It didn't work for Brian...

The Blind Squirrel's 'Monday' Morning Notes. Year 3; Week 40.

It didn’t work for Brian…

I am going to retell a story. In my defense (beyond being a repetitive elderly Gen-Xer), (i) most of you were not subscribers to this letter when I told it over 2 years ago and (ii) last time I left out a couple of details that are highly pertinent to this week’s theme.

Natural Gas trading has always struck me as a unique form of masochism. In financial markets, there are many assets that have become traders’ graveyards. Short positions in Aussie banks and Japanese government bonds used to get a lot of the attention, but the rollercoaster that is the Henry Hub futures contract is the apex predator among the “widow makers”.

Back in September of 2006, the 🐿️ had a decent run of capital markets business raising private convertible debt for small energy E&P companies. As you can imagine, just 2 years ahead of the GFC, boundaries were being pushed in the pursuit of performance, and ‘style drift’ was rife among the hedge fund community.

These privately placed convertibles were certainly not for ‘widows and orphans’, but the guaranteed first call we made with a new deal was to a convertible bond arbitrage fund turned ‘energy specialist’ called Amaranth Advisors. They were an excellent lead investor for these (fairly racy!) deals. For a while it felt like the 🐿️ had become an in-house asset originator for the fund. Then one day, Amaranth no longer existed.

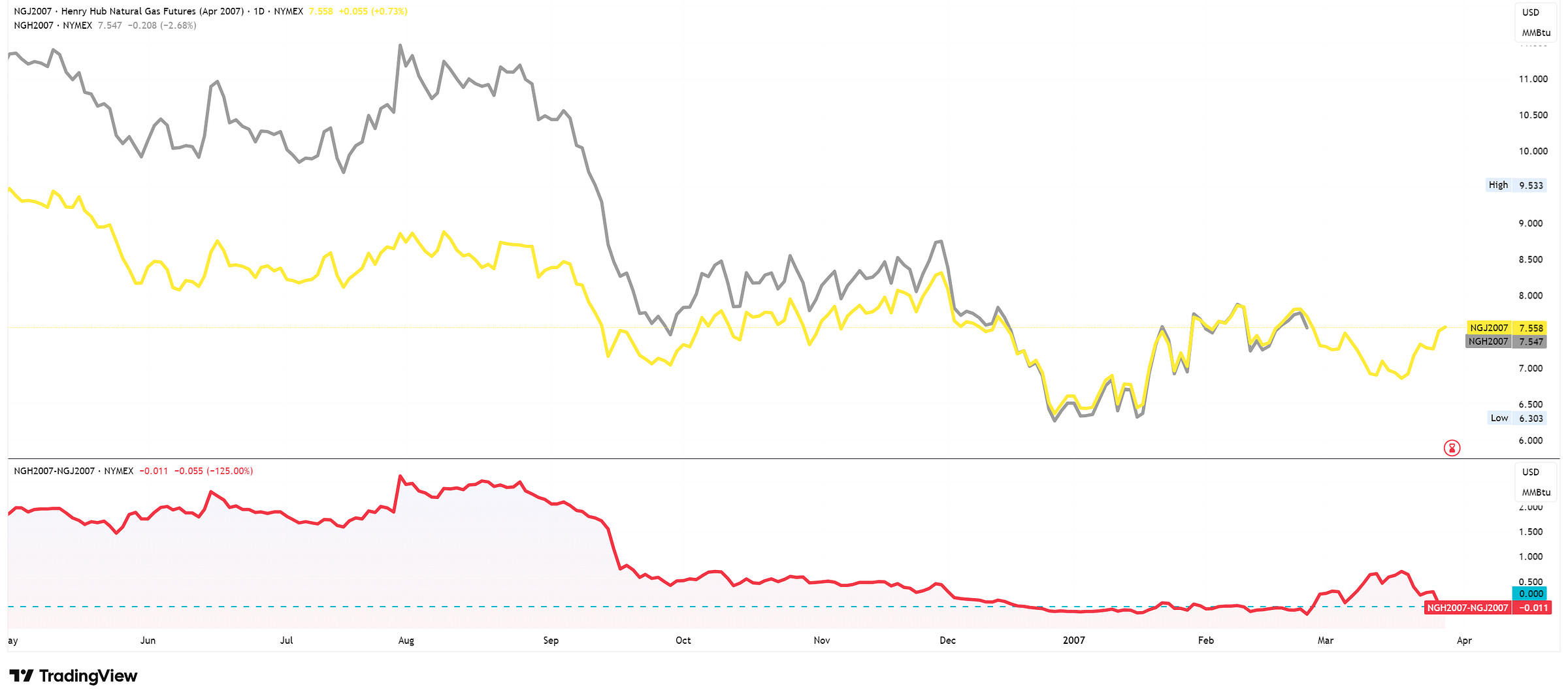

Amaranth’s chief energy trader, Brian Hunter, among various other eye-popping positions throughout the long term NG futures curve, was heavily long the notorious “H/J” spread in the Henry Hub natural gas futures market. Essentially this is when a trader is long the last ‘winter’ gas contract (March or ‘H’) against a short position in the first ‘summer’ contract (April or ‘J’).

The “H/J” spread is essentially a bet on winter being cooler than expected (triggering a spike in heating demand). According to the June 2007 Senate report on the collapse of the fund, as of July 31 2006, Amaranth’s trading in the March and April 2007 contracts represented almost 70% of the total NYMEX trading volume in each of these contracts in the summer of 2006. What could possibly go wrong!?

Well, pretty much everything did - a combination of mild weather and the absence of major hurricane disruptions over the summer of 2006 led to much higher levels of storage (for the winter ahead). Hunter’s offside positioning was spotted by John Arnold formerly a top gas trader at Enron by then at a rival energy hedge fund called Centaurus. He took the other side of many of Hunter’s positions in those winter contracts. Then came September - the spread collapsed by $2 per MMBtu. Goodnight Brian!

Turns out that even if Natty had not taken out Brian Hunter, most of those private E&P convertible bonds would have ended up defaulting on him in 2008! Amaranth was not the first fund or investor (and will certainly not be the last!) to be taken ‘to the woodshed’ by the NG widow maker. Don’t worry we are not ‘betting The Drey’ on this one!