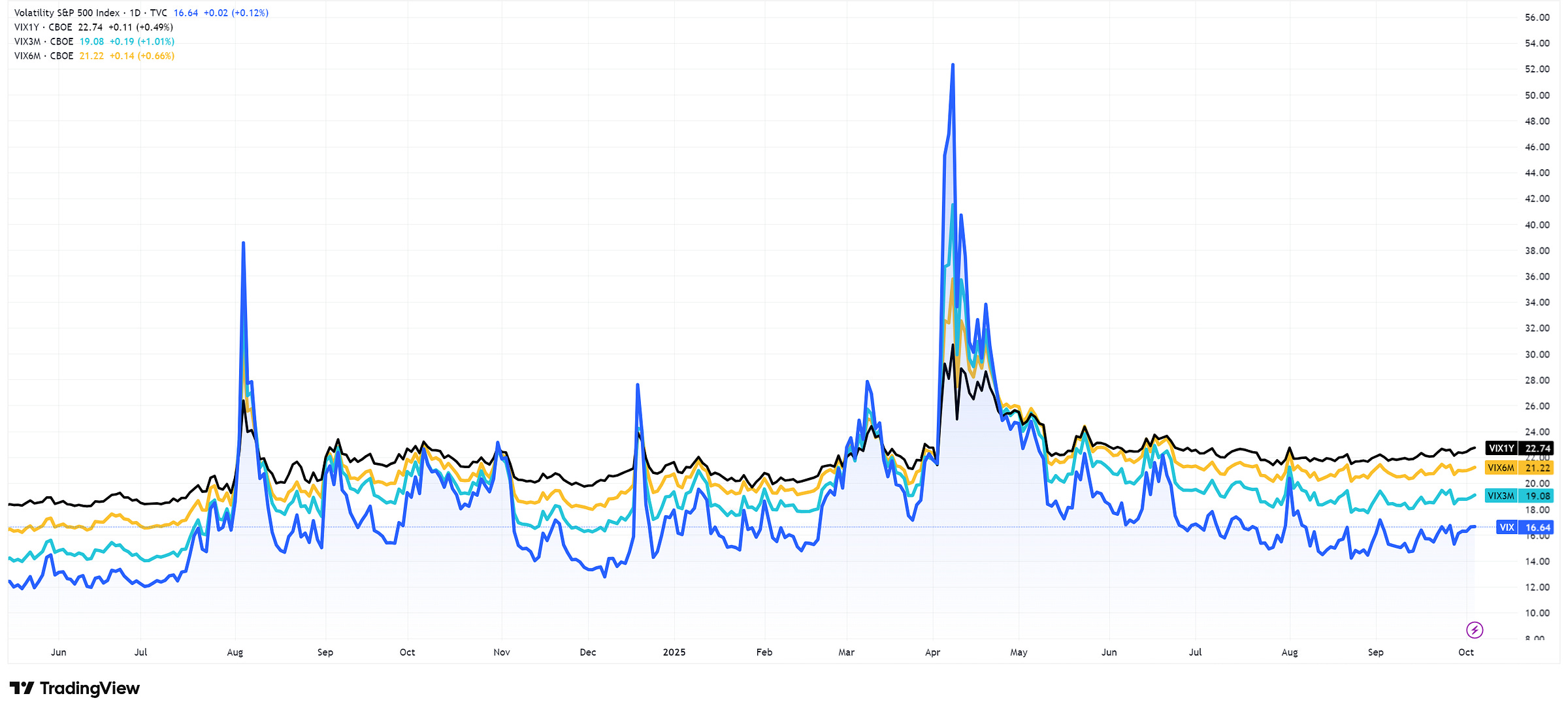

My final cause for twitchiness is the volatility VIX complex.

I have always been taught to pay close up to ‘stock up, vol up’ regimes. Well, we are in one now…

What does this all mean for my current book?

BUSHY™ Review

BUSHY™ added 92bps last week, lagging benchmark by 62bps but still well ahead on the year. I am pretty relaxed about the relative performance on week.

Let’s recap on positioning…