'Aaa'-pple! The best bond in the world?

The Blind Squirrel's Monday Morning Notes, August 7th, 2023.

Apple lost US$150bn of market capitalization on Friday. The company’s bond-like characteristics are often cited when justifying the valuation of a stock that props up US equity markets (almost) single handedly. Let’s stop that.

It is human nature to reach for sexy narratives in support of share price action. The 🐿️ hates to spoil the fun, but the reality is sadly a bit more prosaic.

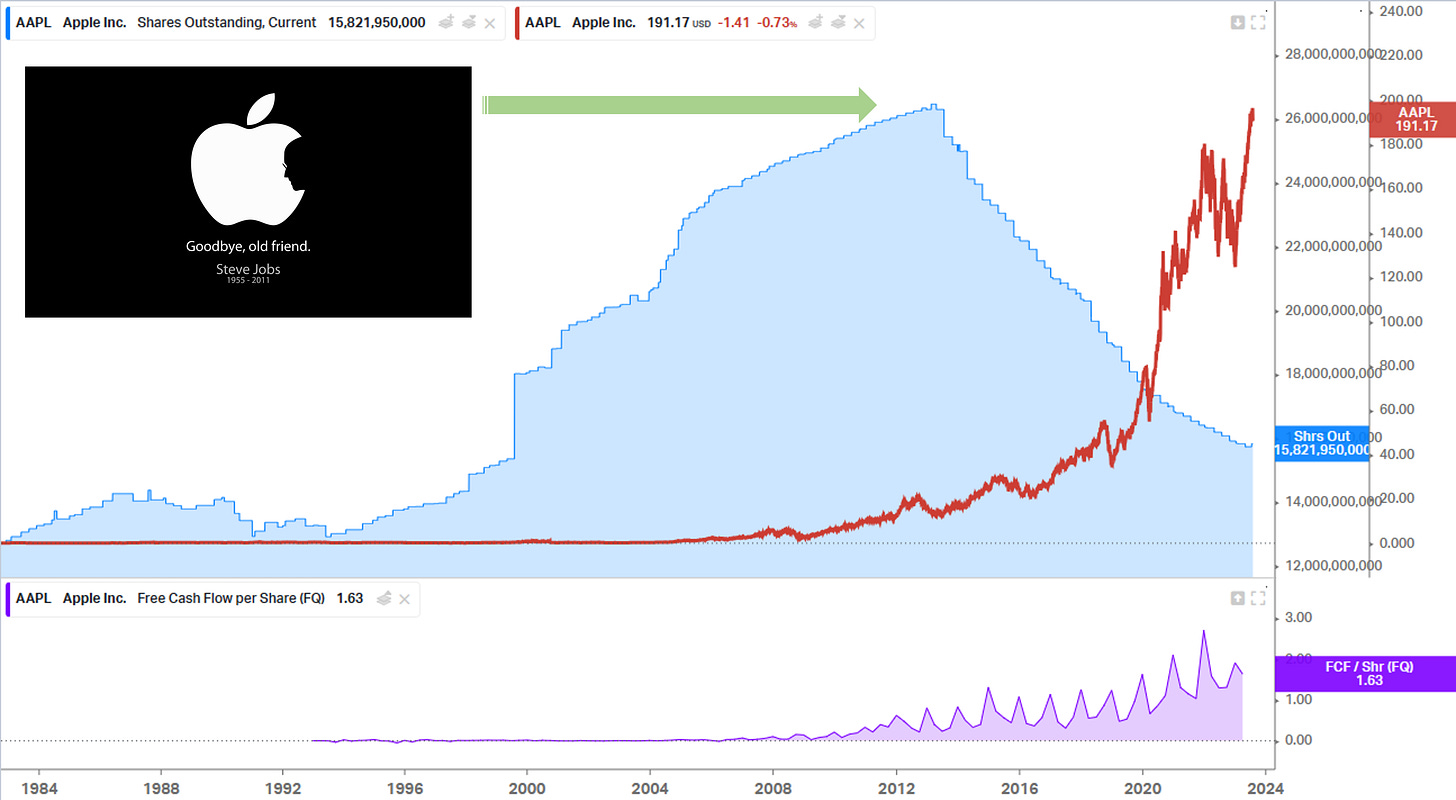

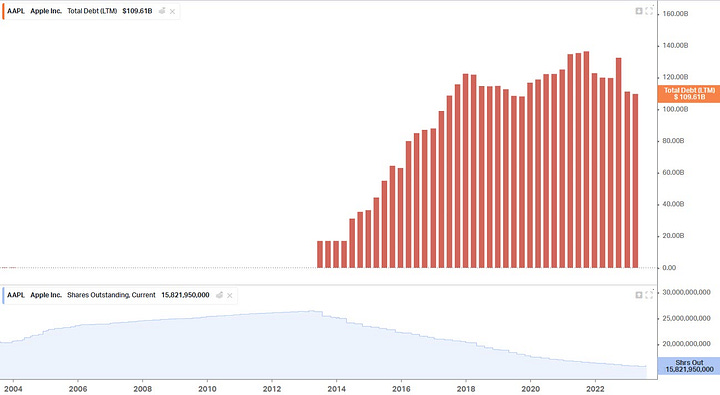

There is a temptation to fetishize about Steve Jobs ‘the visionary’ behind Apple but is it in fact Tim Cook ‘the financial engineer’ that has made Apple the

$3$2.8trn monolith that it is today?We take a hard look at the props supporting the prop.

If you want to buy an Apple bond, buy an Apple bond (there are plenty of them!!). And by the way, don’t worry Mrs. Yellen, Apple’s credit rating from Fitch is Double-A too!

Busy week for the Acorn portfolio. Updates on DBA 0.00%↑ WEAT 0.00%↑ COIN 0.00%↑ GS 0.00%↑ $AUDUSD #Uranium # Mercedes

‘Aaa’-pple! The best bond in the world?

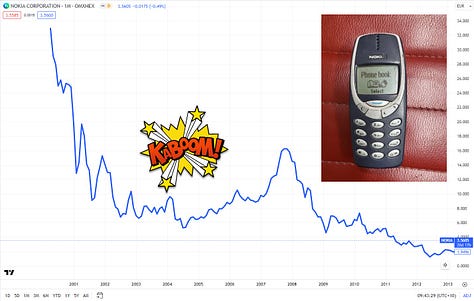

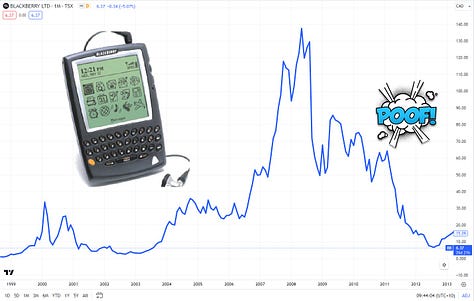

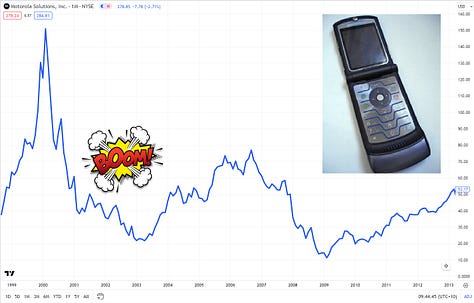

I know that this montage is a bit mischievous and does not constitute an ‘apples to apples’ comparison (sorry!), but last week’s downgrade of the US’s sovereign credit rating by Fitch has prompted me to return to one of my favorite AppleAAPL 0.00%↑ stories. Otherwise, I can assure that this is a 100% a [insert doomer voice] “Fitch US DOWNGRADE!”-free edition.

Back in the early 2010s, I (ill-advisedly) opened my mouth at a meeting of senior colleagues with a strong point of view about our bank’s graduate recruitment strategy. This idiot 🐿️ was ‘rewarded’ for his frankness with the responsibility of leading the ‘Super Saturday’ team that would interview final round candidates for that summer’s investment banking intern program.

It wasn’t just a Saturday! This job involved meeting with over 120 undergraduate candidates over 12-hour days over a 4-day weekend in London and New York with my body clock still in Hong Kong!

These young aspiring bankers all had nearly identical academic backgrounds - i.e., perfect GPAs in finance or economics degrees from ‘Ivy League’ schools (my principal gripe with my peers in Asia) 🐿️ Note: the finance profession needs more liberal arts graduates!

Partly out of fairness, and partly because it was all that my jetlagged brain could cope with, I used to ask the same set of questions to every candidate. My ‘go to’ opener was the following question:

“So, [insert candidate name here], what PE multiple does Apple currently trade on?”

Only around 10% of candidates would have a numerical answer to this question, and so I would continue with the follow-up question:

“OK, if I were to tell you that the S&P500 index currently trades on a multiple of around 17x, do you think Apple trades at a premium or discount to the broader market?”

Well, 90+% of respondents would reply - incorrectly - that the mighty Apple traded at premium to the index (finance & economics majors!). The point of the question was not a ‘gotcha’ to expose ignorance, but rather to see where candidates took the conversation when I asked them to imagine some possible reasons as to why the storied inventor of the iPhone traded at a 40% discount to the broader stock market.

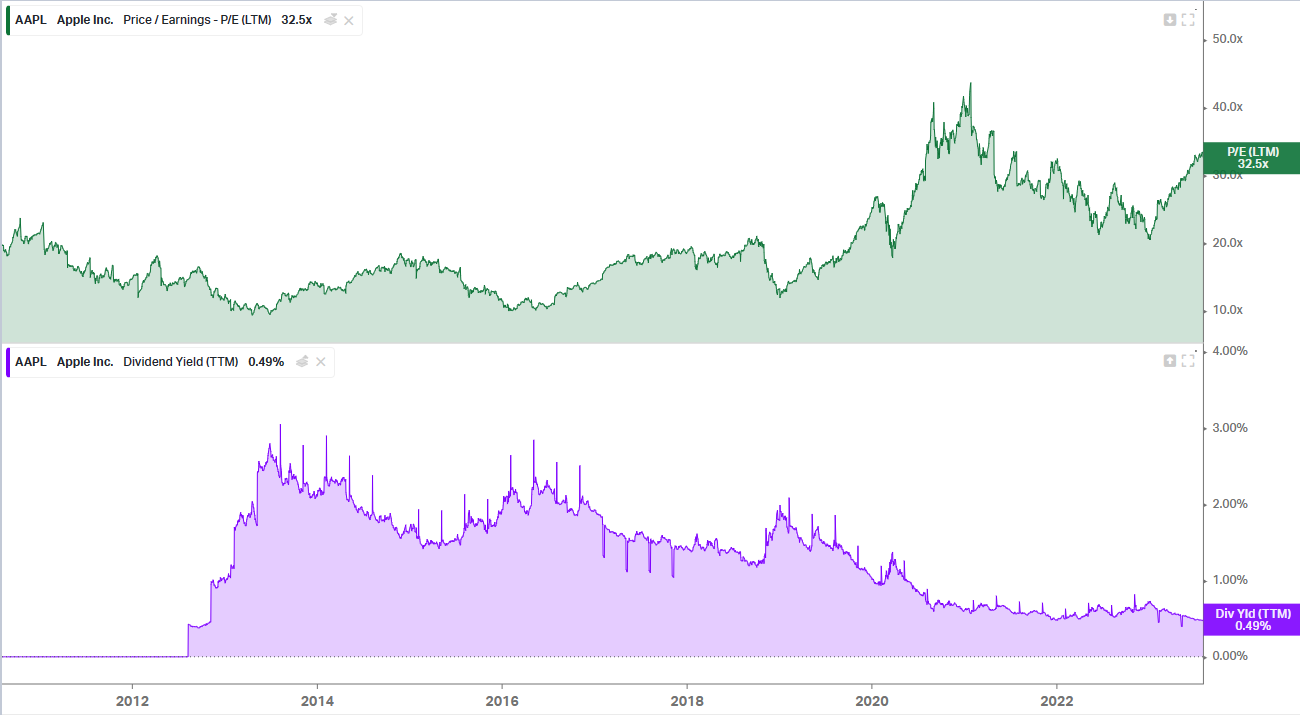

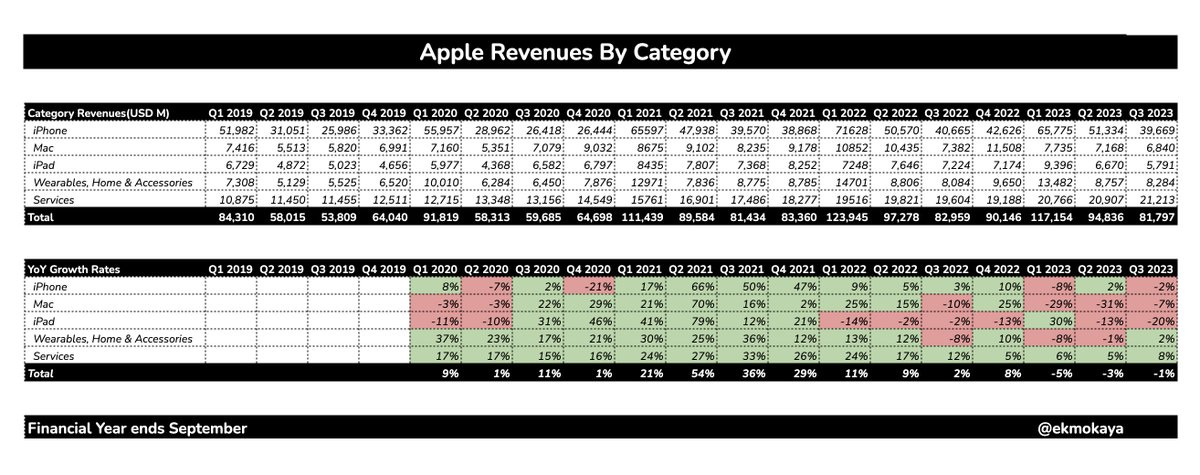

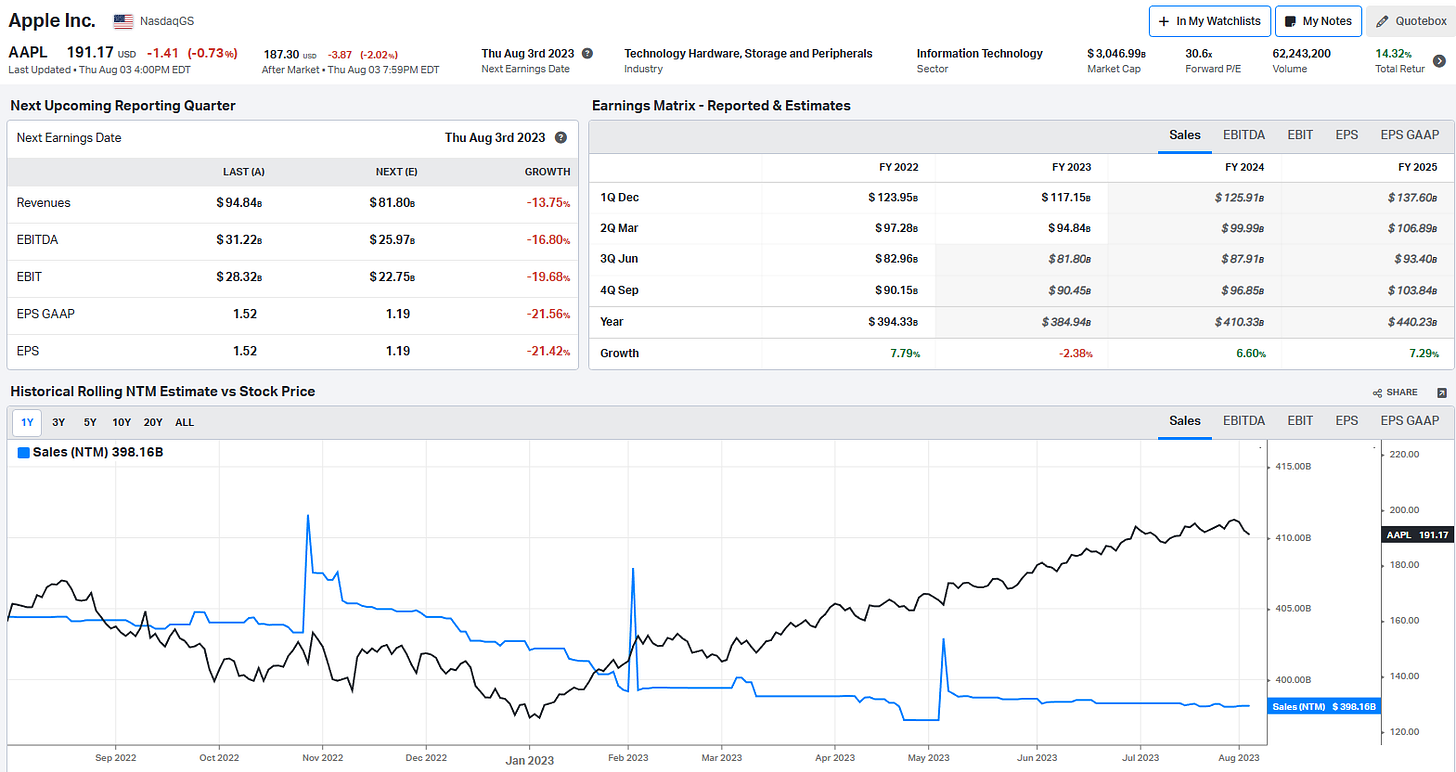

Fast forward 10 years and we see a completely different picture:

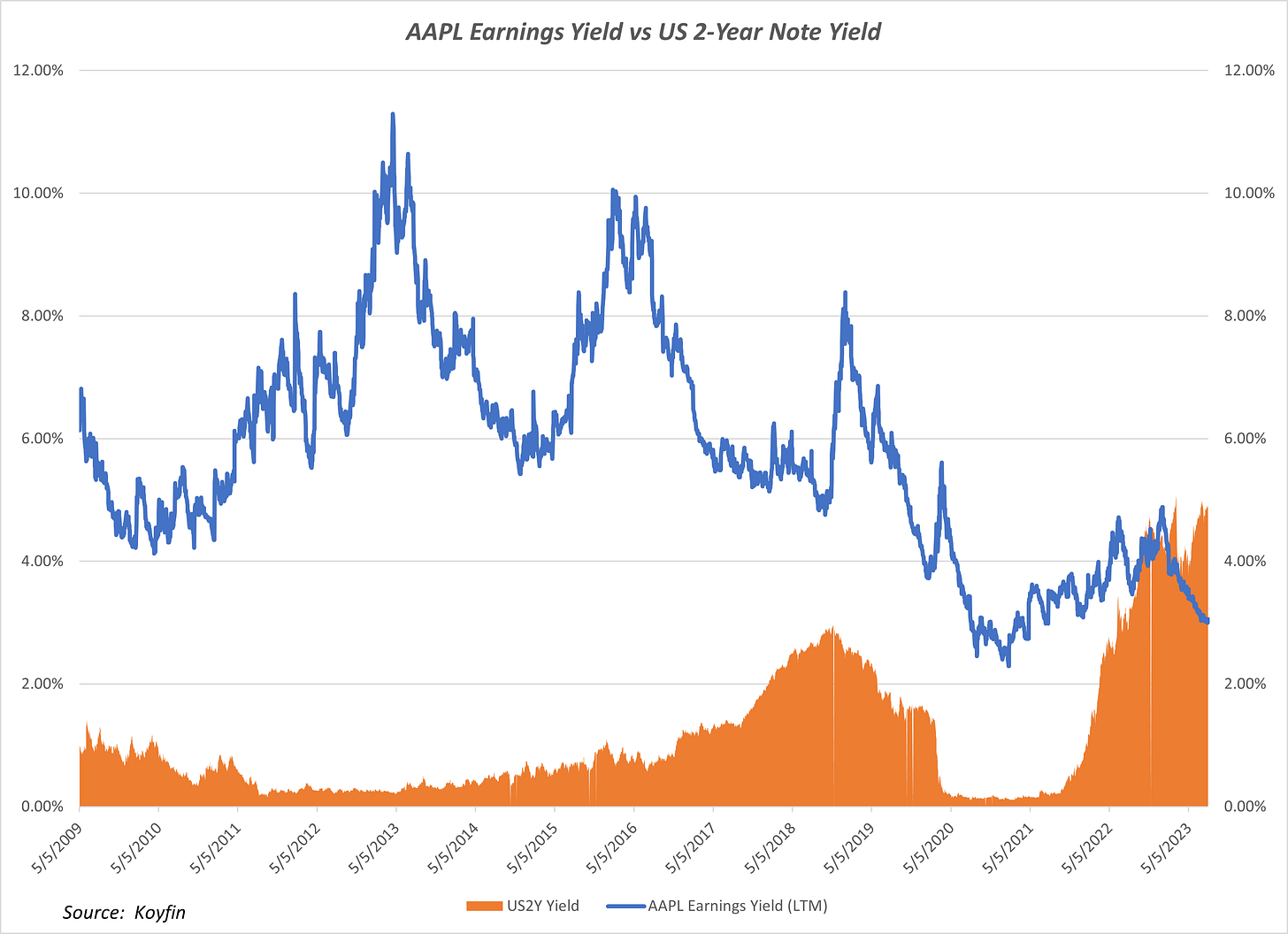

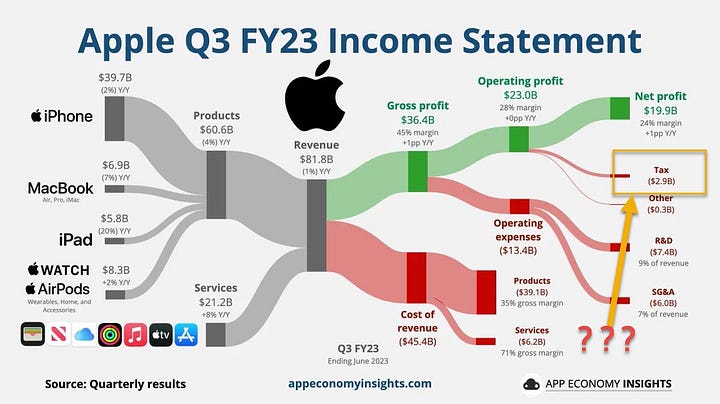

If you compare Apple’s earnings yield (the reciprocal of the PE ratio) to the returns that investors can earn for lending cash to the US Government for 2 years, Apple has gone from offering a 10% yield premium to ‘Uncle Sam’ in 2012 to commanding a yield 1.85% lower today!

My final London / New York graduate recruitment marathon took place in January of 2013. The timing of those interviews coincided with the start of a major shift in Apple’s corporate finance strategy (less than 18 months after the death of Steve Jobs). It started shrinking it’s share count. Aggressively. I wonder what Jobs would have thought about that. I think we might also not be having to feign excitement about nerdy VR headsets…

The brilliant Russell Clark has been vocal on this US large cap de-equitization effect. He strongly believes that share buybacks are a defining driver of markets. On Apple specifically, I quote his piece (link - paywalled)1 from last month:

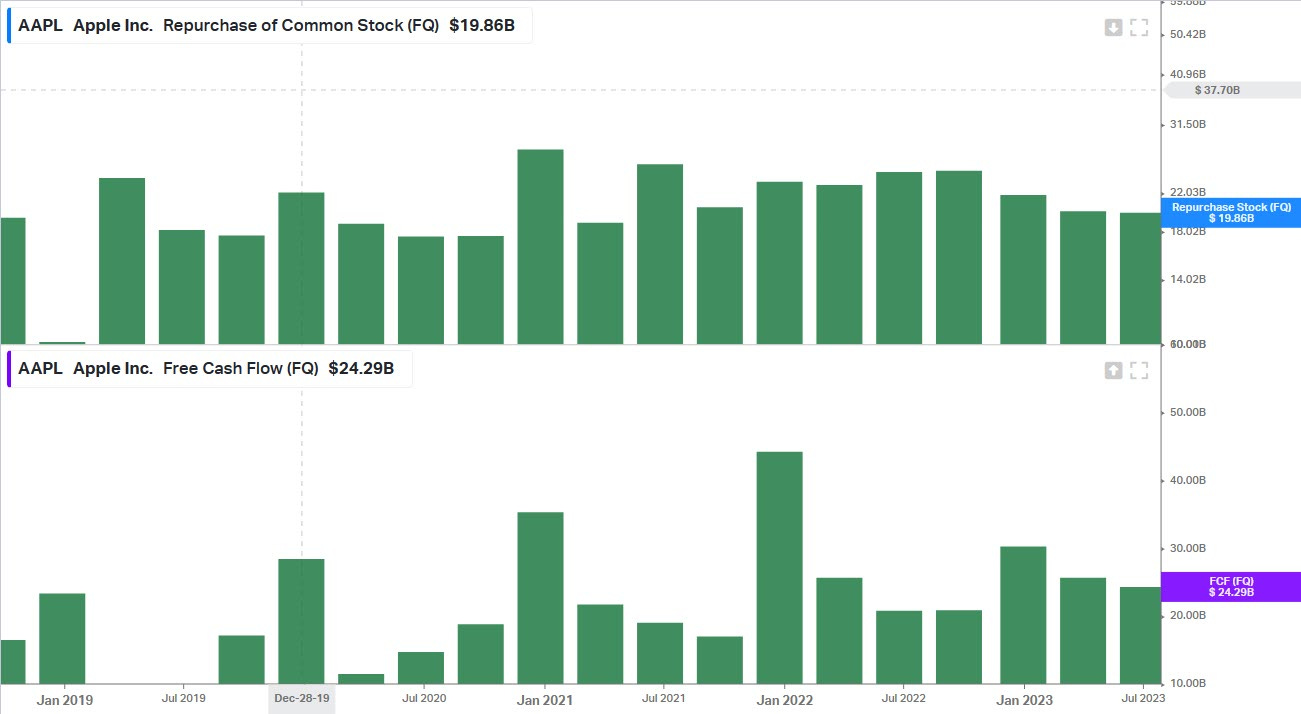

“Apple share buybacks are not valuation dependent. If the cash is there, then they will buy back shares. Apple has bought back 8bn shares since 2014 - or 4 times of all the shares Vanguard and Berkshire have bought (1.2bn and 0.8bn respectively).”

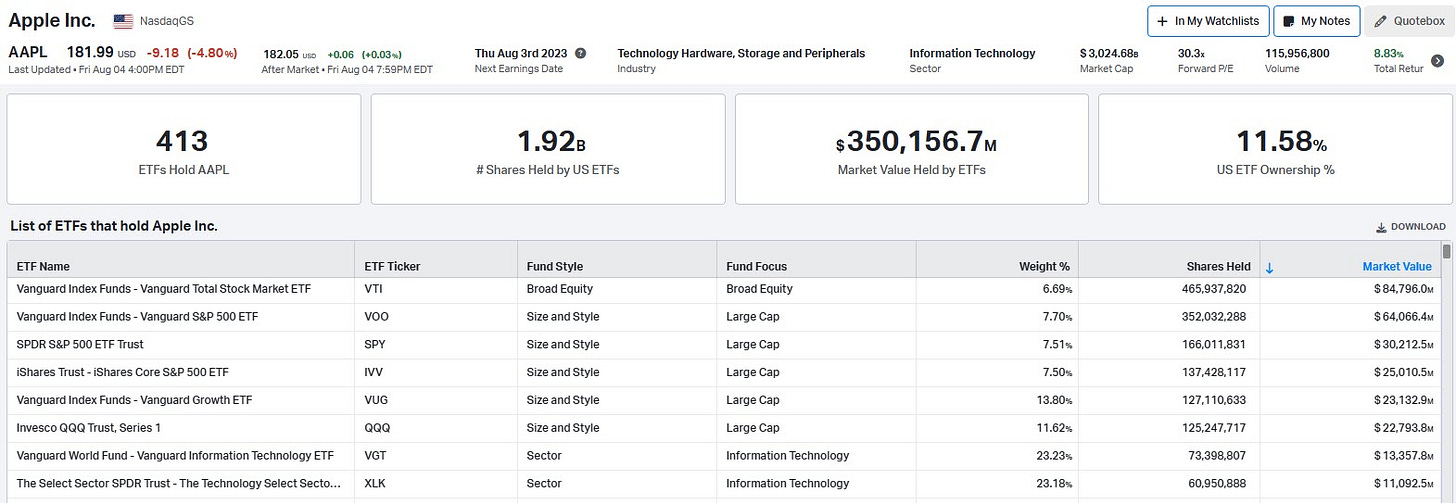

Curmudgeonly value investors (like this 🐿️!) are often found moaning about the negative impact (on price discovery) from the dominance of passive / index investing2, but it is clear to me that de-equitization by large cap US (mainly tech) corporates in combination with the indexing effect is the major influence the in supply / demand equation for US public equities.

In the past 5 years, Apple has bought back between US$20bn and US$25bn worth of its stock per quarter. This is a number often in excess of 100% of the company’s quarterly free cashflow.

And it has worked wonders on the stock price…

On Friday, Amazon was able to pick up the baton and soften the market impact of Apple’s fall with its “beat”. The reality is that I share the skepticism of many on the Amazon equity story (this was a complete gem of snark from ‘Wasteland Capital’3) so I do not have much faith that Amazon can replace Apple as the mainstay prop of the market for any great length of time.

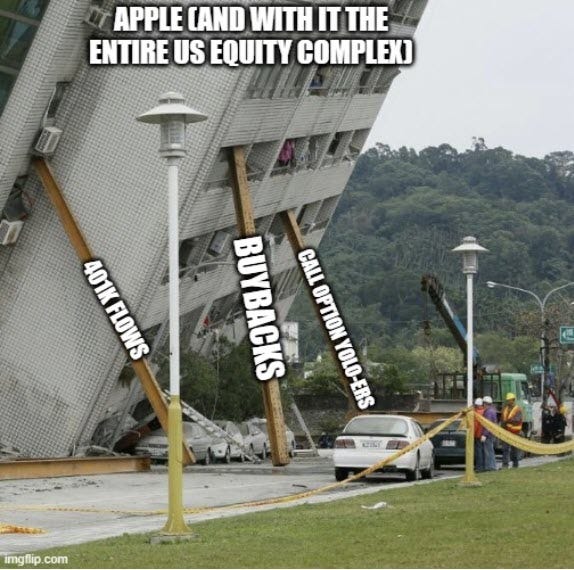

In the meantime, what holds up Apple, and with it, the broader market for US equities?

The ‘props’ to the ‘prop’:-

Buybacks - as discussed above, these appear to have been doing the bulk of the heavy lifting. Can they maintain the pace? What are the implications of the recent slowdown in growth? With interest rates now elevated, will the company be as active in debt issuance markets? Might they instead start repatriating some overseas cash to fund the buybacks? All good questions to ask.

Index fund (401(k)) flows - Apple shares currently receive 7.5 cents of every new savings dollar hitting the equity market. These flows are maintained for as long as the US doesn’t go into recession. I know people are getting more and more relaxed about the economy, but…

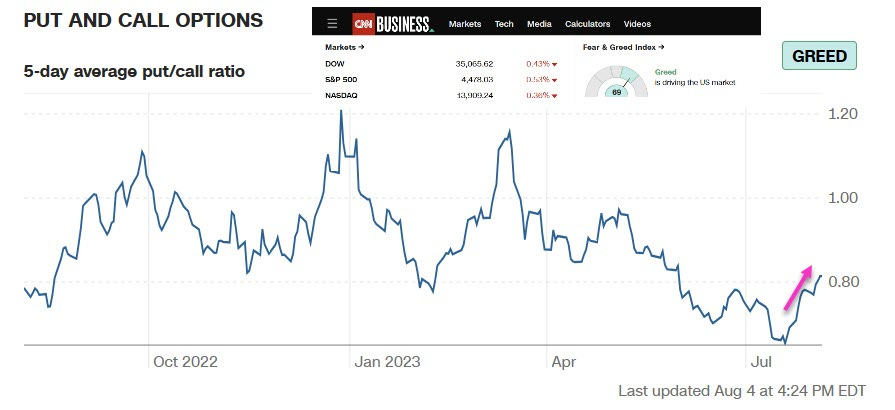

Option activity - The short-dated call option speculators are back again this year with a vengeance. This is not just retail investors. There is plenty of institutional money looking to catch up on lackluster returns via options. However, any shift in investor sentiment removes that leg of demand very rapidly.

Apple shares are often described as having the safety characteristics of a high grade (dare I say triple-A rated?) bond when defenders seek to justify the richness of the company’s valuation. Please don’t do this!

I would make a couple of points on valuation: the Everything-As-A-Service economic model to which investors like to ascribe huge value is yet to be tested by a recession. People should not confuse user inertia for loyalty. Folk are going to figure out very fast how to extract themselves from ‘nice-to-have’ monthly services when pocketbooks get tight.

In terms of the next leg of growth, my bold prediction is that with the ‘Vision Pro’ VR headset, Apple be launching the most effective prophylactic since Charles Goodyear introduced the vulcanized rubber condom. I am just not sure what I want to pay for all that excitement.

Comparing Apple’s earnings yield with Treasury yields simply highlights the fact that Apple equity investors are currently paying for the privilege of accepting an equity risk premium at a time when the shares are valued as richly as they have ever been and are being propped up by forces largely beyond the company’s control.

But the more important point is that if Apple has a problem, so does the whole equity market. In the meantime, if you want to buy Apple’s safe cash flow/ bond-like characteristics, then buy an Apple bond (there are plenty of them!!).

And by the way, don’t feel too sad Mrs. Yellen, Apple’s credit rating from Fitch is Double-A too!

++++

That’s it for the front section this week. Full Acorn Review and Portfolio Update below.