Quality Street

Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 46.

The 🐿️’s weekend note (published on Saturday) took us to Indonesia - it’s time to play ‘the Prabowo Pivot’ . Link below in case you missed it.

Ahead of the usual portfolio reviews, the 🐿️ reflects on quality. Is this style factor giving us its traditional signals as to where we are in the cycle?

Quality Street

“Life’s a box of chocolates. You never know what you’re gonna get.”

A tin of Quality Street chocolates is the classic “zero thought involved” gift exchange during the British festive season (although it can also be passed off as the ‘perfect crime’, as there is always a chance that the giver was simply being ironic). We Brits are a complicated species.

Quality is a loaded word when it comes to style factors in investing. Why would one ever not want to restrict one’s investment choices to simply stocks deemed to be of a high quality? What wealth manager could ever be fired for indexing on such a descriptor?

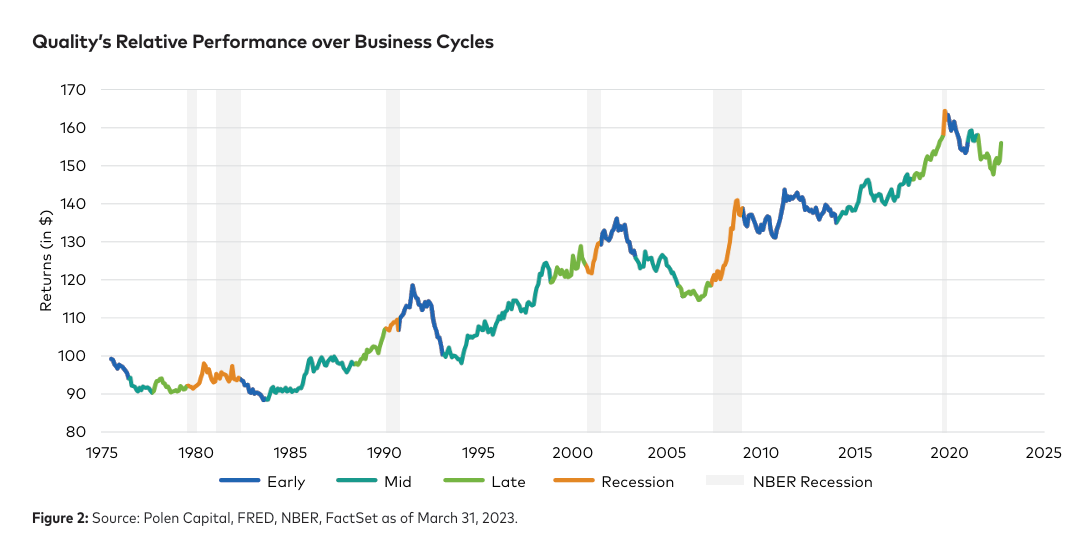

Think again. The finance text books will tell you that the quality factor outperforms only during the mid to late / recessionary part of the business cycle. In the early cycle phase, allocators should favor cyclicals, momentum and - dare I say it - trash!

Underperformance by the quality factor can also be a ‘canary in the coalmine’ with respect to problems for risk assets ahead. 2 examples of this during my career were seen in the late 1990s (ahead of the DotCom bust) and in the mid-2000s (ahead of the GFC).

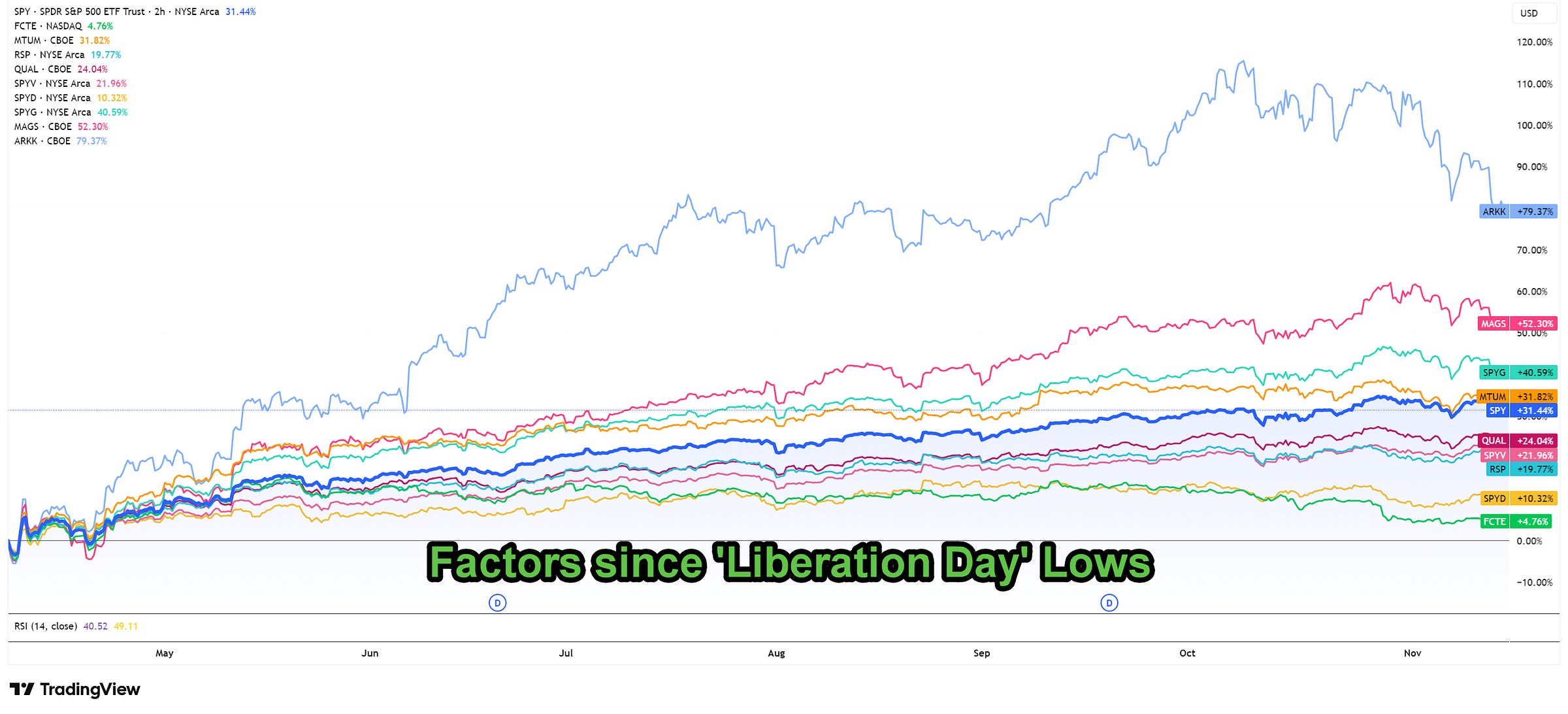

The nature of the powerful bull market we have experienced in US equities since the ‘Liberation Day’ lows in April is screaming ‘early cycle’ at the same time as even ardent bond bears (guilty) are beginning to question their aversion to that particular asset class.

Cathie Wood’s flagship ARKK ETF - with - let’s face it - its focus on the trashier end of the quality spectrum - has shown the rest of the market a clean set of heels. ARKK has outperformed the mighty Magnificent Seven (MAGS) by a healthy 27%, S&P Growth (SPYG) by 39%, S&P Momentum (MTUM) by 48%.

The S&P Quality factor (QUAL), S&P Value (SPYV) and S&P Dividend Yield factor (SPYD) have all underperformed the broad benchmark by between 10% and 20%.

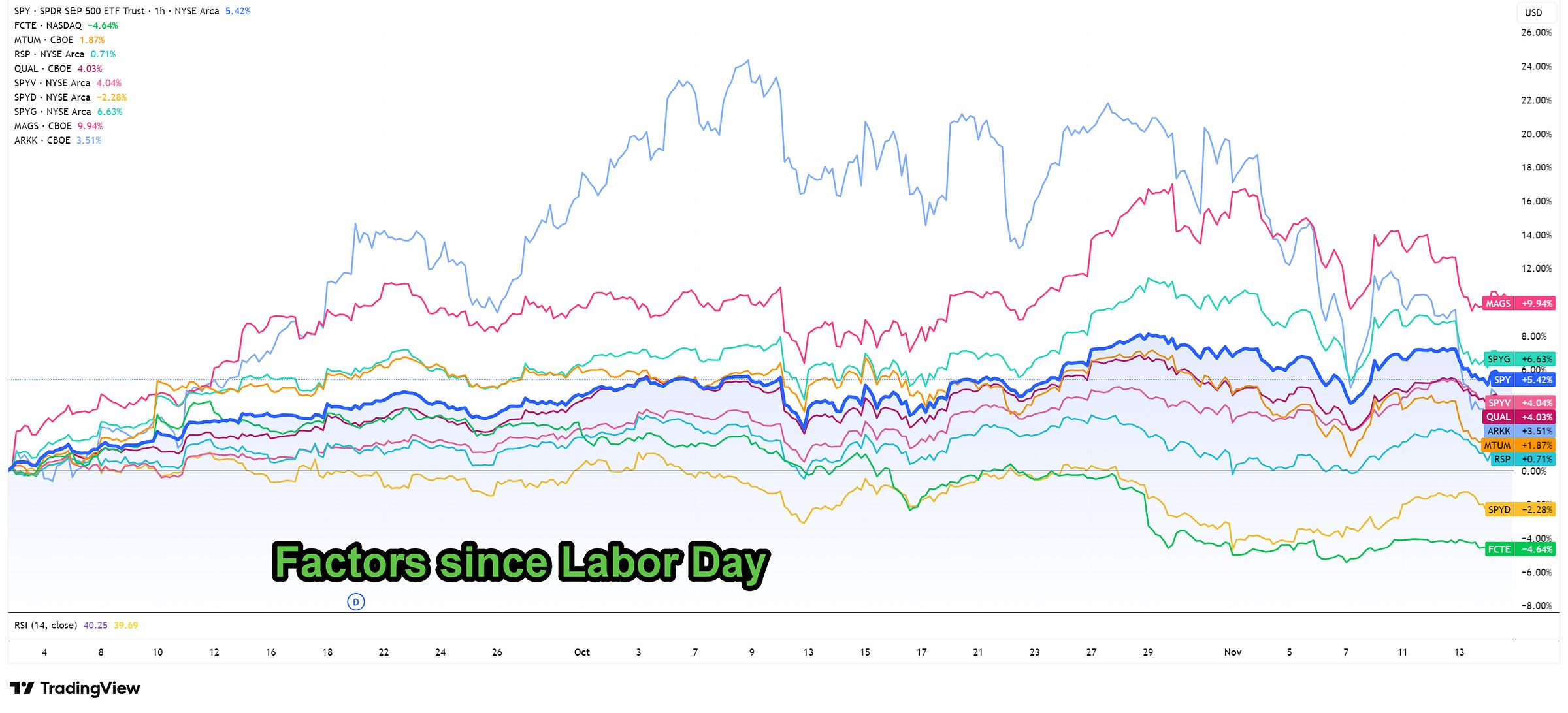

Since Labor Day, the ‘Mag 7’ have re-asserted their market dominance of the past decade and a half.

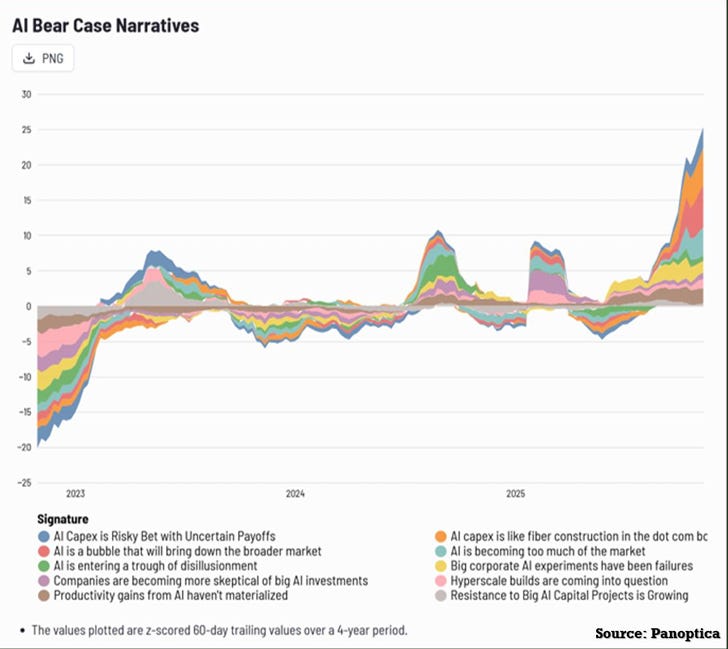

Curiously, this has happened just as the ‘AI capital misallocation’ narrative around the hyper-scalers has reached fever pitch - see below a terrific chart on this from Ben Hunt and Rusty Guinn’s Panoptica.

With the pivot by the Mag7 (ex-Apple) from asset light cashflow beasts to debt-issuing promisers of ‘jam tomorrow’ (in the form of a ‘digital God’), you have to ask yourself in which style factor bucket these tech giants now sit.

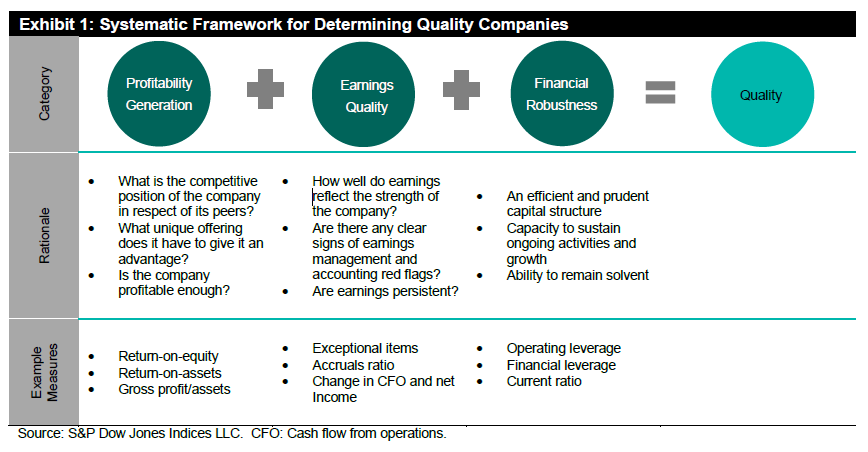

If you look at the outlook for the hyper-scalers through the prism of the classic ‘quality’ assessment framework used by index compilers like S&P (outline below), some negative scoring might appear to be overdue.

When you look at the current composition of the S&P factor ETFs, the Mag7 still dominate the growth (in capex?!) index and pretty much hold their market cap weighting in the quality bucket.

The likes of Broadcom, JP Morgan and Palantir have eased the Mag7 from the top of the Momentum index (where only 3 of the 7 currently have a weighting). At 8.9x and 11.3x EV/Sales (NTM) respectively Apple and Microsoft somehow still sit as the 2 largest holdings within the S&P Value ETF (SPYV)!

Below a link to a downloadable spreadsheet containing the Top 20 holdings within these 7 ETFs. IT’S BASICALLY ALL THE SAME TRADE (except for FCTE - more on that later).

Having been pretty much the only game in town for the last 15 years, the index compilers have clearly tried exceptionally hard to ensure that the Mag7 stay appropriate for every style factor bucket. Possibly a cynical take, but I fear we waived goodbye to the signaling benefit traditionally drawn from relative factor moves some time ago.

The market cap weighted indices are where all the passive money flows. The only business cycle signal we are likely to receive will be coincidental with an economic slowdown (i.e., when white collar jobs are lost and those 401k flows stop dribbling into the cap-weighted SPY and QQQ).

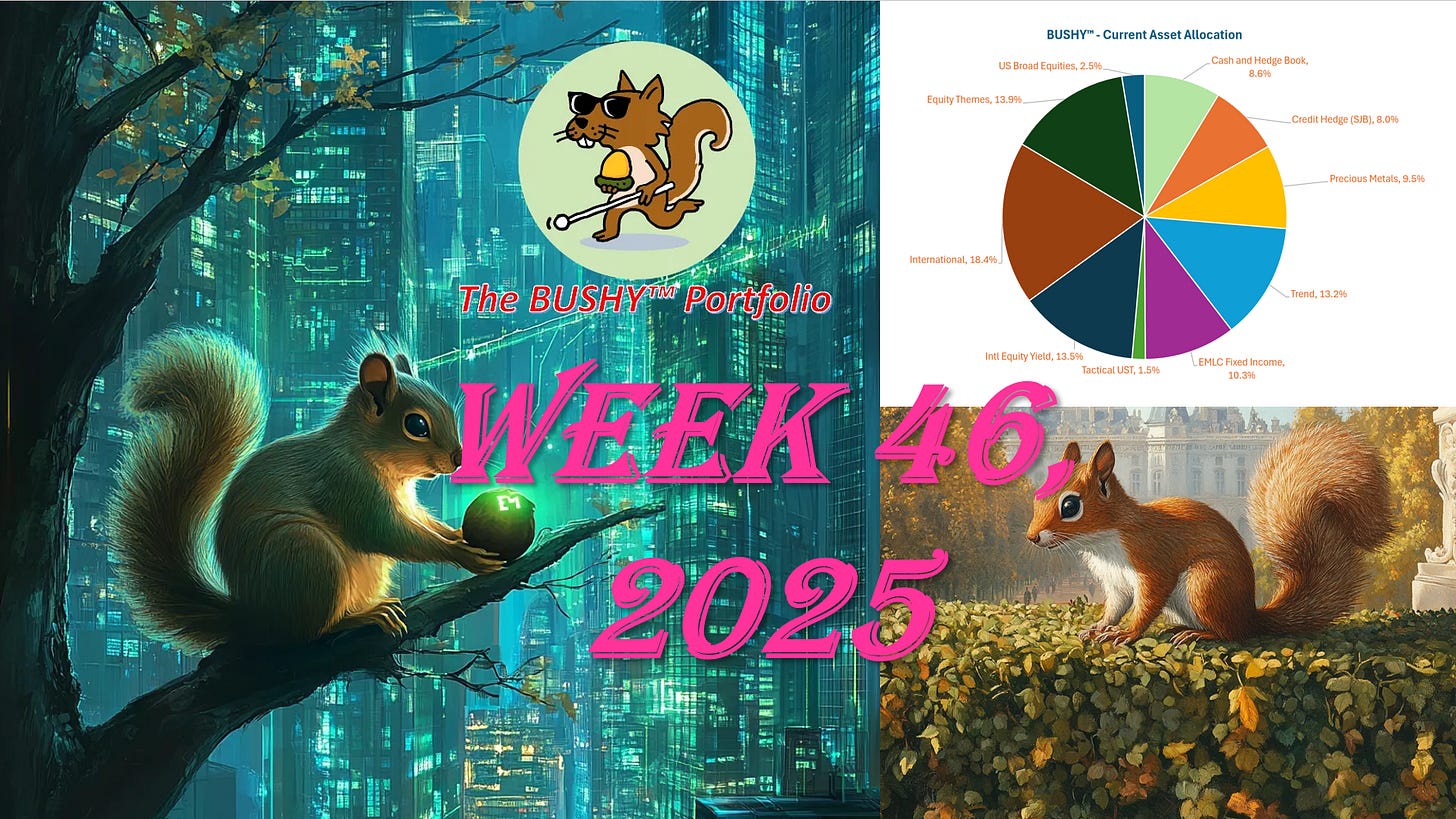

BUSHY™ Review

BUSHY™ had a decent week and we are now only 75bps away from the YTD ‘high water’ mark achieved in October.