The Foundry Sisters

The Blind Squirrel's 'Monday' Morning Notes. Year 3; Week 48.

The Foundry Sisters

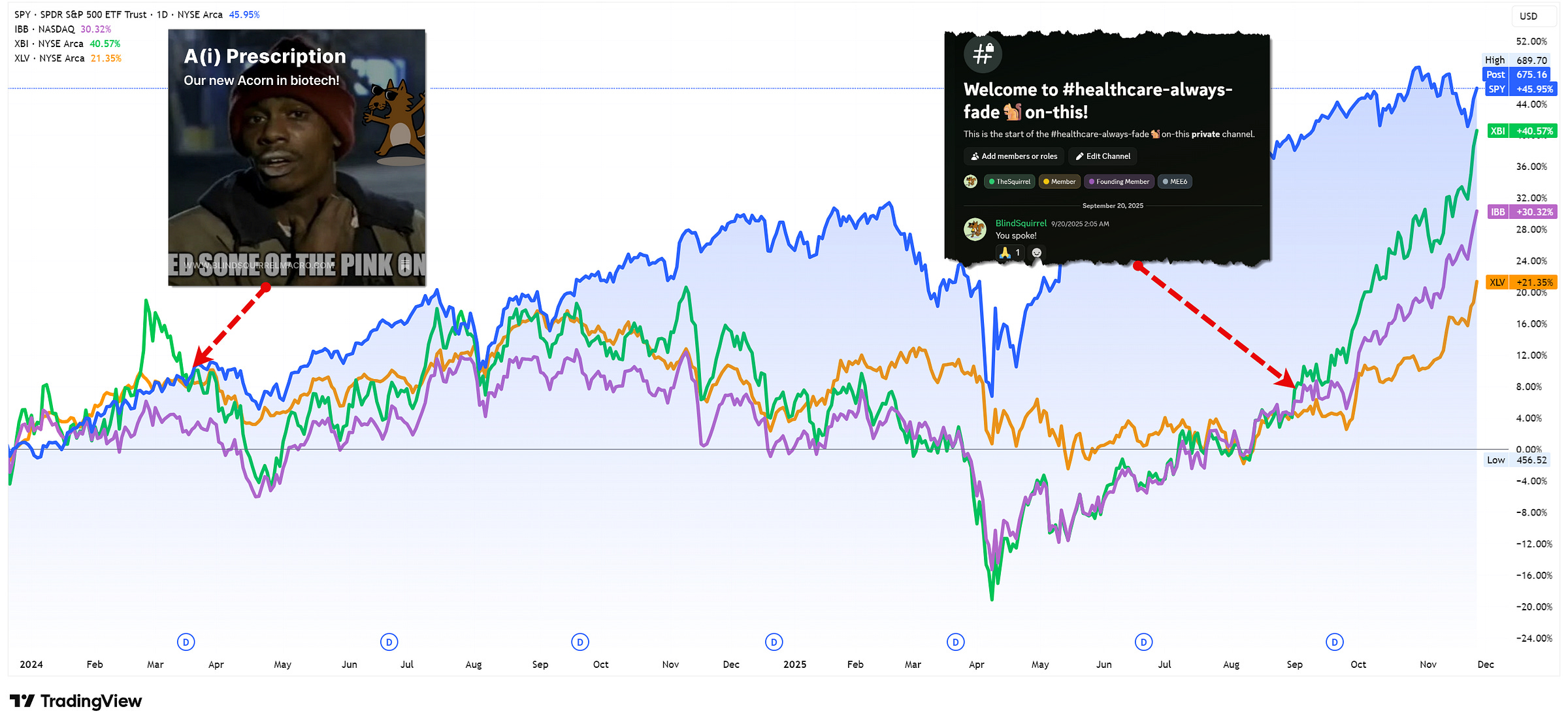

This week’s note comes with a health warning (partial pun intended). After repeated requests from members, I created a new healthcare channel in our ‘Drey’ server on Discord in late September.

The fact that the 🐿️ does not regard himself as having a hot hand when it comes to the sector was reflected in the channel’s “always fade the 🐿️” title.

It’s a testament to my smart readers that since that date, not only has that sector channel become one of the busiest but also XBI 0.00%↑ (“biotech on nitro”), IBB 0.00%↑ (“broad-based biotech”) and XLV 0.00%↑ (“big healthcare”) have outperformed the S&P 500 by 25%, 20% and 16%, respectively. Kudos to them, my readers (and my podcasting partner Ben Brey) have crushed it. The 🐿️ has sadly not participated😔. Yet!

Last March in A(i) Prescription, I felt that the biotech sector - an active user of machine learning technologies - had been ‘missing in action’ with respect to the AI feeding frenzy (among investors) of the previous 15 months since the public release of ChatGPT in November 2022.

I repeated my traditional mantra when it comes to investing in the drug space:

“Picking winners in the biotech sector, however, is notoriously hard. In the late 2000s, I spent an ‘entertaining’ time running an equity financing business in London where two of the most successful investment banking teams that I supported specialized in energy E&P (with a focus on the ‘E’) and pre-revenue pharmaceutical companies, respectively. I used to moan to the healthcare team that “at least the oil and gas boys had the benefit of 3D seismic when it came to picking their winners!”

My personal experience of listening to experts talk about “promising” pre-clinical data on individual drug stocks has been pretty completely miserable. I am sure that many of you have the PTSD and scar tissue that comes from owning stocks with fast evaporating cash reserves as they await that binary ‘hero or zero’ outcome of a regulatory approval.

To my mind, you have 2 options when it comes to biotech investing. You either ‘buy the market’ or you leave it to the experts. The biotech investment specialists may be gambling on those regulatory outcomes but they at last know how to count the cards! This rodent certainly does not.”

Back in March of 2024, we took both options via a core position in Mike Taylor’s actively managed PINK 0.00%↑ ETF, paired with some racy call option structures on IBB 0.00%↑ and XBI 0.00%↑. Those calls fairly rapidly went to option heaven and I finally lost patience with PINK in Q1 of this year.

My impatience was (temporarily) rewarded with the March / April sell off but the outperformance of biotech (vs the S&P) since the “Liberation Day” lows has been nothing short of spectacular.

Introducing the Drug Foundries

Wary that I bought eerily similar looking breakout charts in PINK/IBB/XBI in March of 2024, I am going in a different direction. We are heading back out East.