Respecting Trend

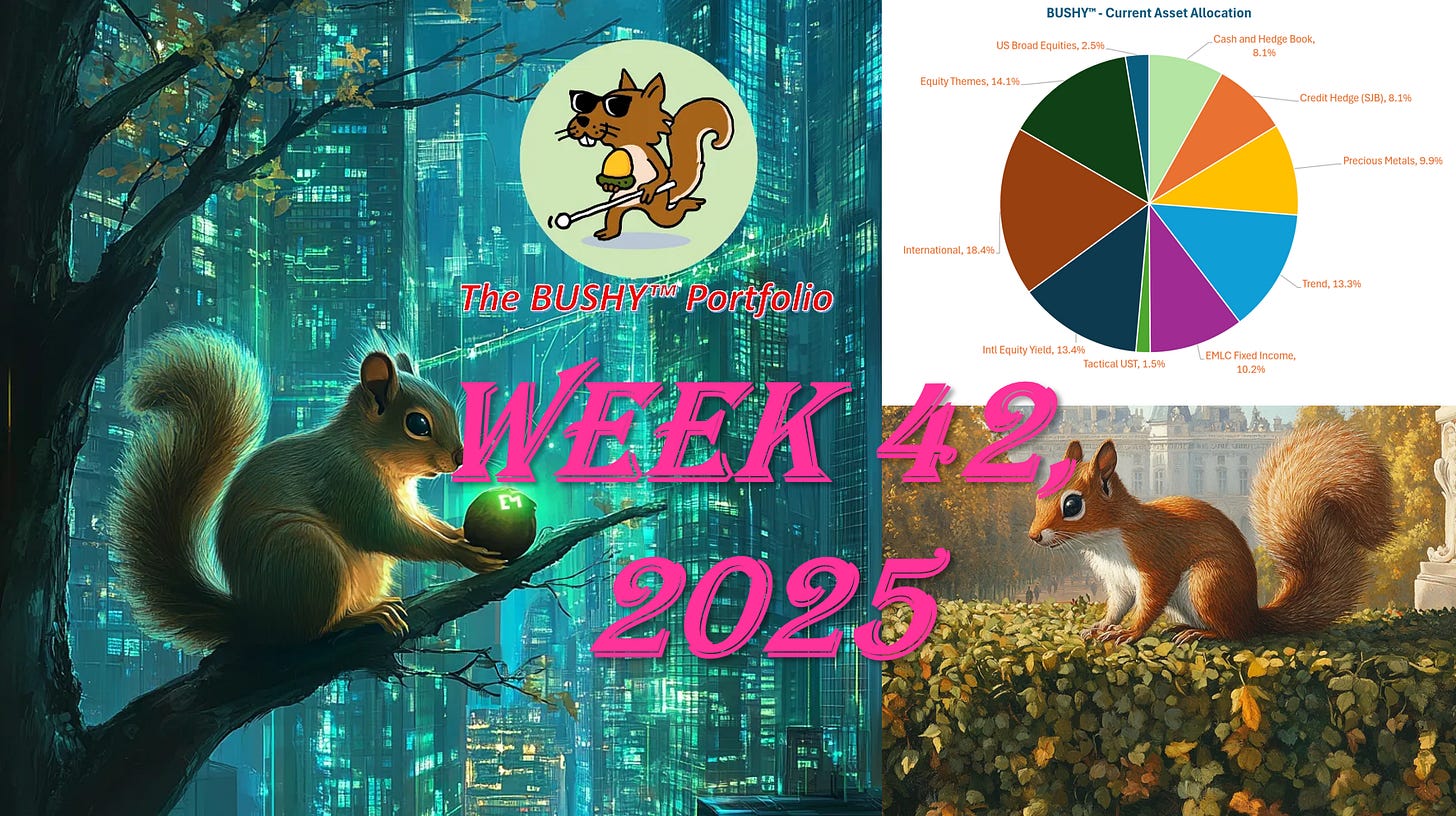

Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 42.

The 🐿️’s weekend note (published on Sunday) covered the growing risks in the ‘But Now, Pay Later’ sector. We are initiating a new short position in the sector. Link below in case you missed it.

Respecting Trend

BUSHY™ had a strong week. It would have kept pace with benchmark without a -35bps headwind from the hedge book (drawdowns from the new gold collar and the FX hedges against a USD rally). I suspect that these hedges will do their job at some stage between now and year end.

The beta portfolio continues to perform well year-to-date versus the Vanguard benchmark, the S&P and the various multi-asset / real asset ETFs that I track.

Before doing the usual review of BUSHY™ and the Acorn trades (I have some minor tweaks in the China consumer basket this week to report), I want spend a bit of time focusing on trend following. The CTA / Trend allocation within the beta portfolio is now 13.3% of NAV (from a 15% initial allocation on January 1) but it is finally now adding regular weekly positive contributions to total returns.

Most of the holdings in that sleeve have had a solid run since early August. After a few months of a market regime that has favored momentum investors, its time to do some forensics on the positioning of our 7 outsourced momentum / trend investors.

The 🐿️ is on high alert for a potential scare in risk asset markets and I want to know where the CTAs are positioned relative to my self-managed discretionary books. The trend allocation is designed as an alternative to bonds as a diversifier for the portfolio and I want to make sure I do not have too many positions that overlap with the CTAs.