The 🐿️'s BUSHY™ Hedge Book

The Blind Squirrel's Monday Morning Notes, 13th January 2025.

Last week saw the launch of BUSHY™ - a Long-Only Multi-Asset portfolio comprised of US-listed exchange traded funds (ETFs).

This week we introduce the accompanying hedge book and defend BUSHY™’s overweight position in Europe, ‘Ye Olde Continent’.

The 🐿️'s BUSHY™ Hedge Book

It’s getting giddy, isn’t it? Last night, I was forwarded the weekly wrap from Goldman Sachs’ fixed income and FX strategy team. Its title: ‘The USD is King’. In a breathless extrapolation from Friday’s scorching hot jobs number, the note exhorted Goldman’s clients to press dollar longs (versus everything) as “our favored expression for the “US exceptionalism that continues to dominate”.

As an afterthought, the note half-heartedly suggests buying the dip in short-term interest rate futures as a hedge against a cyclical turn that is, I paraphrase, “clearly not imminent”.

Minutes later I exchange WhatsApp messages with a very experienced strategist friend just returning home from a week of meetings with ‘hedge fund central’ in New York. Any suggestion by him in his client meetings that 2025 might not see yet another year of dominance by the Magnificent 7 of US large cap tech was met with universal derision and facial expressions that implied that he had a second head protruding from his neck. Recency bias alert!

Exceptionalism is now fully embedded within the political zeitgeist too as we witness the emerging ‘all stock merger’ between the overlords of Silicon Valley and MAGA World. This 🐿️ muses that ‘Sir Nick’ Clegg possibly broke Usain Bolt’s 100-meter world record as he fled from Facebook’s Menlo Park HQ, having just seen his boss book himself in for a 3-hour catch-up with Joe Rogan.

The exceptionalism now appears to extend to geopolitics. A campaigning platform of American Isolationism appears to have morphed into some kind of New American Imperialism fantasy. Back in November, in ‘Lost Umbrella’ your rodent wrote that “the afterburners must now be ignited for a European defense apparatus that is already nervous about reliance on the US security umbrella”. With hindsight, was this possibly an understatement?

The recent statements about Greenland / Canada / Panama have clearly triggered more than a surge of Google searches for ‘Monroe Doctrine’ in Europe’s corridors of power. It’s probably now time to do more than dismiss it all as mere ‘Art of the Deal’ rhetoric. Spare me those European plastic bottle cap memes. It’s game time. However, in ‘The Night Before Christmas’, ‘St Nicholas’ had some wise words for the 🐿️:

"Don't count out Ye Olde Continent," he said with a grin,

"When pessimism's high, that's the time to jump in!"

Well, in the early days of this new year, pessimism about Europe (and the UK) has reached fever pitch levels. Even the most fervent ‘Sovereignty purists’ of the UK’s right-wing tabloid press are expressing a touch of envy as they look across to their 54,000 (fellow European) Inuit cousins of the North Atlantic.

Consumer and business confidence measures are now matching the negative valuation and equity fund outflow charts for the ‘Old Continent’.

Your rodent firmly believes it is now the time to focus on what can go right in ‘Ye Olde Continent’. Positioning is so negatively skewed against European risk assets that it would not take very much at all to trigger dynamic returns. Never forget that some of the best investment returns are enjoyed during the transition from ‘dire’ to ‘improved’.

The new US administration would appear to be creating the kind of geopolitical tectonic plate shifts that might finally force an end to the continent’s political gridlock and provide the impetus for a popular / populist (tomato / ‘tomayto’) reinvestment in growth.

Could, for example, Germany finally relax its ‘debt brake’ and embrace fiscal stimulus? Could the European Commission now look to embrace Mario Draghi’s 328-page ‘The Future of European Competitiveness’ report. Is now the time for serious consideration to be given to some consolidation in Europe’s banking and telecom markets?

An end to hostilities in Ukraine would appear to be high on the MAGA shopping list. If so, would half a trillion dollars of Ukraine reconstruction plus European defense investment to replace a diminished US security umbrella not seem like an obvious source for a near-term economic win?

Is Europe’s exposure to potential US tariffs really as extensive as the headlines suggest (once adjusted for (exempt) services and local US production)? Especially if the continent is able to balance trade deficits rapidly with purchases of US LNG to replace the energy that previously came from Russia?

Finally, what if China finally starts to stimulate its economy in earnest? Great news for Europe’s struggling exporters!

None, I repeat, none of the above is priced right now.

This rodent has his money where his mouth is. Last week, we launched BUSHY™, a Long-Only Multi-Asset portfolio comprised of US-listed exchange traded funds (ETFs). The equity component of BUSHY™ is unashamedly underweight US assets relative to its ‘Big Retirement’ benchmark (a Vanguard ‘target date’ fund).

One of the key building blocks of BUSHY™’s international equity allocation comes in the form of DTH 0.00%↑, WisdomTree’s International High Dividend ETF. 74% of DTH’s assets are Europe-based and around 72% of DTH is allocated to ‘old economy’ sectors (Financials, Industrials, Utilities, Energy and Materials).

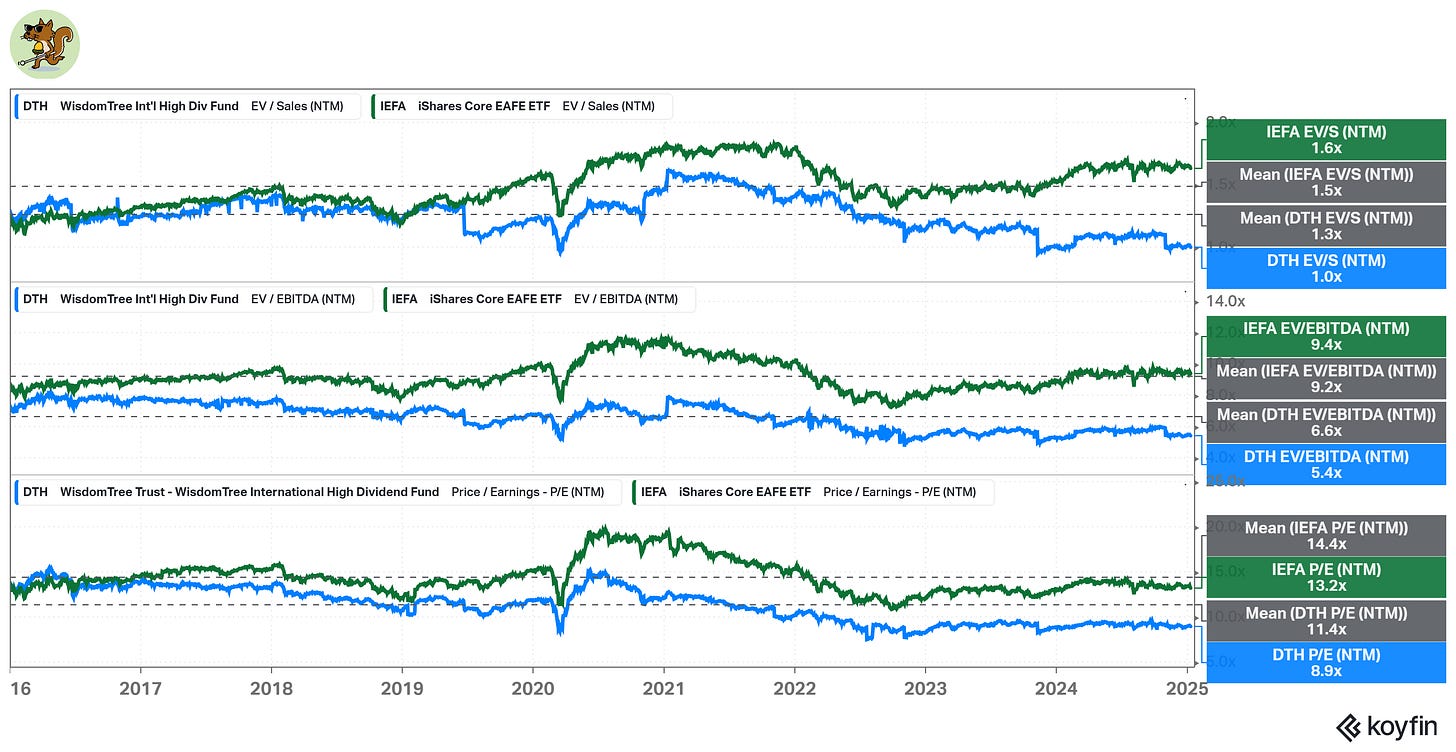

These sectors are low beta (average for all constituents is 0.84 - we very much like that factor for our international equity exposure). In terms of valuation, the DTH portfolio is trading a substantial discount to both the (ex US) MSCI EAFE Index of international developed market stocks as well as its own trading multiple history (on an EV/Sales, EV/EBITDA and PE basis).

DTH’s correlation with global equities has dropped dramatically in the past 5 years and is very much a ‘low vol’ asset.

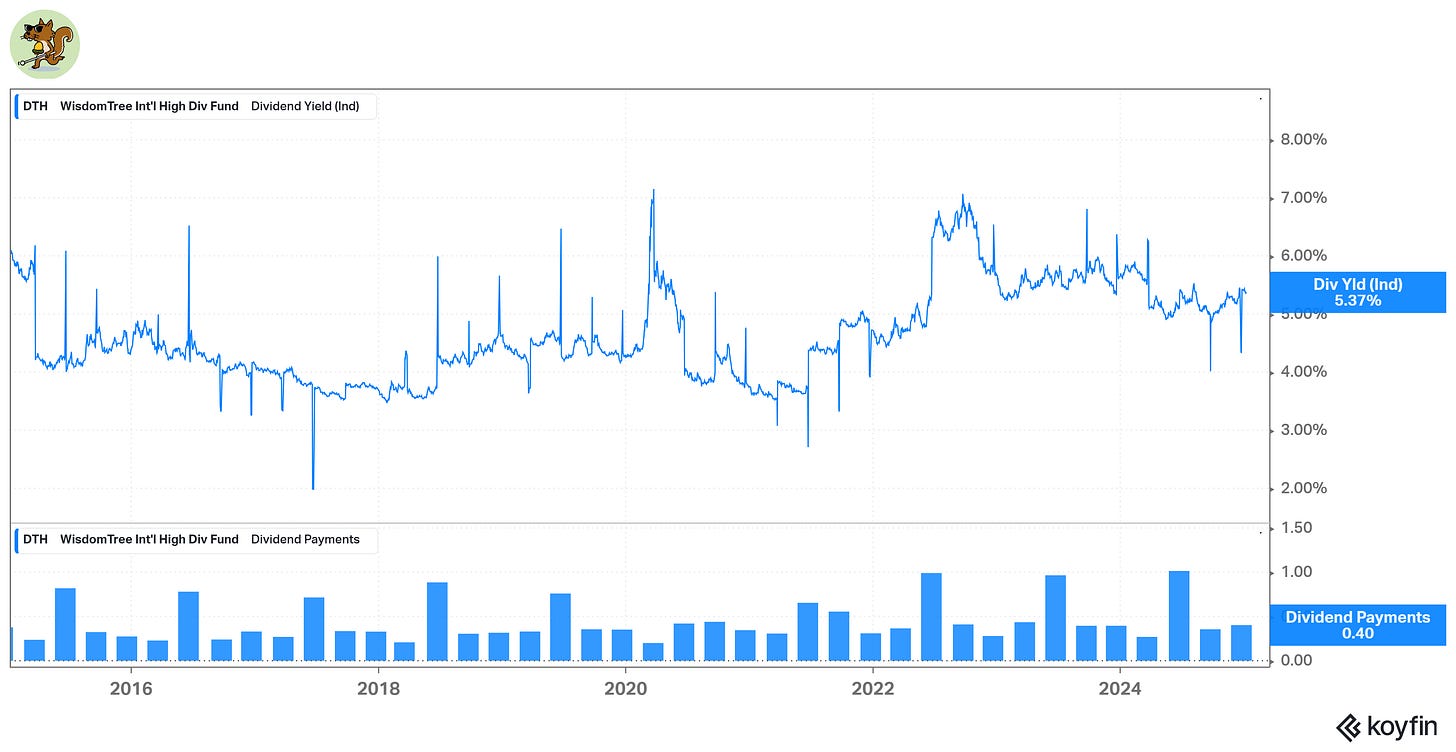

Meanwhile you get ‘paid to wait’ for those potential catalysts that I mentioned. DTH’s indicated dividend yield of 5.37% is 2.59% above the ECB’s current policy rate.

Let’s take a quick look at the charts:

DTH is yet to make a positive contribution to the BUSHY™ in 2025 (with a negative 8 basis points of portfolio attribution year to date). However, the 🐿️ has high hopes for the contributions that might come from the dividend heroes of Ye Olde Continent.

BUSHY™ gave back some ground on Friday’s (post-NFP) risk asset sell-off having had a strong 2025 debut. The portfolio’s ‘bond alternative’ allocations provided precisely the diversification we were looking to them for. The 🐿️ gives thanks to the trend-following robots.

BUSHY™ is positioned for a market in 2025 that looks very different from what global risk assets experienced in ‘23 and ‘24. However, we have to protect ourselves from relative performance pain in the event that recency bias was indeed the right way forward for the year to come. We carved out an allocation in BUSHY™ for a risk budget for hedges against our core macro views.

In Section Two of this week’s letter (for paid subscribers), we introduce that hedge book in detail.

Join hundreds of smart investors and market watchers by becoming a paid subscriber to Blind Squirrel Macro and receiving the other 65% of 🐿️ content (including these BUSHY™ hedges, members’ Discord access (The Drey) and even ‘limited edition’ merch!).