The Prabowo Pivot

The Blind Squirrel's 'Monday' Morning Notes. Year 3; Week 46.

Last week, in Silk Roadent, the 🐿️ found himself getting excited about the opportunities along nodes of the ancient Silk Road in Uzbekistan. This week we explore the chokehold of the similarly important maritime Silk Road, the archipelago of Java and Sumatra.

Anyone that has done business in Indonesia will know that it has traditionally not been for the faint of heart. I first arrived in Asia in 1999. Many close friends in the market had had to flee from Jakarta with barely the shirts on their backs to catch the last flight out of a city in flames and overrun by rioters the previous May.

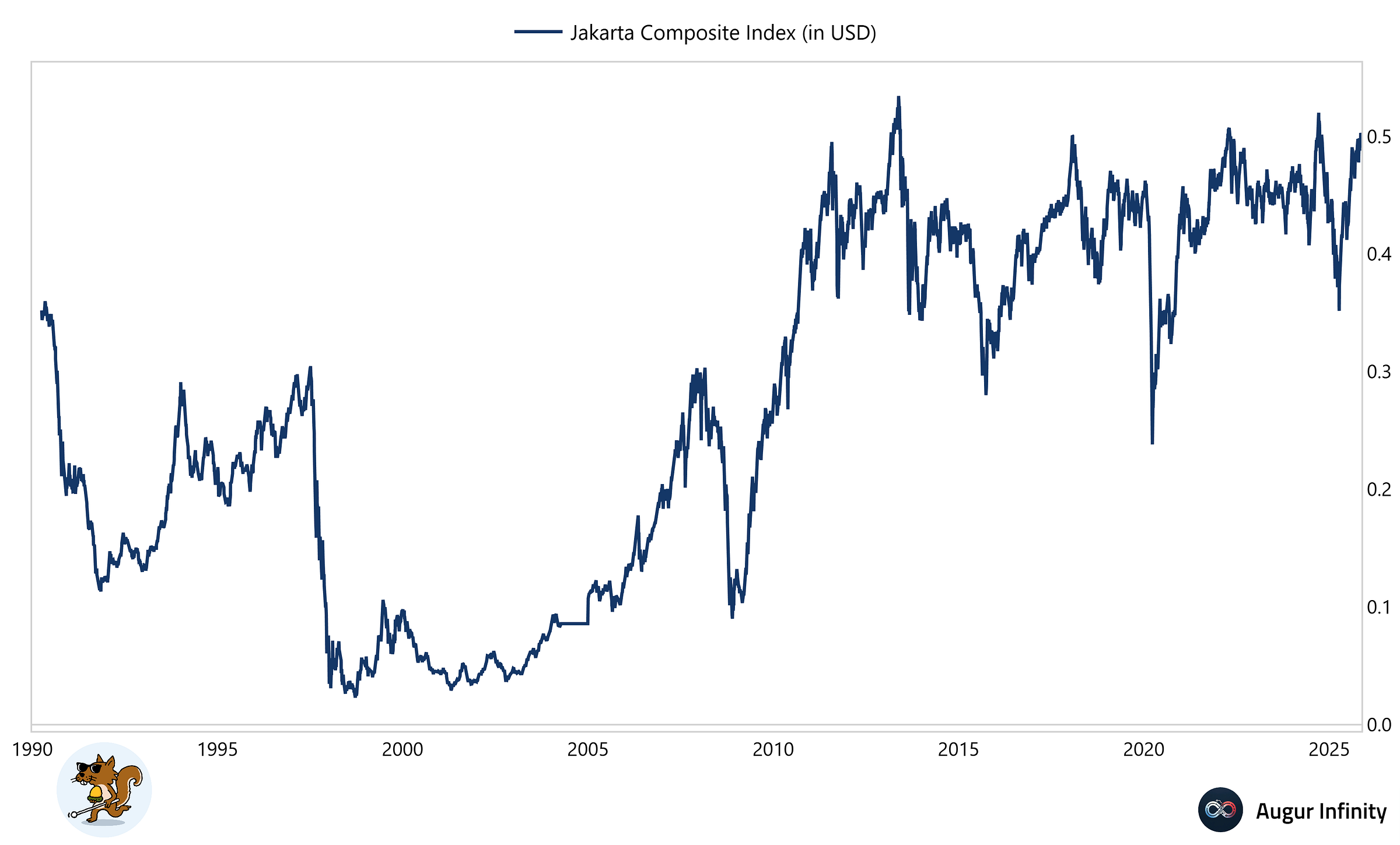

Indonesian equities most certainly participated in the great commodity and emerging bull run of the mid to late 2000s but the market - in USD terms - has done very little in the past 15 years.

More recently, Indonesian equities have underperformed their Asia Pacific (ex-Japan) equity market peers by a staggering 40% since the bull market in China stocks took hold at the beginning of last year.

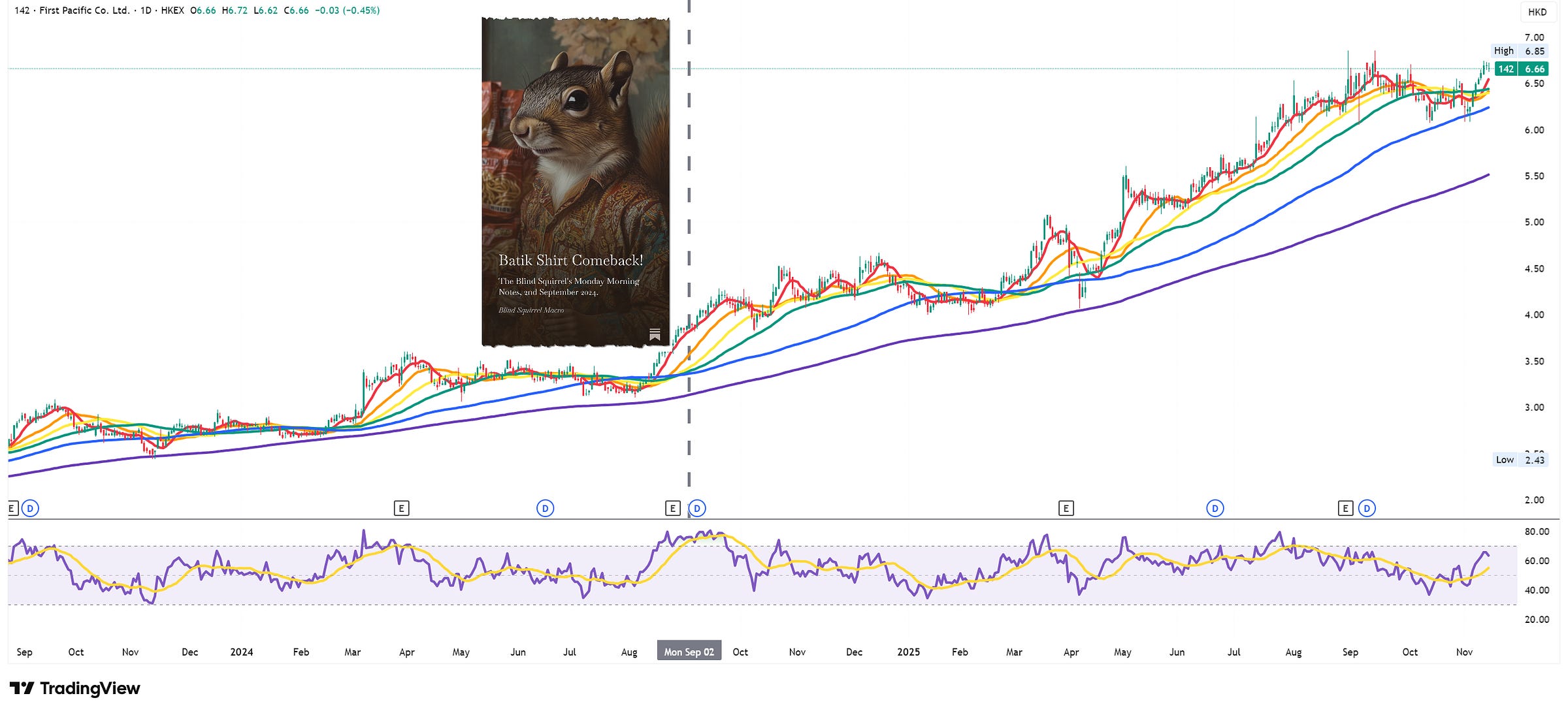

In the late summer of 2024, I toyed with the idea of an ASEAN ‘catch up’ trade. In the end, I decided to play the theme more defensively, and lean into an ‘old friend’, the Hong Kong-listed conglomerate First Pacific (142.Hk).

First Pacific, controlled by Manny Pangilinan and Indonesia’s Salim family, has not let me down.

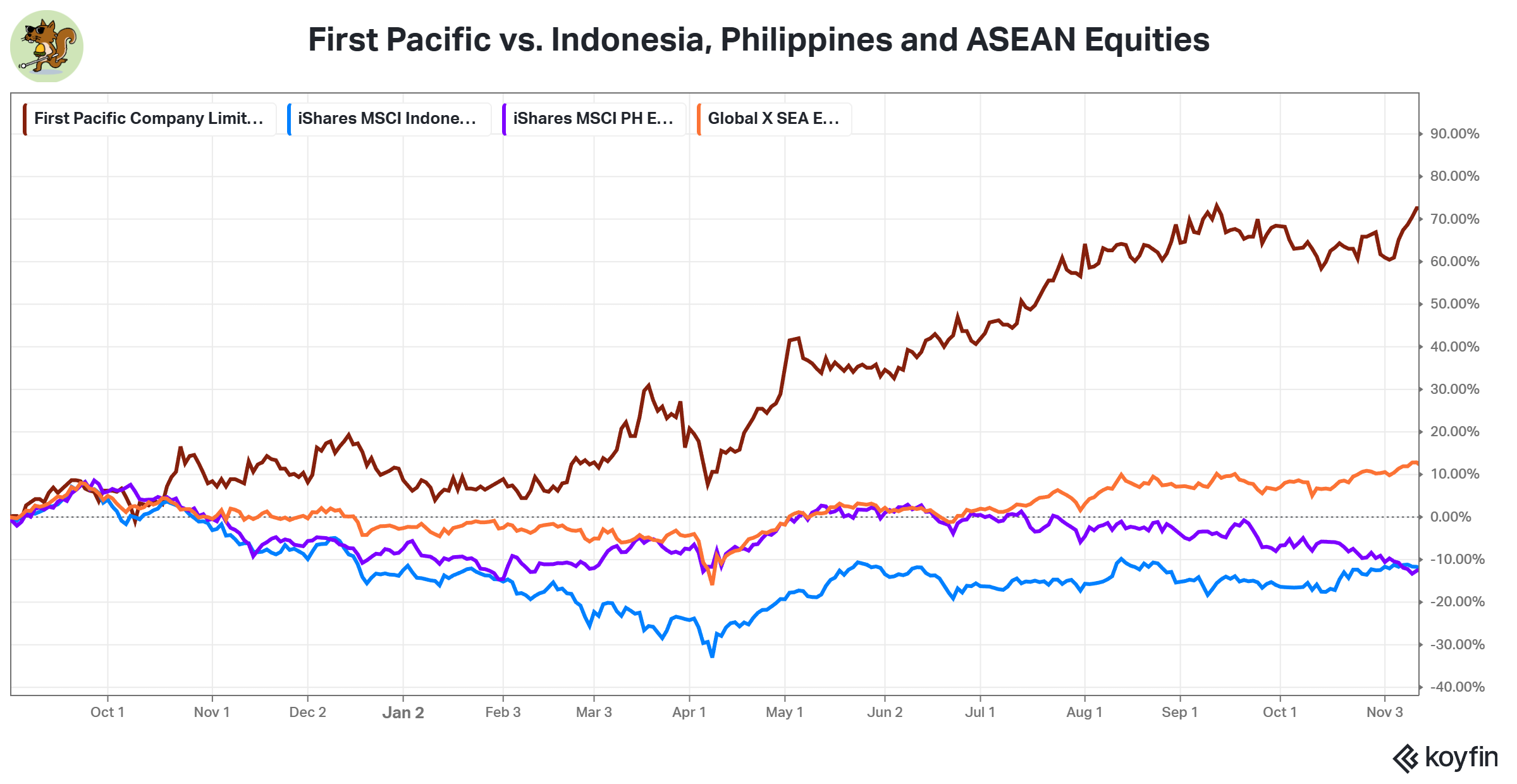

I re-underwrote the position in ‘‘Stock Take’ (Part 2) - The EM Edition’ back in June. The ‘instant noodle to telecoms’ assets across Indonesia, the Philippines and Singapore have comprehensively outperformed broad-based regional indices.

The group’s outperformance has continued over the course of the summer but the 🐿️ is not yet a seller. Not even close.