Testing Times for Bazball

Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 47.

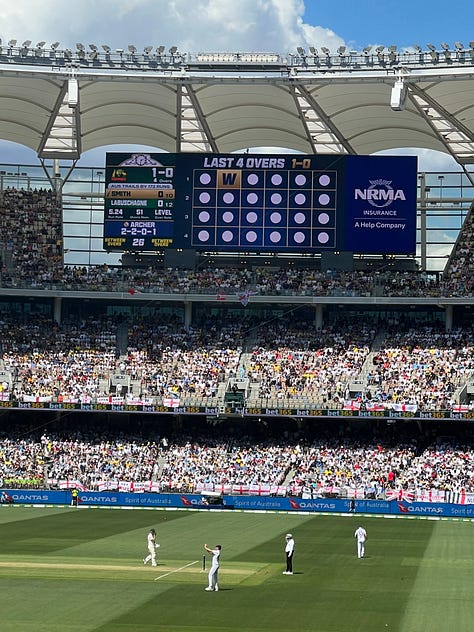

The 🐿️ is back in Melbourne after spending the weekend in Perth fulfilling a lifetime ‘bucket list’ ambition to see an Ashes Test1 live on Australian soil. He did not count on seeing the entire (5 day!) game… in 2 days! It was a true ‘we are so over!, we are so back!, and it’s gone!’ rollercoaster.

‘Bazball’ is the swashbuckling, combative brand of cricket brought to the English Test side by its head coach Brendon McCullum. As Général Bosquet said of the ‘Charge of the Light Brigade’ during the Siege of Sevastopol in 1854: “C’est magnifique, mais ce n’est pas la guerre: c’est de la folie”.2

A ‘Bazball’ approach to trading would be ill-advised for current market conditions. We have been in the midst of a collateral collapse not dissimilar to either of England’s two innings on Friday morning and Saturday afternoon.

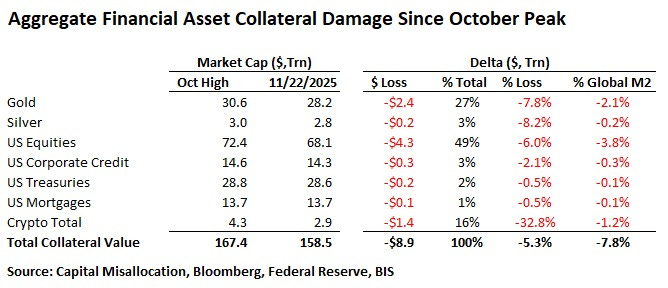

My friend and podcasting partner, Ben Brey (Capital Misallocation) has added up the damage. It all appeared to start with that flash crash in crypto markets in early October…

… but has leached into most other asset classes. Since the October highs, a staggering $8.9 trillion of financial asset collateral has evaporated, equivalent to almost 8% of global money supply. This is a proper deleveraging. For perspective, the US Treasury market drawdown during the 2022 rate hike cycle amounted to “only” $3.6 trillion.

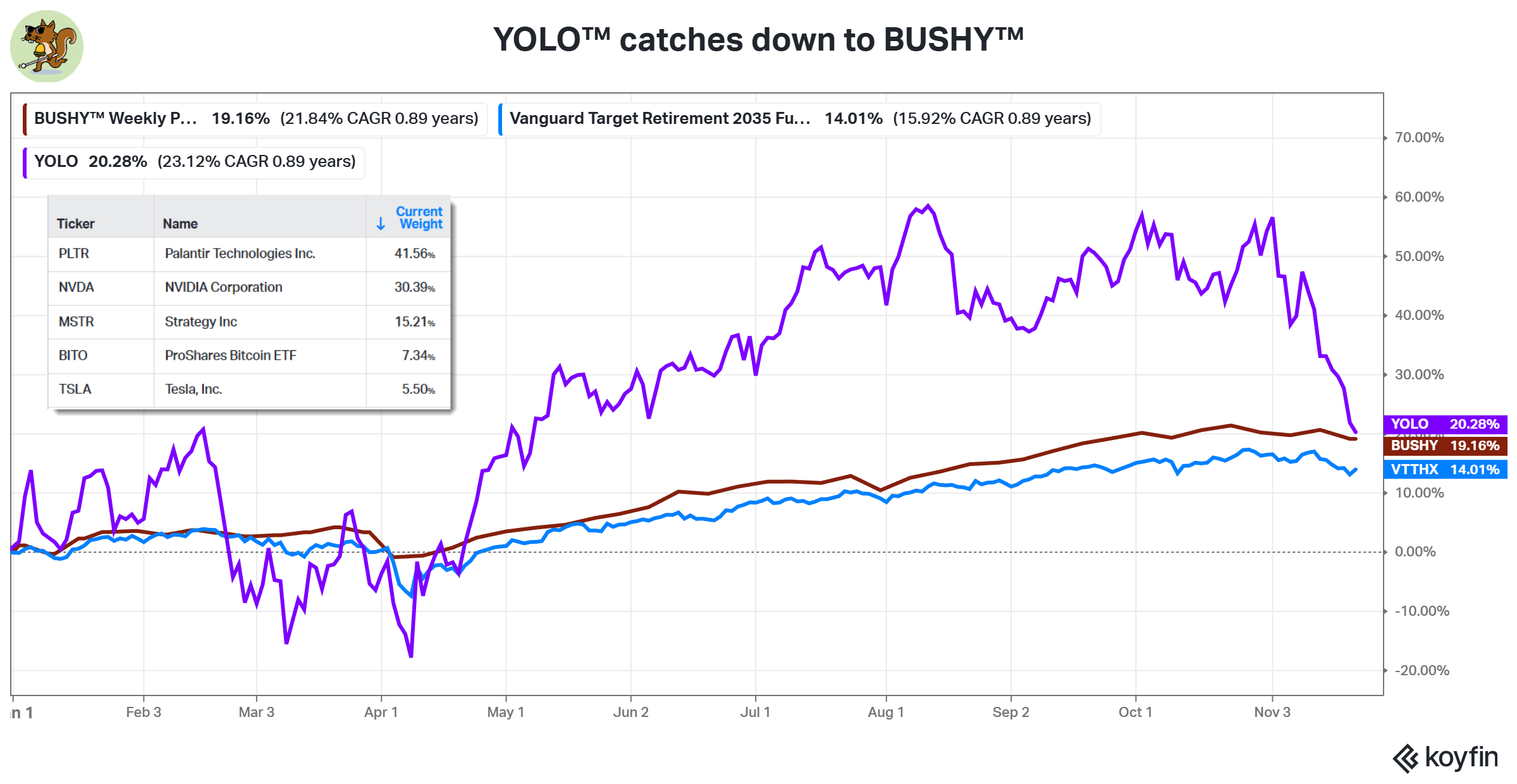

Crypto assets and high beta equities have borne the brunt of this drawdown. No surprise that Team YOLO™ has just given back two-thirds of year-to-date returns - since the beginning of the month.

Team YOLO™ are the ‘Bazballers’ of global risk assets. Their aggressive dip buying in April was rewarded. However, their appetite for high beta assets will only be rewarded if we see a return of ample liquidity conditions.

In this most recent market chapter, lower beta exposures are certainly the hiding place of choice. MSCI EAFE (Developed markets ex-US, IEFA ETF) has come off by about 3% since the October highs...

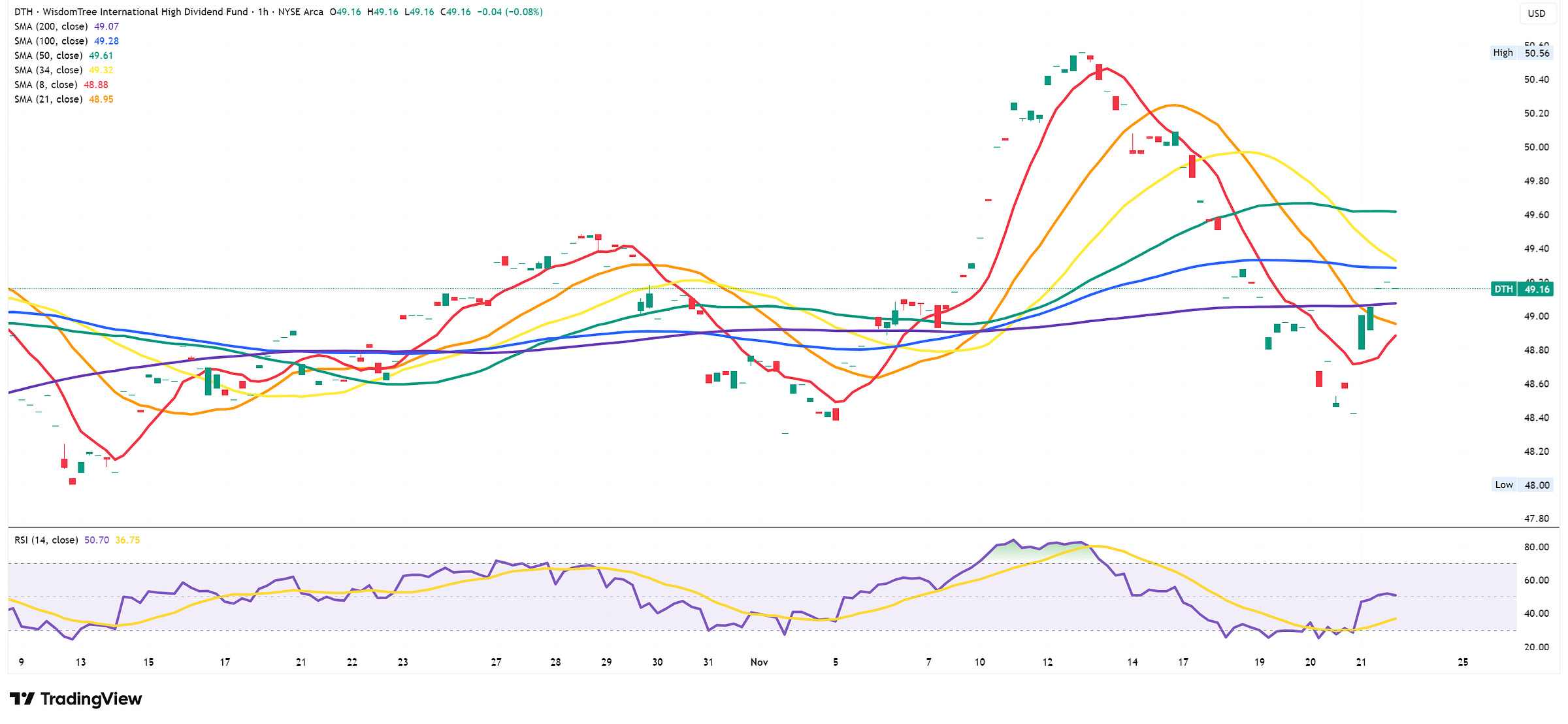

…whereas the ‘high dividend’ version of that index (DTH ETF) has offered positive returns.

We are seeing the same effect in Emerging Markets, where the broad-based MSCI EM (EEM ETF)…

… has underperformed its high-yield (and lower beta) equivalent, DVYE.

Staying in EM, this risk-off phase in markets has not been felt in EM fixed income. Both USD-denominated (EMB)…

…and local currency-denominated (EMLC) fixed income paper have offered decent returns.

Am inclined to continue to favour the ‘non-Bazball’ factors in ex-US risk assets.

BUSHY™ Review

BUSHY™ drew down 1.51% last week. The rally in the US dollar that the portfolio has been bracing for finally showed up. The hedge book (principally USD calls and Nasdaq/QQQ put spreads) did its job, delivering 49bps of portfolio attribution for the week.