Multi-polarity Accelerates

March 3rd, 2025. Weekly update for the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 9.

Slight change in the publication schedule this week, as I put out the first of my new monthly interview shows on Saturday. The 🐿️ had a terrific conversation with Jerry Parker, one of Richard Dennis’ original ‘Turtle Traders’. Link below 👇.

The world has moved along quite significantly since last Monday morning when the 🐿️ was asked on to CNBC to discuss Chinese equities in the light of the new ‘America First Investment Policy’ that had been announced after the close the previous Friday.

The last two weeks have seen a significant vibe shift in markets. The most notable change has been the dramatic momentum unwind in popular retail stocks. The 🐿️ has been tracking a YOLO™ basket for while in order to gauge performance of the ‘Robinhood generation’ of retail investors in the market.

YOLO™ is a non-rebalanced portfolio that ‘equal-weighted’ holdings of Bitcoin (via BITO and MicroStrategy), Tesla, Palantir and Nvidia as of the end of 2021 (when the original futures-backed Bitcoin ETF was launched). YOLO™ would appear to be highly representative of how retail risk has been allocated of late.

The ferocity of YOLO™’s recent drawdown probably no doubt goes a long way towards explaining the massive spike in AAII bearish sentiment highlighted by my pal MC of Macro Charts in his mid-week note:

It seems almost comical to think that investor sentiment has managed to deteriorate so badly with broader equity markets still sitting so close to all-time highs. You have to imagine that muscle memory (or PTSD!) for those that experienced the 2022 drawdown is playing a role here.

Well, the news flow for YOLO™ has indeed been terrible (and somewhat targeted for that universe of holdings). A Hemingway-style ‘slowly then suddenly’ narrative collapse if you like!

But this is more than a simple narrative shift. Concern over tariff policy, ‘DOGE’ government spending cuts and now geopolitical tape bombs are causing economic policy uncertainty gauges to surge to levels normally reserved for proper crises.

Secretary Bessent is still trotting out the mantra that tariffs are not inflationary as they are ‘paid by foreign countries’ and not consumers, and that it is certainly possible for a 3% real GDP growth to be consistent with a 3% budget deficit (vs. 7.3% currently). This rodent has doubts.

In times of policy uncertainty businesses stop making investment decisions and implement hiring freezes. Consumers just stop spending money. On Friday, this shift in microeconomic activity showed up in data. The Atlanta Fed's GDPNow forecast for Q1 2025 clocked in at negative 1.5% as personal consumption activity collapsed in January (and I am never a buyer of ‘bad weather’ explainers).

There are plenty of GDPNow haters out there, but evidence of softening housing and labor markets is piling up with every data release. What is more, these nowcasts tend to get more reliable beyond the half-way mark for the quarter as further data is amassed.

Short-term interest rates have most certainly woken up. In the past 2 weeks, almost 2 rate cuts have been priced back into December 2025 3-month SOFR futures.

Further out the curve, 10-Year yields have moderated (by 20bps since the election and 60bps since the January high in yields). Bessent’s explicit target of lower 10-year yields would also appear inconsistent with his simultaneously held belief that the US economy can return to levels of above potential growth. If he wants those long-term borrowing rates lower, I am afraid that he probably needs the recession that nobody voted for.

Rates are certainly not going lower on the basis of moderating inflation expectations. Recent University of Michigan survey data created some alarming headlines last week.

But even if you want to dismiss the reliability of ‘old school’ sentiment survey data in today’s politically polarized times, breakevens in the bond market are still implying levels of sticky medium-term inflation well above the Fed’s 2% target rate.

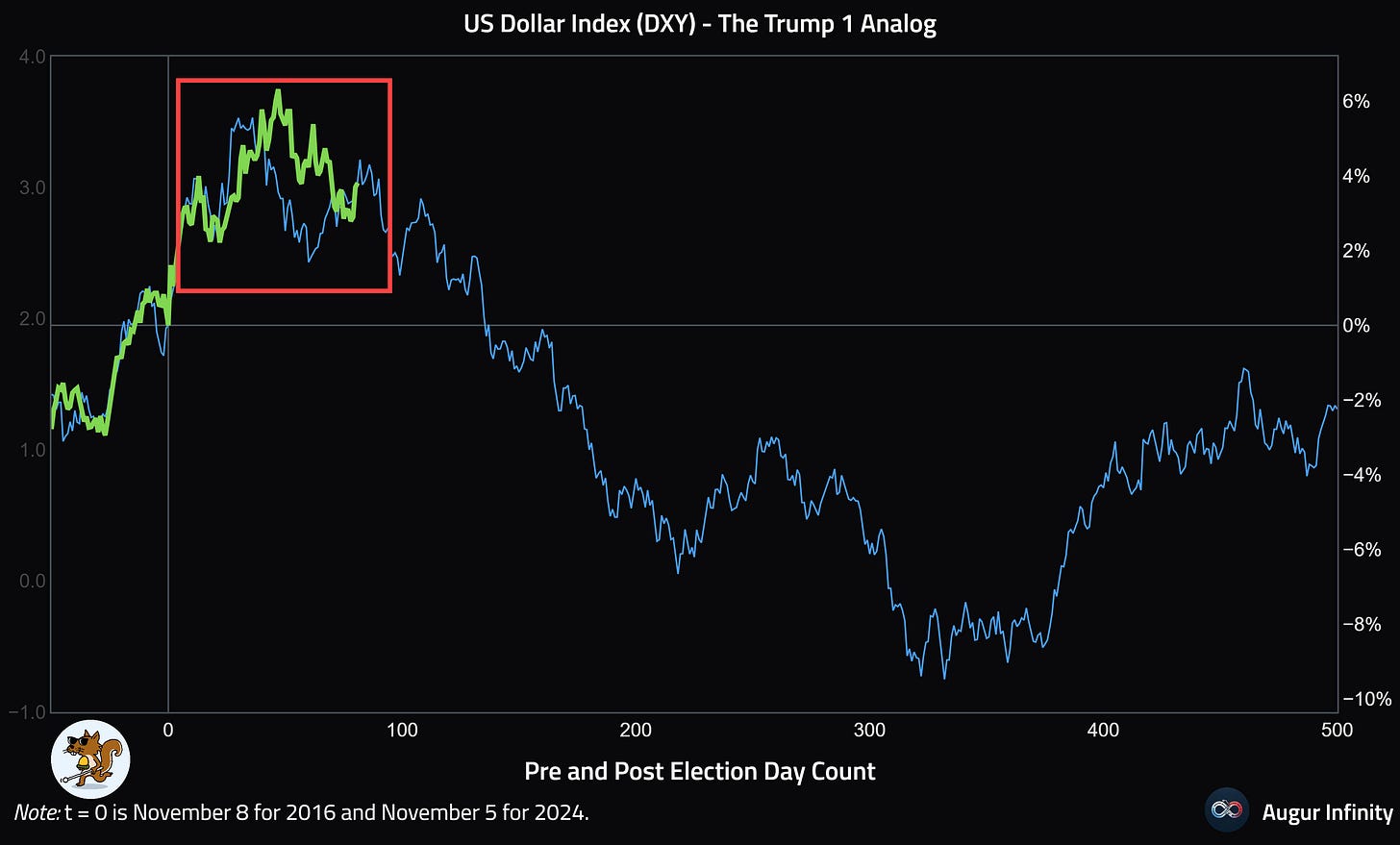

Was last week’s mini rally in the US dollar simply a risk off impulse, tariff news related, or was it telling us that this inflation persistence is at risk of thwarting Bessent’s ‘lower yields’ plan?

As of now, the dollar is rhyming perfectly with the Trump v1.0 analog. A small USD rally was expected at precisely around now!

It also feels right that the 🐿️’s American Exceptionalism gauge (US equities relative to Developed Markets ex-US) got checked at the 200-day SMA at the end of last week.

Zooming out to the monthly chart of the same gauge, it is still too early to call out a definitive break in trend from a pure technical standpoint (even if the 🐿️ is firmly positioned for one).

However, 2025 full year earnings forecasts for the S&P 500 continue to be trimmed back by Wall Street analysts (Goldman Sachs was the latest to capitulate) and there are trillions of dollars of foreign capital sitting in US equities when their ‘home’ markets are both significantly cheaper and delivering impressive YTD returns. Those outflows have the potential to overwhelm shrinking 401k flows (if labor markets are indeed rolling over).

In the 🐿️’s opinion, the old truism of ‘the market is not the economy’ is getting well past its ‘sell by’ date. In the hyper-financialized US economy, the stocks have to be working in order for the economy to hum.

I received a live situation report from the St. Louis boat show from one of my favorite readers this week.

‘HR’ said that “the only things on display were priced at $250,000 and up. Absolutely nothing in the $40-$70,000 metal boat range. Definitely two different economies these days.”. 🐿️’s response: “if the bottom falls out of the S&P, the top strut of the ‘K-shaped’ economy stops spending too”. It could become a vicious circle.

The BUSHY™ Portfolio - Week 9

Plenty going on this week besides the usual BUSHY™ update. Acorn updates this week focus on a ‘drains-up’ review of our exposures in the energy sector (refining, offshore and nuclear/ uranium). We are making a couple of changes.

The dollar rally and that international equity rotation check contributed to another drawdown for BUSHY™, which was lower by -0.66% (net of hedge book) on the week. BUSHY™’s Vanguard benchmark narrowed the performance gap, aided by its long bond position (BUSHY™ is ‘net short’ long duration fixed income thanks to its trend following / CTA allocation).

BUSHY™ is also firmly on the ‘other side’ of the ‘American Exceptionalism’ trade with overweight positions in developed and emerging market equities and EM local currency fixed income.