Rethinking some Hedges

March 17th, 2025. Weekly update for the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 11.

In case you missed it yesterday, this weekend’s thematic note covered the opportunity in China’s beverage (beer and baiju) sectors. Chart breakouts galore! Check it out! 👇

Quick programming notes. On Wednesday I am sitting down with Leonid Mironov of Panda Perspectives to chat China equity themes and compare notes on the recent NPC meetings. The recording will come out on both our feeds next weekend.

However, TODAY, I am back on with the wonderful Maggie Lake at 4pm EST (after the US close). Please join live (link via the image below). Maggie monitors the YouTube chat for questions if you would like the 🐿️’s thoughts on anything in particular.

Judging by the tone of my social media feeds this weekend, it looks as though I should expect to be reacting live to an extension of last Friday’s rally in US equity markets - according to Walter Deemer it was the first ‘90% upside day’ (definition) since last August’s rally following the yen carry unwind.

Queen of the hand-drawn technical charts, Helen Meisler, conducts a weekly sentiment poll on Twitter. That 90% upside day appears to have been enough to give this weekend’s response the most bullish tone since last November.

This rodent is not convinced. While I am open to the possibility of a few green days, it feels like US equities are in distribution mode and that any rallies will flush out new sellers. I am sticking to my belief that allocators of capital (especially of the non-US variety) are divesting US assets.

Last week’s rally in some of the most favored retail counters (recall that the 🐿️’s YOLO™ basket is a concentrated blend of Nvidia, Palantir, Tesla, MicroStrategy and Bitcoin) has moved Team YOLO™ to within a couple of hundred basis points of getting back to flat for the year.

My sense is that the recent trauma of a 35% drawdown from late February will see many ‘take the win’ and flee to cash if they get back anywhere close to breakeven for the year. In other words, we would be looking at yet more distribution in the very names that are the biggest drivers of retail investor animal spirits.

Policy uncertainty - whether intentional or accidental - is knocking the stuffing out of investor confidence in US financial assets. The pace of tariff tape bombs appears to be showing no signs of slowing down and the markets hate it.

CEOs and CFOs dislike uncertainty too and respond by stamping on the capital expenditure brakes:

Weakness in US equities has been accompanied with tepid price action in Treasuries and the US dollar. Capital is seeking out markets overseas that are both cheaper and trending positively.

I keep on checking back on this chart below of the S&P 500 (SPY 0.00%↑) relative to the MSCI EAFE Developed Markets ex-US (IEFA 0.00%↑). The volume bars on the rare green days (numbered in purple) when the S&P outperforms are getting noticeably smaller.

This rodent is a seller of rips in US stocks from here but watch me squirm live with Maggie as the ‘spooz’ have just ripped another 200 points against my view by the time we get to the close later today! Maybe 😉.

The BUSHY™ Portfolio - Week 11

Plenty going on this week besides the usual BUSHY™ update (which includes some thoughts on BUSHY’s hedge overlay). Acorn updates this week include coverage of [ ].

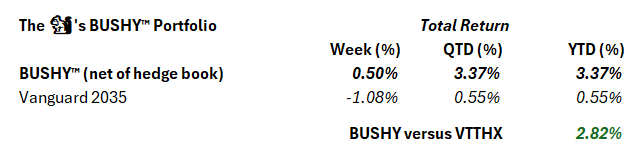

Friday’s S&P rally was enough to keep the 60/40 portfolio in positive territory for the year, but our Vanguard 2035 Target Date benchmark gave up a chunky 108 bps of returns on the week. The BUSHY™ portfolio was up 0.5% on the week and is now pulling away from the benchmark, +3.37% for the year after -0.74% of negative P&L attribution from the hedge book.