The 🐿️ takes a look at the long bond again.

Our insurance policy against US rates market meltdown ($TLT Acorn) needs to be rolled. Much has changed but we still want the insurance.

Summary

The economic picture remains confusing. As / when / if [delete as appropriate] the US recession hits, a very large crowd is convinced that an overweight position in long dated treasuries will protect their portfolios.

The 🐿️ is not convinced. We need to renew the treasury market meltdown insurance that we put in place back in April and think it looks even more interesting this time.

The 🐿️ takes a look at the long bond again.

Back in April, we published this Acorn (link 👇), contemplating forms of insurance against an ‘accident’ in the US Treasury market. The Acorn was a put option structure on TLT, the iShares 20+ Year Treasury Bond ETF (with a long-only alternative in the form of PFIX 0.00%↑ for those that don’t use options). It’s time for an update.

So, let’s take a look at what has shifted in terms of price and narrative.

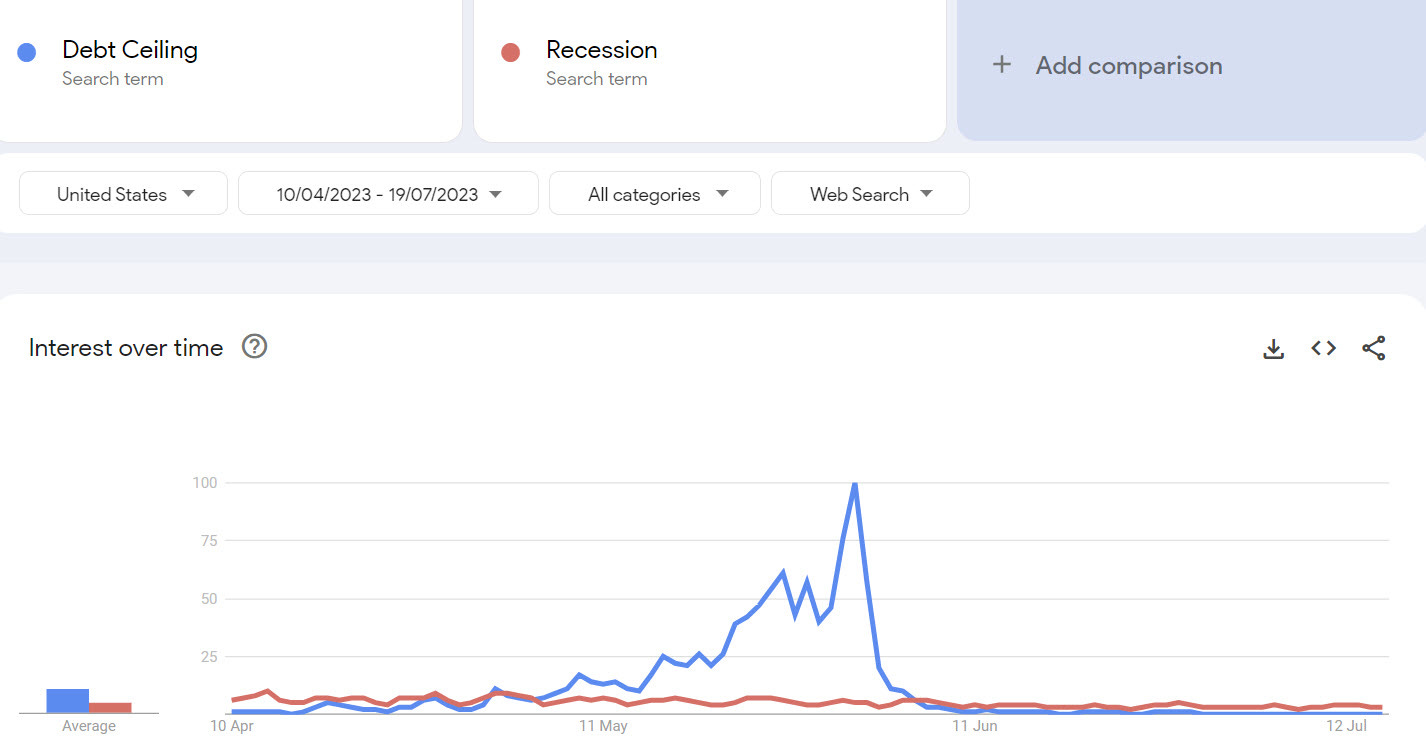

Back in April, we were dismissive of the ‘soft landing / no landing’ narrative that was beginning to emerge with respect to the US economy. Debt ceiling panic stations at the time were not even a glint in the milkman's eye.

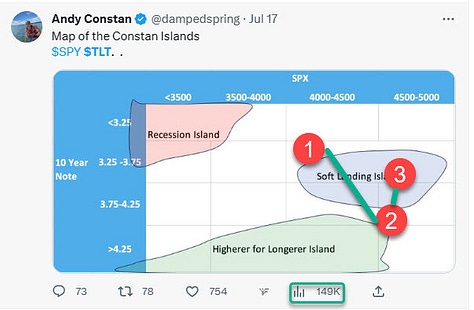

Former 🐿️ (‘Solly’) colleague Andy Constan has (deservedly) received plentiful praise for his framing of the ‘narrative arc’ in markets over the past 9 months plus. His ‘Constan Islands’ framework describes the status of the recession debate by market participants, cross-referenced with price levels in the S&P 500 and US 10-year yields.

So, what about price?

Well, TLT 0.00%↑ is off about 5% and earlier this month spent a fraught couple of days in sub-$100 per share territory - an area [in price] being described by some as the edge of a potential precipice for the ETF. However, treasury volatility has dampened down significantly since April (when rates markets were still recovering from the regional banks crisis).

Although TLT 0.00%↑ has been weak, the fall in treasury volatility has kept the trade out of the money so far1. However, recall that our structure was designed as catastrophe insurance that paid out in the event of total Treasury market disfunction. Something that we have not yet seen.

The focus of our concerns back in April was the risk of a ‘buyer’s strike’ in the US Treasury market akin to what greeted ‘Trussenomics’ in the UK Gilts market back in Q4 2022 (remember the cabbage?). We are more than comfortable with the small loss of premium. More than that, we feel that the US Treasury market is yet to be tested in earnest (i.e., who is going to buy long bonds in size from the US government?).

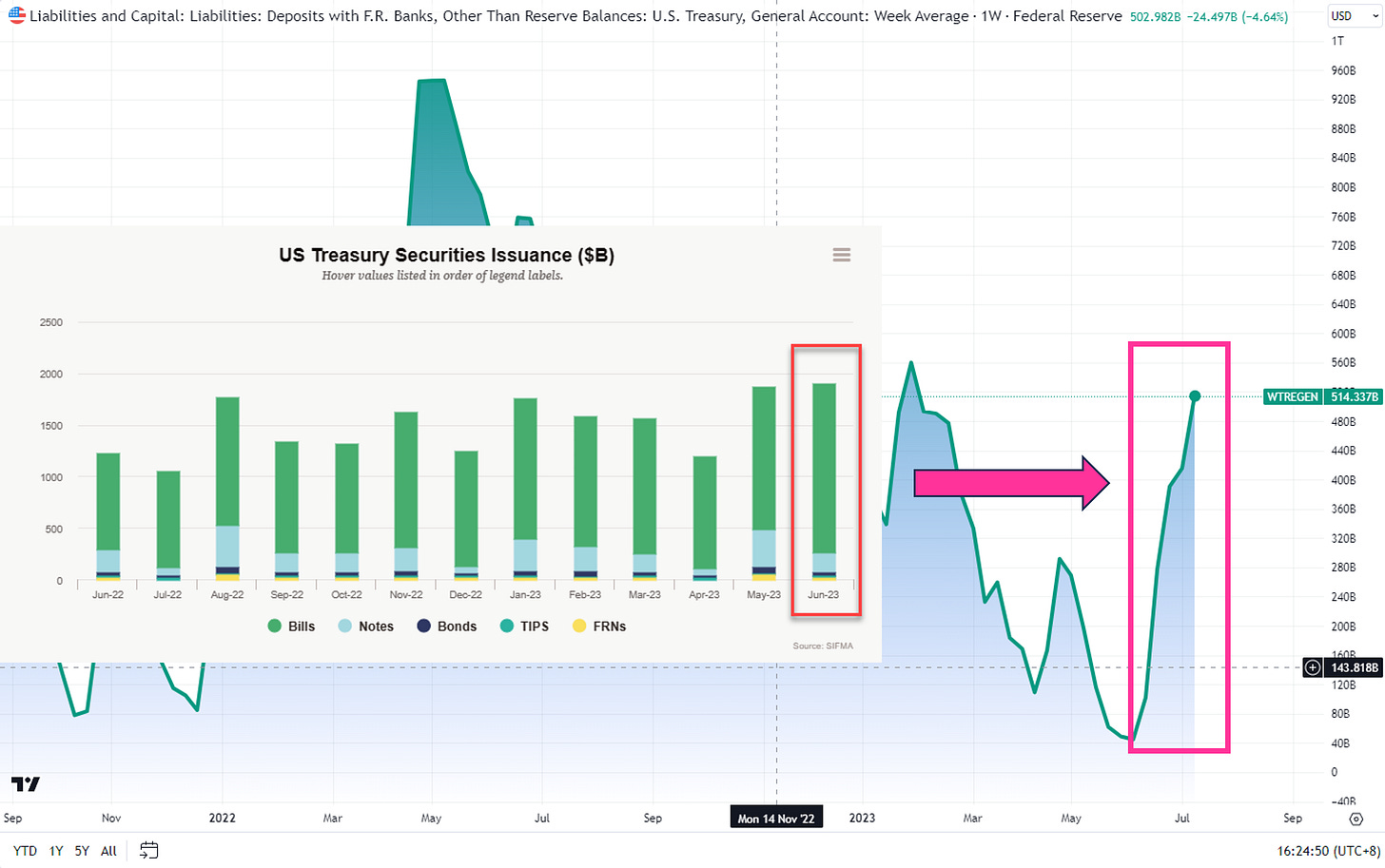

Since the resolution of the debt ceiling at the tail end of May, Mrs. Yellen has been a busy ‘Games Master’ (TM Jim Leitner). She has been refilling the Treasury General Account (the US Government’s checking account at the Federal Reserve) via the issuance of (a LOT of) Treasuries. The vast majority of this issuance (US$1.64 trillion!) has been via short term T-bills2.

In other words, Mrs. Yellen has not yet been testing the longer duration markets. We speculated on Monday that her recent trip to Beijing might have been a ‘pre-marketing’ exercise for when she needs to term out her liabilities in earnest. This was rampant rodent speculation for which the 🐿️ (among others, looking 👀👀at you Kevin Muir & Chase Taylor !) got an admonishment from Brent Donnelly (no shade, the 🐿️ is a long-standing happy subscriber to his excellent AM/FX letter).

I am coming at this from a simplistic former capital markets banker’s perspective: ‘who buys long term debt from a degenerate spender?’. I am 100% fine to lend money to ‘Uncle Sam’ at 5% - but for 90 days at a time, maybe 2 years at a push! For 10, or even 30 years at 4% with a risk of re-emerging inflation?3 Not so much!

Readers should definitely take a moment to review this excellent presentation from Russell Clark4 on TLT 0.00%↑ (TLDR - the clue is in the title: “DO YOU OWN TLT? ARE YOU BRAIN DEAD?”). I am assuming he has been crossed off Hugh Hendry’s Christmas Card list…5

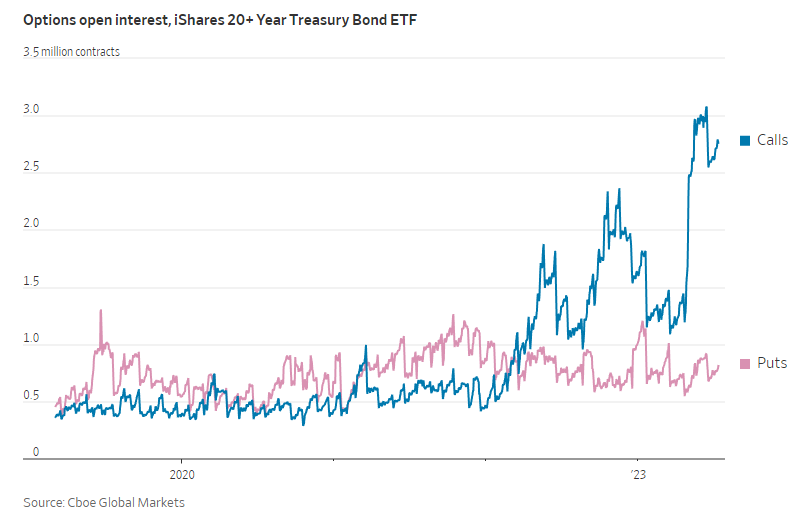

But, it does appear that Mr. Hendry’s ‘Sermon from St. Bart’s’ may have found a large audience. Fintwit OGs Paulo Macro and Kuppy were quick to jump on this chart earlier this week.

Now, I grant that TLT is unlikely to be the instrument of choice for institutional positioning (i.e., this could well be a poor signal as to the bigger picture but is directionally interesting). In addition, basis trading confuses the picture if you try and draw conclusions from COT data from the Treasury futures market.

Anyway, the traders that have been buying TLT call options are following the conventional recession playbook. They are taking the view that as the economy hits recession, the Fed will cut the Fed Funds rate and that the price of long-term treasuries will in turn appreciate. They all think that they are going to make out like Paul ‘Tudor’ Jones in 1987 (he made the money being long bonds not short stocks in that crash).

To reprise what I wrote in April:

Convexity Maven, Harley Bassman has long been arguing that the market response to a recommencement of rate cuts by the Fed may in fact be a RISE in long end yields. The traditional wisdom in developed markets is that recessions kill inflation. Every time. What if Twitter’s inimitable Paulo Macro6 is correct in that we all now need to be thinking in (Brazilian) Portuguese (i.e., this time we follow an emerging market playbook)? The risk of a premature re-loosening of monetary conditions is that it triggers a reacceleration of inflation. If enough players in the bond market believe the same thing, maybe we face a “buyers strike” in long dated paper this time? This has not happened before. Therefore, it is very hard to make this a ‘base case’ view. However, the 🐿️ is always attracted to expressing views on outcomes which we think that the market is potentially underpricing. Size appropriately (i.e., SMALL!)

I think it is time to renew our little insurance policy (read on below). For readers not interested in options trades, either get yourself familiar with the PFIX Interest Rate Hedge ETF from Simplify or make sure your rates exposure is focused on shorter maturity debt (ideally inflation protected too).

Before you go to the technical section, a quick advertisement. We have just launched our new referral program. Details here 👇 or simply just start referring friends via the button below.

The new trade.

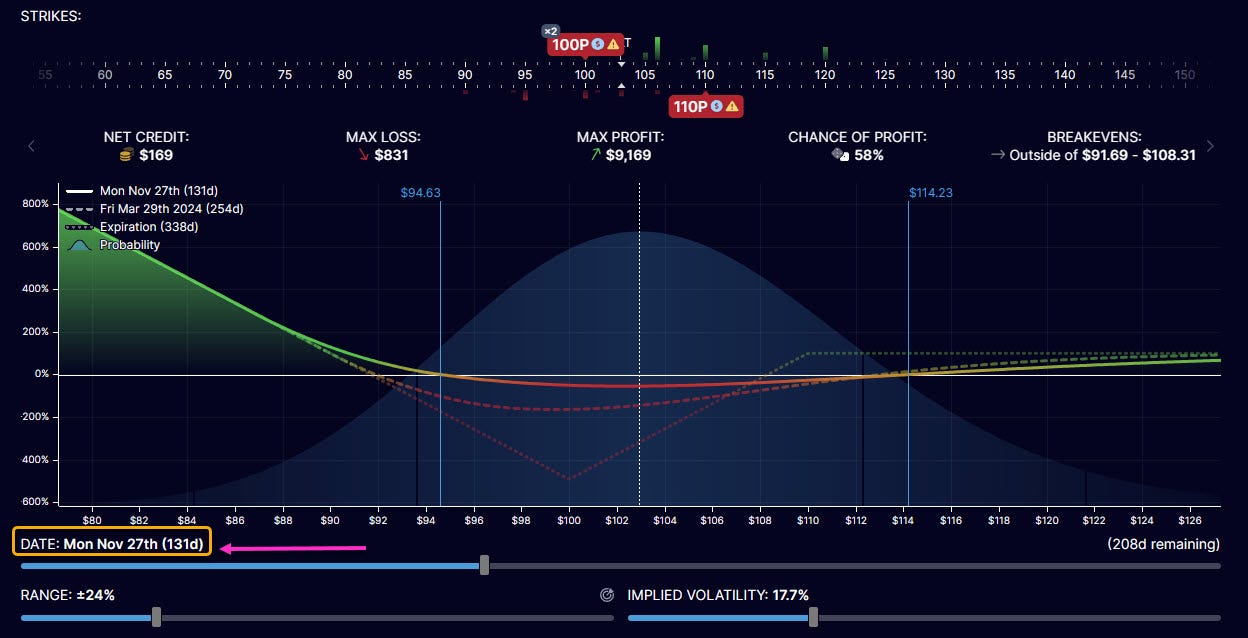

We have rolled the existing put ratio backspread out to June 2024 without adjusting the strike prices of the put options. Remember that we NEVER EVER hold backspreads to maturity. As such, we are effectively rolling this trade out to Thanksgiving time (i.e., late November) i.e., adding about 4 months to our insurance policy.

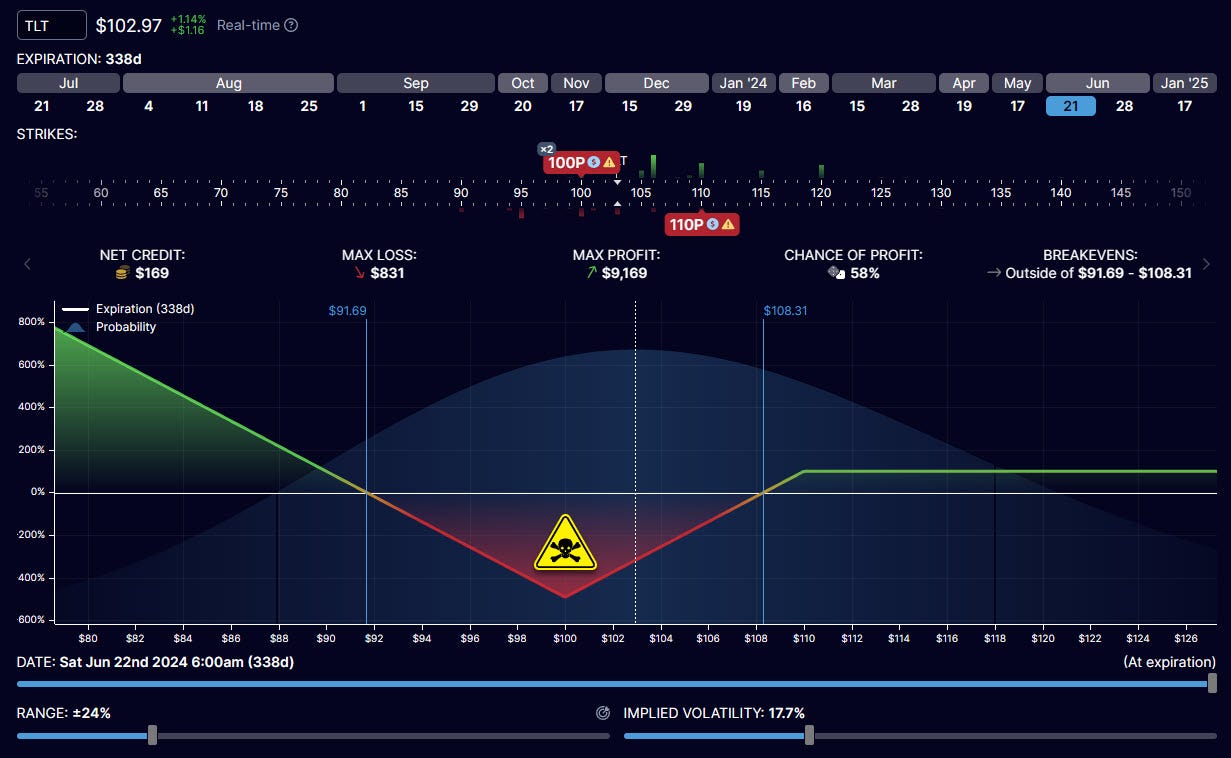

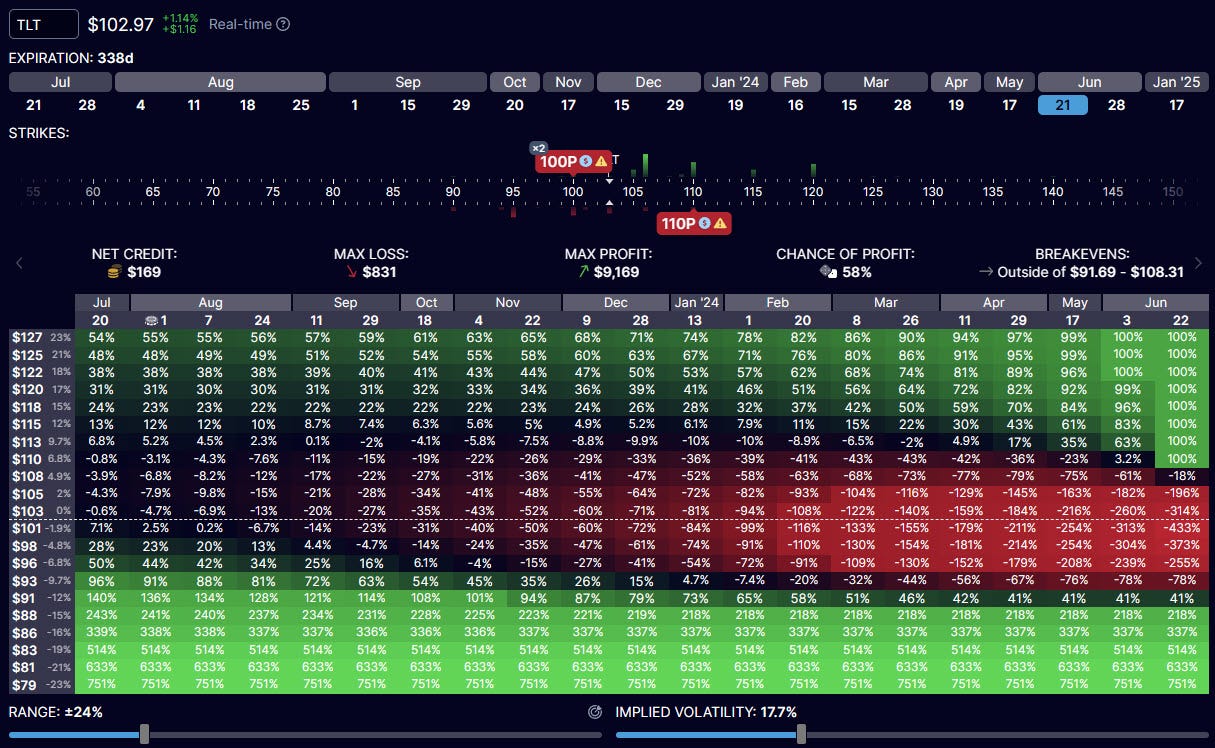

The new structure is as follows:

SHORT 1 x June 21st, 2024, TLT PUT struck at US$110 per share (further in the money than it was in April, creating a net credit for the trade)

LONG 2 x June 21st, 2024, TLT PUT struck at US$100 per share

As per normal, you can review the structure on OptionStrat here. However, this week, we are going to try and do something a little different. I have recorded a short video to take you through the trade on the payoff simulator on OptionStrat.

For those that hate British accents or video, here are the usual pictures (with embedded links to the model):

What I like about the structure is that even if the St. Bart’s crew end up being correct with their out-of-the-money TLT calls, we still probably make a little bit of money. On the flipside, if Mrs. Yellen has a shocker; this insurance policy pays out aggressively.

This is not an entry level option strategy, so please make sure you fully understand the product before messing around with it.

That’s all for today. If you enjoy the 🐿️’s work, please refer a friend via the button below and don’t forget, rewards are available!

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

PFIX 0.00%↑ would have been a better trade over this time period (+5%-ish over the period) but would have tied up a lot more of your capital.

Selling this quantity of T-bills has not been a challenge given the interplay between the Fed ‘Reverse Repo’ facility and private sector money market funds. The 🐿️ is not a US Treasury ‘plumbing’ expert. For detailed explanations of how those markets work, I strongly recommend that you read some of Concoda’s legendary explainers.

On the topic of re-emerging inflation, 🐿️ favorite Vincent Deluard of StoneX came out with this salutary reminder about serial peaks in inflation. We just had the first wave, if the history of the ‘40s/’50s and ‘70 but they come in 3s!

I am pretty sure this is outside of Russell’s paywall but not 100%.

Can you imagine what those cards would look like?!

Paulo was back on Twitter with an exceptional thread overnight on this topic. Recommended reading. I completely agree with him that if you HAVE to own US rates, then own 2-year TIPS (where you get 3% plus inflation) or hang out with the 🐿️ in the very short end.

Thanks Ru. Good stuff. Love the trade. Vid too, good to see the software I action. Best, Ken!

Great piece, the video is also a great way to complete the article