Summary

Last week, we discussed the popularity of ‘Big Government’ with the median voter. This weekend the libertarians very nearly got to live through their fantasy of ‘zero government’ come Monday morning!

The FTC antitrust lawsuit against Amazon AMZN 0.00%↑ has got the 🐿️ thinking about a topic that gets many raging - that is regulatory capture by large corporations.

Consumers also need to be vocal about the wicked cousin of regulatory capture that is regulatory arbitrage!

Amazon was already looking shaky before its latest legal dramas. Is the equity market at risk of losing another of its major drivers of year-to-date returns?

This week’s Acorn review covers #Bonds TLT 0.00%↑ #Offshore #Energy BNO 0.00%↑ DBA 0.00%↑ #Mercedes DASH 0.00%↑ and #uranium

The audio companion to this week’s note will be uploaded to Substack on Tuesday to allow me to incorporate comments and feedback from this note. It will also be available as a podcast on Apple, Spotify and the other major podcast apps.

Seeing Red over Red Tape.

Last week, the 🐿️ gave some thought to how ‘Big Government’ was getting bigger - a fact that was not necessarily unpopular with the median voter. This weekend, we are encouraged to swoon with relief as US lawmakers narrowly manage to ensure that their government remains open for business on Monday morning.

Shutdown threats are no longer an annual event. In fact, cliffhanger Senate vote fans will only have to wait 6 weeks for the next one.

Judging from Friday’s price action, equity markets appear to be as non-plussed about the proceedings as Bill Murray at the start of another Groundhog Day. Let’s see.

I have been giving a lot of thought to the role of government and regulation in recent months. There is no shortage of hypocrisy, and some deeply bad faith takes on the topic. Last week, we reflected that we may now be entering an economic era that is supportive of labor over capital (the reverse of the status quo of the last 30 years). The (proper) regulation of corporations will play a major role in this regard.

Away from the Kabuki theatre of Congressional budget negotiations, FTC Chair Lina Khan finally launched her much anticipated antitrust suit against Amazon last week. After recent losses against Microsoft (attempting to block the Activision merger) and Meta (attempting to force divestiture of WhatsApp and Instagram), this firebrand Millennial regulator is hoping that third time’s a charm in her latest ‘Big Tech’ face-off. Sadly, the 🐿️ does not fancy her chances in court.

Silicon Valley seldom wastes an opportunity to rail against ‘big government’ interference and regulatory capture in Washington. Yes, that would be the same ‘Planet Palo Alto’ boy band that was screeching for a Federal bailout of Silicon Valley Bank back in March.

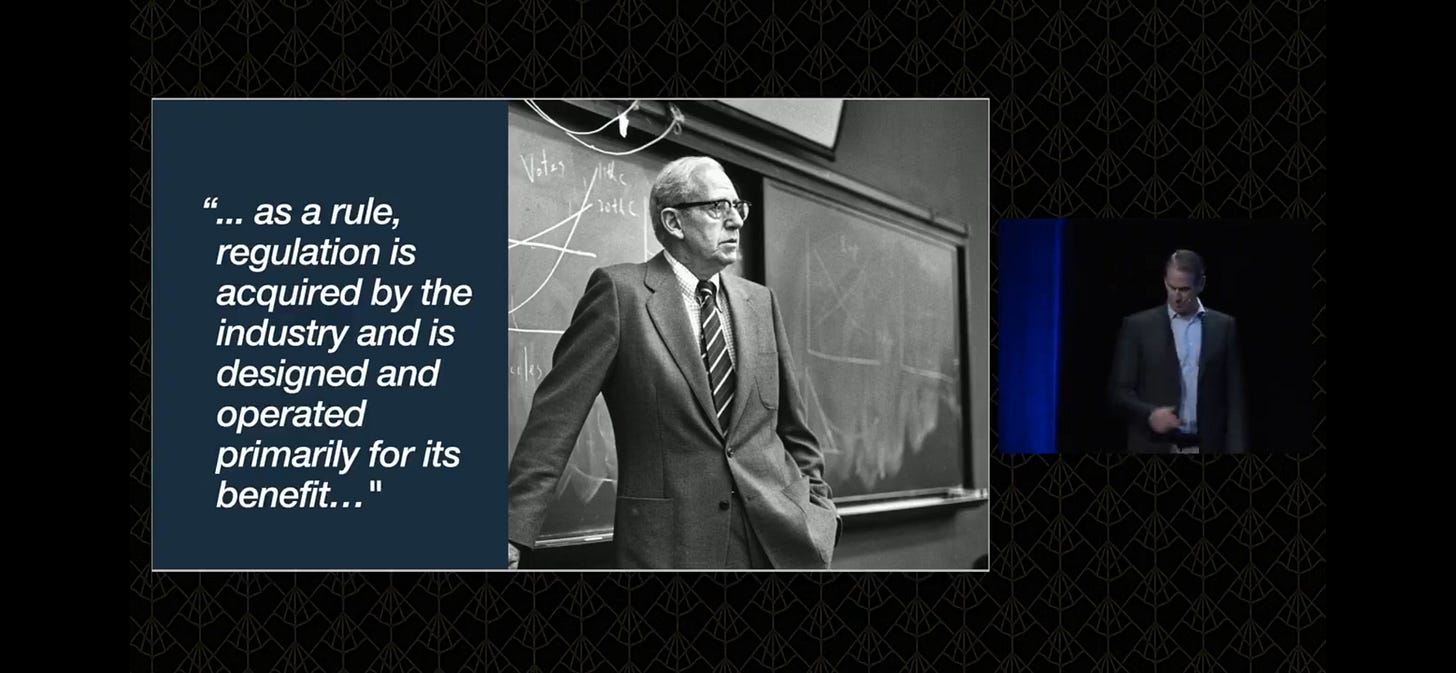

It turns out that this boy band also runs a conference. The 🐿️ would need to be paid serious money to clamber ‘into the arena’ and join the ‘All-In Summit’ in person. I am not remotely worried about being called a ‘mid’ by Mr. Palihapitiya. However, this presentation from Benchmark Capital’s Bill Gurley at the conference is worthy of contemplation.

In fairness, Gurley’s presentation does an excellent job of highlighting the societal costs of regulatory capture by various industries. For the sake of your blood pressure and mental health, you may want to skip the ‘wrap-up with The Besties’ section at the end.

Gurley focuses in particular on ‘regulatory capture’ in the telecom and healthcare sectors. Later in the presentation he has a little (and slightly risqué, given the company) poke at social media, crypto and AI. He correctly points out that META, Coinbase and OpenAI would love nothing more than a cozy bit of regulation to cement their first mover position / incumbency.

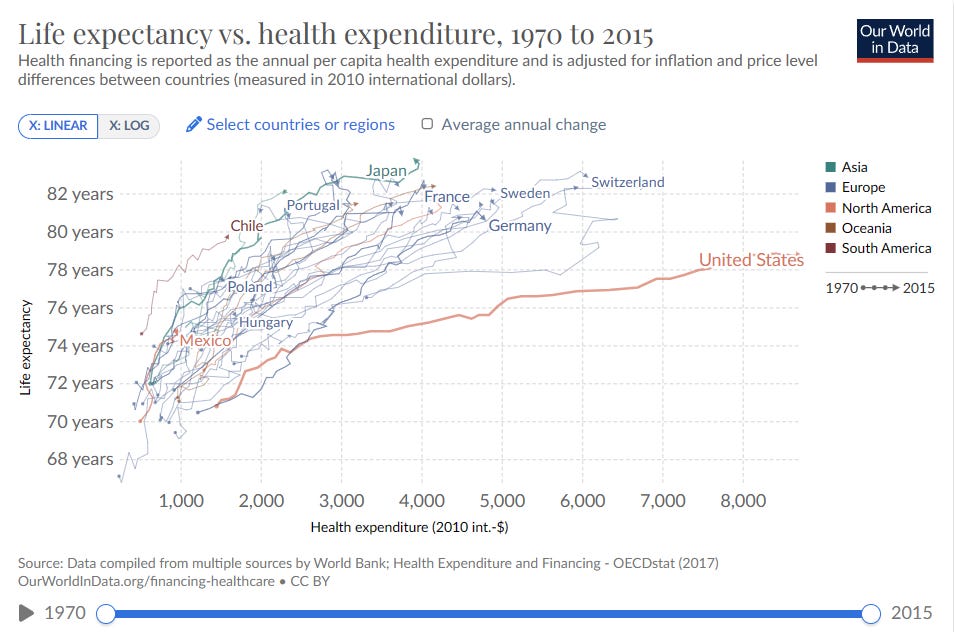

Gurley’s righteous indignation about community broadband, doctors’ CRM software and Covid antigen tests is certainly justified. Regulatory capture has a habit of delivering harmful (and expensive) outcomes for consumers. I wish The Economist would provide an update to the chart on health expenditure below. I expect it would look worse (Dear reader, if they have done so and I have missed it, please send it to me!).

Private equity sponsored roll-ups in the healthcare industry are one of the major villains of the piece here. On a side note, it does feel as though the media and regulators are finally starting to get vocal on the topic. We touched on anesthesiology services in Texas last week, but FT Alphaville’s ‘subs’ (headline writers) are simply the best in the industry. The brilliantly titled “When Granny gets LBO’d” is well worth a read.

“Across the outcome measures, PE ownership was most consistently associated with increases in costs to patients or payers. Additionally, PE ownership was associated with mixed to harmful impacts on quality…No consistently beneficial impacts of PE ownership were identified.” British Medical Journal (via FT Alphaville).

One of the reasons that we have chosen to express our negative view on private asset markets via the PE industry’s investment bank intermediaries (rather than the PE ‘shops’ themselves) is that we feel that, like ‘Big Tech’, these asset gathering behemoths are still very powerful in political circles.

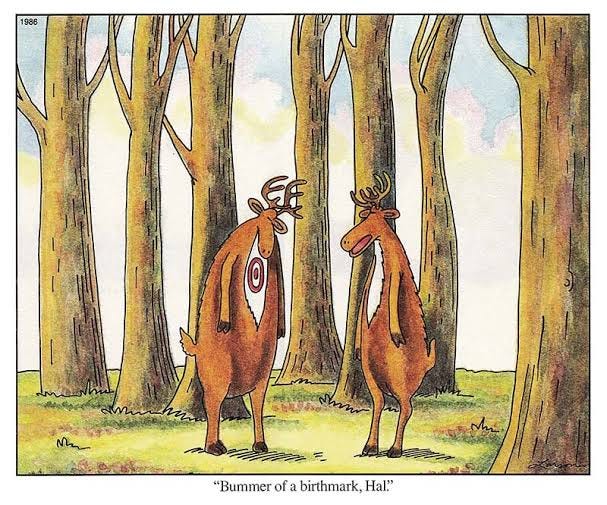

In the ever more populist world that we are expecting, we think that this view could change rapidly. A few more ‘Granny gets LBO’d’ headlines could easily paint a target on the front of ‘Big PE’ in the world of political discourse.

But let’s get back to our Venture Capitalist friend Mr. Gurley. His first brush with the might of the telecom industry’s corporate lobby was when one of his investments, Tropos Networks, was seeking to ‘disrupt’ (the favorite word of the VC community) the ‘community broadband’ market.

The 🐿️ is going to take a wild swing in the dark here, and guess that the provision of ‘free’ Wi-Fi services to municipal city centers was a bit of a Trojan Horse. I would be prepared to bet that this was not an act of selfless philanthropy and that this service planned to come with plenty of hidden costs in the form of (at the very minimum) consumer ‘eyeball’ and data monetization.

In the context of UBER 0.00%↑, DASH 0.00%↑ and CART 0.00%↑ we have written about the proliferation of ‘blitz-scaled’ e-commerce businesses that effectively ‘sell dollar bills for 50 cents’ with a view to building monopolistic market positions from which rents can be sought from consumers down the line. At the end of the day, the monopolist sits at the apex of the pyramid of capitalism.

These businesses and other ‘gig economy’ players are also active in the wicked cousin of regulatory capture - regulatory arbitrage! Leveraging anachronistic legislation to skirt employment laws or local real estate / lodging regulation and taxes is really no different. Also, in a digital economy filled with intangible assets, it is very clear that big tech is not shouldering its fair share of the corporation tax burden.

The problem with current antitrust legislation in the US (and elsewhere) is that the drafting focuses pretty much exclusively on the monetary cost of a service or good. It has not kept up with a modern world in which consumer preferences are swayed by algorithms and every second of our online attention is auctioned off to the highest bidder.

I suspect that another reason that ‘Planet Palo Alto’ gets so worked up about regulatory capture comes down to money. The TAM [*Total Addressable Market] -obsessed great disrupters of Silicon Valley are looking at the vast regulated sectors of energy, healthcare and education and dreaming of extracting rents from them.

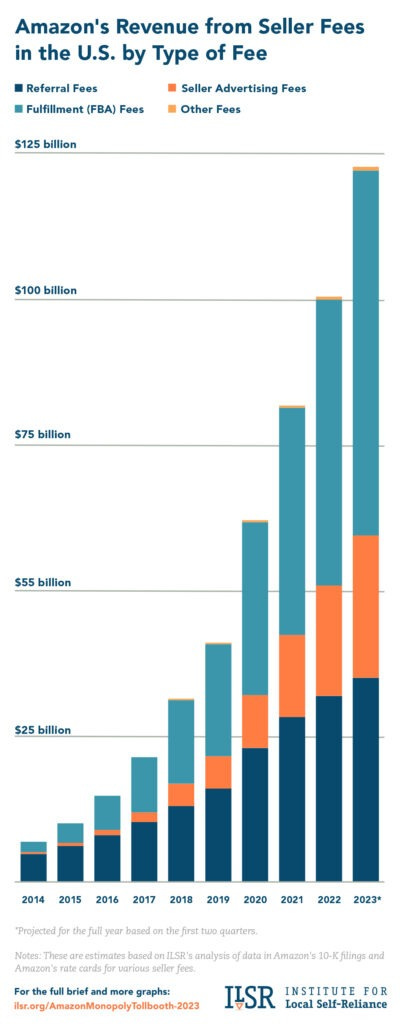

Back to Amazon. The voices leaping to the company’s defense focus on its position as consumer ‘champion’, driving down the cost of goods via its price comparison software, ignoring the retail giant’s sources of revenue from a stranglehold over logistics, webhosting, advertising and other seller services (not to mention its ability to compete directly with its vendor customers).

Ultimately, the consumer ends up with less choice. Never forget that Amazon (and its imitators in other sectors) can charge what they like once there is no remaining competition…

“As Amazon has grown, the number of independent businesses has fallen. Between 2007 and 2017, the number of small retailers fell by 65,000. About 40 percent of the nation’s small apparel, toy, and sporting goods makers disappeared, along with about one-third of small book publishers.” Source: ILSR

So, what 🐿️?! I am not sure that Ms. Khan’s trust-busting ‘Hail Mary’ comes off. She may be ahead of her time. In the investment business, to be early is to be wrong. It is probably still too soon for ‘trust-busting’ to hit the top of the populists’ agenda.

Her press release states that “The FTC, along with its state partners, are seeking a permanent injunction in federal court that would prohibit Amazon from engaging in its unlawful conduct and pry loose Amazon’s monopolistic control to restore competition.”

If it does come off, what does ‘permanent injunction’ mean for Amazon? A speeding ticket of a fine? Prime membership fee refunds? A forced demerger of Amazon Web Services or of its Advertising Services business (which some might even determine as bullish for the Amazon stock price)?

The other reason that Ms. Khan may lose is that Amazon is struggling to provide concrete evidence to the market (yet!) of monopolistic profits! Is this what is being reflected in the collapse of its multiple versus bricks and mortar retailers like Walmart?

Regulatory action aside, the 🐿️ has never really been a fan of the stock. Frankly, it is nosebleed expensive (technical term!). My friend

has written interestingly about the company’s free cash flow. We agree that Amazon’s aggressive use of capital leases greatly flatters its cash generation profile. The company is also a serial offender in the stock-based compensation add back game.Back in August, we wrote about AAPL 0.00%↑ in 'Aaa'-pple! The best bond in the world? Like Apple, Amazon is one of the small cohort of ‘Magnificent Seven’ stocks propping up equity returns YTD at the index level.

Amazon’s chart in particular was having a tough time even before Ms. Khan’s intervention:

There seems to be a consensus view developing whereby everyone thinks that they are going to buy the S&P 500 on a dip down to 4200 and then surf the market up to 4600 by Christmas in a textbook ‘Santa Claus’ rally. Guess what, that probably means that it is almost certainly not going to be the case!