Santa's Scorecard

Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 48.

I hope all of my American readers enjoyed a festive Thanksgiving weekend. Let me take this opportunity to thank you all for your loyal readership and support as the Blind Squirrel Macro letter readies itself for its 4th year.

SPECIAL ‘Cyber Monday’ PROMO!: For Annual Subscribers only, I have a really special (actually bonkers) offer on holiday gift subscriptions for your colleagues, friends or family. DM me (or reply to this email) for details:

In case you missed it, on Saturday we published a new healthcare idea in this weekend’s ‘Monday Morning Notes’. Link below.

The Foundry Sisters

This week’s note comes with a health warning (partial pun intended). After repeated requests from members, I created a new healthcare channel in our ‘Drey’ server on Discord in late September. The fact that the 🐿️ does not regard himself as having a hot hand when it comes to the sector was reflected in the channel’s “always fade the 🐿️” title.

The 🐿️’s inboxes is brimming fuller than Richie Rich’s Christmas stocking with bullish assurances that a ‘Santa Rally’ is ‘nailed on’ for the balance of the year. I get the technical and systematic arguments, but such unanimity of conviction has this rodent’s whiskers twitching. It’s lonely.

Longstanding readers will know that last year’s 2025 outlook piece took poetic form - a tradition that shall continue. I spent a few hours over the weekend to review St. Nicholas’ deep baritone Christmas Eve forecast.

Let’s start with some of the good calls before fessing up to some of the stinkers.

We came into the New Year positioned for a ‘rentable’ flash rally in long duration Treasuries (you know my long term stance on bonds). TLT rallied over 10% before the “Liberation Day” chaos enveloped them. Am back to a neutral-to-negative stance on long duration fixed income (with a side order of my Mind the Gap trade).

‘Santa’ then offered up a battery of (largely ex-US) equity ideas and themes:

These themes have handily outperformed the S&P 500 over the ensuing period. I was shaken out of the ‘space’ trade (via the UFO ETF) very early in the year but it had worked well from late October 2024 when we tentatively put it on - profitless dream stonks are not generally the 🐿️’s favored tipple.

SPYSTRADDLE was a reference to our ‘go to’ hedge against a breakdown in the (still very crowded) equity dispersion trade. The strategy worked very well in August 2024 and Q1 this year but it has been bleeding premium since we put it back on in May.

I took quite a bit of heat for the positive call on European equities (and I still like them here - even if I have trimmed some of the high-flying defense names further recently, DTH is core holding in BUSHY™ and that ETF is packed full of cheap, high yielding financials from ‘Ye Olde Continent’).

There was however plenty of love (you know who you are!) for Santa’s PGM call and we platinum and palladium bulls finally got some (long overdue!) love from mid-May onwards. The recent pull back is not causing me any angst.

While my call for an investor revolt against non-GAAP earnings adjustments may have been little more than wishful thinking, 2025 has certainly been a year of reckoning for the ‘SaaS’ boys. We have run a core short in the ‘one-stop-SaaS-shop’ ETF (WCLD) for most of the year, but since June center-piece expressing the view has been via Salesforce. Taking this as a tangential win.

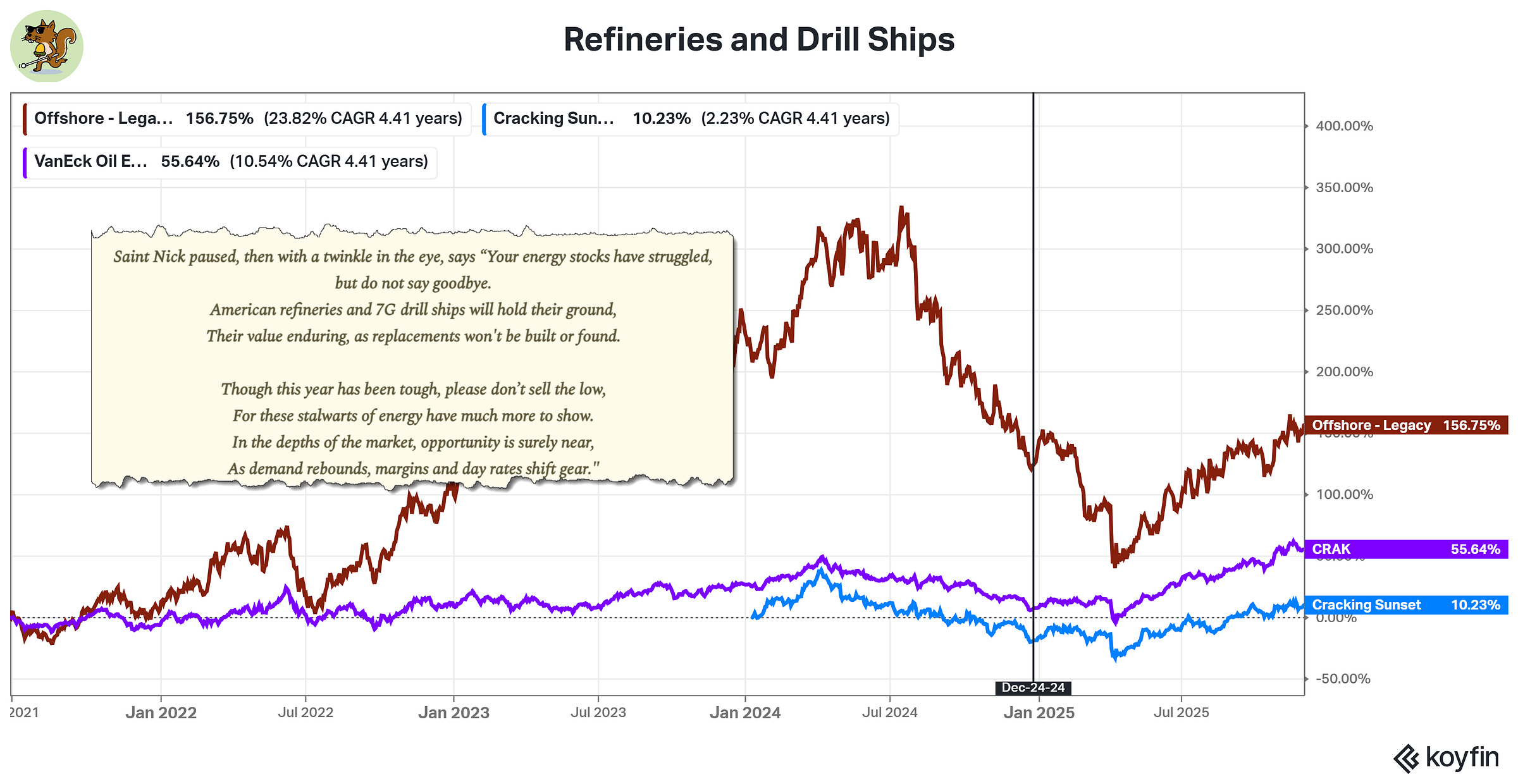

Then Saint Nick ruminated on a year of bag-holding and roundtripping in offshore oil services and refining in 2024. Further pain was to come at the start of the year, but it looks like the 🐿️’s stubbornness patience (health warning - never a great strategy!) is finally being rewarded.

Now for a complete lemon! Apart from a brief - but costly - attempt to fade the AI capex narrative in 2023, I have continued to view (incorrectly) the richly valued US power utilities as being overdue a correction (my buddy Chase Taylor was resolutely on the other side of this trade - chapeau!). Fortunately, I took most of my lumps in 2024 and the utes looked way too strong to fight for most of this year.

Most of you know that the 🐿️ is pretty grumpy about delivery businesses! I had another (short-lived) attempt at shorting DoorDash at the time of the “Liberation Day” lows in April and also completely missed the recent correction. One day, both DoorDash and Instacart will be much lower. The start of that process feels close.

The process of starting this year’s Christmas message starts now. Watch this space.

BUSHY™ Review

A positive week for BUSHY™ not withstanding a meaningful (54bps) drawdown in the portfolio’s hedge book, driven by the Nasdaq (QQQ) put spread and the US dollar calls.

The dollar index (DXY) once again last week failed to hold its recapture of its 200-day SMA. I still see a weaker dollar on a medium to long term timeframe but we will keep the hedges in place given the portfolio’s very overweight ex-US positioning.

BUSHY™ continues to track well relative to its ‘target date 2035’ Vanguard benchmark and other other multi-asset ETF peers that I track.

Aside from the hedge book, the shortened week saw firmness in US Treasuries (negative for PFIX) and high yield credit (negative for SJB).