The Tough lot of the Innkeeper

The Blind Squirrel's 'Monday' Morning Notes. Year 3; Week 32.

The Tough lot of the Innkeeper

The macro investment community is littered with very smart folk suffering from PTSD related to having made premature recession calls starting in late 2022. The scar tissue from getting aggressively long bonds too early or from serial incineration of equity put premium is still itchy.

Last summer, those insufficiently courageous to use the “r word” hid behind euphemisms such “growth scare” or “soft patch”. Don’t worry, the 🐿️ was guilty of it too - the anecdata was becoming overwhelming! The earnings call transcripts were littered with references to falling demand from the middle- and low-income cohorts of the economy.

It did not matter. While the AI capex train continued to boom, while the boomers continued to earn 4.5% in money market accounts and while the flood of fiscal spending continued to pour down on the economy it simply wasn’t possible that growth would dip into negative territory.

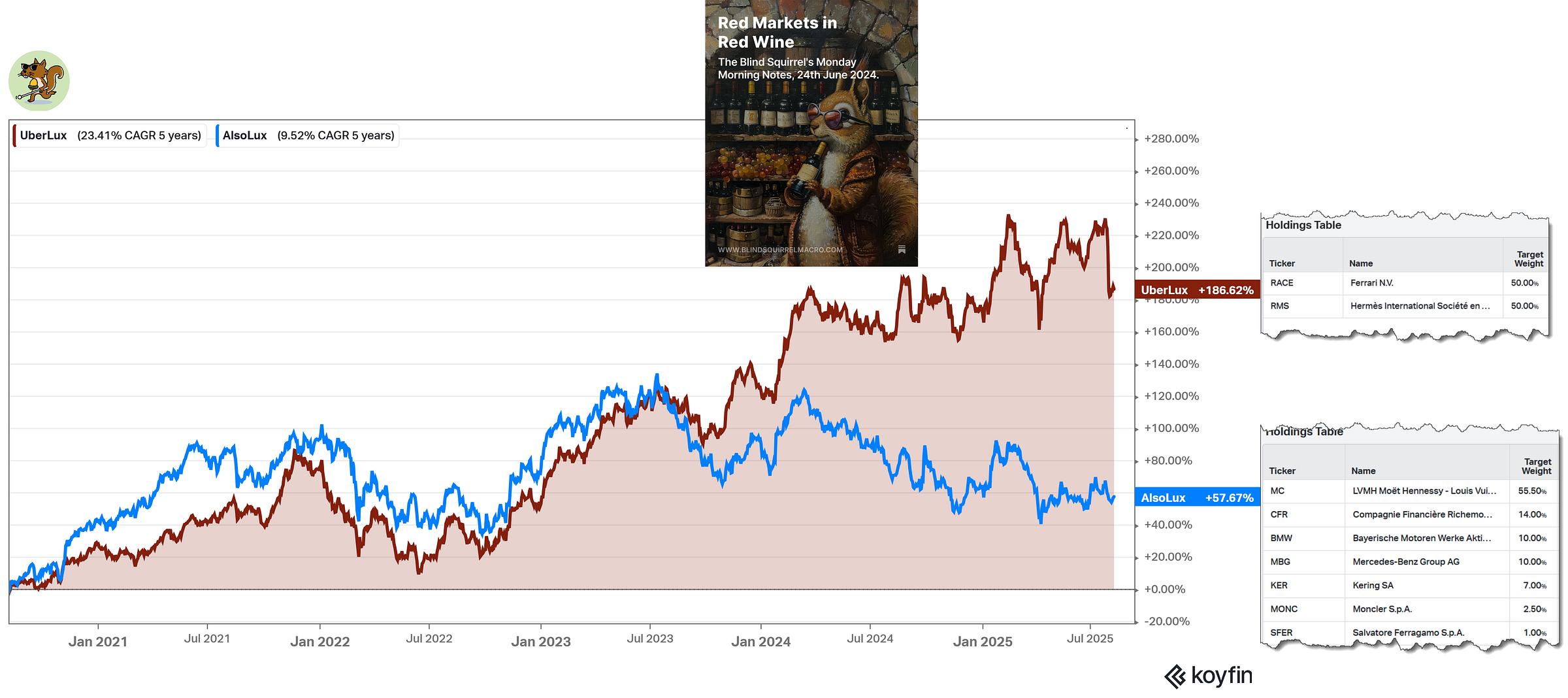

In June of last year, I noticed that the bottom had fallen out of the secondary market for luxury watches and fine Burgundy. Was demand leaching from the top 1% of consumers (ex the ‘UberLux’ consumers of the top 0.01%)? Since then, ‘UberLux’ (Hermes and Ferrari) has outperformed my ‘AlsoLux’ basket (LVMH, Richemont, BMW, Mercedes, Kering, Moncler and Ferragamo) by 30%. So, I guess the answer was yes. But still no recession.

In March of this year, a similar theme (combined with the ongoing Covid claw forward demand hangover) focused the 🐿️’s attention on the big-ticket consumption items (boats, RVs, snowmobiles and motorbikes). We are still short Brunswick and Harley-Davidson but have given back some P&L in recent weeks.

Part of the motivation behind our recent (short-lived) attempt to call the top in the bull market in feeder cattle - beyond the 🐿️’s destiny to lose money in agricultural commodities at least once a year - was a view that squeezed US consumers would start to ration their beef consumption if prices climbed much higher than the current $6 per pound at Costco.

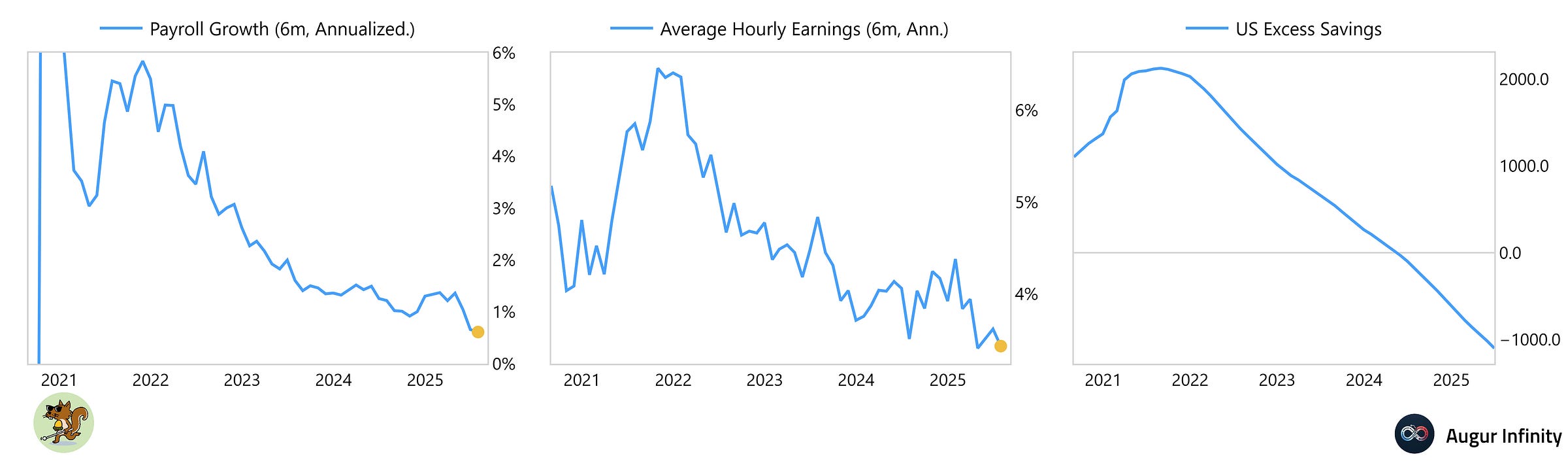

Take note that I was feeling brave enough to start fading Polymarket’s US recession odds in that note (well, sort of - consider that as a skeptical pink arrow!). In truth I am now sensing a real shift in the health of the US labor market. Mark Zuckerberg may be signing AI stars on ‘telephone number’ compensation packages but the rest of the jobs market does not look so pretty.

Survey-based data is probably giving us more head fakes than anything else. Not a Bureau of Labor Statistics personnel comment I assure you - just that societal polarization has turned most sentiment surveys into political polls in drag for several years now.

Check out Amanda Goodall’s ‘TheJobChick’ work. She uses an interesting methodology and reckons that Corporate America is cutting headcount rapidly and that, these days, most job postings on LinkedIn are fake! These are well paid jobs that are disappearing.

I think you can make a decent argument that the labor market is now rolling over. I also have a hunch that shifts in net migration are creating quirks in the data that may be flattering the reality employment numbers. All this comes just as US Excess Savings have been fully depleted. No bueno.

While Zuckerberg and his fellow Silicon Valley overlords are planning to spend more than $3 trillion over the next 3 years carpeting rural America with datacenters, headline GDP growth may continue to tell a conflicting story to what the jobs market appears to be screaming.

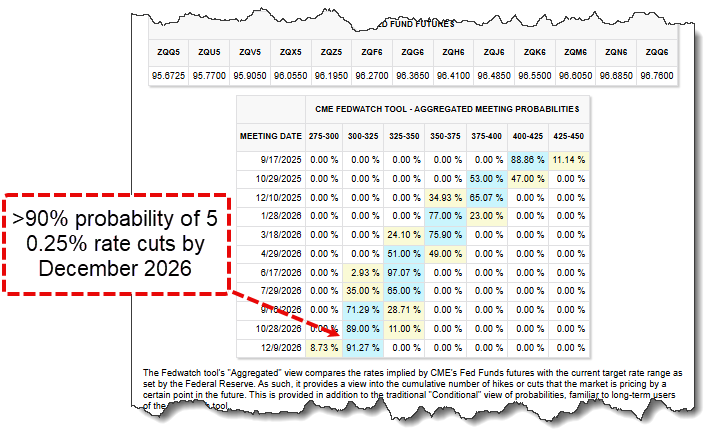

‘The Fed is always late, Squirrel!’ I hear you cry. ‘I guess you are going to tell us that now is the time to pile into bonds or SOFR call options!’. Nope, we shall not be doing that. No edge in the call. The Fed Fund futures are already pricing in 5 full rate cuts by December 2026.

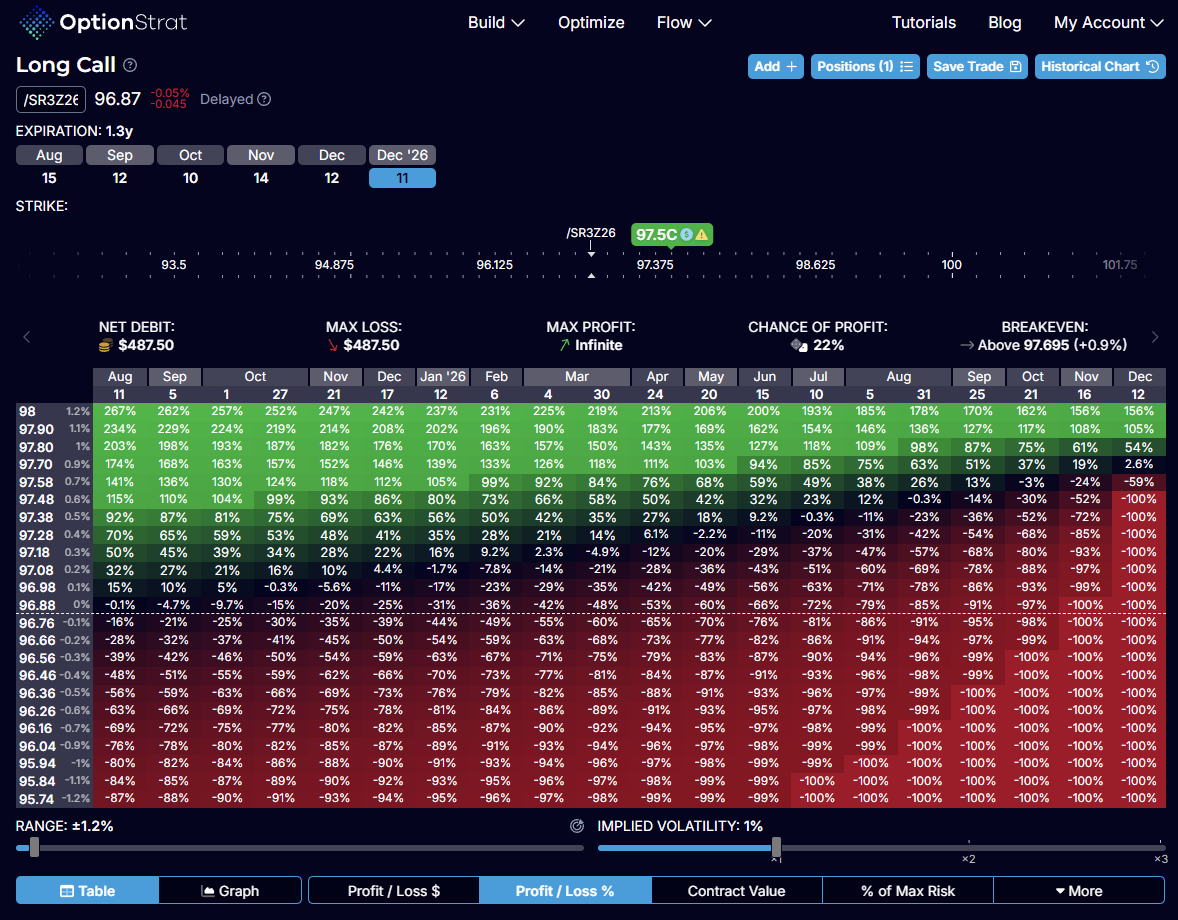

Let me put some numbers around this. Let’s say you are super bearish and think that 3-month interest rates will be back at 2% by Christmas 2026. You might think about buying a call option over December’26 3-month SOFR futures struck 97.5 (i.e., a 2.5% level for 3-month interest rates at that point in time). Being dead right on that massively out of consensus call would only pay off 3.67 to 1. Not great expected value.

We are going to leave the short-term interest rate market alone and do something else. During my recent chat with Matt Zeigler (which aired last Thursday), I shared some background about my early life which gives me some personal perspective on an industry that really does not react well to the combination of falling disposable incomes and sticky inflation.