Mid-caps are for stock pickers

A quick stocking stuffer from the 🐿️.

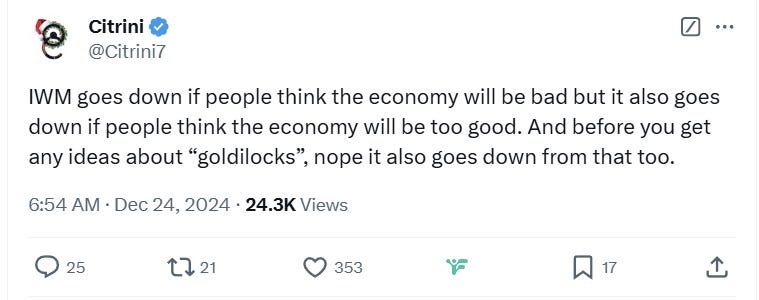

I thought I was done with publishing this side of Christmas, but this tweet this morning from the excellent Citrini made me think that it might be worth resharing some thoughts I put together on the Russell 2000 / IWM 0.00%↑ in early November (pre-election).

At the time, small cap US equities were a key feature of the ‘Trump Trade’. The 🐿️ was nervous:

“The Russell 2000 (both futures and tracking ETFs) are the ‘one stop shop’ for this factor. The 🐿️ is wary of this ‘zombie beta’.”

As it turned out, the ‘Trump trade’ as relates to the small caps turned out to be ephemeral (charitable). Versus the Nasdaq 100 (QQQ 0.00%↑) the IWM 0.00%↑ (Russell 2000 ETF) has bled out aggressively since the beginning of December (notwithstanding the red sweep in the election).

I tend to agree with Citrini’s observation around some of the lose/lose characteristics of the Russell 2000. The next part of this note looks under the hood of the index to explore why that may be the case. The analysis led me to the view that “the Russell is basically a random ‘rag bag’ of economically unrepresentative, SBC-incinerating ‘sh#tcos’ with an ‘inverse Darwinian’ selection bias.” I also had a look at expensive restaurant chains. I suspect we will be coming back to this theme in 2025.

Readers who were already paid subscribers in early November can go back to wrapping presents, stuffing turkeys and selecting fine wine from the cellar for Wednesday. Others might want to read on (and then perhaps subscribe at the end if you enjoyed it😉).

Section Two: Russell and Restaurants (originally published to paid subscribers on November 3rd)

So let me explain why the 🐿️ struggles with the Russell 2000 index as a ‘buy and hold’ investment vehicle. It’s time to ‘lift the hood’.

You are ‘short calls’ on your winners. It may sound obvious, but a market-cap weighted small and mid-cap equity index suffers from a major compilation handicap. While the giant trees of the S&P 500 can continue to ‘grow to the skies’, the Russell 2000 consistently evicts its winners, replacing them with untested new entrants with every June rebalancing of the index.

In the past 12 months, 94 of the 1962 Russell constituents saw their share prices fall by more than 50%. The good news is that 253 names were up by more than 100%. Most of those winners, however, will go on to compound returns (unless they turn out to be fraudulent like SMCI 1.22%↑) in the larger cap indices.

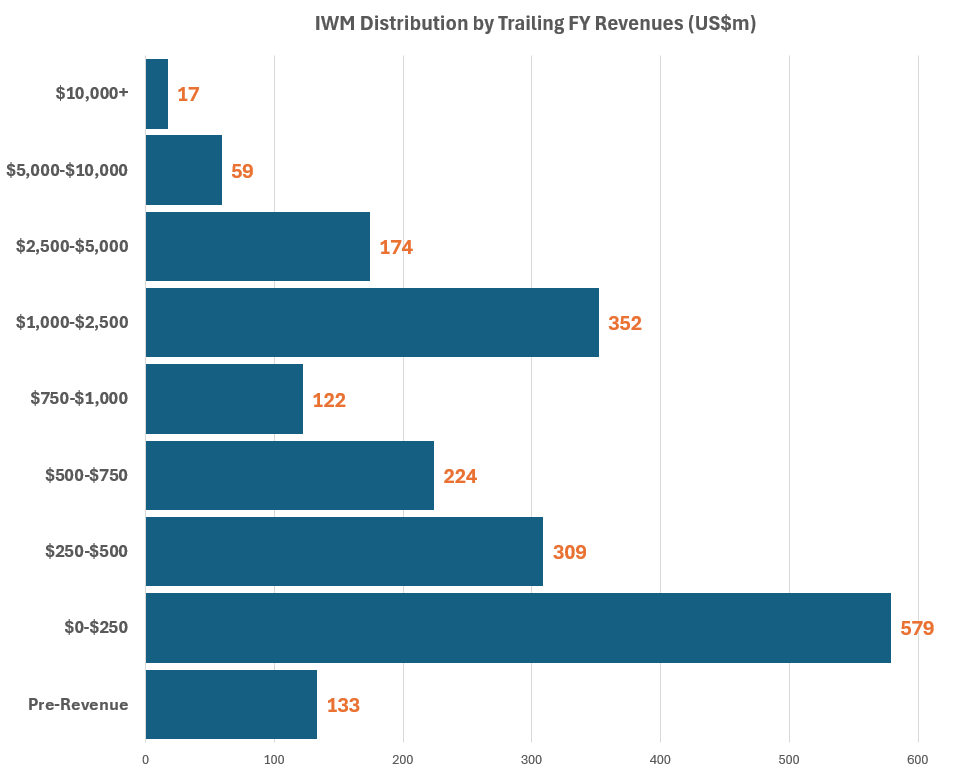

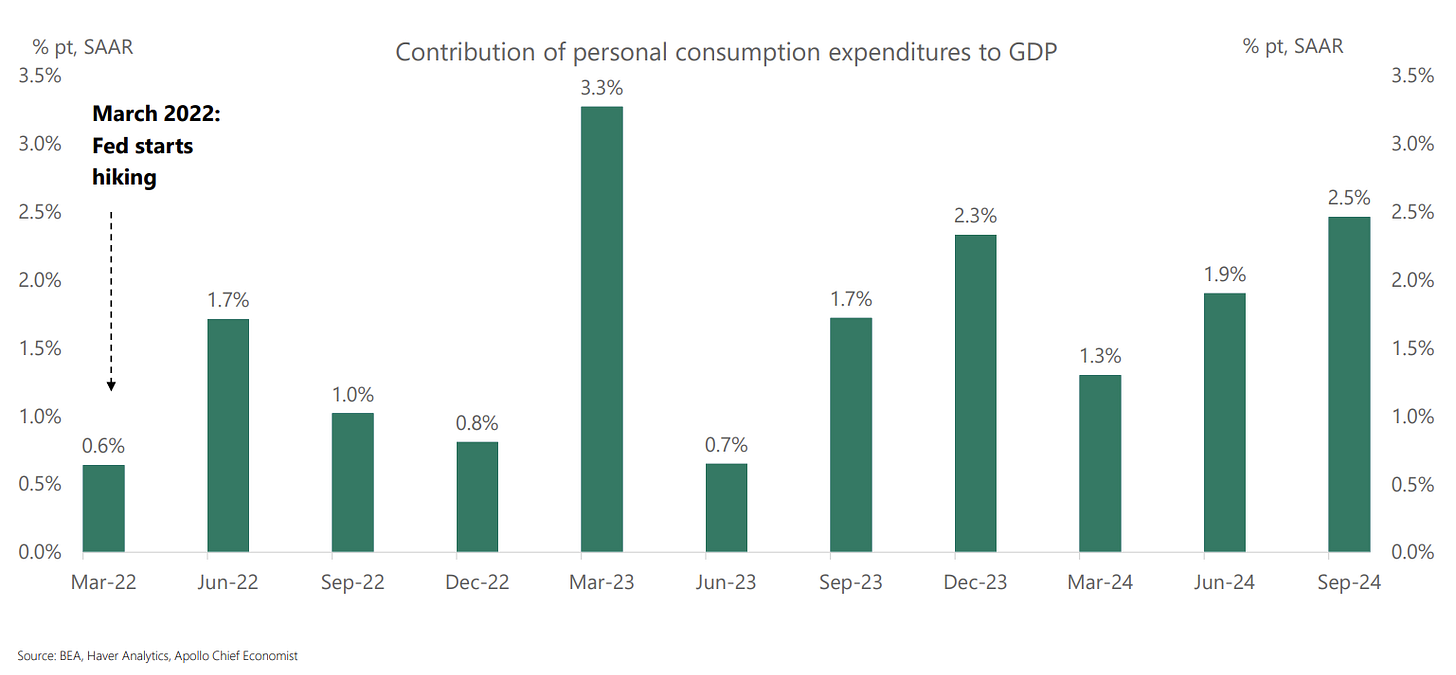

Not properly exposed to the real economy. Here I will borrow another of Torsten Slok’s charts to illustrate the extent to which the ‘engine room’ of ‘SME’ corporate America is not properly represented by the public equity indices. Over 80% of these small and medium sized enterprises are in private hands!

When it comes to revenues for Russell constituents, over 50% of the index booked revenues of $500m or less during the past financial year.

Size is all that matters. While there may be some technical eligibility constraints, market cap is basically the only meaningful driver of R2K inclusion. In the current world in which narratives trump fundamentals when it comes to equity valuation, some potentially negative outcomes are inevitable. As of today, 43% (852 companies) of current Russell constituents had negative GAAP EPS for the last financial year.

It gets worse, 57% of constituents have an Altman Z-Score of below 1.8 (indicating an elevated risk of bankruptcy). While a larger share (64%) of the constituents was free cash flow positive, sadly stock-based compensation exceeded 50% of free cash flow among 45% of those issuers (naturally!). Only 14% of companies paid a dividend yield in excess of the 3.68% weighted average indicated dividend yield for the index.

Small does not equal cheap. On a forward PE basis, the R2K IWM -0.56%↓is actually more expensive than all of the other broad-based US equity indices. The Russell is not exactly a deep value play.

Diversification, but with a catch. At a superficial level, the R2K would appear to be better diversified than the tech-dominated S&P500 or Nasdaq 100 indices. However, this diversification also burdens you with 426 (largely pre-revenue biotech) healthcare stocks selected on the basis of market cap alone and 348 financial (mainly small regional bank) stocks with an average market cap of $1.6bn. Do you really know what you own?!

So, the Russell is basically a random ‘rag bag’ of economically unrepresentative, SBC-incinerating ‘sh#tcos’ with an ‘inverse Darwinian’ selection bias. R2K / IWM is clearly not a suitable long-term ‘buy and hold’ diversifier for your equity portfolio.

I wonder just how many 401(k) portfolios have a lazy IWM -0.56%↓ allocation in them. If you roll up the current IWM -0.56%↓ ETF (the largest but certainly not the only Russell tracker) assets under management as well as the E-Mini Russell 2000 Index futures open interest, you are looking at $80bn of capital engaged with that one ‘US small cap’ investment factor.

The world of factor-based investing has exploded in recent years. ‘Pods’ within the multi-strategy hedge funds have set up a myriad of quantitative trading systems that aim to exploit idiosyncrasies in how equities trade based on different fundamental and economic variables.

On that note, my good friend Kevin Muir wrote an excellent piece on how the EPS revision factor is increasingly at the root of stock moves. As if active investing in the value and midcap space was not hard enough! The (anonymized) stock that Kevin selected was particularly close to heart.

As mentioned above, the 🐿️ is not averse to the idea of a rally in risk assets once the election is out of the way. As I write (Sunday morning, Australia time), the Polymarket (yes, am aware of the potential bias issues with this measure) odds of a Republican sweep do not appear to be recovering from their precipitous drop that started mid-week. For now, outrage over the fate of the late Peanut the Squirrel do not appear to have impacted market pricing!

However, I do suspect that there is still a great deal of ‘red sweep’ money hanging out in the R2K / IWM trade. This will need to be reversed out in the event of a different electoral outcome before any kind of positive seasonal effect can kick in.

In any event, if you are believer in a ‘Santa Rally’, I think that (i) you can sit on your hands until you see a result this week and (ii) investors and traders can do much better than the ‘Zombie beta’ of the Russell 2000.

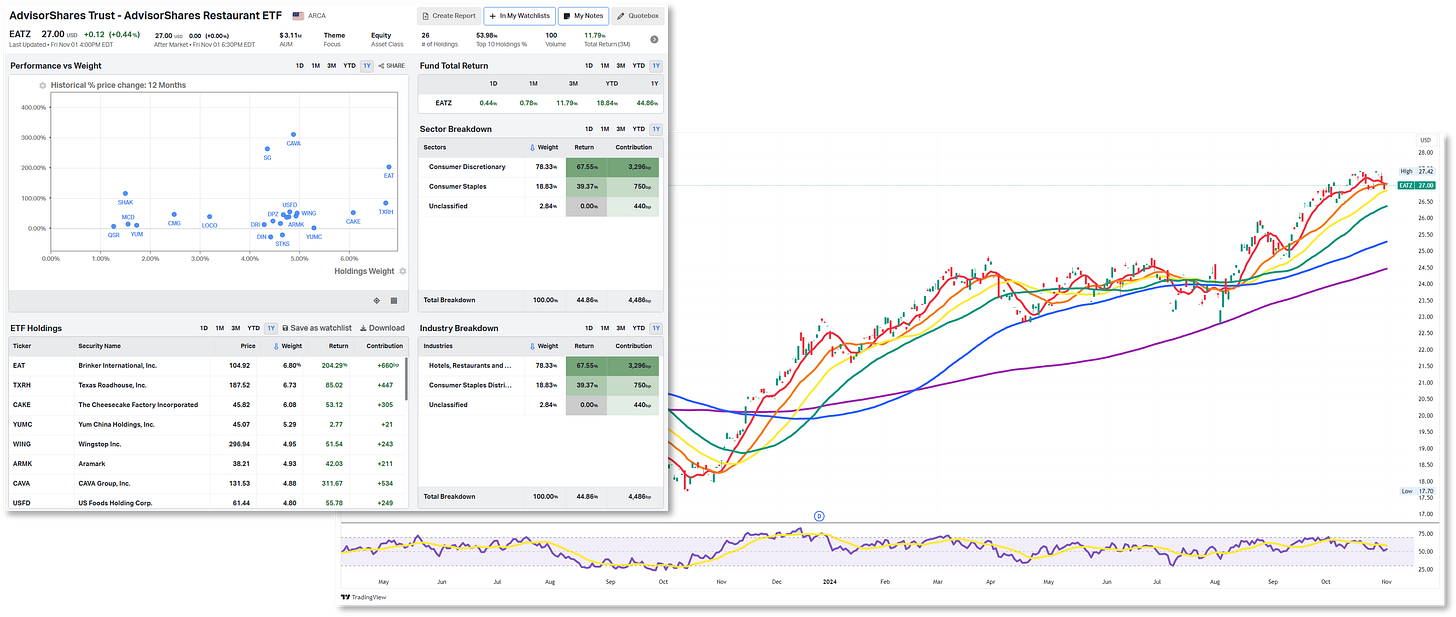

Before getting on to the Acorn review and portfolio update, I wanted to flag an area where I have started to do some work. That is very expensive North American restaurant chains. I keep the tiny (but very well constructed) EATZ 0.00%↑ Restaurant ETF on my market dashboard.

You would have thought that this group would be a pretty reliable barometer for the health of the real economy. Judging by its performance in the past 12 months, the US economy would appear to be doing just fine.

However, the 🐿️ is firmly in the camp of those thinking that last week’s correction in the valuation of Wingstop WING 0.00%↑ was long overdue.

Even after a 20% pruning, this purveyor of finest chicken wings still trades at a flighty (😉) 14.9x forward revenues. I am aware that there is a large cohort of burned short sellers when it comes to this name (one good friend refers to the restaurant chain as his own personal ‘widow maker’!).

The 🐿️ is not ready to add his name to that group but have been consistently intrigued by the extreme valuations of some of these growthy themed restaurant chains. Chipotle CMG -0.28%↓ has been a confounding stock market phenomenon for some time. New kid on the block, Mediterranean fast casual chain CAVA -0.98%↓, even makes Palantir look cheap!

At the moment, the US consumer is showing no sign of quitting.

However, this rodent believes that once this cycle truly starts to turn, these richly valued fast casual dining chains could derate dramatically. We will be ready. For now, it feels early and, as the legendary Bill Fleckenstein says, you only ever shoot stocks in the back!

Thanks as ever for your support. Squirrel out!

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

Thanks great as always. Slightly annoyingly, the thing I want to comment on the most is RE the restaurant chains - ‘yes! And what is happening here?!’ Goes onto the ‘if I don’t understand it do not touch’ list